Good morning!

The avalanche of year-end trading updates has landed.

Wrapping it up there for now! Thank you.

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Rentokil Initial (LON:RTO) (£12.0bn | SR69) | Mike Duffy is appointed CEO from March. The outgoing CEO is thanked for his “enormous contributions”. | ||

Games Workshop (LON:GAW) (£6.2bn | SR78) | Core revenue +17% (£316m), licensing revenue £16m (H1 last year: £30m). Core operating profit +28.5% (£126.1m). £1.10 dividend declared bringing the total so far in FY26 to £4.85. | GREEN = (Roland) Licensing revenue dropped in H1 and the receivables pipeline for the year ahead suggests a weaker performance is expected in H2 as well. However, the core retail business continues to grow and profitability remains exceptional, with margins above 40%. A 110p dividend declared today is a reminder of the group’s cash-generative quality and transparent policy on shareholder returns. While the stock might not be obviously cheap, I think the quality of this business justifies a stronger valuation than most others. On a medium-long term basis, I’m happy to maintain a positive view today. | |

Persimmon (LON:PSN) (£4.5bn | SR94) | New home completions +12% (11,905). Full-year underlying PBT for 2025 at upper end of market expectations. On track to achieve current market expectations for 2026 (underlying PBT £461 - 487m). | AMBER/GREEN ↑ (Roland) This solid update nudges profit guidance higher for 2025, but suggests the recovery in volumes seen in 2025 could slow in 2026. However, I’m more interested to see that forecasts suggest profitability could improve modestly in 2026. Pairing this with today’s upgrade and recent evidence of improving momentum has convinced me to move my view one notch higher today, despite feeling that the valuation is already at a level I’d view as fair. | |

Whitbread (LON:WTB) (£4.4bn | SR22) | Will deliver a higher level of efficiencies in FY26 than previously expected (£75-80m vs. £65-70m expected). Q3 total group sales +2% (£781m) (Q3 finished around the end of November). Current trading for six weeks to Jan 2026: UK accommodation sales and RevPAR both up 4%. Germany accommodation sales +11%. | ||

Primary Health Properties (LON:PHP) (£2.7bn | SR82) | Combination between PHP and Assura successfully delivered, creating £6 billion healthcare REIT. 60% of total annualised synergies of £9 million already delivered. | ||

Grafton (LON:GFTU) (£1.76bn | SR91) | Full year adjusted operating profit expected to be in line with expectations. Revenue for the year was £2.52 billion (2024: £2.28 billion), up 10.4%. | ||

Integrafin Holdings (LON:IHP) (£1.16bn | SR63) | Strong Q1 FY26 net inflows to the Transact platform of £1.0bn, up 11% year-on-year. Reiterates cost guidance from December 2025. “In a strong position to accelerate profit growth in the coming years.” | ||

Gamma Communications (LON:GAMA) (£814m | SR54) | FY 2025 in line with market expectations. Consensus for FY25: Adjusted EBITDA £140.0m - £143.0m, adjusted EPS 93.6p - 95.4p. Buyback for £42.5m. | AMBER ↓ (Roland) [no section below] Gamma shares have continued to sink since I last covered the stock in September. Today’s update highlights strong performance from recent acquisition in Germany and good cash generation in 2025. My sums suggest the shares may now offer a trailing free cash flow yield of more than 8%. I see that as good value, as is the trailing EBIT/EV yield of c.10%. However, there seems to be some uncertainty about prospects for 2026 and perhaps 2027. Earnings forecasts for 2026 have drifted steadily lower for this year and are now broadly level with 2025. The company reiterates UK market headwinds today in addition to the structural headwind that will be caused by the switch-off of traditional PSTN (copper wire) telephone services from 2027, which I believe will affect demand/pricing for some of Gamma’s telephony services. I’m also a little discouraged by today’s decision to freeze the dividend for the next two years while diverting up to £85m into buybacks. It feels to me like management may be digging in for a difficult period. The StockRanks style this as a Contrarian stock which feels about right to me. But I’m also wary about the very low MomentumRank of 18. I wonder if it might be too soon to take a positive view here? I’m going to revert to a neutral view until more clarity emerges. | |

THG (LON:THG) (£794m | SR64) | Record H2 revenue performance (+6.7%), c.14% ahead of the top end of guidance (guidance was +3.9% to +5.9%). FY25 adjusted EBITDA expectations unchanged and in line. High confidence in THG Beauty and THG Nutrition trading momentum into Q1 2026, following c.8% revenue growth over November and December. | ||

Trustpilot (LON:TRST) (£742m | SR36) | Bookings +18% (constant currencies), ARR +19% (cc), revenue +20% (CC). Adjusted EBITDA projected to be ahead of market expectations. Extending buyback by up to £10m. | AMBER/GREEN ↑ (Graham) I acknowledge that this might be an unpopular stance and that Trustpilot is a controversial company. Bear raiders have been attacking it and I agree that the valuation is hot according to traditional metrics. But on a multiple of ARR, it's not expensive, if we are willing to value it as a quality software business. With an "ahead of expectations" update today, I think I can justify raising our stance on this by one notch. | |

Pagegroup (LON:PAGE) (£734m | SR48) | Gross profit -4.6% (cc), -3.1% (actual currency rates). 2025 operating profit to be broadly in line with current market consensus of £21.1m. "While the market outlook remains uncertain due to the unpredictable economic environment, we will continue to control the controllables and we remain confident in the execution of our strategy, given our highly diversified and adaptable business model, strong balance sheet and our cost base that is under continuous review." Net cash £31m. | AMBER/RED = (Graham) We were AMBER/RED on this last year and a cautious stance in relation to the recruitment sector continues to look prudent. The quarterly decline in gross profit for Q4 was better than expected, according to Reuters, but the “broadly in line” description of full-year profitability does not inspire. EMEA and the UK have both posted double digit declines in gross profit for the full year, with the group as a whole seeing gross profits down 7.8% vs. 2024. Even temporary recruitment declined in Q4, and the outlook statement does not suggest there is any light visible at the end of the tunnel yet for the recruitment sector, and I maintain my concern that the old way of doing business in this sector might have been fundamentally broken by technology. | |

Hunting (LON:HTG) (£621m | SR90) | Group EBITDA of c.$135 million, up 7% year-on-year. Guidance: 2026 EBITDA to be c. $145 million - $155 million, “representing an additional year of good organic growth, despite wider market volatility.” Zeus 2026 EPS forecast unchanged at 40.2 cents. Canaccord Genuity 2026 EPS forecasts cut by 20% to 45 cents. | AMBER = (Roland) [no section below] 2026 guidance suggests Hunting could generate c.£55m of free cash flow in 2026, giving a possible 9% free cash flow yield. While cyclical and geopolitical downside is always a risk in the oil and gas business, this seems a potentially attractive valuation to me, especially as the company ended the year with a strong net cash position. However, checking today’s EBITDA guidance against previous expectations suggests to me that it may be at the lower end of the range of previous forecasts – today’s update has prompted a material cut to 2026 forecasts by CG (see left). Drilling into the business, Hunting appears to have scaled up its medium-term growth ambitions for its Subsea division. My reading of this is that it should support growth on longer-cycle offshore projects and reduce the group’s dependence on the somewhat unpredictable and short-cycle US onshore (shale) business. My overall impression is that a stronger recovery in earnings has been pushed back slightly today. While I’m encouraged that the company has met its revised 2025 EBITDA guidance, I don’t think Hunting can completely escape its exposure to (weakening) oil prices. I’m going to leave Mark’s October view of neutral unchanged today. | |

Raspberry PI Holdings (LON:RPI) (£561m | SR21) | Adjusted FY2025 EBITDA to be ahead of market consensus forecasts, at not less than $45m. The Board is confident that H1 2026 unit shipments will grow versus H1 2025, with profitability in the period in line with Board expectations. Visibility beyond H1 2026 is limited. | AMBER/RED = (Roland) [no section below] Booming demand for hardware for AI data centres is starting to affect the PC market due to memory shortages. Raspberry Pi says this situation means that both pricing and availability of a key type of memory chip is becoming challenging. While mitigating actions are being taken, this situation translates to very limited visibility on volumes or profitability beyond the first half of 2026. I’m not sure if today’s update will translate into a broker downgrade, but I think there’s clearly a material risk of a cut to 2026 forecasts at some point. This is an interesting business that floated to great fanfare in 2024. However, the shares have fallen by c.50% over the last year and are now trading below their IPO level. Despite this, RPI stock is still trading on c.30x forward earnings. The StockRanks view this as a Falling Star and both the ValueRank and MomentumRank are under 20. While I hope to see this innovative British tech business succeed, I am not inclined to get involved at current levels. I’m going to leave our previous AMBER/RED view unchanged today. | |

Thor Explorations (LON:THX) (£476m | SR99) | Q4 gold poured of 23,719 ounces. FY 2025 gold poured totalled 91,910oz. Q4 cash balance of US$137m. FY 2026 production guidance range set at 75,000 to 85,000 oz of gold, All-in Sustaining Cost ("AISC") guidance range set at US$1,000 to US$1,200 per ounce. | ||

Picton Property Income (LON:PCTN) (£399m | SR60) | “Whilst the Company is in a strong financial and operational position, the Board believes it is important to be proactive and has initiated this process, which will take into account the views of shareholders and other key stakeholders.” “Continues to trade at a material discount to EPRA net tangible assets…” | ||

Tharisa (LON:THS) (£360m | SR99) | CEO: “While output was softer at the start of the year, leading indicators across the business are trending positively, particularly in mining, where recoveries have begun to improve following weather and sequencing-related impacts experienced during the quarter.” | ||

GYM (LON:GYM) (£280m | SR55) | Full year results slightly above the top end of current analysts' forecasts. Revenue +8%, LfL revenue +3%. 16 new sites, taking the total to 260. £10m buyback planned. FY26 Group Adjusted EBITDA Less Normalised Rent also expected to be slightly above the top end of the range of estimates, currently £55.2-59.3m. | ||

SRT Marine Systems (LON:SRT) (£242m | SR45) | H1 revenue +95% to £51.1m, pre-tax profit +47% to £3.1m. Gross cash +85% to £41.5m. H1 performance in line with exps. Expect continued progress in H2. | ||

Science (LON:SAG) (£236m | SR97) | Expect record adj op profit for 2025, ahead of expectations. Net cash £61.2m at 31 Dec. Expect to continue buybacks in 2026 at similar level to 2025. | GREEN = (Graham) [no section below] I've learned my lesson with this "international services and systems company", I hope. After undue caution in the past, I'm happy to give it the GREEN light for now, until it puts a foot wrong. Our last coverage was in October. Today's update shows the company overcoming "volatile market conditions" with an adjusted operating profit result that should be ahead of the £22.2m forecast in the market. Reported gains will be higher again, reflecting the successful (and surprisingly short-term) investment in Ricardo. That investment leaves with company with net funds of £61.2m as of year-end, giving it plenty of flexibility for future ideas. They provide a table to illustrate their long-term share price performance, something which the vast majority of AIM companies will never do, for entirely logical reasons! But they still think they are undervalued, and so buyback activity will continue. While I don't have a strong view on the underlying quality of the businesses within SAG, they clearly have a motivated and entrepreneurial Chair in the form of Martyn Ratcliffe, who owns nearly 19% of the company. I wouldn't bet against him, so I'll leave our stance on this GREEN for now. | |

Petrotal (LON:PTAL) (£191m | SR78) | Production averaged 15,258 bopd in Q4 and 19,473 bopd in 2025. $112.4m of unrestricted cash. Work underway to address production issues. | ||

Rainbow Rare Earths (LON:RBW) (£120m | SR35) | Pilot plant will operate through H1 2026, producing data to contribute to DFS and project financing efforts. | ||

SIG (LON:SHI) (£114m | SR50) | LFL sales flat w/ revenue of £2.6bn. Adj op profit c.£32m, in line with expectations. Leverage c.4.7x at year end. | ||

Afentra (LON:AET) (£95m | SR75) | Total 2C WI contingent resources across Blocks 3/05, 5A and 24 now 87.3 mmboe, up from 20.9 mmboe previously. | ||

Eagle Eye Solutions (LON:EYE) (£84m | SR51) | Won contract with US supermarket co-op Wakefern. Expected to go live mid-2026, with “a material contribution to Group ARR”, supporting the Board’s FY26 expectations (forecasts unchanged). | ||

Brave Bison (LON:BBSN) (£71m | SR42) | FY25 trading ahead of expectations, with net revenue +57% to £33.5m, adj pre-tax profit +41% to £5.5m. Board is comfortable with FY26 expectations. | ||

Petra Diamonds (LON:PDL) (£57m | SR22) | Recovery of 41.82 carat Type IIb blue diamond at Cullinan Mine | A diamond of “seemingly exceptional quality”. Company is analysing stone and determining the best method of sale. | |

Iofina (LON:IOF) (£50m | SR81) | FY25 ahead of expectations, with revenue >$65m w/ EBITDA >$11m. 2025 crystalline iodine production rose by 17.2% to 743.2MT. | ||

Shoe Zone (LON:SHOE) (£31m | SR63) | FY25 revenue -7.6% to £149.1m, pre-tax profit 67% to £3.3m. Net cash £5.9m. FY26 outlook “challenging”, expect FY26 PBT of £1.0m (Zeus previous f’cast £4.5m). | BLACK (RED ↓) Downgrading to a wholly negative view after yet another profit warning. I do see positives that could bode well in a recovery, particularly around cash conservation measures, so in my view this is far from a lost cause. But the timing of any potential recovery is uncertain and profitability is likely to be marginal for the foreseeable future. | |

Sosandar (LON:SOS) (£19m | SR64) | Q3 revenue +10% to £13.4m, gross margin 66% (FY24: 64.7%). Net cash £9.7m. On track to meet FY26 expectations. | ||

Lexington Gold (LON:LEX) (£19m | SR19) | £1.19m Equity Fundraise & Conversion of Loans & JORC Mineral Resource Estimates for JKL Project | 53% increase in contained gold for the combined JKL Project. Total Inferred Resource of 12.90 Mt at 0.78g/t Au for 323,500oz of contained gold. Raised £1.19m in new equity at 4p per share. Converted £350k of loans into equity, also at 4p per share. | |

Mission (LON:TMG) (£17m | SR72) | SP -12% PW: Completion of some projects delayed into H1 26. FY25 revenue now to be £68m w/ adj op profit £5.1m (CG previous f’cast £73m & £8.5m). Year-end date being moved to 30 Sept; next year end is 30/09/26. | BLACK (AMBER ↓) (Graham) [no section below] I tentatively upgraded this to AMBER/GREEN last year, in a move that now appears to have been misplaced. TMG is a people business: a group of collective agencies, and I must always be taught the lesson to be cautious with this category of business! Macro uncertainty is blamed for some project delays. which is fair enough, but the lumpiness of revenues is highlighted by the large gap between the expected and annual numbers (both revenues and profits), especially given that this is an update for FY December 2025! Net debt is £9m, which doesn't strike me as being all that comfortable for a business of this size, but at least it's moving in the right direction. A new CEO is attempting to achive annualised cost savings of £1.5-2m. | |

Itaconix (LON:ITX) (£15m | SR19) | Navitas has signed a MOU to acquire 65% working interest in JHI’s PL001 licence, which is adjacent to Sea Lion. No financial details provided. | ||

Westmount Energy (LON:WTE) (£11m | SR62) | Navitas has signed a MOU to acquire 65% working interest in JHI’s PL001 licence, which is adjacent to Sea Lion. No financial details provided. |

Graham's Section

Shoe Zone (LON:SHOE)

Down 18% to 55.1p (£25m) - Final Results - Graham - BLACK (RED ↓)

We already had three profit warnings here in recent memory, and today brings yet another.

First, let’s review FY September 2025.

Revenue £149.1m (FY24: £161.3m)

Digital revenue up slightly, store revenue down.

PBT £3.3m (FY24: £10.1m)

Adjusted PBT £2.4m (FY24: £10m).

This PBT result is in line with expectations.

Net cash has increased year-on-year to £5.9m.

The store count has reduced from 297 to 269 and its composition has also evolved with only 68 original stores left from 112 last year. These have been replaced with new larger format stores, relocations, refits, etc.

Outlook:

Trading conditions remain challenging due to macro-economic pressure and higher wages, with expected profit before tax of approximately £1.0m for the year ending 3 October 2026.

Forecasting the next ten months must be difficult, so I wouldn’t bet on this £1m PBT estimate being too accurate.

However, it’s still a major downgrade from the £3.4m forecast for after-tax income that’s currently in the market..

Management commentary

This is one of those stocks that can easily and with some justification point to the challenged consumer as the explanation for its poor trading:

This was a challenging year, particularly in the second half, as consumer confidence declined further following the Government's October 2024 budget, and highly adverse fiscal policies. Persistent inflation, higher interest rates, and reduced disposable income contributed to negative economic and consumer sentiment in the UK. Sales were good when there was a reason to buy, such as the warm summer and the Back-To-School period, however, discretionary spending remained subdued as consumers exercised greater caution in what they were spending money on.

Leases: lease length is only 2.6 years, which is excellent and helps to reduce the risk for shareholders. And rents aren’t increasing.

Product margin reduces from 62.8% to 61%. I’m surprised it’s even as high as this!

Cash: it sounds like Shoe Zone has been running a tight ship. Inventory fell £5.4m as the number of stores reduced, and capex also collapsed to only £3.3m (FY £11.5m). They cancelled their profit share scheme. They also paid no dividend, and haven’t declared one today.

The result is that the cash balance was protected, and grew from £3.6m to £5.9m.

Outlook is appropriately downbeat:

Trading conditions remained challenging in the first quarter of the new financial year, with revenue down on forecast, reflecting ongoing macro-economic pressures that continue to weigh on consumer confidence resulting in lower footfall on the UK High Street, alongside the highly adverse Government fiscal policies. The Government's November 2025 budget included an additional increase in the National Living Wage, raising our cost base further, with broader measures not materially improving consumer sentiment. In light of these conditions, we expect a profit before tax of approximately £1.0m for the financial year ended 3 October 2026.

Graham’s view

I’ve been AMBER/RED on this, and I’m going to downgrade it further today, to an entirely negative view.

I would like to quality this with some positives:

Management has acted very prudently to conserve cash with a wide range of cash-saving measures.

This has resulted in a positive net cash position, before considering leases.

Lease liabilities on the balance sheet are some £34.5m but they could have been much larger, if the average lease length was longer.

Given the low average lease length (2.6 years), Shoe Zone has the flexibility to continue closing stores as necessary.

Those are the positives. The negatives are pretty clear: they sell a commoditised product, and external conditions play a huge role in deciding whether or not it’s possible for them to make a profit. For now, these conditions are not conducive to success.

So I’m RED, but this is very much a temporary view. I’m open to the idea that this could become an interesting turnaround at some point. But personally I wouldn’t go near it for now.

Trustpilot (LON:TRST)

Up 11% to 208p (£819m / $1,103m) - Trading update for the twelve months ended 31 December 2025 - Graham - AMBER/GREEN ↑

This is a controversial one. Many readers have expressed some form of disgust over Trustpilot’s business model, and the stock has attracted the attention of professional short-sellers (Grizzly Research in particular).

But the share price is now higher than it was when Grizzly raided it:

Today’s full-year update shows excellent growth for FY December 2025:

Bookings +18% (at constant currency)

Annual recurring revenue +19% (cc)

Revenue +20% (cc)

Adjusted EBITDA is projected to be ahead of expectations.

Cash: $48m, after buying back $72m of shares.

Buyback: extended by up to £10m/$13m.

Interesting little snippet: “Importance of Trustpilot in AI answer engine optimisation helping drive growth”.

In a rejoinder to short-sellers and sceptics who describe it as a sewer of fake reviews, they claim to have removed 7.8 million fake reviews.

CEO comment:

"2025 was a year of excellent strategic and financial progress, with growth accelerating in H2. Answer Engine Optimisation drove particularly strong growth in enterprise new business. This, combined with product innovation and improved gross dollar retention, positions us strongly for 2026. We reinforced our core commitment to trust, implementing new AI-enabled fraud detection technology, ensuring that both consumers and the 1.3 million businesses using Trustpilot can continue to build trust with confidence."

“Answer Engine Optimisation” is similar to SEO (search engine optimisation), but for AI bots:

People are increasingly asking AI tools for recommendations instead of relying solely on traditional search engines. Answer Engine Optimization (AEO) helps your business appear in those AI responses.

AEO works a lot like traditional SEO, but instead of optimizing for search engines, you’re optimizing for the AI systems people now use to find and evaluate businesses.

I’d never thought about this before, but it obviously makes sense. Traditional SEO is going to have to evolve for ChatGPT, Grok, etc.!

Graham’s view

I’m a huge admirer of Trustpilot’s market position, and my view hasn’t really changed in the light of the bear raids. I still think Trustpilot has very little direct competition, and has the potential to be an extremely successful business in the long-term.

For me, the question is more around whether the share price can be justified on valuation grounds.

In recent time, we've been neutral:

I’m actually more comfortable valuing this on a multiple of sales or on a multiple of ARR, rather than on a multiple of earnings. I think it makes sense to treat Trustpilot in the same way we should treat other high-quality software businesses with interesting long-term prospects.

Given the latest ARR of $296m, Trustpilot is today trading on a multiple of 3.7x ARR.

This is a little low, in my book. If we put it in a US context, it's normal for software companies to trade around 6-8x ARR.

Since Trustpilot is profitable, is trading at a modest ARR multiple, and has just informed us that 2025 was ahead of expectations, I’m going to revert back to AMBER/GREEN on this. I acknowledge this might be an unpopular stance! But I think there are enough reasons to justify it.

Roland's Section

Persimmon (LON:PSN)

Up 0.5% at 1,421p (£4.5bn) - Trading Statement - Roland - AMBER/GREEN ↑

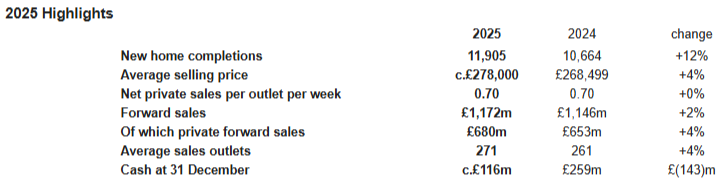

Today’s update flags up a strong recovery in volumes for 2025 and good progress on building safety remediation at this large housebuilder.

Profit upgrade: underlying pre-tax profit for 2025 is now expected to be at the upper end of expectations.

The company has helpfully included details of consensus forecasts in today’s update:

2025E underlying pre-tax profit of £428m (£415 - 440m)

Based on today’s guidance for PBT to be at the upper end of expectations, I think we can now expect a result between £428m and £440m for 2025.

Checking last year’s results, the equivalent figure for 2024 was £395.1m. So it looks like profits may have risen by around 10% in 2025. That’s not a bad result, in my view and suggests the group’s pre-tax margin may have risen from 12.3% to 12.9% last year. A useful increase.

Improved operating metrics: the increase in profit seems to have been driven by higher volumes rather than any improvement in profitability.

New home completions rose by 12% to 11,905, while the average selling price also edged higher.

Although private sales per outlet were unchanged, Persimmon also managed to end the year with a slight increase in its order book:

I think one thing that’s interesting about these figures is that they mask an improvement in private sales (to individual homebuyers) last year.

Like most housebuilders Persimmon now generates substantial sales from built to rent (bulk sales) as well as private sales. In its commentary, the company reports a number of positive metrics for private sales:

Private selling price up 5% to c.£301k;

Incentives stable at c.4-5%

Sales rate excluding bulk sales rose by 4% to 0.59;

Private sales in forward order book +4% to £680m

While Persimmon is still having to offer fairly material incentives (such as kitchen upgrades, etc) to complete sales, these figures are slightly more positive than the overall figures listed above.

The difference between the two is explained by softer bulk sales during the final quarter of the year. Persimmon attributes this to uncertainty ahead of November’s Budget.

On balance, I think it’s probably positive to see these tentative signs of strength in the core private sales business. Perhaps falling mortgage rates are helping to encourage transactions and liquidity in the housing market.

2026 outlook

Persimmon’s management isn’t pricing in too much optimism for 2026, but they echo my comments above about private buyer activity:

While we are not expecting any material improvement in market conditions this year, early indications from our Boxing Day marketing campaign are encouraging. Recent reductions in mortgage rates are helpful for our private customers although we remain mindful of continued affordability constraints.

However, sales elsewhere may remain weaker:

In addition, fewer bulk sales in the order book, and continued challenges in the registered provider market, are likely to slow our growth in these markets in 2026.

The end result is that volumes are expected to rise by less than 2% to 12,043 in 2026.

However, the company says its “unique level” of vertical integration should help the group manage continued cost growth.

Consensus forecasts for underlying pre-tax profit lie in a range of £461 - 487m. Based on the mid-point of this range, I estimate the group’s pre-tax profit could rise by c.9% in 2026.

Roland’s view

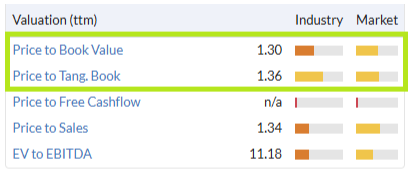

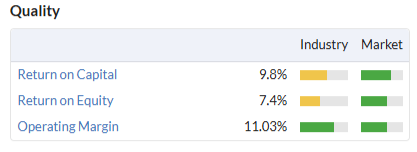

I’ve been neutral on this business for a while, purely on valuation terms.

Persimmon has been trading at a premium to its book value:

… but only generating a c.7%-8% return on equity:

For a property company that simply buys land, builds houses on it and then sells them, this valuation looks relatively full to me. To justify paying a premium to book value for a housebuilder, I’d want to see it earning a 10%+ return on equity.

However, today’s mild upgrade and 2026 outlook suggest to me that we could see a modest improvement in profitability in 2026. In addition, today’s positive update is itself a positive sign – our research has shown that one upgrade often follows another as expectations gradually edge higher.

Although earnings forecasts for Persimmon have drifted lower over the last year:

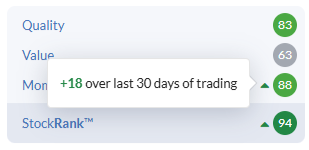

… more recently, the StockRanks have measured improving momentum:

In addition, our algorithms are now styling Persimmon as a Super Stock.

With this combination of trading and quantitative improvements, I’ve decided to move my view up by one notch to AMBER/GREEN today.

Games Workshop (LON:GAW)

Down 2.5% at 18,390p (£6.1bn) - Half-Yearly Report - Roland - GREEN

Today’s update from Games Workshop hasn’t set the market on fire – the shares are down slightly as I write, but as usual with this business I am struggling to find any serious concerns in today’s results.

I’ll review the results in a moment, but first take a look at todays’ second RNS update – a dividend.

Dividend: rather than paying dividends on a fixed schedule, Games Workshop declares dividends when it has “truly surplus cash”.

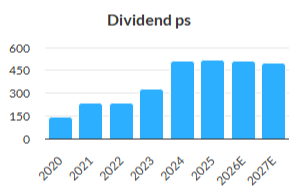

The Board has today declared a dividend of £1.10 per share taking dividends declared so far in 2025/26 to £4.85 per share (2024/25: £4.20).

Last year’s total payout was 520p per share. Last year saw payouts in January and March, so I suspect we’ll see one more dividend this year. On that basis, it seems reasonably likely that the FY26 dividend could exceed last year’s payout.

Having said that, consensus forecasts shown on the StockReport are more conservative than this:

Based on these forecasts, the stock offers a yield of around 2.7%. Games Workshop’s share price growth means it’s no longer an attractive yield play, although it could still deliver strong income growth over time.

Half-year results summary

Moving on, today’s half-year results show a respectable increase in the group’s top-level numbers:

Revenue up 10.9% to £332.1m

Operating profit up 11.3% to £140.4m

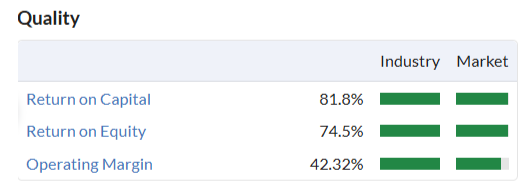

Operating margin: 42.3% (H1 25: 42.1%)

Trailing 12-month return on equity: 64.7%

Drilling down one level reveals growth in the core retail business during H1, but a reduction in licensing revenue:

Licensing: this fall may explain today’s share price reaction – licensing revenue is almost pure profit and has helped to juice earnings growth in recent years.

However, the near-term pipeline of licensing revenue seems weaker than last year. Licensing revenue fell by 47% to £16m in H1, while the pipeline of licensing receivables due in the year ahead is just £12.5m (FY25: £30.0m).

86% of the royalty income generated in H1 came from PC and console game licences. Timing on future payments from the Amazon deal that has so excited investors remains harder to predict, as the company admits with its usual admirable transparency:

Our live action endeavour is still in development with our partners: Amazon MGM Studios, Henry Cavill and Vertigo. It is the nature of these things to take several years, and while we wish we could tie down a release the way we can with our core business, the reality is that, as with any licensing deal, delivery is not in our control. We leave it to our partners to manage their own businesses.

However, work is said to be “almost complete” on a standalone Warhammer Age of Sigmar episode for Prime Video.

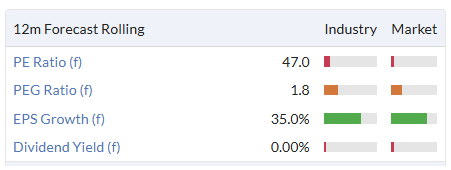

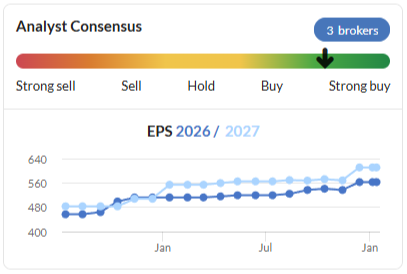

Outlook: Games Workshop doesn’t provide forward guidance, but there are some consensus forecasts in the market. If correct, this estimates suggest earnings could dip slightly this year:

FY25 actual: 594.9p per share

FY26E: 563p per share

FY27E: 611p per share

However, today’s H1 earnings of 319.2p per share represent 57% of current full-year forecasts. I don’t think it would be a massive surprise if the group’s full-year earnings were slightly ahead of these forecasts.

Roland’s view

Earnings forecasts were upgraded in November after a strong update which Graham covered here.

The shares rose sharply at the time but have drifted lower since:

On conventional measures the shares hardly look cheap on a P/E of 32. However, Games Workshop is hardly a conventional business. The group benefits from a differentiated product that appears to have both growth potential and pricing power, excellent management and superb high-quality financials:

While I wouldn’t buy the shares as a short-term trade at current levels, I don’t see any reason why they cannot continue to justify their valuation over the medium-long term.

The core business is continuing to grow and the company’s television and film efforts appear to have strong backers and are being developed methodically. I am confident they should eventually bear fruit.

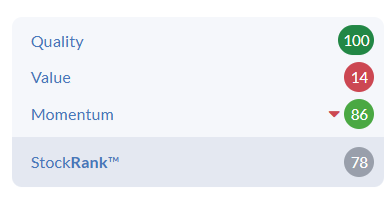

The StockRanks also remain impressed, despite a low ValueRank:

With only slight trepidation, I’m going to leave Graham’s GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.