Good morning!

All done for today, have a great weekend!

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£209bn | SR70) | New strategic collaboration agreement with CSPC Pharmaceuticals to advance the development of multiple next-generation therapies for obesity and type 2 diabetes across eight programmes. CSPC will receive an upfront payment of $1.2 billion from AstraZeneca. CSPC is also eligible to receive development and regulatory milestones of up to $3.5 billion across all programmes. | ||

Experian (LON:EXPN) (£24.7bn | SR52) | US$1bn share repurchase programme. “We continue to trade strongly underpinned by our strategic execution and we expect to end this financial year in a favourable leverage position.” Buyback will reduce shares in issue and also fund employee share-based payments of c. $200m. | ||

Airtel Africa (LON:AAF) (£12.5m | SR87) | Total customer base increased by 10% to 179.4 million. 9-month period: revenues of $4,667m (+24.6% in constant currency). EBITDA +35.9% in reported currency to $2,283m. Profit after tax of $586m improved from $248m year-on-year. | ||

Drax (LON:DRX) (£3.1bn | SR98) | Tolling agreement with West Burton C Limited, a company owned by Fidra Energy (an independent Battery Energy Storage Systems developer), for 250MW (500MWh) of new BESS capacity. | ||

Yellow Cake (LON:YCA) (£1.69bn | SR59) | Value of Yellow Cake's uranium holdings decreased by 0.5% over the Quarter from US$1,778.0 million to US$1,768.2 million as at 31 December 2025, as a result of the corresponding decrease in the uranium spot price. NAV per share £6.06. | ||

Chrysalis Investments (LON:CHRY) (£555m | SR87) | NAV 165.36p (share price: 112p). NAV down 3.7% since 30th September 2025. | ||

Cohort (LON:CHRT) (£553m | SR20) | SP -3% Marlborough Communications Ltd has been awarded a contract with a total value of £14.0m, by a UK government customer for immediate delivery of uncrewed air systems, together with in-service support for two years. Plus another £3.9m order for a UK customer. | AMBER = (Graham) [no section below] £18m of total contract wins did not strike me as a very meaningful news from a business generating annual revenues of c. £300m, and the 3% fall in the share price seems to confirm that. There is reassurance that "sufficient orders have now been secured to underpin fully the Group's 2025/26 financial year consensus forecast revenue", and that is worth something, but the financial year ends in April and so it would have been more worrying if orders to meet FY26 forecasts had not yet been secured. | |

Avon Technologies (LON:AVON) (£541m | SR44) | Avon Protection: record start to the year, healthy order book and sales pipeline. Team Wendy: strong order book but slower first quarter. Assuming no further extended US government shutdowns, the impacts are to be temporary. At Group level, full year guidance unchanged. | ||

Stelrad (LON:SRAD) (£175m | SR80) | 2025: another year of adjusted operating profit growth (+c.3% to c. £32.5m), in line with market expectations. Volumes declined 4%. Outlook: “although there remains a level of uncertainty around the timing of the wider market recovery”, the company has “a robust platform for further progress during 2026.” | ||

Peel Hunt (LON:PEEL) (£131m | SR82) | Continued to trade well in H2. Full year revenues and profits ahead of current market expectations. | GREEN = (Graham) The news that we'll have “full year revenues and profits ahead of current market expectations” doesn’t really tell us all that much, unless Peel Hunt would like to confirm for us what these market expectations are? It would be much easier to invest if all companies provided that information in their RNS announcements, of course. | |

Shield Therapeutics (LON:STX) (£117m | SR35) | Partner in China expects to submit the file for marketing authorisation to the China National Medical Products Administration for the approval for ACCRUFeR® in China in Q1 2026. | ||

Centaur Media (LON:CAU) (£67m | SR62) | Return of up to £64m by way of a Tender Offer at 48p. | ||

Kr1 (LON:KR1) (£35m | SR29) | Aggregate income from staking activities on a range of proof-of-stake networks: £169,615. Net asset value £50.2m, 28.25p per share. | ||

Transense Technologies (LON:TRT) (£17m | SR63) | Pace of growth is below market expectations, primarily due to delays in customer on-boarding. FY26 revenue not less than £5.2m. Revenues from the two operating businesses are expected to grow by not less than 30%. Lower levels of revenue than previously anticipated mean that profitability for FY26 is expected to be materially below current market expectations. | AMBER/RED ↓ (Graham) Marking this down one notch from the neutral stance I took on this last year. This is a major profit warning that puts back financial progress by about a year, in my view. While the business as a whole may be undervalued at this level, market caps of this level are particularly risky in my experience (e.g. delisting risk), so I would tread carefully. | |

RC Fornax (LON:RCFX) (£14m | SR32) | Non-Exec Chair to resign. NED becomes Independent Non-Exec Chair. MD/Head of Engineering joins the Board as Exec Director. FY August 2025 results to be published in mid-Feb, anticipated to be in line with what has been previously communicated. | ||

Rua Life Sciences (LON:RUA) (£10m | SR51) | Revenues for 18 months £6.7m (12 months to March 2024: £2.2m). Loss before tax reduced 85% to £0.2m (2024: £2.0m). Cash £3.25m. “Activity levels achieved during period have continued into current year with encouraging new business pipelines.” |

Backlog (last night)

Pinewood Technologies (LON:PINE)

Up 24% to 476.2p (£548m) - Response to Press Speculation - Graham - PINK

This provider of software for car dealerships put out some pleasant news last night:

The Board of Pinewood.AI notes the recent press speculation regarding Pinewood.AI and confirms that it has entered into discussions with Apax Partners LLP ("Apax") regarding a possible cash offer of 500 pence per share for the entire issued and to be issued share capital of Pinewood.AI (the "Possible Offer") by Apax. As an alternative to receiving cash, the Possible Offer will include an unlisted partial share alternative.

Apax is a global but London-headquartered private equity firm. So I’d view this as a local bid for Pinewood, not a foreign bid.

Importantly, the Board of Pinewood “would be minded to recommend” the offer at 500p, if it materialises.

The share price was 385.5p last night, having already risen from 351.5p two weeks ago.

Therefore, against last night’s price, the 500p possible offer is an almost 30% premium.

Against the price two weeks ago, it’s a 42% premium.

That’s the level of premium which is often enough to get deals over the line.

Although I note that PINE shares did reach 500p at one point in the autumn:

Graham’s view

I was AMBER/GREEN on this in June, observing a punchy valuation but with promising growth prospects. US ambitions marked it out as a potentially interesting growth story.

EPS is forecast to grow strongly over the next few years, e.g. in September Zeus published forecast EPS of 12.1p (FY26) rising to 20.2p (FY27). So Apax might be about to pay 25x next year’s earnings.

That might sound a little rich, but there is at least a net cash position (£30m as of June 2025), and that cash position is also forecast to grow strongly. For a successful, growing software business, doing well in the United States, I don't think that 500p is an outlandish price to pay.

So Apax can perhaps do well out of this acquisition, but PINE shareholders may also be perfectly happy to exit and to crystallise their gains. So I guess everyone’s a winner. Let’s hope that the possible offer turns into a real offer soon.

Graham's Section

Peel Hunt (LON:PEEL)

Up 4% to 113p (£139m) - Trading ahead of expectations - Graham - GREEN =

It’s a terse update but a positive one.

Fewer than 100 words:

Reflecting the strength of our corporate client base and both our Investment Banking and Execution Services franchises, Peel Hunt has continued to trade well in the second half of the financial year, and we have supported clients on a range of M&A and equity capital markets transactions. As a result, the Group now expects to deliver full year revenues and profits ahead of current market expectations.

Graham’s view

As I’ve speculated already, the London market is set to be more active in 2026 than it has in previous years.

After all, the FTSE-100 has been carried 18% higher over the past year, and 33% over two years. Not what you might expect if you only focused on the weak flows into London-based active funds:

The soaring UK index has created a welcoming environment for forthcoming large-cap IPOs. Two in particular stand out: RAC which is “close to selecting banks” for its IPO (Bloomberg), and also the Norwegian software business Visma.

Other banks are rumoured to be on track to get the RAC deal, and I’m not sure if Peel Hunt will have any involvement with Visma. But these deals point to the “mini-revival” that is expected in London this year.

When it comes to Peel Hunt, I’ve noted that the forecasts available for its revenues and profits this year make little sense, when compared to its interim results. Peel Hunt already made 60% of forecast full-year revenue in H1, and more than 100% of forecast PBT, based on what I can find.

Indeed, from what I can gather, there is only one analyst covering Peel Hunt - the one at Keefe, Bruyette & Woods, Peel Hunt’s broker. And their estimates do not look to me as if they are updated very regularly, at least not in terms of what is released to the public.

Therefore, the news that we'll have “full year revenues and profits ahead of current market expectations” doesn’t really tell us all that much, unless Peel Hunt would like to confirm for us what these market expectations are? It would be much easier to invest if all companies provided that information in their RNS announcements, of course.

But I’m not going to complain too loudly: this is a company I’ve considered to be undervalued, and that I left on my annual watchlist for 2026. So I’m not upset that it’s beating market expectations. It's just that the market expectations themselves are something of a mystery. The numbers on the StockReport are definitely very stale, in my view - this is unfortunately what happens sometimes with stocks that receive limited coverage. The consolation is that this creates opportunities for those who are willing to dig a little deeper!

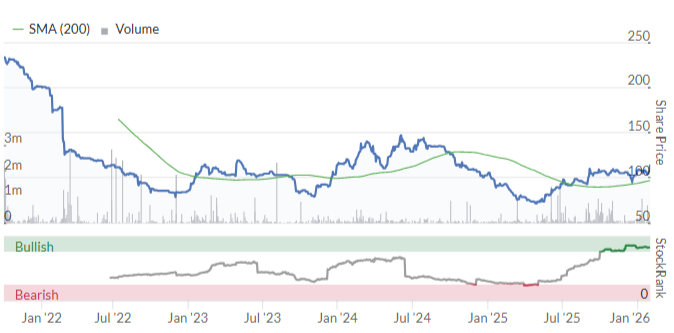

Peel Hunt shares still trade at only 50% of the price at which they IPO’d in 2021 (113p today vs. 228p IPO price):

Update: I contacted Peel Hunt's PR firm, who informed me that prior to this update, market expectations were for PBT of £12m. This doesn't line up with what I can gather from any other source, but it must be true. H1 PBT was £11.5m, suggesting that market expectations were for PBT of £0.5m in H2. At least we can rest assured that the efficient market hypothesis isn't going to be true any time soon!

Transense Technologies (LON:TRT)

Down 36% to 72.05p (£11m) - Trading Update and Notice of Interim Results - Graham - AMBER/RED ↓

Commiserations to anyone who was holding this overnight:

Transense Technologies Plc (AIM: TRT), the provider of specialist sensing solutions and measurement systems, announces a trading update for the six months ended 31 December 2025 and updates on the outlook for the full financial year ending 30 June 2026 ("FY26").

We don’t cover this one regularly, with the last time being February 2025.

It has two divisions, SAWsense (industrial sensors) and Translogik (tyre inspection tools).

H1 has not gone as planned:

Whilst both core trading divisions, SAWsense and Translogik continue to demonstrate increasing revenues, the pace of growth is below market expectations, primarily due to delays in customer on-boarding from their respective pipelines of new business. In addition, expected royalty income from Bridgestone iTrack is now considered likely to be approximately 10% lower than previously expected.

“Delays in customer on-boarding” is a tricky reason, as it requires further elucidation: are customers dragging their feet, or are enthusiastic customers being slowed down by technical problems?

We do get a bit more on this topic, a little further down.

SAWSense: revenue growth +70% in H1, and…

On-boarding of new customers is generally progressing well, however this process can be time consuming in agreement of technical scope, commercial terms and allocating financial budgets. There is currently elevated reluctance to make new commitments, often due to prevailing volatile geopolitical and economic considerations.

This sounds like a “bit of both”: technical obstacles, and some customer reluctance.

Translogik: revenue growth +13% in H1, “despite subdued demand from major tyre producers”.

Guidance:

…the Company now expects that Group revenue for FY26 will be not less than £5.2m, including approximately £2.0m of royalty income. Revenues from the two operating businesses are expected to show composite growth of not less 30% for FY26. Whilst gross margins have been maintained, the impact of these lower levels of revenue than previously anticipated mean that profitability for FY26 is expected to be materially below current market expectations.

Net cash was £0.9m as of Dec 2025.

Estimates: with thanks to Cavendish, the new forecasts are as follows.

FY June 2026 revenue £5.2m (previously £6.5m), adj. EBIT £0.3m (previously £1.3m).

FY June 2027 revenue £6.4m (previously £7.7m), adj. EBIT £1.5m (previously £2.3m).

Graham’s view.

I interpret the new estimates as putting back the company’s progress by about a year. The new FY27 revenue forecast is similar to the old FY26 forecast. And the new FY27 EBIT forecast is similar to the old FY26 forecast. So in simple terms, the timeline of financial progress has been pushed back by a year.

And it’s curious that all revenue streams are marked lower. Not just the operating divisions, but even the royalty stream from Bridgestone iTrack has been reduced, due to lower volumes and negative FX movements.

It is curious that a business earning £2m+ of royalty income per annum is only worth £11m - the operating divisions must be adding almost nothing to the valuation at this stage?

On that basis, I do think there could be value arguments for the stock at this level. Against that, I’m wondering if the group as a whole is perhaps just fundamentally too small to justify a stock market listing? Adjusted EBIT of £1.5m in FY27, even if it’s achieved, wouldn’t change that.

Given the major profit warning, I am going to mark this AMBER/RED today, down from my previous neutral stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.