Good morning folks! We've made it to the end of another week.

Seeing as it's a quiet Friday, I've reviewed both my personal portfolio and my 2026 watchlist, in the hope of bringing you some interesting commentary on the year-to-date performance of one or both of them. However, each of these portfolios has barely moved so far this year!

In my personal portfolio, the really big movers this year are companies in which I have fairly small stakes:

- Rightmove (LON:RMV) (3% of the portfolio): this is down 16% as investors fear that AI will replace the need for a centralised property portal. I don't want to dismiss those concerns out of hand, but I do struggle to imagine a world where property portals become obsolete as people search for properties using new AI tools instead. That said, I admit that I have personally found that ChatGPT is extremely good at valuing properties, and I have no doubt that it could be used for idea generation for property hunters. Rightmove is now back around the price I paid for it many years ago, though it has paid many dividends over this time. It's at 14x earnings which in my view is extremely cheap if the bearish AI thesis is wrong.

- ASA International (LON:ASAI) (2% of the portfolio): this is up 17%, helped by an ahead of expectations update that we covered here. It's a high-risk idea but I'm pretty excited about the potential of this international microfinance lender. The price is certainly a big part of what got me interested, and it's still trading at just 4.4x earnings, according to the StockReport.

- Evoke (LON:EVOK) (1% of the portfolio): this is up 25% but I am still nursing a (fully deserved) large loss on this one, as I've continued to hold it even after it ruined its own balance sheet. Management are now considering the sale of some or all of the group's businesses. I think the recent UK tax changes could be the nail in the coffin for this one, and I'm likely to sell out at some point. We are RED on it - see here.

All told, my portfolio is only up slightly year-to-date. I think my total return is 0.3%, vs. 5% by the FTSE All-Share Index.

As for the 2026 watchlist, it's doing a little better, tracking the FTSE All-Share more closely with a return of 4.8% year-to-date. The biggest movers here are:

- Polar Capital Holdings (LON:POLR) - this fund manager is up 17% helped by a very strong AUM update that included net inflows, very high performance fees, and their first share buyback. Backing quality is working in this case.

- PayPoint (LON:PAY) - up 15% after an "in line" update that reassured investors after its November profit warning. Leaving this financial infrastructure business on my watchlist for another year was a little controversial, but I think it was just too cheap on a P/E multiple of 6x . Even today it is not even trading at 7x forecast earnings.

- Peel Hunt (LON:PEEL) - up 11% after confirming that it is beating expectations for FY March 2026. But as I've previously explained, those expectations never made sense to me in the first place. In any case, it's great to see that the London markets are getting busy again.

- Hostelworld (LON:HSW) (in which I have a long position) - down 9% despite an "in line" update in January. I really like the value on offer here for a successful online travel agent with a well-defined niche, although in theory I guess AI could also disrupt the business model. They are profitable, cash generative, and trading at 9x earnings.

So that's a brief overview of both portfolios year-to-date. As usual, investing is messy, unpredictable and difficult, but always interesting!

Today's Agenda is complete.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Natwest (LON:NWG) (£52bn | SR70) | Income of £16.4 billion and a Return on Tangible Equity of 19.2% are significantly up on last year, and ahead of guidance, whilst dividends per share increased by 51% compared to 2024. CET1 ratio 14% is up 40 basis points. TNAV per share up 55p to 384p (share price 595p). 2026 outlook: return on tangible equity greater than 17%. | ||

SDI (LON:SDI) (£84m | SR80) | Net consideration £9.3m. PRP “designs and manufactures custom high performance microLEDs, LED light engines and monolithic LEDs for a range of applications within the avionics, defence and industrial sectors”. PRP’s 2025 revenues £5.99m, reported EBIT £1.54m, net assets £4.43m. | AMBER/GREEN = (Graham) I'm comfortable staying moderately positive on this. Limited organic growth is the main counter-argument but it does at least still have the M&A engine working in its favour, as evidenced by today's acquisition. | |

Skinbiotherapeutics (LON:SBTX) (£50m | SR23) | SP -34% | RED ↓ (Graham) [no section below] I looked at this for the first time in June and took a neutral stance, willing to give it the benefit of the doubt as it raised fresh funds (over £4m) and announced an agreement to sell its supplements into SuperDrug. That may have been too optimistic as we learn today that the CEO has abruptly left with the Board asking questions about his conduct. The statement in today's announcement that "there will be no further comment at this time" leaves the market to assume various worst-case scenarios. In December, the company said it was on track for revenue this year (FY June 2026) of £6.2m, and adjusted EBITDA of £0.7m, which would represent excellent year-on-year progress. However, following today's announcement, I have to assume that it will be difficult to meet these expectations, following the loss of the CEO and at this delicate stage of the company's development. Therefore I'm afraid that a downgrade all the way to RED seems most sensible. | |

Celebrus Technologies (LON:CLBS) (£49m | SR39) | The Board has approved a share buyback programme of up to 1 million shares. “The Company intends to hold all Ordinary Shares so purchased in treasury for the purpose of satisfying future obligations in relation to its employees' or other share schemes.” | [GN] This buyback merely reduces dilution from various share schemes; it is not designed to permanently reduce the share count. | |

Nexteq (LON:NXQ) (£43m | SR61) | Nexteq has secured its first customer win and initial software license purchase order for its recently launched gaming software platform, “Launchpad”. This is the first commercial software-led sale for Quixant, which is Nexteq’s gaming brand. | ||

Cellbxhealth (LON:CLBX) (£12m | SR6) | CLBX has “decided to discontinue maintenance of its FDA establishment license and device listing for the Parsortix® system, which aligns its regulatory strategy with the Company's current operational and commercial priorities and strengthening cost discipline.” “This change has no impact on CelLBxHealth's sales pipeline, market forecasts, customer support, or ongoing partnerships.” | ||

GSTechnologies (LON:GST) (£12m | SR1) | 66.7% owned subsidiary Semnet has now formally issued and served a writ of summons against the sellers of Semnet a former Semnet manager “to vigorously pursue claims for alleged breaches of fiduciary and contractual duties”. The total damages sought are approximately US$4.2 million. |

SDI (LON:SDI)

Up 4% to 83.97p (£88m) - Acquisition of PRP Optoelectronics - Graham - AMBER/GREEN =

SDI calls itself “the buy and build group, focused on companies which design and manufacture specialist lab equipment, industrial & scientific sensors and industrial & scientific products”.

That doesn’t exactly roll off the tongue. I tend to think of it as a smaller iteration of Judges Scientific (LON:JDG).

Today it announced the acquisition of PRP Optoelectronics Ltd for £9.3m.

Key points:

PRP makes “custom high performance microLEDs, LED light engines and monolithic LEDs for a range of applications within the avionics, defence and industrial sectors”.

It is said to have “long-term revenue visibility, supported by long-term agreements, with a stable, blue-chip customer base and strong international revenues.”

Financials: in 2025, PRP had revenues of nearly £6m, EBIT of £1.5m and net assets of £4.43m including cash.

That remark about “including cash” is important, because SDI is paying £9.3m for the business excluding the cash. It’s paying an additional £2.8m for the cash (some of which is deferred until after completion).

So SDI is paying £9.3m for £1.5m of trailing EBIT, which is £1.125m assuming 25% tax. That makes for an earnings multiple of about 8x.

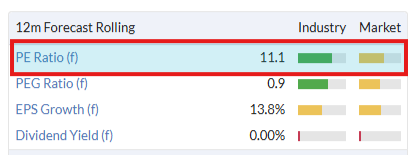

SDI itself trades more richly than that, as you’d expect for the acquiring company:

The above PE ratio could be increased slightly if you wished to adjust for £14m of net debt at SDI as of October 2025.

Indeed, SDI have updated us today with some cash and debt figures which imply that net debt had increased to £18m as of January 2026.

And this acquisition will also be funded by debt - the revolving credit facility from HSBC.

SDI’s CEO comment:

"The acquisition of PRP is a significant milestone for SDI, marking our entry into the avionics markets. The business boasts a range of products in a very particular niche, which have applications across multiple sectors, including in aviation and on platforms, including the General Dynamics F-16 and Airbus A320 among others.

Graham’s view

I have no objection to this. Of course it benefits SDI shareholders to see acquisition take place as cheaply as possible, and with small companies like PRP, I would ordinarily expect to see a lower trailing earnings multiple than 8x. But there may be very good reasons for the price paid. Maybe this is the going rate for businesses making LEDs?

Checking SDI’s interim results, I see organic growth was 3% (at constant currencies), buttressed by 6.9% growth from acquisitions.

We’ve been AMBER/GREEN on this for pretty good reasons, I think. Until organic growth speeds up, it’s hard to argue that it deserves a dramatically higher valuation than it’s already got. But at least the M&A engine is still working in its favour, meaning that the prospects for shareholders should hopefully still be decent.

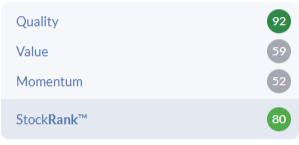

The StockRanks seem to agree with me: a view that’s positive, but not excessively so.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.