Good morning!

Norcros (LON:NXR)

Share price: 209.6p (up 0.8% today)

No. shares: 61.0m

Market cap: £127.9m

(at the time of writing, I hold a long position in this share)

H1 trading update - this group describes itself as, "the market leading supplier of innovative branded showers, taps, bathroom accessories, tiles and adhesives" - how refreshing to read a simple, plain English description of what the company does (a rarity today!).

The key part confirms that H1 is in line;

Group underlying operating profit1 in the first half is expected to be in line with the Board's expectations.

Other points;

- H1 sales £118.7m (up 9.3% vs LY, up 12.0% on constant currency basis)

- Encouragingly, 6.5% of that 12.0% is LFL organic growth

- Balance of 5.5% non-organic growth came from Croydex acquisition

- UK LFL growth +1.8%, S.Africa +16.9%

- UK retail sector "remains challenging"

- UK trade sector "good year on year growth" - new house building helped

- Croydex performing in line with expectations

- Net debt £29.5m (2014: £20.0m)

- Cash outflow of £20.1m for Croydex acquisition in the period

Outlook comments -

All of our businesses continue to perform well notwithstanding the mixed market conditions and the recent weakening of the Rand. The improved manufacturing efficiencies in Johnson Tiles UK have been sustained and we have made good progress in integrating the Croydex business into the Group. The Board remains confident that the Group will continue to make progress in line with market expectations for the year to 31 March 2016.

That all sounds pretty good to me.

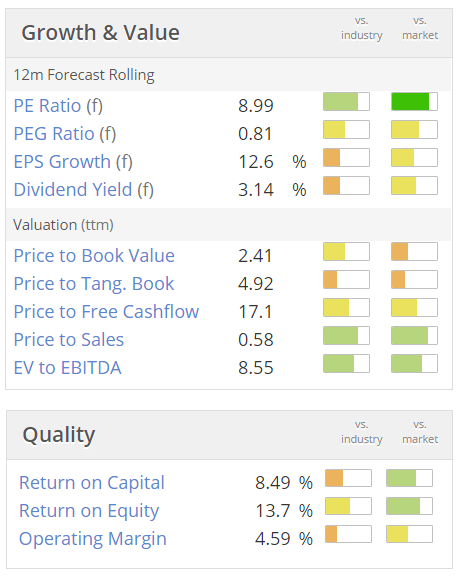

Valuation - since the company is trading in line, these valuation figures should be accurate;

Bear in mind there is a large pension scheme here, which is a negative, so valuation needs to factor that in.

Stockopedia likes it, with a StockRank of 93.

My opinion - I like it - this is a long-term holding of mine, and it's strikingly cheap compared with practically everything similar out there.

I particularly like that S.Africa is powering ahead, shrugging off currency issues. The company is making very sensible acquisitions, with the intention of growing the business substantially. As long as they don't take on too much debt, then that's a good strategy in my view. Debt is under control at the moment, and remember that there is also freehold property on the balance sheet, so personally I tend to offset freeholds against debt, when valuing companies.

I think fair value here is about 300p, but am not holding my breath over when we are likely to get there! It's a boring share, but it pays nice divis, and at some point should re-rate nicely. That could happen very quickly (e.g. on a takeover approach), so I'd rather be in it, than sitting on the sidelines and miss any potential big move.

I'm still getting used to the new figures, post 10 for 1 consolidation. Still, you only have to move the decimal point one space to the left, to go back to "old money"! I think it was a sensible move to do the share consolidation - although it shouldn't make any difference, it now looks a more sensible share, whereas a 20p share looks a bit mickey mouse, particularly for institutional shareholders. Also, the price being quoted in 0.25p increments was clunky when it was 20p - each increment was quite wide, at 1.25% of the price. Whereas now it's c. 209p, and the price is moving in 1p increments, that's a much better 0.5% per price increment.

With a low valuation, and some good points in today's in line statement, I'd guess that the price is probably more likely to go up, than down.

Ab Dynamics (LON:ABDP)

Share price: 259p (up 7.2% today)

No. shares: 17.3m

Market cap: £44.9m

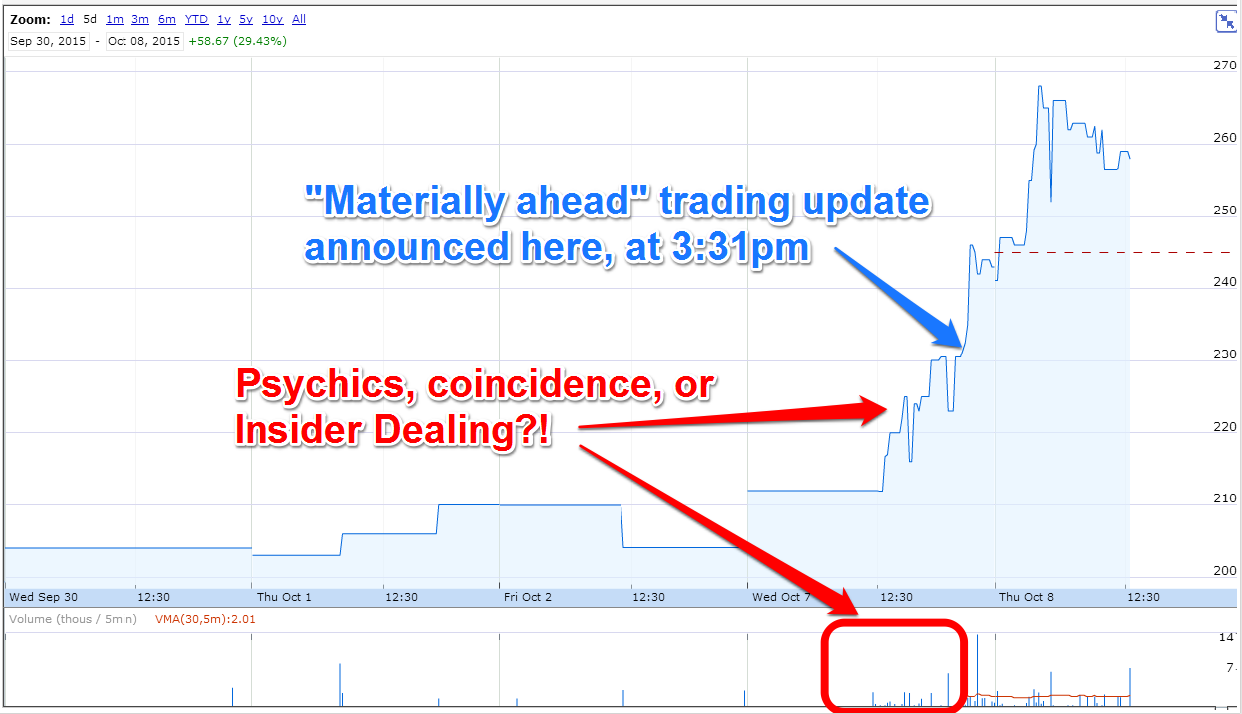

Trading update - this company issued a terrific update yesterday, but during market hours! At 3:31pm to be precise. What on earth are they thinking of? It caused chaos, and is horribly unfair to investors who are not glued to their screens all day. This is why all results & trading updates should be put out at 7am, or after the market has closed, but NEVER during market hours.

I'm going to ask the NOMAD, Cairn Financial, why they allowed this to happen, as it's very bad in my view. I've put a call in to them, and am awaiting a response.

There's also the matter of a flurry of trades before the announcement - so these people are either psychics, or it's a complete coincidence, or they're insider dealing. I accept that some people might have seen the price moving, and bought in reaction to that, but this certainly needs investigating. Someone was aggressively buying just before this announcement came out, and that's not on.

If you have concerns about this type of thing, then the relevant email address is:

|

EDIT: NB - There may actually be a valid explanation for what happened here. A source (NOT Cairn Financial, who haven't returned my call yet) has advised me that apparently a broker sent a share tip to its clients, which triggered the flurry of small buys.

ABDP was then apparently advised by the LSE, to issue their trading update immediately, instead of the scheduled time of 7am the next day.

I've not verified the broker tip, but this explanation certainly sounds plausible. The important thing is that the company will usually put out trading statements at 7am, and this was a one-off caused by the share price spiking up.

So perhaps we do not need to trouble the FCA after all?

EDIT2: A friend who is a client of the Share Centre has just contacted me to say that there was indeed a tip from the broker before the RNS, and that they bought some stock on the basis of that tip, before the RNS, but completely unaware that there was going to be an RNS.

Therefore, this is now case closed - not guilty! It was indeed a pure coincidence, and not psychic activity, nor insider dealing.

The announcement itself says;

The Group has performed well in 2015 and the Board expects to report revenues and profits materially ahead of market forecasts.

The company's year end is 31 Aug 2015.

Surprisingly, the company also says that it has turned down a mooted £2.3m Govt grant, as the "additional requirements are over burdensome". So it sounds like some civil servants have been busy doing what they do best - creating red tape! What a situation - whenever Govts meddle in business, they usually see to do more harm than good.

The company says it has sufficient funds, without the grant, to meet "increasing global demand", including financing its new building.

Outlook comments sound positive;

"The Group has performed well in the period with continued growth in revenues and profits and we have a strong order book that takes us into the new-year with confidence. Construction of the new facility should start in Q1 2016 with completion expected by the Q2 2017 bringing the increase in capacity necessary to meet the growing demand for our products"

My opinion - One broker expected 14.5p EPS for 2015, so "materially ahead" means at least 10% above. So 16p+, for a PER of 16.2. That rating looks justified in my view, as further earnings growth seems likely, given the doubling of capacity in the pipeline, and strong demand.

Clearly this company is on a roll, and looks worthy of further research.

Flybe (LON:FLYB)

Share price: 77.4p

No. shares: 216.7m

Market cap: £167.7m

(as the time of writing, I hold a long position in this share)

Surplus planes update - one more down, six to go! Another of the surplus E195 planes has been found a role, connecting Exeter & Norwich airports with five destinations in mainland Europe, starting in Mar 2016.

Of the original fleet of fourteen legacy E195s, five were handed back to lessors, two have been based at Cardiff Airport under a long-term agreement signed in March 2015 with the airport operators, Cardiff Airport Limited. The agreement with RCA provides resolution for the eighth aircraft. Flybe is still in active discussions with other parties to redeploy the remaining six E195s and announcements will be made as appropriate.

No financial details are given, so one has to assume that using the aircraft on these routes should at least be less of a financial burden than paying the lease rentals, and it remaining idle. Although there's no guarantee that will be the case - if the new routes fail to generate passengers, then the losses could be even worse.

My opinion - I remain a holder here. The company's very strong balance sheet has enabled it to survive, and gradually resolve many legacy issues. It will be interesting to see what emerges in a couple of years' time. In my opinion, there is more upside potential, than downside risk, at the current price.

Dart (LON:DTG)

Share price: 469p (up 0.8% today)

No. shares: 147.6m

Market cap: £692.2m

(at the time of writing, I hold a long position in this share)

Trading update - there's a really strong trading update today - my attention was drawn to it by a reader in the comments section, many thanks (as this would normally be too big for me to report on here).

The key sentence says this;

With winter 15/16 Leisure Travel bookings for both package holiday and flight-only products continuing to perform in line with expectations and notwithstanding the important post-Christmas booking period that is still to come, it is now apparent that Group performance for the full year ending 31 March 2016 will materially exceed current market expectations.

Also, H1 profits are strongly up ("at least 60% ahead" of prior year, implying £143m+ H1 profits this time), with the caveat that losses over the H2 winter season will also be larger than last time.

Valuation - EPS expectations are currently at 40.6p EPS for this year, so we can add at least 10% to that, suggesting 45p+. That puts the shares on a PER of just over 10 - not bad.

My opinion - the market seems to be pricing in expectations of higher fuel prices, a large element of airline costs, which is probably why these shares have stopped rising, and if anything now seem to be drifting down.

So the big question is whether we should be regarding this year as a bit of a one-off good year, and therefore factor in a fall in future earnings for valuation purposes?

That's a matter for market sentiment to resolve, but for me, the recent dip in price, combined with a rip-roaring trading update today, has tempted me to pick up a small opening position here, more as a short-medium term trade, than an investment. The bumper interim figures might well spur another wave of optimism perhaps, when they get published in late Nov?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.