Good morning!

The market mood certainly seems to have changed lately - small cap growth stocks are forging ahead, and it seems that investors are now prepared to pay up, often very high PERs, for growth companies.

I was discussing this with a broker friend this week over lunch, and he pointed out that a PER of 20 might seem high, but actually it's an earnings yield of 5%, which is enough to pay a twice-covered divi of 2.5%, and for a company that is growing strongly organically, those numbers will improve each year. When practically everything else is expensive, or ex-growth, then a 5%, growing return (half of which is paid out, half reinvested in growth) is actually not bad at all, in an era of ultra-low interest rates.

However, it won't look quite so good when interest rates go back to normal (if they ever do!), so it's difficult to know how to handle things.

Zytronic (LON:ZYT)

Share price: 337p (up 10.9% today)

No. shares: 15.3m

Market cap: £51.6m

(at the time of writing, I hold a long position in this share)

Trading update - there's excellent news today from this specialist manufacturer of touch screens (for things like cashpoints, vending & gaming machines);

Further to the outlook statement made with the interim results on 19 May 2015, the second half showed an improvement in revenues over that reported for the first half. This was particularly marked over the last quarter, resulting in a 13% increase in total revenues for the year above that reported for 2014.

The improvement in revenues, together with the continuing benefits of the production efficiencies and capital investments, as reported upon at the time of the interim results, have resulted in the Board expecting pre-tax profit for the full year to be materially ahead of market expectations.

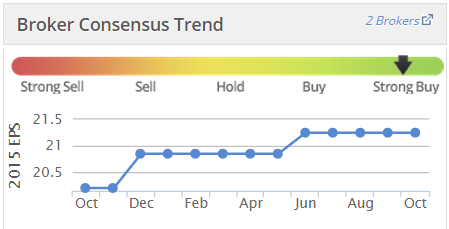

Materiality is usually described as 10% or more. It's interesting to see that broker(s) have been edging forecasts up this year, so clearly the company has been doing well for a while - this graph is often a good indicator (but not always);

My opinion - I like this company, and am pleased to continue holding. It's still good value, and there's nice growth potential from the larger, and curved screen which the company has developed. On the downside, there can occasionally be a gap in the order book - order visibility is quite limited. That's just something investors have to live with - but the dips have historically been good buying opportunities.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.