Good evening!

A short, and very late report tonight, as I had to head down to Bournemouth to visit Mum in hospital today. She's had a nasty do, with a heart attack & pneumonia, but is beginning to improve, with antibiotics & oxygen. So fingers crossed. Anyway, I have my laptop with me, so should be able to write my reports here in the mornings, and spend the afternoons with her in hospital, all being well.

InternetQ (LON:INTQ)

Share price: 74p (up 19.4% today)

No. shares: 40.3m

Market cap: £29.8m

(at the time of writing I hold a long position in this share - NB. just as a short term trade)

Additional response - this is the latest company that has been subjected to a bear raid, which I reported on last week here on 3 Dec 2015.

I agree with a lot of what the bear attack says. However, I've been studying how these things pan out, and there is often a substantial rebound in share price when the company puts out a rebuttal. In this case, the company put out a rather weak rebuttal last week, but has issued something that looks a bit more substantial today, going through each point in detail.

Have I taken leave of my senses by going long of a share which I think is a load of rubbish? Quite possibly, but my hunch is that there was strong rebound potential in this share, and I think the bear case lacks the killer punch needed to actually finish off the company. Remember that shorters need to buy back the shares to bank their profits, so you can get very powerful rallies in heavily shorted shares, which can be nicely profitable trades on the long side, if you get the timing right.

So far, so good - my long position is in profit, and I think there could be more to come, although it's high risk, and only a punt - i.e. intended for a very short term hold. I'm only mentioning this, because I am obliged to report all holdings, so this being an unusual one, it needed some further explanation.

What happens next? Presumably Tom W will keep bashing away at it, but as mentioned above, I don't see a killer blow having been dealt, and the law of diminishing returns seems to apply to shorting attacks. Shorts have to cover (i.e. buy back), so we could see a further rebound, possibly? It's fascinating to observe how these bear raids via online dossiers play out.

Plastics Capital (LON:PLA)

Share price: 106.5p

No. shares: 35.3m

Market cap: £37.6m

Interim results to 30 Sep 2015 - I can't get excited about these numbers unfortunately.

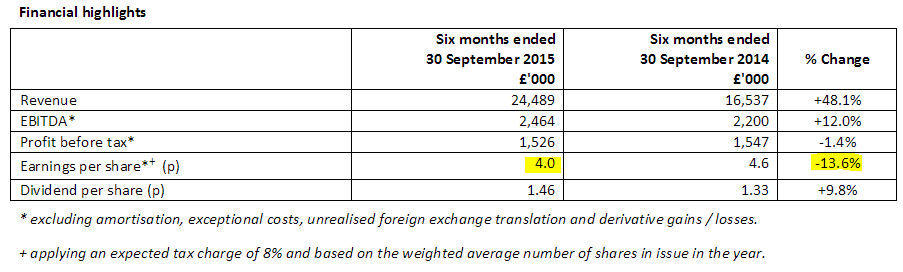

As you can see below, from the highlights table, turnover is up considerably, due to an acquisition, but profit is flat, and EPS is actually down. That doesn't strike me as impressive.

Also, I find the accounting at this group rather aggressive, so am not sure I'd want to rely on the company's own adjusted profit figures.

Outlook - note that the company predicts a much stronger H2, but also consider how many companies end up warning on profits in H2, because they fail to achieve the jump in profitability needed to meet full year forecasts.

We are seeing a significant improvement in our order books and anticipate improved financial performance in the second half due to the seasonality that now applies to the Group and as the foreign exchange and polymer price situation normalises. We also expect the pipeline of new business to enter production at a more rapid rate in the Industrial division. We anticipate that our five year plan and the associated management processes will continue to drive the business forward notwithstanding weakness in some of our end markets. The Board therefore remains confident about the future growth of the Group.

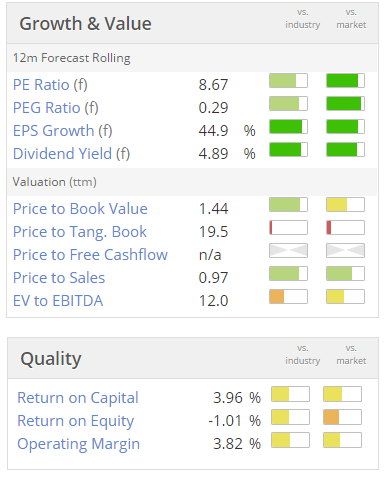

Valuation - if broker forecast is achieved this full year, then the shares would look reasonable value at first sight:

Balance sheet - not great, with only £2.0m of NTAV, and gross debt of £15.9m is looking quite high now, although cash of £4.0m reduces the net debt to £11.9m.

My opinion - I rarely buy shares where the company is relying on an H2 surge in trading to meet full year numbers, as it very often doesn't happen to the extent required.

This company can look superficially attractive, but the shares never really seem to go anywhere, and I'm not convinced the businesses are much good, or have much in the way of growth potential. So for me, it's a no.

Games Workshop (LON:GAW)

Share price: 596p (down 1.4% today)

No. shares: 32.1m

Market cap: £191.3m

Trading update - this seems a rather uninspiring update:

Games Workshop Group PLC announces that trading in the six months to 29 November 2015 at constant currency has been broadly in line with the Board's expectations and 2014/15 first half performance.

Over the six month period we have seen modest sales growth at constant currency. However, the adverse impact of a stronger pound will result in a small decline in reported sales for the period.

The Company's half yearly report for the six months to 29 November 2015 will be released on 12 January 2016.

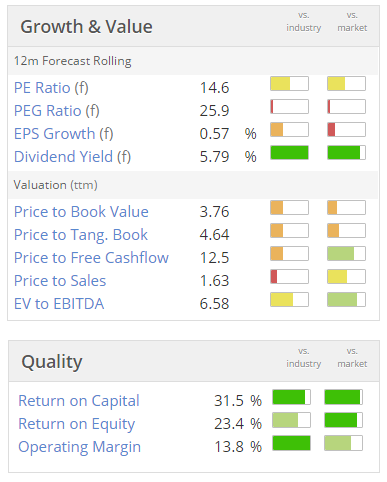

Where's the growth? It's difficult to see how the valuation stacks up, unless you think the business can start to deliver profits growth, where it has failed to do so in recent years. Although note the smashing dividend yield.

All done for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in INTQ, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These articles are personal opinions only, which are liable to change without notice. These are not recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.