Good morning!

Sorry there was no report yesterday - I had a relaxing day lounging by the pool, and there wasn't much in the way of news to report on anyway. Am flying back to the UK on the overnight Sat-Sun flight.

I've enjoyed Abu Dhabi very much, although the lack of civil liberties & human rights is a nagging concern. There again, the payback for that is a lack of crime - something everyone can enjoy every day, providing you don't fall foul of the law in some way.

Radio 4 - BHS

Last night, Radio 4 broadcast a very interesting programme, "The Briefing Room" concerning BHS & Sir Philip Green. They used a couple of recorded clips of me, about halfway through.

It's an excellent, and very balanced programme, in my view. Here's the link to the audio.

IPOs

The IPO market seems to be perking up again. I'm seeing new floats almost every day in the news feed. Hotel Chocolat (HOTC) is of particular note, because it has launched very successfully on AIM at 148p per share. In the first 2 days of trading, the price leapt to an immediate premium, and is now about 207p, or 40% up on the Placing price.

The founders still own 66.6% of the stock, so that small free float and strong demand have combined to squeeze the price much higher. Whether the shares offer value for money, is another question. I had a look at the Admission Document, and it seems to have had strangely erratic profitability. There was a sharp fall in profits due to a failed IT project, and cessation of operations in USA, and somewhere else. That doesn't exactly fill me with confidence.

I wonder if it will join the long list of companies which warn on profits 6-12 months after listing? Time will tell.

IPOs generally seem to be very poorly structured. The promoters clearly want to do as little work as possible, in return for a large fee. So they just place big lumps of shares with Institutions. Combined with founders often retaining a large stake, this means the shares launch with virtually no liquidity. How on earth does that make sense?

Instead, I think companies should insist on a decent chunk of the shares being offered to private investors, in relatively small parcels. This would greatly improve liquidity from the start, which is surely the whole point of having a listing - to create a liquid market in the shares? So why are promoters currently doing IPOs in the worst way possible - Placing shares in large blocks only? It's just laziness.

Motorpoint Group (MOTR)

Share price: 200p (IPO price)

No. shares: 100m

Market cap: £200m

IPO - this share is launching on the main market today. It looks rather interesting - the company operates a chain of 10 car supermarkets, selling nearly new cars at competitive prices.

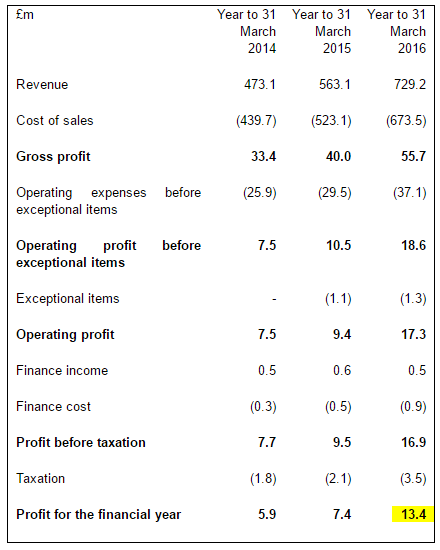

The price seems to be a PER multiple of 14.9 times earnings for the year to 31 Mar 2016 (calculated at £200m market cap, divided by £13.4m earnings (highlighted figure below).

As you can see from the table below, the figures show an excellent progression of profits in the last 3 years:

All of which makes me wonder why the founders are happy to sell half the company now?

Both Hargreave Hale, and Miton Group have taken 3% of the company each. It's always reassuring to see them participating in an IPO, as they're shrewd investors, and good judges of management teams, usually.

So this looks a potentially interesting share, I think.

Brady (LON:BRY)

Share price: 62.5p (up 0.8% today)

No. shares: 83.0m

Market cap: £51.9m

AGM statement - this sounds reassuring:

"The Group has continued to make progress in the year to date and the first quarter's results were in line with management's expectations.

More detail is given on contract wins.

On outlook, the company says nothing on the full year, but makes reassuring, but non-specific noises about Q2:

We look forward to reporting deal flow and business progress as the Group enters the traditionally busy second quarter. We will provide a further update in the Interim Results.

My opinion - this share has now recovered by about 50% from the low after a profit warning late last year. So it would have been a good falling knife to catch.

That said, my reservations about this company persist. In particular, its profits seem lumpy, due to a reliance on winning high margin licences in Q4 each year. Success or failure in this regard can mean the difference between good, or bad profits for the year.

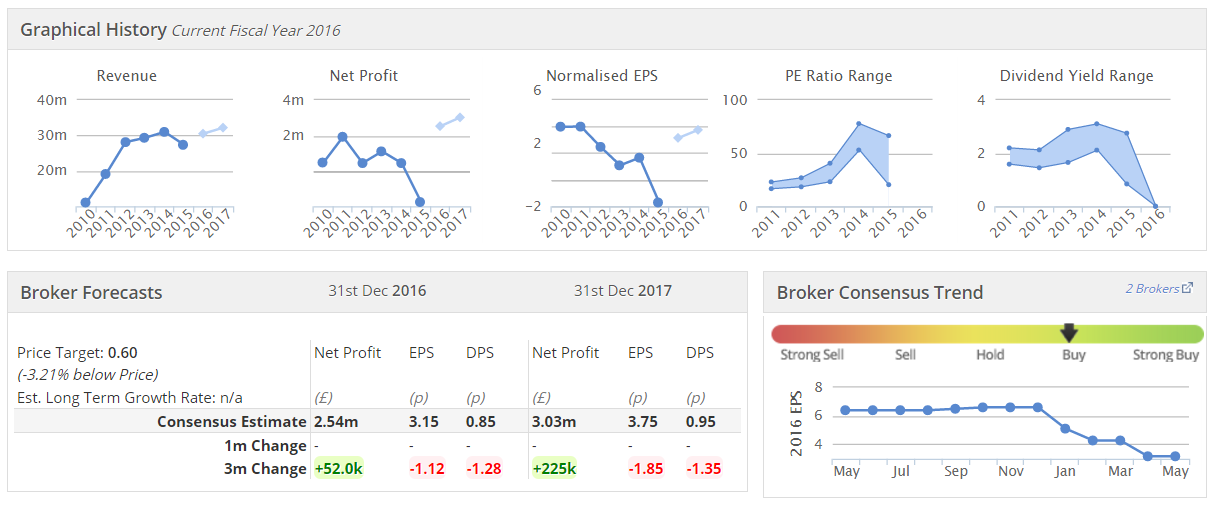

Broker forecasts are therefore little more than guesswork. So I don't see any reliable way to value this share. If you buy the share, then really you're just backing management and hoping that they will perform.

The divi was passed last year, but brokers are now forecasting a resumption of divis this year.

Even if broker forecasts are achieved for this year and next, the share wouldn't be cheap, on a PER of 18.4. So buyers of this share now must be assuming that the company can beat forecasts. It might do, if the right combination of licence wins are achieved. Or, it might not.

I prefer to have more visibility of earnings, so this share is not for me.

Restaurant (LON:RTN)

AGM remuneration vote - it's always pleasing to see shareholders bare their teeth at overpaid Directors. Executive remuneration generally is an absolute scandal, in my view. All too often mundane management are paid outrageously high remuneration packages at listed companies. This happens for a very simple reason - because there's little to stop them doing it! A large number of shares are held in forms which cannot or won't be voted at AGM - e.g. shares held via spread bet or CFD usually won't carry any voting rights. Or funds held in trackers, or other passive investment vehicles. Plus a certain amount is in the morgue, as it can take a very long time for executors to liquidate portfolios of deceased people.

This means that many listed companies effectively have an absentee shareholder base. Management cotton on to this, and ratchet up their own remuneration with impunity. Every company seems to think it has top quartile quality management, which of course is an impossibility!

So I love it when there's a big vote against the remuneration report at AGMs.

RTN shareholders voted 26.3% against the remuneration report. That may not sound much, but many Institutions usually don't like to rock the boat, or just can't be bothered. So it's actually quite a significant sign of shareholder disquiet. I don't blame them either, as judging by the last conference call, the CEO gave a lamentable performance, and gave every impression of being bottom quartile. The collapsing share price has also not endeared the company to its shareholders.

The company published this response yesterday in the notes to the announcement:

The Company notes the significant number of votes cast against Resolution 2, the advisory vote on the Directors' Remuneration Report. The Company understands that this reflects the concerns of a number of investors in respect of the termination arrangements for Alan Jackson and the level of the Executive Director annual bonus awards for 2015. The Remuneration Committee will carry out a detailed review of all of the feedback received to understand fully all of the reasons behind the vote result so that it can reflect, where appropriate, in its approach going forward.

At least the company has sat up & listened.

There's nothing else of interest today, so I'll sign off for the day.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.