Good afternoon, it's Paul here.

It's quiet for news today - good thing too, as it's far too hot to be working! We've got the plumber in, so there's no water - so I can't even make a cup of coffee. Hopefully the lack of caffeine won't affect my writing too much, although I do feel duty bound to flag up the risk of impairment.

(sometime later) There's been a further delay because the plumber turned off our electricity without warning me, so I lost all my work. Thankfully Google Chrome has come to the rescue - it's managed to retrieve my lost work. I didn't have the heart to chastise the plumber, because a brief loss of electricity is nothing compared with his usual handiwork - last time he flooded our ground floor by cutting the wrong pipe, thus causing the hot water tank to empty its entire contents in our kitchen-diner. Still, he's a nice chap, just not a very good plumber.

Incidentally, I did some reading up on N Brown (LON:BWNG) on the train to London last night, and it looks potentially interesting. I've picked up an initial opening sized position in it myself, and want to flag the idea to readers too. It's a mid cap, so outside my area really. The company issued a strong trading update yesterday, and it seems to me that the stock looks very cheap compared with other internet retailers (most of its sales are conducted online). Anyway, have a look, and let me know what you think. I've only done superficial research on it so far, so would be interested in reader views, who may know the company better than me. The company seems to have had problems in recent years, but could now be back on track? I think there might be a possibility that the share gets re-rated to being a growth company, perhaps?

All this business going to online retailers must be coming from somewhere - so I remain bearish on more traditional, mid-market retailers in particular.

Walker Greenbank (LON:WGB)

Share price: 197p (down 1.7% today)

No. shares: 70.4m

Market cap: £138.7m

AGM Statement (trading update) - this is a luxury interior furnishings company. It today reports on trading for the year to date (ending 31 Jan 2018).

There's a fair bit of detail, but the most important bit says;

"The current financial year is set to mark a step change in Walker Greenbank's financial performance as it will include a full year's contribution from the Clarke & Clarke acquisition.

Whilst today's AGM comes at a time of political and economic uncertainty in the UK, at this early stage of our financial year we continue to expect to meet Board expectations for the full year."

That sounds alright.

Other points of interest;

In the first four-and-a-half months of the current financial year, Brand sales were up 4.5% in reportable currency and up 1.1% in constant currency, with sales in Europe and the USA outperforming the UK, where sales were in line with the same period last year.

That sounds solid, rather than exciting growth.

Licensing income is performing strongly.

Improving order books & export sales growth.

Insurance claim for flooding;

"We are pleased to announce today the final settlement of our insurance claim following the flood at our fabric printing factory in December 2015.

We expect to receive the final payment of £2.4 million by our half-year end, bringing the total amount received in respect of the claim to £19.3 million.

This has been a highly material issue. As a reader pointed out last year, whilst it is good that WGB was insured against flooding, what happens next time? Flooding often occurs in the same places, so the big question is whether WGB's insurers have hiked its premiums, and/or limited cover for future flood claims? Have their premises been protected against future flooding, with suitable defences (if possible)?

This reminds me of the joke that 2 retired businessmen were chatting, on board a luxury cruise ship. One confided that he could only afford the cruise because his insurance policy had paid out generously when his factory burned down. The other businessman chuckled, and said he was in the same situation - his factory had flooded & he'd banked the insurance money. Incredulous, the first man asked, "How the hell do you start a flood?!"

Of course the answer is simple - just get my plumber round, but check that you're fully insured before he starts work.

The outlook comments sound quite interesting;

"The current financial year is set to mark a step change in Walker Greenbank's financial performance as it will include a full year's contribution from the Clarke & Clarke acquisition.

Whilst today's AGM comes at a time of political and economic uncertainty in the UK, at this early stage of our financial year we continue to expect to meet Board expectations for the full year."

I like the step change comments.

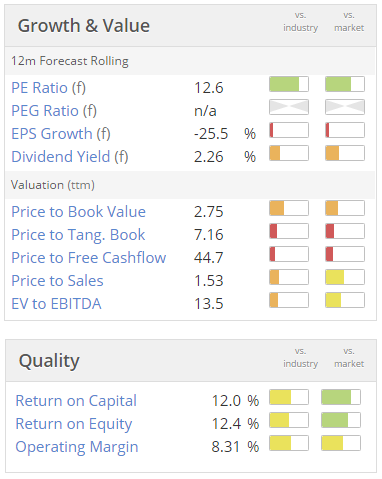

Valuation - this looks attractively priced now, on a forward PER basis;

My opinion - I like this company, but it usually seems too expensive.

That seems to have changed for the better - on a forward PER of 12.6, this share now looks quite attractively priced. Worth a closer look, in my view.

Wynnstay (LON:WYN)

Share price: 572.5p (up 0.9% today)

No. shares: 19.5m

Market cap: £111.6m

Half year results - for the 6 months to 30 Apr 2017.

This is an agricultural products supplier. It also has a loss-making chain of 25 pet shops, branded Just For Pets, which also sells online.

Adjusted profit before tax is flat against last year, at £4.1m, for the 6 months.

A very low margin business, as revenue was £205.3m, so the adjusted profit margin is only 2.0% - that's too low to interest me, I like businesses with pricing power, and decent profit margins. Or rapid growth companies which can expand their margin later. Wynnstay is neither.

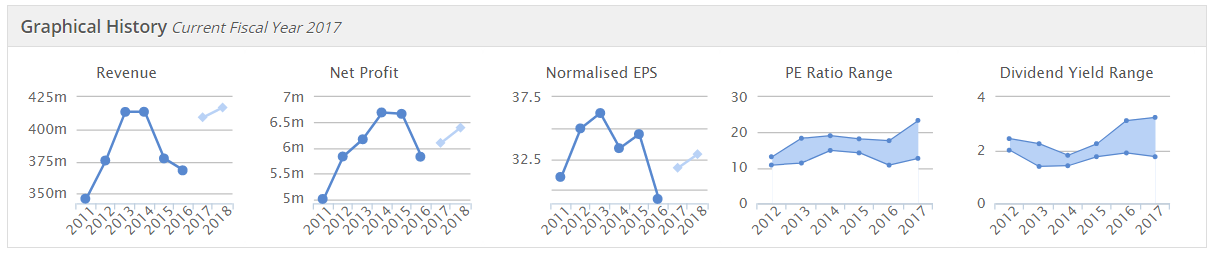

As you can see from the Stockopedia graphs, this business doesn't really seem to be going anywhere in particular;

I don't really understand why the market is affording this company such a generous PER?

The forward PER of 17.5 seems very expensive for such a mundane business. Maybe the market is anticipating higher profits, from reduced losses at the pets business, which is being restructured?

Balance sheet - is strong, with NAV of £85.0m, and NTAV of £70.7m.

The current ratio is excellent, at 1.86 - although that does beg the question whether this company is providing working capital for its customers (stock and debtors), but poor returns on capital for its shareholders?

Outlook - this all sounds a bit lacklustre;

It is encouraging to see an improvement in output prices for our farmer customers. However the current oversupply of many commodities in the Global market and the negotiations for the UK's exit from the European Union will bring further challenges for many farming enterprises.

Nonetheless the strategic and environmental importance of UK agriculture should provide a foundation for an increasingly efficient industry in which a focus on productivity will remain a major consideration for many customers.

All this provides for a challenging backdrop for the agricultural supply industry and will affect the rate of recovery of the supply sector.

However Wynnstay is well-placed to continue its organic and acquisitive growth strategy. In addition, it is actively addressing the issues at Just for Pets. The breadth of our activities, our talented team and strong balance sheet provide firm foundations for the Group's further development over the coming years.

My opinion - I'm scratching my head to understand why this stock is on a relatively high PER of 17.5. Also the high StockRank of 91, and classification as "Super Stock" are a complete mystery to me! Maybe the Stockopedia computers have spotted something that I've missed?

To me, this seems a boring, low margin, ex-growth business, which looks expensive, and with an unexciting dividend yield.

I think a PER of about 9 is more appropriate for this type of business. That is the valuation of a similar company, NWF (LON:NWF) which I reviewed yesterday. Of the two, that seems far better value than WynnStay. Although as usual, that view is based on a brief review of the numbers. There could be other factors which I've not spotted, hence why you always need to DYOR.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.