Good morning, it's Paul here!

I have a diary note this week, written this time last year, advising the future me to book a holiday this week, as it's usually very quiet for results & trading updates. Accordingly, I'm jetting off to Spain tomorrow, just for 4 nights, having found a deal for only £300. Our Graham has very kindly offered to hold the fort here, so that I can relax on the beach for the rest of the week.

I'm hoping that newspaper reports of 8 hour delays to check passports at Barcelona airport may be false. It amused me that right-wing newspapers reported that the delays were due to industrial action. Whereas pro-remain journalists reported that the delays were deliberate punishment by Spain for the UK having voted for Brexit!

It all reinforces my belief that human beings are fundamentally irrational, and simply believe what they want to believe. That creates wonderful opportunities in financial markets, as many shares are frequently priced wrongly due to investors being so irrational.

Talking of which, the situation at Revolution Bars (LON:RBG) has just got a bit more interesting today, so let's start with that.

Revolution Bars (LON:RBG)

Share price: 181.6p (up 4.4% today)

No. shares: 50.0m

Market cap: £90.8m

(at the time of writing, I hold a long position in this share)

Merger proposal - there are 2 announcements relating to RBG today. The first RNS was issued by another company, Deltic Group, suggesting a merger of their company with RBG. That was followed by a response from RBG, which I will cover below.

Deltic Group is the phoenix company which rose from the ashes of overly-indebted nightclub operator Luminar, which went bust in 2011.

Deltic starts off its announcement today by describing itself like this;

Deltic (http://delticgroup.co.uk/) is the leading specialist late-night operator in the UK. Since it was acquired by its current shareholders out of the administration of Luminar plc, its predecessor firm, in 2011, management has refurbished the majority of its estate of 57 clubs, including those operating under the PRYZM, Bar&Beyond, Steinbeck&Shaw, ATIK, and Fiction brands.

It is a highly cash generative and growing business of similar size to Revolution, its major competitor in the UK late-night market. Trading at Deltic continues to reflect confidence in the late-night market and its future prospects.

My sector expert has texted me to advise that Deltic is a hot-potch of brands, with no focus!

I've had a look at Deltic's last filed accounts at Companies House, with a few key points being (this is for the 364 days ended 27 Feb 2016 - the most recent filed accounts);

Revenue £100.8m (RBG was £119.5m for y/e 30 Jun 2016)

Underlying EBITDA £13.4m (RBG was £15.6m)

Underlying operating profit £8.6m (RBG was £9.2m)

So at the P&L level, they look quite similar.

The balance sheets are very different though. Deltic only had net assets of £10.3m, whereas RBG had net assets of £41.2m. RBG has a net debt-free balance sheet, whereas Deltic is carrying a fair bit of debt, which incurred an interest charge of a hefty £4.0m for the year (including a shareholder loan charging 8% p.a. interest).

Therefore, if RBG were to consider a merger with Deltic, it would need to value Deltic's equity at a much lower valuation than RBG's equity, to reflect the considerable debt which Deltic is carrying.

Furthermore, note that Deltic is revamping its sites, thus requiring heavy capex (of £8.6m). Although it does say that most sites are now revamped. Whereas RBG has a fully revamped estate, so requires less maintenance capex - most of RBG's capex relates to new site openings.

The other issue with Deltic, is that its sites seem to be larger than RBG sites, so probably require heavier capex when they need (frequent) refits. The company does however look for a 2-year payback on capex, which is competitive.

Going back to Deltic's RNS today, it sees the Stonegate 200p cash proposal as being opportunistic (which it is!);

Revolution's recent poor share price performance resulted in its 31 July, 2017 announcement of the possible and opportunistic offer by Stonegate Pub Company Limited ("Stonegate") to acquire the entire issued and to be issued share capital of Revolution at 200p per share.

Deltic believes that if a firm offer by Stonegate is made, and is recommended by the Revolution Board, it would be a disappointing outcome after two years of roll out and investment to merely return to its shareholders the same value of the business as at its 2015 IPO.

I think those are absolutely valid points. My view is that the Stonegate offer is not at all generous, if you crunch the numbers. The key point is that Stonegate would be able to eliminate as much as 60% of RBG's central costs (an estimate by a well-respected research firm). Plus it would be able to considerably boost RBG's profit margins by renegotiating drinks supplies at cheaper bulk discounts, and I think also would be able to make staff savings through pooling staff.

Plus of course, RBG has a well-progressed pipeline of new sites on terrific rents, which provides it with 4-years worth of self-funded growth - which would considerably increase its future profitability. That's thrown in for free, with the mooted 200p bid from Stonegate (which is not a formal proposal as yet, they're still doing due diligence).

Deltic then goes on to say that a merger with RBG would create synergies, and be a larger group which might interest stock market investors more. There's some merit in this proposal, in my view. The sting in the tail is that Deltic management want to run the enlarged group!

In a nutshell then, the Deltic proposal to RBG is this - please buy us, using your stock market listed shares. Then we'll kick out your management, and run the enlarged company ourselves! I can see why RBG management wouldn't want to progress that idea. Hence why Deltic has today gone over their heads and appealed to RBG shareholders direct.

Another worry is that a merger which is structured as Deltic shareholders receiving RBG shares, would create an enormous overhang of sellers. It could be seen as Deltic shareholders seeking an exit route by the back door. That could then result in the RBG share price being almost permanently depressed from selling by former Deltic shareholders.

Response from RBG - they've given the Deltic proposal fairly short shrift in this announcement today;

The Board confirms that it received a possible proposal from Deltic and thereafter met with Deltic. Based on these preliminary interactions, the Board had concerns over both the value and deliverability of the combination and did not see any merit in progressing their proposal as the Board believes that a combination of Revolution and Deltic is not in the best interest of shareholders at this time.

The Company continues to engage with Stonegate Pub Company Limited in connection with the possible offer, as announced on 31 July 2017.

I find this rebuttal a bit weak. If I were a major shareholder in RBG, I'd want to know specifically why the proposal was turned down?

It sounds as if the Stonegate approach is likely to result in a formal bid fairly soon, would be my guess. They've had enough time to do due diligence now. Maybe they're arguing over price? It would be rather difficult for RBG management to recommend a 200p bid, given that was the IPO price in 2015. A 200p bid suggests that RBG management has added no value at all in their time as a listed company - not something I would want to explain to shareholders, if in their shoes.

My opinion - the Deltic proposal probably won't work, in my view. I think Institutions would probably prefer a clean exit, for cash. Deltic doesn't seem to be in a position to be able to fund a cash bid for RBG, which is the only serious alternative, so I doubt the merger proposal as it stands would be progressed.

However, the positive thing is that a second potential suitor emerging has reinforced the attractions of RBG to a trade buyer. The stock market has consistently failed to grasp that RBG is a decent quality business, with good growth potential, generating bucket-loads of cash to self-fund its roll-out. So it's encouraging that more than one potential trade suitor is circling the company.

I think there is potential for Stonegate to improve their possible offer, so personally I'd be disappointed if the company sells for less than 240p. So hopefully another, more credible (than Deltic) bidder, might emerge in due course, to force up Stonegate to a higher price?

Personally, I accept the downside risk of bid(s) falling through, as I believe RBG is worth more than the current share price anyway, bid or no bid. So there's maybe 40p downside risk (in the short term), but longer term value with or without a bid is potentially a good bit higher than the current share price. An interesting situation, let's see what happens!

Castings (LON:CGS)

Share price: 461p (down 0.3% today)

No. shares: 43.6m

Market cap: £201.0m

AGM statement- this is a successful UK-based iron casting & machining company. Given its sector, I've always been surprised at how profitable it is - as it's the sort of thing that I would've imagined could be made by overseas companies more competitively. Apparently not!

This company is also noteworthy for its excellent balance sheet.

Its update today doesn't really say a lot;

Demand from our main customers remains steady which represents a continuation of the outlook reported in the Chairman's statement in June.

Our efforts remain focussed on developing work with both existing and new customers, with a concentration on core business that can be produced and machined within the group.

We continue to invest in production techniques and technologies to improve our productivity and profitability.

That seems reassuring, so I think can probably be interpreted as in line with expectations - even though it doesn't exactly say so.

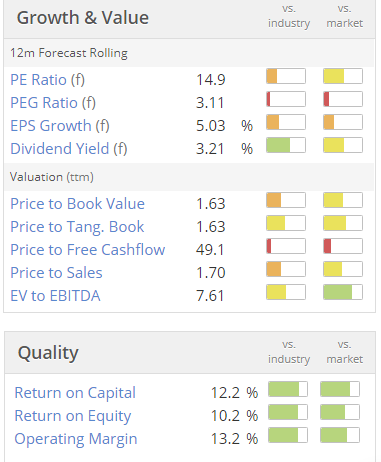

Valuation - whilst I admire the business, and its balance sheet, I don't see any particular upside on the current valuation - this looks about right;

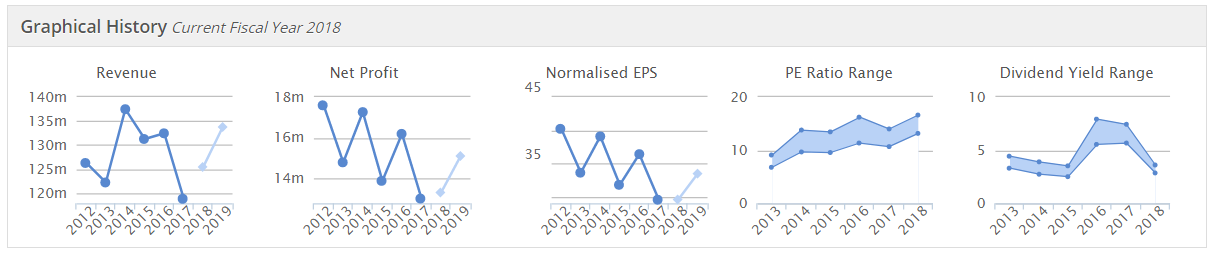

As you can see from the Stockopedia graphs below, revenue and profit are essentially going sideways, to slightly down, in a zigzag fashion.

Meanwhile, the valuation on a PER basis has been steadily rising, and the divi yield reducing. That doesn't sound particularly great to me;

My opinion - this is a good quality company, but I don't see growth here. So a PER of 15 for an ex-growth company? That isn't really attractive to me. It's the sort of share that I would have on my list of things to buy on a profit warning - as it would probably recover, and has a bullet-proof balance sheet.

John Menzies (LON:MNZS) - I've had a quick look at today's interim results. Underlying operating profit is up 43% to £30.1m, although a fair bit of that is due to favourable forex movements. At constant currency the uplift reduces to a (still good) 26% increase.

The trouble is, this profit is a wafer thin margin, on H1 revenues of £1,217m. That's an awful lot of activity, just to make £30m profit.

The interim divi has been raised just over 10% to 6p, but the full year yield shown on Stockopedia is unremarkable, at about 2.8%.

I like the outlook comments, which sound upbeat, concluding;

Overall the Board is confident with the Group's outlook for 2017 and we are firmly on track to meet the Board's expectations for the full year.

That sounds as if there could be an earnings beat, if H2 continues to do well.

My opinion - I can't get excited about a low margin business, in highly competitive markets. Also, bear in mind that the balance sheet is hideous here - with a huge amount of debt, and negative NTAV. There's a pension deficit too. So a thumbs down from me, I'm afraid, not my kind of thing at all. Although it does sound as if the company is trading reasonably well. So if you don't care about balance sheets (many people don't, in bull markets), then it might be worth a look.

Marshall Motor Holdings (LON:MMH) - another one where I've only done a quick skim of the figures. The results look good, and the forward PER seems to only be 5! Car dealers generally appear very cheap at the moment, this one particularly so. The stock market seems to be anticipating a fall in future earnings. Maybe we could be at the top of the cycle for earnings, I don't know.

As with other car dealership chains, this one has plenty of freehold property on the balance sheet too. So it might be worth a closer look, if you are relaxed about the potential for Brexit to disrupt trade. Also there seem to be increasing worries about consumer spending generally, at the moment.

I'm tempted, but have decided to steer clear of car dealers for the time being.

STOP THE PRESS! BREAKING NEWS!!

Laura Ashley Holdings (LON:ALY)

Share price: 8.9p (down 19% shortly after intra-day profit warning)

No. shares: 727.8m

Market cap: £64.8m

NED resignation - I noticed that a NED resigned with immediate effect 5 days ago, which I thought was odd. Well, it looks as if she probably jumped ship because of the bad news which has just been announced:

Profit warning - issued at 13:30, during market hours - which is incredibly annoying & unfair for shareholders. Although I believe there is a stock market rule that price sensitive information has to be released immediately. Something like that, anyway. Surely a sensible company would hold the Board meeting to consider such information after market hours, thus enabling them to inform that stock market at the correct time - i.e. any time the market is closed, basically.

The most important bit says this;

...as previously disclosed, trading conditions have continued to be demanding.

The Board of the Company therefore expect net pre-tax profits for the year ended 30 June 2017 will now be materially below market expectations.

Stockopedia is showing broker consensus of 1.2p for the year in question. So materially below that basically means 1.1p or less.

There's also a £2.8m impairment charge announced today, on the huge office block in Singapore which this company bought, in a bizarre move some time ago.

My opinion - I would need to see the numbers, before forming a firm view. They are going to be released next week, on 23 Aug 2017 - so I'll crunch those numbers on the day.

Graham wrote an excellent section on ALY here on 2 Jun 2017, raising concerns about the share, particularly corporate governance issues.

I visited a store a few weeks ago, and thought the product was seriously over-priced, and a lot of it was just rubbish. So it's no particular surprise to hear that the company is finding trading difficult.

Mind you, with a market cap now only £65m, who knows there could be speculative upside here? Maybe the Malaysian shareholders will take it private? Trouble is, there's no guarantee they would pay much (if any) premium. Someone else might try to buy the business - does anyone have Mike Ashley's phone number, perhaps we could go binge drinking with him & tempt him into buying it!

With consumer confidence apparently waning, and internet competition growing, I wonder if ALY could be sliding permanently downhill? Overall then, I'll look at the figures next week with an open mind, but am not tempted to catch this falling knife at the moment.

Hooray, I've actually managed to finish a report by the 1pm email deadline!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.