Good morning!

Seems busy in RNS-land, so I might make each comment a bit more concise, to extend coverage.

Interquest (LON:ITQ)

- Share price: 28.5p (suspended)

- No. of shares: 38.7 million

- Market cap: £11 million

Update on Nominated Advisor and Suspension

I'll start by bringing this recruitment company's story (scandal?) up to date.

In a late announcement on Friday, Interquest released an "update" saying among other things that when it fired Panmure Gordon, it believed it was going to be able to find a replacement within the required notice period to avoid suspension.

But since it unfortunately (!) failed to carry out due diligence in time, the shares have been suspended as of today.

It also said the following:

The Company is actively working to engage a replacement nominated adviser and broker and expects that an appointment of a replacement nominated adviser and broker will be completed within one month of the suspension. Any appointment of a new nominated adviser and broker is subject to the satisfaction of due diligence and therefore, whilst the Company does not foresee any circumstances at this stage which would lead the admission of its AIM securities to be cancelled, there can be no guarantee that such due diligence will be completed satisfactorily.

No reason has been given for firing Panmure Gordon in the first place. So one is left with the conclusion that the powers that be simply don't want to have a stock market listing.

The risk of de-listing is particularly high with smaller companies, for investors who need liquidity.

If you don't need liquidity, then there is nothing wrong with owning shares in private companies. Most companies aren't listed publicly, after all.

What makes this particular episode a bit distasteful is that there hasn't been a positive rationale given for choosing to be a private company rather than a public one. Unless there was some specific problem with their existing advisor (and we have no reason to believe that there was), then it looks as if the company is being taken private on a technicality, deliberately. Which isn't in the spirit of how the stock market is supposed to work.

UP Global Sourcing Holdings (LON:UPGS)

- Share price 117.8p (-44%)

- No. of shares: 82 million

- Market cap: £97 million

This branding, sourcing and distribution company has been listed since February. It imports a range of consumer products from Chinese manufacturers (cookware, tabletop, laundry, etc).

Growth for the current year sounds excellent. But when you read through the statement, and get to the outlook, you find the growth picture suddenly evaporates.

For the year ended July 2017, performance is above expectations:

Group revenue increased by 39.1% to £110.0m (FY16: £79.0m), and continued to be driven by three main factors: growth in sales to discounters in the UK and in Europe (up 64.6% to £63.8m); increased sales from the main UK supermarkets (up 95.0% to £10.3m); and the emergence of online platforms as a new revenue for the business (up 63.6% to £4.6m).

The Board anticipates reporting underlying EBITDA and underlying PBT performances that are above market expectations, mainly driven by higher revenues.

Major retail accounts have been opened in Germany, where the potential sounds really strong.

And then we have the stark announcement that revenue growth for FY 2018 is unlikely, for the following reasons:

Consumers' discretionary spend is under pressure and confidence is therefore lower than it has been for some time, which is inevitably being reflected in purchasing behaviour. For retailers, this has also coincided with cost price increases in the wake of last year's sterling devaluation. As a result, retailers are generally exercising caution with regard to their non-food buying for Autumn/Winter 2017. This is manifesting itself in a reluctance to commit to purchasing too far forward, with retailers instead placing orders later or buying from stock.

Is this really news, in terms of the macro conditions?

Despite the stock market being so richly-valued, investors can see where the price of sterling is and we have known very well that high street conditions are tough.

I suppose what's particularly worrying about this announcement is how growth can go from such a fantastic clip to suddenly drop all the way back to zero.

PBT was £6.7 million in H1. The company is more than 60% weighted to H1 but even if you assume little profitability in H2 and negligible growth going forward, maybe the shares are decent value here?

As I said with Safestyle UK (LON:SFE) last week, though, I would try to be a bit more ambitious in my timing when it comes to some of these most highly cyclical sectors. We are still very far from peak-gloom, in my opinion!

Luceco (LON:LUCE)

- Share price: 245p (-1.6%)

- No. of shares: 116 million

- Market cap: £284 million

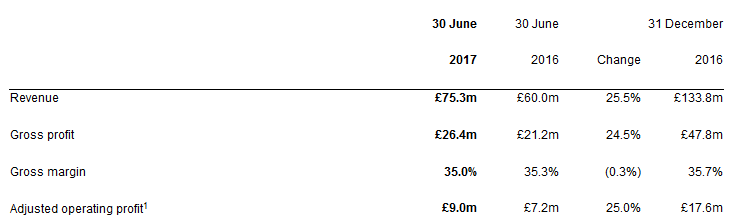

This LED manufacturer is a recent IPO which has been more successful for investors. It joined the stock market last October and the shares are now up almost 70% from when they listed.

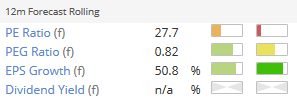

I covered the full-year results earlier this year and was really impressed by the growth. The shares had already appreciated by then, though I said it looked like the company might be able to grow into the valuation.

These are fine growth rates and I would note that no adjustments were made, so adjusted operating profit equals operating profit.

The outlook for the full year is in line with market expectations.

Net income improved at a much faster rate than operating profit due to the post-IPO capital structure with much lower net debt, so interest costs to be deducted from operating profit are much lower now.

Net debt is now £26 million, or 1.1x adjusted EBITDA. Gross debt is around £32 million. Seems fine versus annual earnings power.

One slight negative perhaps is the failure to improve the operating profit margin, due to distribution and administrative expenses rising proportionately with revenues.

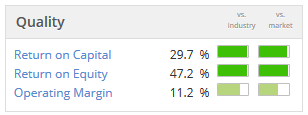

It's still a high-quality stock, though. 12% operating margin isn't bad and combined with its asset turnover (revenues/assets) and the use of financial leverage, it generates a massive return on equity:

So my overall impression remains pretty good and I don' think the valuation is too far out of line. I'm not expecting industrial/commercial LED lighting to be highly cyclical markets, Luceco has broad geographic exposure, and there is plenty of market share for it to reach for.

XLMedia (LON:XLM)

- Share price: 139.5p (+8%)

- No. of shares: 204.4 million

- Market cap: £285 million

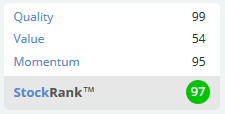

Lots more progress from this Israeli performance marketing group. It funnels internet users into gambling websites and other highly commercial venues, and operates related websites which do the same.

It gets a stake in the long-term revenues of the users it sends to gambling websites, making it highly incentivised and richly rewarded for finding and converting the highest-value users.

It's also growing in the financial sector (credit cards, etc) and is making acquisitions with the large cash pile it has accumulated. Gambling has reduced to 63% of total revenues.

For this latest period, revenues are up 33% to $68 million and PBT up 23% to $19.5 million.

The Board is confident of "comfortably meeting market expectations" for the full year.

My opinion

I think the co-founder and CEO of this company is an intelligent fanatic as defined by the expert small-cap growth investor Ian Cassel. He has had important colleagues, for sure, but it has primarily been his vision which has created this company out of nothing and which is guiding it toward the future.

Investors on the whole find the company a bit hard to understand, and have a bit of scepticism toward Israeli companies, therefore you get this incredible StockRank:

For my own part, even though I rarely have ethical objections to investing, I am a little bit squeamish about what might be interpreted as the manipulation of internet users into setting up gambling accounts. Strangely, I don't feel this way about gambling companies themselves such as Paddy Power Betfair (LON:PPB). There is probably a flaw in my thinking somewhere.

Leaving aside the ethics, it looks like a fine investment opportunity.

EKF Diagnostics Holdings (LON:EKF)

- Share price: 24.75p

- No. of shares: 464.3 million

- Market cap: £115 million

I'll offer a quick comment on this, which hasn't been covered in the SCVR for a while.

It's a medical diagnostics business which makes point-of-care patient tests and laboratory products.

Current trading is in line with expectations for 2017. Operations have been streamlined, including the closure of a manufacturing facility in Poland. In total, the number of sites has reduced from 12 to 7. But the growth numbers are still good:

· Revenue up 22.8% to £21.50m (H1 2016: £17.51m)

· Gross profit up 40.6% to £11.84m (H1 2016: £8.42m)

Capital reduction: interestingly, EKF considered splitting itself in two, separating the two divisions. It won't be doing this, for tax reasons. Instead, shareholders will need to be satisfied with a planned share buyback of 15% of shares.

My opinion: all divisions are growing nicely. R&D spending has reduced to £0.8 million for the period, which is probably a bit conservative, but that's ok.

The rating is on the high side so I'd need to see more evidence about the underlying quality to have interest in making a purchase. It might be worth exploring in greater detail:

That might be it for today, I'll see if I have any more time later this evening.

Thanks for dropping by,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.