Good evening, Paul here! I'm getting into the routine of putting up a placeholder article the night before, and I think it's working quite well - meaning that we can swap RNS ideas on trading updates & results, from 7am in the morning (tomorrow).

Talking of which, see you in the morning! Regards, Paul.

Good morning! It's Paul here.

The roaring bull market continues. Although I've noticed that a lot of UK small caps seem to be wobbling. Take Fevertree Drinks (LON:FEVR) for example - a previous high flyer, it's dropping sharply again today. Peaking recently at 2500p, I've just picked up a few (more as a trade than an investment) at about 1900p - that's a 24% drop from the recent high, quite a considerable retracement. A lot of other high flyers have done the same - e.g. Boohoo.Com (LON:BOO) is down 26% from the recent high (roughly 196p now, versus recent high of c.266p). It's interesting how so many companies have similar charts.

My broker has just flagged up to me that there's been a broker downgrade for FEVR today apparently. I probably should have checked out why it was falling before buying some! Oh well. It does reinforce though, that highly rated shares don't leave any room for disappointments.

The trouble is too, that I think so many market participants are now following Mark Minervini-style momentum trading, that once a stock breaks through the 50 or 200 day moving average, then a stampede of selling occurs. Could it be a buying opportunity? Who knows - only time will tell.

eg Solutions (LON:EGS)

We bid a tearful goodbye to this little software company, and its bizarre CEO, Mrs Gooch. The shares are suspended, following a scheme of arrangement to sell the company. We should get through 112.5p per share in cash fairly soon.

Supermarkets

I saw an interesting article yesterday, saying that major brands are signing up for a new service which will offer cheaper groceries direct to consumers. Apparently the idea is to use blockchain technology to cut out the middlemen (supermarkets), and offer groceries direct to consumers at wholesale prices.

This sounds fascinating, and could spell the end for supermarkets. I'm going through the numbers, with a view to opening short positions on supermarkets, which are potentially doomed, with their onerous fixed costs.

I wonder about shorting commercial property companies too. It seems to me that rents on retail premises are likely to collapse, long term. Although more & more warehouses are likely to be needed, as disruptive companies need distribution centres. Or are they? Maybe manufacturers might end up supplying customers direct, via fleets of self-driving electric delivery vans? So warehouses might also end up being a thing of the past? Fascinating times!

I think we have to be terribly careful with "value" shares at the moment. Mean reversion may not happen this time - a lot of low PER companies could be at the early stages of their death throes, due to the seismic changes occuring, driven by technology?

Norcros (LON:NXR)

Share price: 177.5p (down 2.9% today)

No. shares: 61.7m

Market cap: £109.5m

Acquisition & Placing/Open Offer - a reader has asked me to look at this. Norcros is a bathroom fittings group, operating in the UK & S.Africa. Today it announces another acquisition - of Merlyn Industries Ltd - a designer & distributor (hence by implication not a manufacturer) of mid to high end shower enclosures.

This is a major acquisition for Norcros, which is paying £60m for Merlyn, which is 55% of Norcros's market cap. This is being funded through a placing & open offer at 172p, to raise £31.4m before expenses. Numis is doing the fundraising - they're very good at raising money. The balance of the acquisition funding is debt - through a new £120m borrowing facility. That seems a rather large facility - I hope the company doesn't over-gear again, as it got into trouble with too much debt in 2008.

Merlyn seems to be highly profitable, so looks a nice acquisition. Although you have to bear in mind that private companies often don't pay Directors salaries, paying them via divis instead. So real profits can be lower than reported profits. That may or may not be the case here, I don't know;

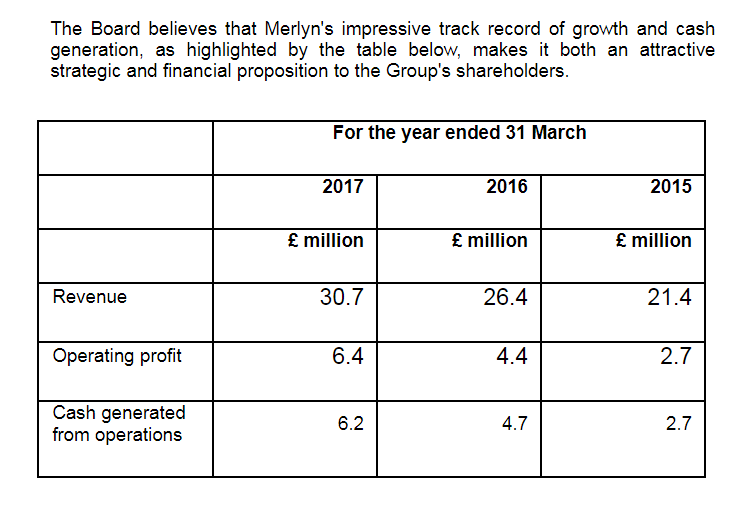

In the year ended 31 March 2017, Merlyn reported revenue of £30.7 million and operating profit of £6.4 million.

The track record at Merlyn looks terrific;

Trading update - there is an in line with expectations trading update in section 5.2 of today's announcement. Market conditions are described as "challenging".

My opinion - this looks like another good acquisition. I like the strategy at Norcros - to buy & build complementary bathroom fittings companies. This has worked well so far. Joining the Norcros group enables acquired companies to improve their routes to market. That sounds like management speak! I just mean that Norcros can sell more stuff through its existing sales network, when it acquires other companies.

The really good thing about making decent acquisitions, is that it enables Norcros to dilute its gigantic pension schemes. The pension deficit becomes less of a problem, as the group grows through sensible acquisitions. That should, in time, trigger a re-rating of the shares from the current extremely low PER.

I suppose the downside risk is that Norcros could be gearing up again at the top of the economic cycle - if that's where we are, nobody knows for sure. I'm tempted to buy a few NXR shares.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.