Good morning!

Apologies for the break in service over the past couple of days.

Best,

Graham

(Please note that I hold shares in UCG)

United Carpets (LON:UCG)

- Share price: 8.6p (unch.)

- No.of shares: 81.4 million

- Market cap: £7 million

I thought I might briefly mention this chain of carpet stores as it's something I've held a position in for a while, and it might be relevant to those of you interested in Carpetright (LON:CPR), SCS (LON:SCS) and others in this sector.

The market cap is very small here, only £7 million, and it's a tiny company, so I'm certainly not suggesting that anybody else should buy shares in it.

Fortunately, the like-for-like revenue performance remained stubbornly resilient, up 2.9%. This is despite overall revenues falling, as the mix of stores became a little bit more heavily weighted towards franchisees rather than corporate-owned stores, compared to a year ago.

It earns a higher return on franchise stores, so that doesn't bother me at all.

To support its growing online activities and the Beds operations, there was a slight increase in distribution and administrative expenses.

Overall, then, operating profit reduced by about 7.5% to £590k.

Outlook statement is very nice. It acknowledges the extent of economic uncertainty which prevails, while also noting that like-for-like performance continues to improve:

Trading in October was similar to the first half before improving strongly in November. Like for like sales for the 10 weeks since the period end to 7 December 2017 show further improvement on the first half performance.

We have started the lead up to Christmas well, which places the Group in a good position for the year. The market remains unpredictable and so our focus will continue to be on protecting our position through maintaining margins and focusing on our delivery of quality and value to our customers. We do see incremental opportunities to expand the business looking ahead into 2018 through the addition of new stores and development of new trading formats but fundamentally the focus is on good execution across our existing business.

My opinion

While not totally relaxed about it, I'm a happy holder here.

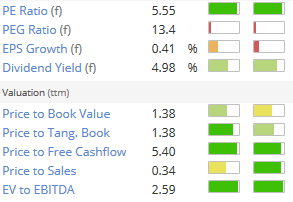

It has net funds of £1.6 million, so that on an enterprise value basis, it's even cheaper than it first appears. The EV/EBITDA ratio is less than 3x, which is perhaps about as cheap as you will ever find an undistressed stock to be. And thanks to the franchise model, it earns a fantastic return on capital of c. 27%.

This is not a high-tech business by any means but management are highly competent and I'll happily stick around for the foreseeable future, at least until something dramatically changes.

In terms of the outlook for other companies selling carpets and beds, maybe they are attractive contrarian plays after all?

Luceco (LON:LUCE)

- Share price: 135p (-42%)

- No. of shares: 160.8 million

- Market cap: £217 million

It's a nasty share price reaction for this LED lighting manufacturer.

Luceco doesn't waste any time in resetting market expectations, and does so with great clarity, so it deserves credit for that.

The Group has seen gross margins weaken during the second half of the year and will now deliver gross margin of approximately 33%, leading to a £3.5m reduction in profit after tax to £13.2m, versus current market expectations of £16.7m.

Regrettably, the gross margin weakness was not identified sooner due to an incorrect assessment of the value of the Group's stock. The Group's Financial Controller has resigned as a result of this error.

Gross margin last year was just shy of 36%. Margin of 33% is more in line with what was earned in 2015.

The company blames exchange rates and commodity prices for the deterioration, but says that efficiency savings and overhead reductions will help things to recover, and it will hedge the RMB versus USD exchange rate to a greater extent in future.

Without inside information, it's impossible to know exactly what the error was. Incorrectly valuing stock presumably means that the company thought the stock it was selling was less expensive to produce than it really was, and I guess this was due to failing to update cost prices when exchange rates moved?

Luceco (LON:LUCE) only joined the market in October last year, and this looks like the customary wobble which we expect from a newly-listed company in the first year or two.

The IPO was at 130p, and the share price had grown by almost 80% on top of that. So today's share price reaction is a resetting of market expectations to where they were at IPO, basically.

The expected reduction in profit after tax is only about 20%, which is not so terribly serious in my book.

The issue might just be that the stock was priced for good growth, at a PE ratio of c. 18x, up until today. We find out today that current earnings are lower and that there will be a little bit of time before performance recovers, so the share price gets the double whammy of a lower multiple on a learning earnings forecast.

There is also the inevitable loss of trust when something like this happens. Luceco's financial year-end is December, so mid-December is quite late in the day to reset expectations. While investors will hope that this is just a one-off event (and personally, I suspect that it is), the loss of trust when a company fails to forecast results properly, is inevitably going to heap further misery on the share price.

Readers have also noted that the CEO sold 2 million shares a few weeks ago. While he still holds a very large number of shares, that may have left a bad taste in investors' mouths after today's news.

Conclusion

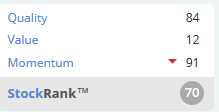

Personally, I'm going to put this on my watchlist now, because I liked the company when I analysed it before, and the only thing which put me off was the optimistic valuation. This might be back in value territory around here.

Momentum will certainly take a hit, but the Value Rank should hopefully improve in the days ahead.

Fulham Shore (LON:FUL)

- Share price: 11.375p (-3.2%)

- No. of shares: 571.4 million

- Market cap: £65 million

During this section of the report, please remember that I am always biased against the pubs and restaurants sector. Fulham Shore operates The Real Greek restaurants and Franco Manca pizzerias.

During this latest six-month period, Fulham Shore opened eleven new outlets, of which one of them is in Italy. It opened another three since period-end, bringing the entire estate to 58 in the UK.

Borrowings have increased by almost £7 million (versus a year ago) to £9.7 million. As noted in the comments, most of the funds used to invest during this latest period came from borrowing, not from operating cash flow. So the roll-out is being debt-financed rather than self-funded.

This next paragraph is fairly explicit. In simple terms, the company isn't growing as quickly as previously planned, and probably won't grow in the future as quickly as was previously planned:

Some of our planned openings this year have been delayed by as much as six months as we seek better deals from landlords thus protracting lease negotiations. These delays have had the beneficial side-effect of improving our cash position and lessening our peak borrowings. We will keep under review our opening programme for the rest of the current and following financial years. We intend that our new restaurants will be selected to give us an average return on capital at the higher end of the scale previously recorded.

Mentioning the cash position and peak borrowings is important, as the company had c. £5 million headroom on its debt facility at period-end. The peak headroom can't be any bigger than that, and might be materially smaller than that. The amount of available capital has thus become a factor in the planned roll-out.

Performance at the pre-2017 estate has deteriorated, for which the company blames inflation, poor consumer confidence, a weakening economy, and rising costs. Those reasons are sort of worrying to me, because they imply that if the economy stays weak or gets weaker, then there is nothing the company will be able to do about it. This is why I generally steer clear of pubs and restaurants.

My opinion

I don't see any like-for-like figures, but the text is clear enough that they were poor for many of the company's existing sites, though they do remain profitable.

The existing sites should logically be in the easiest locations, while the new sites should be in the slightly more marginal/risky locations. With the existing sites doing poorly, and with new sites not doing well enough to justify or enable continuing the roll-out at the planned pace, trading has noticeably worsened here.

That being the case, and given the increased use of debt, I would be inclined to put this on a very cheap earnings multiple - single digits, without a doubt. I would also want to see a strong dividend yield, but the company doesn't pay one.

So this share price looks wrong to me. I regularly make mistakes, however, so good luck if you are a holder here.

Best Of The Best (LON:BOTB)

- Share price: 237.5p (fell 24% on Wednesday)

- No. of shares: 10.1 million

- Market cap: £24 million

Update on VAT Claim and Share Buyback

I'm catching up with this widely-followed share which reported some news on Wednesday.

BOTB started out running car competitions in airports, and has morphed into a company whose operations are principally online.

The airport activities were great for building the company's initial reputation and customer list, but the strategy for some time now has been to focus on growing online activities.

This has led to a change in tax regime, as the company is now in the business of offering "remote gambling" services.

This means it needs to sign up for Remote Gaming Duty - see here for HMRC information. My head is still spinning after reading the tax rules for Remote Gaming Duty on freeplays. The bottom line is that this will cost 15% of profits.

My understanding of how this works (bear in mind that I am not a tax advisor) is that betting duty is paid on gross profits. By traditional standards, that would be considered unjust, as it means that loss-making companies can still end up paying a form of tax on their income. In general, no other industry has to pay tax on gross profits. But gambling has been singled out for special treatment because of the ethical concerns which people have.

Anyway, Best Of The Best (LON:BOTB) reports that registering for Remote Gaming Duty will have a serious impact on its operating margins. It will try to recover overpaid VAT, and will then be subject to RGD rather than VAT.

Quote:

The impact on profit in the current financial year is expected to be mitigated by the old tax regime's ongoing application in H1 and a solid start to H2 and therefore the Company confirms that it expects to report profits before tax of not less than £1.4m (2017: £1.5m). The impact on FY19 is expected to be more pronounced, with forecasted profits before tax of not less than £1.2m.

For PBT to start moving in the opposite direction, rather than rising in line with the growing business, is clearly a great disappointment for investors.

On the other hand, the business still has plenty of attractive features. This profit warning purely relates to taxation, and no other factor.

Management are still heavily invested, and the company is now engaging in share buybacks in the open market, which will further increase management's stake unless they actively choose to lighten their holdings. I would expect them to take the company private, if the share price became too low.

On the other hand, if you don't trust the management team, there is the risk that they could attempt to de-list the company with a weak buyout offer for remaining minority shareholders.

I don't see any reason not to trust the management in this case, but investors have been burned by companies doing that before and are right to worry.

Overall, I'm not in any particular rush to buy shares here. If I already held shares, I would be a bit more concerned about their illiquidity, and I'd be disappointed about the tax regime news. But presumably I wouldn't own the shares in the first place if I didn't trust the management team - and I don't think that Wednesday's news gives any reason not to trust them. So I'd probably continue to hold!

Conviviality (LON:CVR)

- Share price: 386p (+2%)

- No. of shares: 175 million

- Market cap: £677 million

Proposed acquisition and placing

I've been a sceptic of this low-margin, acquisitive, debt-ridden alcohol wholesaler and retailer for some time.

I've got to hand it to Conviviality today, though - this deal seems like a great little bit of opportunism.

You might recall that I recently covered McColl's Retail (LON:MCLS), noting that one of their suppliers had gone bust.

That's the basis of this opportunity, as the supplier in question, through one of its subsidiaries, owns Central Convenience (see here), which describes itself as "the UK's fastest growing convenience store chain", and was evidently put up for sale as part of the administration process.

Conviviality's Bargain Booze subsidiary is now picking it up for £25 million, subject to acceptance of the offer. If so, it will buy it with new shares issued at 375p.

That will add a great bit of scale onto Bargain Booze. It will mean 127 new convenience stores (Bargain Booze currently has just over 600 stores). The company touts the additional economies of scale arising from the potential combination, which are quite believable:

The directors of the Company (the "Directors") believe that potential exists for operational, buying and distribution synergies to be realised from the proposed combination of Central Convenience and Conviviality Retail.

I'm still sceptical of Conviviality as a whole, and Central Convenience only earned EBITDA (unaudited) of £3.5 million in the most recent financial year, making the £25 million deal size rather big on simple valuation grounds.

However, the synergies should indeed be considerable, and the share price is sufficiently high that Conviviality can raise the necessary funds with minimal dilution to shareholders. So it's probably a smart move.

That's all for today. Thanks for your comments!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.