Good morning folks.

Stories on the radar today:

- Conviviality (LON:CVR) - Notice of intention to appoint administrators

- Sosandar (LON:SOS) - Interim Results

- Quarto Inc (LON:QRT) - Final Results

- DX (Group) (LON:DX.) - Interim Results

- CMC Markets (LON:CMCX) - Trading Update

- RM2 - Conditional Placing

Conviviality (LON:CVR) (suspended)

It is game over at Conviviality.

Last night, the company revealed there was insufficient demand to raise £125 million in new equity. It was looking at its options, but the dreaded phrase was used:

The Board believe that shareholders in the Company will receive little-to-nil value.

Today:

Unless circumstances change, and in accordance with statutory requirements, the Board intend to appoint administrators within 10 business days. The secured creditors can, however, appoint administrators without the requirement for notice.

It's amazing how quickly things can unravel.

Up until March 14, we didn't know about the surprise tax payment due to HMRC. We were expecting another weak financial performance this year after receiving another profit warning, but insolvency did not appear to be imminent.

Then, the shares were promptly suspended on March 14 as the company scrambled to find the £30 million due to HMRC.

But it turns out that £30 million would not have been enough. It said yesterday that £125 million was "the minimum amount required to adequately recapitalise the business." This is what the wheels falling off, looks like.

I've written about Conviviality plenty of times, covering it in 2016 and early 2017 on other websites (here and here and here), and also covering it in this report.

Despite being consistently sceptical towards it, I take no pleasure in seeing it fail. Hopefully, most employees will retain their jobs, or find similar jobs with whoever buys up their units.

It's certainly unhelpful news for the drinks industry. Matthew Clark is a structurally important wholesaler, and many suppliers and customers would much prefer for it to survive. It's only fitting that they, to the extent that they are creditors to Conviviality, will find that they are now effectively its new owners. There is a risk of disruption to bars and restaurants, who might need to find new distributors.

Shareholders had ploughed very large sums into Conviviality, including £30 million as recently as December for yet another acquisition.

If anything, this saga reinforces my determination to hunt for organic growth above all else.

The management bonus scheme at Conviviality had the classic error of rewarding EBITDA growth, rewarding balance sheet expansion via acquisitive growth, rather than improving margins and returns in the existing businesses.

As Chris Boxall at Investors Champion has pointed out, the strategy they pursued bore little resemblance to the one they signaled at IPO.

It was dripping in red flags, and is a great example for all of us of what to avoid.

RM2

- Share price: 1.75p (-46%)

- No. of shares: 407 million

- Market cap: £7 million

Another lesson in what to avoid, although I suspected the outcome would be even worse for existing shareholders than what is proposed today.

RM2 has been close to running out of money for a couple of months now, and the moment of truth has arrived.

It is seeking authority to raise $36 million at 1p. If this is successful, it will then give shareholders the chance to take part in an open offer for up to €5 million (the maximum allowed under EU rules).

I personally doubted that it would be refinanced, but a certain well-known fund manager continues to want to plough client money into it. His percentage holding in RM2 will increase from 34% to 68% if this deal goes ahead.

The number of shares outstanding will increase from 407 million to 6.1 billion, and if my maths is right that would imply a market capitalisation of £61 million at the placing price of 1p.

The placing will generate net proceeds of £25 million, so it would be trading at a significant premium to net cash even if the share price resets to 1p (which I think it should). The latest share price of 1.75p only shows that there is still a lot of speculative interest in the company, which still has no material revenues.

Existing shares will represent less than 7% of the enlarged share capital in the new structure, if this deal goes ahead. It could have been much worse.

Sosandar (LON:SOS)

- Share price: 12.75p (-10%)

- No. of shares: 106.8 million

- Market cap: £14 million

There has been plenty of interest in this online fashion retailer since it reversed onto AIM in November 2017.

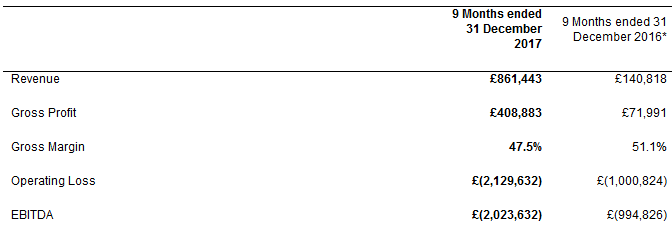

9-month comparative figures are provided as follows:

Since the website only went live in September 2016, we might be better off ignoring the column on the right, and treating the left-hand column as the maiden result.

As might be expected, it's in a period of heavy cash burn.

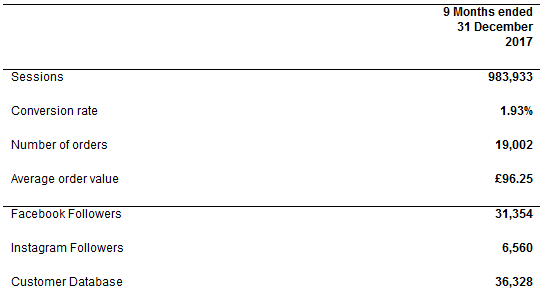

Let's take a look at the most recent KPIs:

For context, average basket value at ASOS (LON:ASC) is about £72, so Sosandar's £96.25 average basket is significantly bigger, perhaps reflecting the mature client base.

If I crudely divide the revenue from the first table by the number of orders in the second table, I'm left with revenue per order of £45.33, much lower than average order value of £96.25.

This implies that 47% of each order is being booked as revenue. VAT at 20% is probably included within the average order value (and would not be counted within revenue), and the rest of the difference would then be customer returns.

If the ex-VAT value of the order is £80.21, then 56.5% of this is being translated into revenue, i.e. returns are 43.5%. This chimes with the returns rate previously cited by Paul as "almost 44%".

The other KPIs look ok to me. Facebook followers at 31k is impressive. Instagram at 6.5k is less so - there are plenty of Instagram accounts with hundreds of thousands or even millions of followers. Asos has 7 million followers there, while Boohoo has 3.2 million. I suppose this could also be a demographic issue, as mature women are more likely to be on Facebook than Instagram!

Outlook sounds good

...increased momentum has delivered new customers, repeat orders and total revenues ahead of forecast, in particular November 2017 and December 2017 were very strong and this momentum has continued into the first three months of this year. We will continue to invest in our marketing and digital strategy and look forward to further substantial growth."

So why are the shares lower today?

One reason might be the lack of hard numbers in terms of forecasts.

Another more pressing reason might be the escalating costs.

In Dec 2017, Paul shared some broker forecasts with us:

The only forecasts I have are a detailed note from Turner Pope from Aug 2017, which is the broker that floated Sosandar. This shows forecast revs of £1.0m this year 03/2018, rising to £3.3m 03/2019, and £9.4m 03/2020.

PBT is forecast at -£1.9m this year, followed by -£1.4m 03/2019, and a small maiden profit of £0.1m in 03/2020.

Today's nine-month figures show revenue at £861k, well on track to beat £1 million for the 12-month period finishing at the end of this month.

On the other hand, the operating loss after nine months is minus £2.1 million, worse than the £1.9 million pre-tax loss forecast for the full year. So it looks like the full-year result is heading for a significant miss against the original broker forecasts.

The company's cash balance was at £5.3 million at December 2017. It is funded for the short-term, but not indefinitely. If losses continued at the same rate as they have over the past nine months, and assuming the losses fed straight through to cash outflows, the company would run out of funds before the end of calendar year 2019.

Cash needs might be accelerating, however, since presumably the need for additional inventory is only going to grow, along with the marketing spend.

It might succeed in funding its pathway to growth, but this remains to be seen. Gross profits only covered 16% of the overhead expenses during this 9-month period, so a huge amount of additional top-line growth is needed.

Putting it all together, I don't think I'd want to hold this unless I was happy to take part in any additional fundraisings which might be needed to get it to profitability, to avoid the risk of getting diluted. More shareholder support could be needed to see it through to success.

CMC Markets (LON:CMCX)

- Share price: 170.7p (+10%)

- No. of shares: 289 million

- Market cap: £493 million

This is of particular interest to me as I own shares in IG Group (LON:IGG).

Our strong year to date performance has been maintained throughout the final quarter of the year. Net operating income for the second half will be moderately above the first half and significantly above the prior year.

Just like IG, CMC is now oriented towards higher-value clients, and doesn't mind if total active client numbers have to drift lower in order to achieve this.

I'm happy to stay invested in this sector, as most of the revenues are generated by small numbers of active and wealthy clients. These can likely be categorised as "elective professionals" and continue to trade with very little restriction under CFD rules being imposed by the EU's securities regulator.

The small trader will find that he can't trade as before, and it will make it that much harder for new CFD brokers to break into the industry. The competitive position of those firms already established, and I think particularly of IG's position, will only be enhanced.

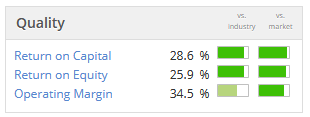

CMC might be a nice investment in its own right, with a StockRank of 88 and superb quality statistics:

Quarto Inc (LON:QRT)

- Share price: 148.5p (-11%)

- No. of shares: 20.4 million

- Market cap: £30 million

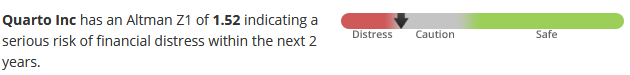

This is a US-domiciled publishing company, which qualifies for the same financial risk warning as DFS Furniture (LON:DFS) did yesterday:

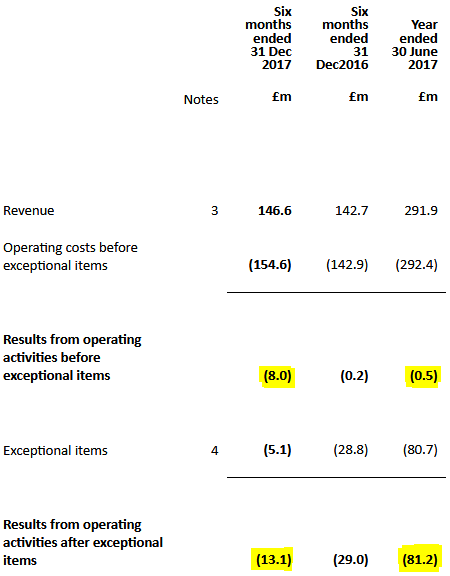

Headline annual results are as follows. The company ended the year with $64 million of net debt:

Within 2017, H2 was the better half, revenues up 5.8% versus H2 2016. Carrying this momentum through into 2018 is mentioned as one of the objectives this year, along with strengthening its balance sheet. Dividends have been suspended for the time being, in keeping with this latter objective.

Indeed, the company is very clear about the need to strength its balance sheet. leading me to believe that it will come up with a solution in due course:

It has become clear that the competing pressures of servicing debt, paying dividends, and investing in the core business currently inhibit Quarto's ability to grow by acquisition. The Group is therefore looking at all options to strengthen the balance sheet and will keep all stakeholders updated with its progress.

"All options" must include an equity raise. Shareholders haven't been diluted much in over a decade, so Quarto would still have a much better record in this regard than many other companies.

The going concern statement is very detailed, and includes the disclosure that amendments to the loan covenants have been agreed, to give Quarto extra headroom. This implies a great deal of concern that the covenants at their original levels could be broken.

This part of the report concludes as follows:

"...the Directors continue to adopt the going concern basis in preparing the financial statements. In doing so, it is recognised that such future assessments are subject to a level of uncertainty that increases with time and, therefore, future outcomes cannot be guaranteed or predicted with certainty."

Overall, it's an unusual going concern statement, and it says to me that those who prepared it are very concerned about the company's financial position. Risk of distress may not be imminent, but the position as it stands is unsatisfactory.

Leaving the debt issue to one side for a moment, the overall outlook is mixed. One-third of revenues are from Children's products - children's books are doing well, but other categories are weak. Adult publishing revenues declined by 9%.

I suppose it's also worth mentioning that with more than half of revenues deriving from the US, the recovery in the pound has dented the attraction of USD-denominated income.

Balance sheet - the balance sheet has suffered very large non-cash impairments, so that balance sheet equity has fallen to just $24 million. Liabilities are $159 million.

If you exclude the remaining goodwill and other intangibles not related to the company's standard pre-publication costs, tangible book value is now about zero.

Cash flow - The impairments of intangibles don't affect cash flow, of course. Quarto's cash flow for the year wasn't too bad: $37 million generated from operations before working capital movements, and about $37 million used in investing activities, by my calculations, if you exclude the acquisitions and disposals made in the year.

So I reckon that underlying cash flow is about breakeven, before you consider the effect of interest and taxes.

Conclusion - it looks like quite a good business. It just needs to do an equity raise to eliminate a decent chunk of the debt, focus on its core operations and minimise exceptional costs for the next few years.

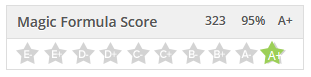

Greenblatt's Magic Formula agrees that this is a fine company and also thinks it is priced cheaply. The only major blind spot this formula has in relation to solvency:

DX (Group) (LON:DX.)

- Share price: 8.33p (+12%)

- No. of shares: 200.5 million

- Market cap: £17 million

A quick word on this logistics business I covered many times last year, at it attempts to stage a turnaround. The senior management team has been entirely refreshed.

It managed to stay afloat in H1 (the six months to December 2017) by issuing £24 million in 8% convertible loan notes to its major shareholder and new directors.

To put the company on a sounder financial footing it proposes to issue 335 million shares at 7.41p, enabling it to redeem these loan notes.

That's a lot of dilution, but existing shareholders were already very vulnerable to dilution, as the loan notes were convertible at 10p (i.e. they could have been converted into an additional 240 million shares).

To further boost the company, it wants to issue another 54 million shares on top, raising £4 million.

So I reckon that the company is headed for about 590 million shares in total, which at the placing price of 7.41p would produce a market cap of £44 million, for a debt-free reincarnation of the company.

Hopefully, this will give the new executives a chance to implement their turnaround plans.

As you can see, the results to this point are highly discouraging. The company has made operating losses for the past eighteen months, even if you exclude exceptional items:

I have no idea if the turnaround will succeed, but hopefully they have a chance:

Trading conditions remain challenging, but we are already seeing encouraging signs that our turnaround plans are gaining traction. Net new business in the past two months at DX Freight has been at a higher monthly level than at any point in the last 12 months. We expect the benefits of our turnaround initiatives to continue to build through the year and into 2019.My consistent stance has been that this stock was uninvestable until it was recapitalised. Assuming that recapitalisation goes ahead, it will become investable again and we can perhaps start to look at it in a more positive light. It might be worth interviewing management to get a better feel for how they plan to fix it.

That's it from me for Q1. Tomorrow afternoon, I fly to Cyprus - less than 200 miles from the Syrian coastline. How exciting.

Paul has been having fun in San Francisco, and will hopefully be back next week with some interesting anecdotes.

Markets are closed tomorrow and on Monday. Have a great Easter weekend.

All the best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.