Good morning, folks.

Apparently, there has been a technical fault with the company announcements RNS feed this morning. Let's hope they fix it soon!

8:45 AM update: there was a large release of announcements at 8:25, so I'm going to assume the backlog has been cleared. Some companies reporting which we follow here include Keywords Studios (LON:KWS), French Connection (LON:FCCN) and Hollywood Bowl (LON:BOWL).

Was anybody caught out by disorderly trading in shares whose news was delayed? There is a risk that some shareholders might have been disadvantaged by the delayed release, to them, of important information.

As an aside - I remain in favour of the US system, where news is announced after the market closes in the late afternoon/early evening. I can't see any downsides to doing it that way!

Conviviality (LON:CVR) (suspended)

A quick post-script on Conviviality, and the final outcome for its two divisions ("Direct" and "Retail").

The news has been positive for employees, customers and suppliers, as a series of deals are likely to have saved many jobs and will lead to the continuation of most of the group's activities, under new owners.

C&C (LON:CCR) (owner of Magners/Bulmers, Tennent's, and other drinks brands), with the support of the giant brewing company AB Inbev, has bought Conviviality Direct, including Matthew Clark and Bibendum.

Bestway, one of the UK's biggest food and drinks wholesalers, has picked up "the business and assets" of Conviviality Retail, but the sale proceeds won't be sufficient to pay off creditors:

It is with regret that the Board notes that the companies are not expected to have sufficient assets to satisfy all their liabilities.

PricewaterhouseCoopers will be in contact with creditors of Wine Rack Limited, Bargain Booze Limited and Conviviality Retail Logistics Limited. The Board also understand that the realisations will be insufficient to provide any return to shareholders.

The new owners are likely to have a more sober view (pun intended) of the true worth of Matthew Clark, Bibendum, Bargain Booze, Wine Rack, etc,, compared to Conviviality.

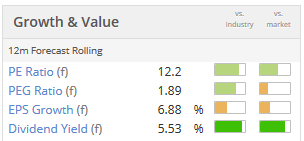

I hope that none of our readers were too heavily invested in CVR. The story continues now with C&C (LON:CCR), at least as far as the wholesaling activities are concerned. Here are its latest value metrics in case you might wish to investigate it further (it is beyond the market cap limits of this report):

With confirmation that shareholders will receive nothing, and the subsidiaries having been sold off, I intend to cease coverage of CVR now.

French Connection (LON:FCCN)

- Share price: 52p (+21%)

- No. of shares: 96.3 million

- Market cap: £50 million

Proposed Sale of Toast to BESTSELLER

Paul owns shares in French Connection, and writes for us:

"Interesting announcement from FCCN - disposal of Toast, for what looks like a good price.

I reckon Stephen Marks is tidying up the business, to maximise the value for ultimate sale of the whole business. He's in his 70s now, so must be looking for an exit at some point. Also, they mentioned in a recent results statement that they'd had an unsolicited takeover bid for the whole group, and had spent several months in negotiations in due diligence.

So it's clear the whole group is "in play" now, I reckon. Could be great upside, as it's moving into profit this year, due to disposal of loss-making shops. Also the balance sheet is bulletproof - market cap is similar to just its working capital, which seems crazy to me. I'm very long on this one, as risk:reward looks favourable to me."

My opinion

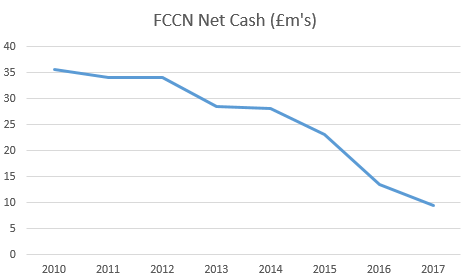

I agree with Paul that this is a good price - French Connection are getting paid 12.2x Toast's most recent EBITDA. It also means good things for French Connection's net cash position, which has been sliding for many years:

(Source: RNS announcements. Chart by GN.)

Net cash proceeds to FCCN will be £13.9 million, but this includes a £2 million special dividend from Toast which I believe should already be included within FCCN's net cash.

So taking that into account, I think FCCN's net cash will increase by about £12 million to £22 million, or a little over 40% of the current market cap.

Governance Issues

This is a share which I unsuccessfully attempted to trade back in 2015.

One of the issues which has nagged me about it is the impression I have of the Chairman's attitude to shareholders.

A fellow investor took the trouble of attending French Connection's poorly-attended AGM a few years ago, and was flatly refused the opportunity to ask any questions during the meeting.

Some might consider this to be a minor issue, but the Chairman's attitude to the City for many years has been one of disdain. And he continues to hold both the Chairman and CEO roles despite this being a very basic no-no as far as corporate governance is concerned. The UK corporate governance code states:

There should be a clear division of responsibilities at the head of the company between the running of the board and the executive responsibility for the running of the company's business. No one individual should have unfettered powers of decision.

Don't misunderstand me - as the major shareholder, he is perfectly within his legal rights.

Furthermore, having held a net cash position, albeit a shrinking one, the company has not needed any financial support from its minority shareholders. So it has been able to afford not to care very much about their views.

But I think this does need to be reflected in the share price. If it had not been for his major shareholding, the Chairman would have been removed from the position of CEO many years ago. The shares need to be discounted, to reflect this issue.

One way to approach it is to apply the "discount to tangible assets" test, which I applied to another loss-making retailer, GAME Digital (LON:GMD). (I own shares in GAME Digital (LON:GMD). It does not have any corporate governance issues that I am aware of.)

At the latest results, French Connection had net assets, excluding intangibles, of c. £46 million. This will be boosted by the Toast disposal to £50m+.

So French Connection shares are also trading at some discount to tangible assets, giving shareholders an opportunity to buy the value of the French Connection brand "for free".

Therefore, I can see the potential for this to be another profitable trading opportunity, if assets can be sold off and stores closed efficiently (there are about £33 million of currently off-balance sheet lease liabilities to be shown on the balance sheet, when new financial reporting rules are implemented).

It's quite possible that I am missing out on a fine opportunity, but I would need a 50% discount to tangible assets to want to get involved with this share again, due to my corporate governance concerns and my view that the Chairman has zero interest in minority shareholders.

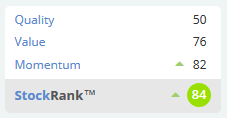

The algorithms love it, again underlining the fact that I am probably missing out on the chance to buy a share with good prospects:

Strangely enough, Sports Direct owns a big chunk of shares in both French Connection and Game Digital. It will be fun to see how the Sport Direct share portfolio turns out in the long run!

Mothercare (LON:MTC)

- Share price: 16.8p (-14%)

- No. of shares: 170.9 million

- Market cap: £29 million

No RNS announcement from Mothercare today, but the papers reported over the weekend that it is considering the potential for a CVA to shut down 47 of its 143 stores, and change rent terms on the others. Well done to Paul for predicting that a CVA was on the cards.

Mothercare's share price started 2018 around 65p and continues to make rapid progress toward zero, as it approaches a resolution of its financial problems. Lenders agreed to defer financial covenant tests last month, and discussions with them are ongoing.

Instead of letting traders speculate on its future according to these newspapers stories, maybe the company should come out and confirm that it is doing a CVA, if true?

I agree with the general consensus that this share is uninvestable, as we don't know what steps will need to be taken to satisfy the company's lenders in the weeks and months ahead. The appointment of a new CEO is interesting, but it doesn't look like it's enough to salvage the value of existing shares.

Retail bloodbath?

The phrase "bloodbath" has already been applied by US commentators to conditions in the retail industry across the pond, and it's an increasingly apt description to conditions over here, too.

I've just quickly revised the retailer exposure in my own portfolio. Key characteristics I'm looking for in my own retail holdings are intellectual property/brand ownership (e.g. £BRBY) or else very valuable and liquid balance sheets, with strong cash positions (e.g. Next (LON:NXT), £GMD).

In a more competitive and rapidly changing marketplace, companies without their own great brands will be eaten up by Amazon or by cheaper alternatives. So we have to be very, very selective in this sector. But there could be some great bargains on offer at the moment, if we can identify those companies which will survive the ongoing transformation to online.

Keywords Studios (LON:KWS)

- Share price: 1605p (+1.5%)

- No. of shares: 61.7 million

- Market cap: £990 million

This support services provider to the video games industry continues to go from strength to strength. It is now well beyond our usual upper market cap limit for this report.

I've enjoyed watching the management presentation posted at piworld today. One of the most interesting quotes I thought was this one, from the CEO:

"I sometimes pinch myself when I look at these numbers. This market [video games] is $120 billion in size and yet it is still an absolute niche market by any sort of measure... the product itself is very unique being this kind of mashup of the very highest creative content with the very technical cradle that it sits in... The market for services is both highly fragmented and also pretty large, it's about $5 billion in size."

The overall games industry continues to grow at a rate of 6-8%, and Keywords benefits from the ongoing trend towards publishers outsourcing much of their work to service providers such as themselves.

The Keywords strategy is simple enough: buy up smaller players in this market, integrate them and cross-sell to their customers an expanding range of capabilities. Services include art production, audio, localisation and functional testing. There is a new engineering line and Keywords is now increasingly involved in full game development.

Thanks to continued sales growth, no client represents more than 10% of revenues. So nearly all of the top video games publishers are counted as clients, and concentration risk appears limited.

My opinion

It's a great story and I'm not surprised that this share is a popular one among investors. The share price is up 10x in three years:

This is a successful company with a great track record of execution and favourable industry tailwinds behind it, so it deserves a strong rating.

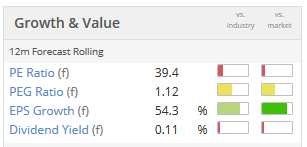

Value metrics are as follows:

Note that the underlying revenue growth is 15%, which in my book is good but probably not enough to justify the 39x PE ratio reported above.

Two months ago, with the share price not far off the current level, I said:

It has performed brilliantly so far, but the risk of a mishap must surely be increasing, with the share price not leaving much margin for error.

I think I'll stick to my guns, and repeat this view today.

Games publishers themselves are trading more cheaply vs. earnings than Keywords, and they own the underlying brands, so I would instinctively prefer to own them rather than Keywords at current share prices. For example, Nintendo (TYO:7974) and Activision Blizzard (US:ATVI) are each trading at around 24x forecast earnings. Their EV/EBITDA ratings are less than half as expensive as Keywords, according to Stockopedia.

As customers of Keywords, they benefit from the opportunity to outsource their work. If it didn't benefit them, they could always in-source it again.

So I'm a fan of Keywords and I think it has a bright future, but I think the publishers are probably a better bet for investment at the moment.

That's it for today! Thanks for dropping by.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.