Good morning, folks.

There is lots to catch up on today. We will be hearing from Paul on French Connection (LON:FCCN).

The list turned out to be:

- Begbies Traynor (LON:BEG)

- Northamber (LON:NAR)

- Inland Homes (LON:INL)

- IG Group (LON:IGG)

- Northern Bear (LON:NTBR)

- French Connection (LON:FCCN)

Begbies Traynor (LON:BEG)

- Share price: 70p (+1%)

- No. of shares: 110 million

- Market cap: £77 million

AGM Statement and Trading Update

A nice easy one to start with. Q1 trading at this insolvency practitioner is in line with expectations. It's investing for growth and benefiting from recent acquisitions while the underlying number of corporate insolvencies has picked up, providing a tailwind.

The long-awaited (for BEG shareholders) spike in insolvencies looks like it might be approaching us, and as such the share price remains within touching distance of a multi-year high at 76p.

Its counter-cyclical nature is probably its most interesting feature for some of its investors, who otherwise might not be too interested in a professional services consultancy.

More growth is on the cards both organically (hiring fee earners) and through acquisitions.

Good luck to those involved with this one.

Northamber (LON:NAR)

- Share price: 29p (unch.)

- No. of shares: 27 million

- Market cap: £8 million

Below our threshold and probably the most boring share on the LSE, I should probably ignore this one. But it has a special place in my heart, as it's a "deep value" investment I fruitlessly held for years.

This share taught me several things. One of the things it taught me was that distribution activities - acting as a middleman - don't offer much of a moat (except in very specific circumstances).

Northamber has struggled to generate much of a gross margin on its tech distribution activities for years, and whatever margin it has generated has been easily gobbled up by staff costs and other overheads.

It last generated a profit in 2010.

Reported NAV per share was 103p in 2005, and has been very gradually declining ever since (though the value of its freehold property has been increasing).

When I bought the shares in 2013, NAV was 81p.

Today it reports NAV down by another 2p during the year to 62p.

Due to the "political, economic and social uncertainties", the long-standing Chairman and 63% shareholder says he is "unable to make any realistic assessment of the next year or so". That seems fair enough actually.

Less reasonable is the company's approach to capital allocation. Since 2010, the company's wonderful asset base full of potential has been stagnant and lying idle (or worse than idle, given the NAV erosion).

There's no reason to suspect that the 62p in value (or more) will be released to shareholders soon. It could happen when we least expect it!

Inland Homes (LON:INL)

- Share price: 63.4 (+0.6%)

- No. of shares: 206 million

- Market cap: £131 million

Inland Homes Plc (AIM: INL), the leading brownfield developer, housebuilder and partnership housing company with a focus on the South and South East of England, today announces its preliminary results for the year to 30 June 2018.

Some nice gains revealed by Inland today. EPRA NAV (the company's net asset value adjusted for gains in value of trading properties) improves by 6,3% to 102.3p. I focus on this number rather than reported NAV for property developers such as Inland.

Some highlights:

- maintained its landbank with respect to number of plots, though with a small reduction in the proportion of plots already achieving planning permission.

- the number of open market homes completed this year is set to reduce, "due to the cyclical nature of the construction programme"

- " Largest ever planning application submitted for 1,853 homes and in excess of 18,000 sqm of commercial space at Cheshunt Lakeside, a major South East UK regeneration scheme"

Outlook

From the Chairman:

Whilst prices have softened slightly in the Greater London area and the industry awaits further clarity on the long term future of the Help to Buy scheme, we are well positioned through our increasingly diverse revenue streams to benefit from the fundamental lack of suitable housing in our target markets.

From the CEO:

We anticipate that any changes to the Help-to-Buy scheme come 2021 will impact those who are not first-time buyers and those looking at properties towards the higher end of the bracket and we'd expect the favorable borrowing environment to persist for the foreseeable future.

My view

This share continues to look cheap to me. I don't see why it doesn't trade much closer to EPRA NAV.

It's a good property company. I don't own it for the simple reason that I want higher returns throughout the economic cycle than you can typically get from property. I also don't feel comfortable betting on Help-to-Buy legislation, though Inland is probably right that politics will remain favourable for the business.

IG Group (LON:IGG)

- Share price: 805p (-7%)

- No. of shares: 369 million

- Market cap: £2,969 million

(Please note that I currently hold IGG shares.)

IG Group Holdings plc ("IG", "the Group", "the Company"), a global leader in online trading, today issues an update on its revenue for the three months to 31 August 2018, the first quarter of its FY19 financial year.

Revenue is 5% lower than Q1 FY 2019. The strong volatility and client activity from FY 2018 has not continued into FY 2019.

ESMA leverage limits on retail traders came into force in August and resulted in a "significantly lower" volume of trading. IG doesn't want to draw conclusions from one month of business however, as it will take time for retail traders to adjust to the new rules.

Therefore:

The Group's performance in the month of August has not changed the Company's previously stated view that the impact of the ESMA measures on historic revenue would have been a reduction of approximately 10%.

So I suspect that today's share price reaction is less to do with the ESMA rules and more to do with the fact that revenue fell by 5% despite those rules only being in force for one of the months this quarter.

There is not much in the statement to make me question the long-run value of the business or my intention to keep holding.

On the positive side, clients in share dealing and investments have increased by more than 50% compared to a year ago (to 37,000).

Share dealing is a much less profitable activity for IG than CFDs and spread betting but in the long-run the company has potential to steal huge chunks of market share from mainstream stockbrokers, due to the strength of its trading infrastructure. It will then have highly profitable cross-selling opportunities as share dealing clients dabble in spread betting (and use their shares as collateral, in the case of professional clients).

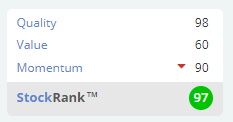

It continues to be classified as a Super Stock by the algorithms.

Northern Bear (LON:NTBR)

- Share price: 79p (+7.5%)

- No. of shares: 18.5 million

- Market cap: £15 million

Straight back to micro-cap territory now. This is a building services company based in Newcastle.

We've had some valuable reader contributions on this share in previous editions of the SCVR.

This is a very quick update:

The Board is delighted to announce that, having sufficient visibility of results for H1 FY19, the unaudited interim results will show operating profit (stated prior to the impact of transaction costs and amortisation associated with the H Peel acquisition) ahead of prior year results.

My view - the sector Northern Bear operates in is perhaps not the most attractive from an investment point of view. This is reflected in a forward P/E ratio of about 7x (according to Stocko).

It's a classic cheap micro-cap. If you're ok with the sector and with some potential illiquidity (I've never tried to buy these shares, so I can't confirm), then you can get access to a cheap and growing business with what I suspect is a highly competent management team.

There's no more time for me today, apologies!

Paul covered FCCN in comment #28 below (link), and is writing tomorrow's report. Have a good evening everyone.

Regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.