Good evening/morning, it's Paul here.

To manage expectations today, I'm on the afternoon shift, so estimated completion time of this report is c.6 pm. As usual, I'll update it in sections as I go along. It's a quiet day for small caps news anyway. All done now (17:36)

Burford Capital (LON:BUR)

Yesterday was so dominated by BUR that I didn't get round to looking at many other things. Hence today's reports starts with some catch up items, written by me late on Weds night. Incidentally, I really liked Graham's coverage of Burford on his own website, here.

Another thought occurs to me. It might be that the share price could bounce from here, but will it get back to previous levels? I doubt that, because now it appears (according to MW) that profit is mainly coming from aggressively anticipating the future cashflows from only 4 big cases, then that casts considerable doubt over the sustainability of future profits. That in turn means that a much lower multiple of earnings should be used in valuing the company.

Taking that into account, means that I suspect Burford shares could eventually settle permanently at a lower level - maybe 500-1000p? As Graham points out in his article, given that Burford appears to recognise future profits aggressively, then we should possibly be valuing it at a discount to published NAV, not a premium? It depends on how you look at it.

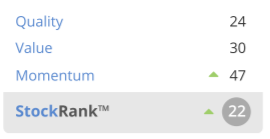

Interestingly, the Stockopedia computers were negative on Burford, before the recent share price collapse. On 4 Aug 2019, when the share price was 1425p, the StockRank here was very low for a (at that date) £3.1bn company;

That has since dropped to 18, as the momentum has obviously dropped this week.

Nobody is claiming that the StockRank system is infallible - it couldn't possibly be, as no system can predict the future. However, I've noticed that ignoring low StockRanks is often a costly mistake - many of my low StockRank personal holdings have done really badly in the last year. With hindsight, if I'd played it safe, and stuck to higher StockRank positions, I'd probably be a lot happier and wealthier than I actually am now. Ho hum, we live & learn. Or maybe that should be: live and make the same mistakes repeatedly?! Anyhow, there's no point in crying over spilt milk.

Zotefoams (LON:ZTF)

Share price: 556p

No. shares: 48.3m

Market cap: £268.5m

These figures came out on Tuesday.

Zotefoams plc ("Zotefoams", "the Company" or "the Group"), a world leader in cellular materials technology, today announces its interim results for the six months ended 30 June 2019.

These figures look solid.

- H1 revenues up 12% to £42.3m - driven by strong growth (+40%) in high performance products. The other 2 categories only delivered 3% growth each

- Profit before tax up 7% to £4.93m - note the decent profit margin there, of 11.7% - so clearly the company has some pricing power, so its products must be good

- Capacity expansion has been in the pipeline for some time. Says this is "on schedule". That's the main interesting thing about this share - as increased production capacity should drive future profits higher

- Outlook comments say it's in line to meet market expectations for FY 12/2019, but notes difficult market conditions in Europe

Balance sheet - note that both fixed assets, and debt are rising strongly - to fund the factory expansions.

Net debt has risen from £13.0m at end Dec 2018, to £23.4m at 30 Jun 2019, to fund capex.

I don't see that as a problem, relative to the profits/cashflow, and the good surplus of working capital. Although of course, increasing bank debt when there may be a recession on the horizon, does increase risk.

My opinion - a good company, I think.

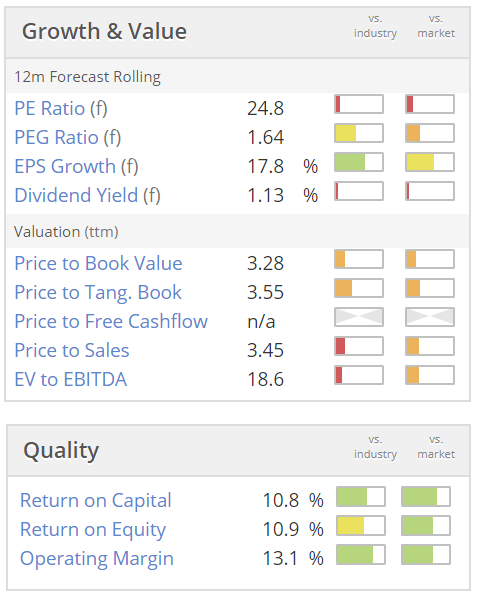

In terms of valuation, I'd only be interested if the price were around say 15 times forward earnings. As it is, this valuation of nearly 25 times forward earnings, seems too rich, given the wobbly nature of the global economy right now, and the macro risks, hence I'll decline to invest here, purely on valuation grounds;

Water Intelligence (LON:WATR)

Share price: 333p

No. shares: 16.9m

Market cap: £56.3m

Water Intelligence plc (AIM: WATR.L) ("Water Intelligence" or "Company"), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water is pleased to provide a trading update for the first half of 2019. Interim Results for 1H 2019 will be published in mid-September.

[potable means safe to drink - I had to google it!]

Things seem to be going well;

Results are ahead of market expectations for revenue [$15.9m, up 34%] and comfortably in-line with expectations for profits before taxes. The Company continues to perform strongly with its multinational growth plan. Global demand for water infrastructure products and services remains strong.

I haven't highlighted that revenues are ahead of expectations, because profit is far more important than revenues.

As some activities are franchised, the revenue number is lower than the underlying transactional value with end customers.

Adjusted profit before tax for H1 of $2.0m, up 29% - pretty good going.

My opinion - very similar to Zotefoams above - this looks a good company, with decent growth going on. However, the valuation appears toppy to me, at 23.8 times forward PER.

If you think it can beat earnings forecasts, then that might justify paying a high price. But the valuation rules it out for me, and I'm not really interested in buying any new positions at the moment, due to macro uncertainty, unless they are really compelling, which this isn't.

Mostly dollar earnings protects from weak sterling, and Brexit issues.

Elecosoft (LON:ELCO)

Share price: 76.5p (down c.1% yesterday, at market close)

No. shares: 82.1m

Market cap: £62.8m

Elecosoft is a specialist international provider of software and related services to the Architectural, Engineering, Construction and Owner-Operator industries and digital marketing industries... its software solutions cover project management, construction site management, estimating, timber engineering, 3D design and visualisation, and cloud based digital marketing solutions.

The Board of Elecosoft announces a trading update for the six months ended 30 June 2019, based on unaudited management accounts for the period.

Things seem to be going well;

Unaudited revenue for the period increased by 20 per cent compared with revenue for the same period last year. At constant rates of exchange, unaudited revenue would have increased by 22 per cent.

Trading margins for the period were consistent with the prior year and preliminary results for the half year based on unaudited management accounts indicate that the outlook for the full year remains in line with market expectations.

The revenue growth looks to have been flattered by two acquisitions, in H2 of last year. Therefore these are contributing to sales & profit this year in H1, against prior year comparatives which would not have included them.

I feel this should have been mentioned in today's trading update, and the organic growth figure should have been presented, but wasn't. That feels a bit underhand. Anyone unfamiliar with the company might have wrongly assumed that the 20% revenue growth was all organic, when actually it isn't.

Net debt - reduced from £2.1m at 31 Dec 2018, to £0.6m at 30 June 2019 - looks good, and a very modest level of debt.

My opinion - this looks an interesting software group, at a fair price - forward PER of 16.4.

I quite like it.

Bellway (LON:BWY)

Trading update - a large cap builder. I often glance at updates from builders, as they're a good barometer of the health of the economy.

- Trading in line with market expectations

- Operating margin "continuing to moderate towards a more normalised level"

- Ungeared balance sheet, with net cash

Outlook comments sound positive -

Trading conditions remain stable and customer confidence is resilient. There continues to be a strong underlying demand for good quality new homes, supported by the ongoing availability of Help to Buy and an environment of low interest rates.

Customer confidence was resilient and despite the evolving political backdrop, trading in the second half of the financial year was more robust, benefitting from site openings and the usual increase in demand throughout the spring selling season. The cancellation rate for the year remained low, at just 12% (2018 – 11%).

How interesting! From watching the TV news every day, we could be forgiven for thinking that the country is in dire straits. Whereas in reality, we have close to full employment, rising real wages, and I think people are just getting on with their lives instead of worrying about Brexit.

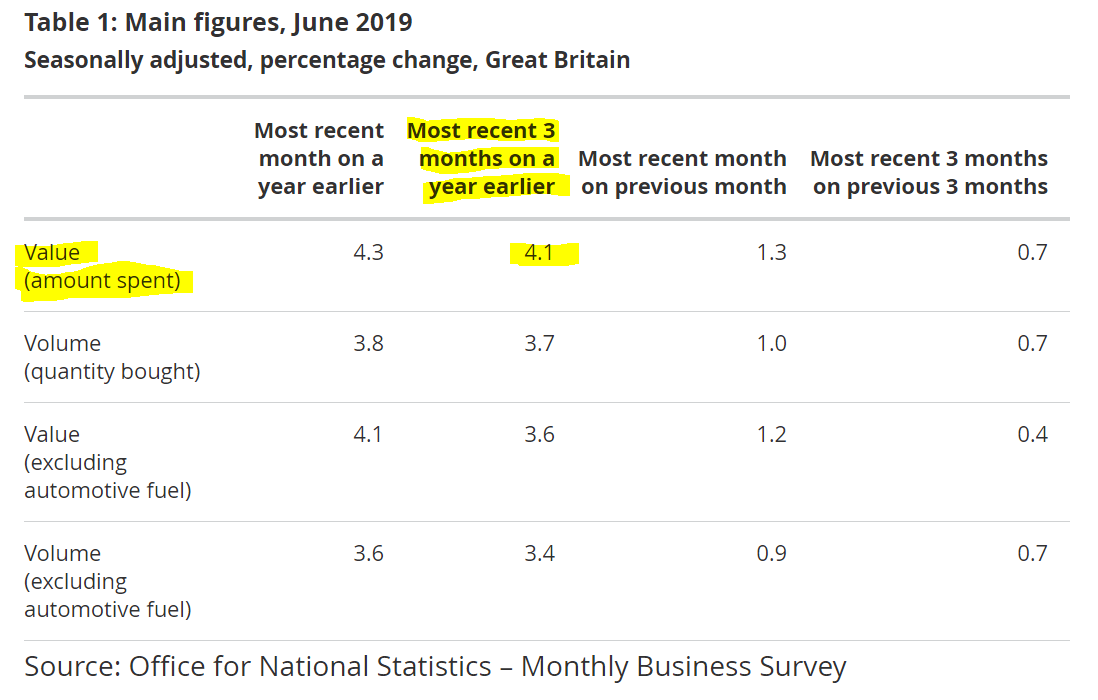

Furthermore, if you look at the ONS statistics, consumer spending is in rude health also;

So why is the TV news full of bad news every night? Basically because they like to report negative things, and ignore positive things. Also, with retailing in particular, there's a massive shift going on, from physical stores to online (now about 20% of all retail spending in the UK). So the news is filled with items about struggling physical retailers & job losses, whilst the growth & job creation up & down the country from online retailers, is ignored.

My opinion - back to housebuilders, my main worry (and the reason I don't own any) is that they're so dependent on Help To Buy. This scheme probably should have been wound down a long time ago. It was needed to kick start the market after 2008. Since then it's boosted prices of new homes, thereby providing windfall profits & dividends for shareholders in housebuilders, at the taxpayer expense.

Remember also the scandalous, obscene, £75m bonus that the boss of Persimmon skulked off with? That was a great example of how Govt action can distort markets, and create unintended consequences. The golden rule should be that all bonus schemes have a cap on the maximum payout, to take into account unknown future distorting factors. I'm generally not a fan of bonus schemes for Directors. They're well paid to start with, and so-called incentive schemes often seem to encourage reckless behaviour, and short-term thinking.

Housebuilders are making ridiculously high profit margins at the moment (c. 20% in some cases), whereas normal margins are about half that. Therefore a PER of 6 might look cheap, but could move to 12 as profits normalise over the next few years. Therefore valuing housebuilders on a PER basis is not really appropriate. I prefer the "build out" method.

Bellway does look quite interesting on valuation grounds, with only a modest premium to NTAV. So it might be worth a look.

Burford Capital (LON:BUR)

Their detailed rebuttal document has just been published, so I'm currently reading through this.

Point 1 - Napo/Jaguar

The explanation given by Burford sounds reasonable. It says that the initial profit booked was for other litigation, and not the Napo vs Salix matter, which Napo (Burford's side) ultimately lost.

It refutes the alleged conspiracy with Invesco, the key point being that at the time of the alleged conspiracy, Burford had no relationship with Mark Barnett, and that his fund did not hold any Burford equity.

This sounds a reasonable explanation to me. One-nil to Burford at this stage.

Point 2 - Gray and delayed recoveries

Burford explains why it took commercial decisions to defer receiving a settlement, which do sound sensible. The ultimate outcome on the Gray case was very profitable for Burford, it says.

It refutes the $200m damages counter-claim, saying there is no counter-claim.

Non-cash settlements are very small, but are occasionally used for sound commercial reasons.

Again, all sounds reasonable, so I make this Two-nil to Burford so far.

Point 3 - Acquisition cost in acquired investments

The accusation here from MW was that profits are over-stated, by not apportioning the cost of acquired cases.

Burford says the accusations are all wrong in this section. It says the acquisitions were for the fund manager businesses, not the actual cases.

I don't follow this point, so can't work out who sounds right on this.

Point 4 - Computation of partially-concluded investments

Burford says that it addressed this point on page 13 of its 2019 interim report.

It claims to allocate costs pro rata for partially settled cases, which sounds reasonable.

Although Burford doesn't seem to answer MW's point that it doesn't properly accrue for ongoing future costs.

Point 5 - Progas

MW claimed that Burford delayed reporting a loss. The rebuttal document says this was because the client lodged an appeal. However, Burford had previously said that the appeal was unlikely to succeed. Therefore, it seems to me that Burford's accounting for this was not prudent - if something is likely to be a loss, then it should be fully provided for & reported as such.

I'd say this sounds like a win for MW over Burford. Two-one to Burford. Although my scoring system is flawed here, as there are too many points where I don't know which side is more persuasive.

Point 6 - Treatment of "trial losses"

Burford says this whole section is incorrect. This could be read to imply that other sections contain partial truths?!

It says that unable to comment further on active cases.

I can't judge who is right here, as it's too complicated, and would involve a lot of work to dig deeper. That's MW's job, so let's wait to see what their rebuttal rebuttal says about the detail.

Point 7 - Deducting costs from recoveries

This is by far the longest section of MW's report, which Burford dismissively describes as;

... Burford believes this final point in the report is basically a long, convoluted morass of text cobbled together, riddled with errors and without much of an organising principle. We address below the key arguments we can discern...

Burford defends its accounting policy of reversing previous unrealised gains, when a gain becomes realised. This policy sounds unreasonable when described by MW, but reasonable when described by Burford! So I'm not sure what to make of this.

Re. MW accusation that only 4 cases produce the bulk of Burford's profits. Burford's document today more-or-less admits this, but says it previously disclosed the general principle (of outsized returns on some cases) in its last interim report.

Burford says that removing (nonsensically) its top 4 cases, returns would still be 33%. MW re-worked the figures, and came up with 19%, so still some difference there. Although the key point MW makes, that Burford has relied on 4 big cases to report the bulk of its profits, does seem to be a valid point.

Financial stress - this was always a weak point in the MW case, which I didn't believe at the time. Burford swats away this accusation easily today, as it should.

Expenses - Burford says it expenses all costs, and doesn't capitalise anything (as some competitors do). Whilst that may be true, Burford does revalue cases upwards before they're settled. So it's booking profits ahead of settlement, which achieves a similar effect to capitalising costs - boosting profits ahead of cashflow.

Concluding remark [from Burford]

Attacks shorting dossiers as a "fundamental menace" to an orderly market.

Threatens to pursue "market manipulators" legally - I think that's fine. If short sellers smash a share price on baseless grounds, then they should be pursued in the Courts, because that would be market manipulation.

Burford seems to imply there are a few valid points in the MW report (without specifically saying so), e.g.

In virtually every instance, Burford has already addressed publicly the points raised by the report, often repeatedly for many years, or has shown them here to be simply erroneous...

Burford points out that the main source for the MW attack, was Burford's own additional disclosures, which it voluntarily began publishing in March 2019. Fair point.

My opinion - please bear in mind that I'm only giving my personal impression, as a potential investor, and am not claiming to be an expert in this sector.

Overall, I think this Burford rebuttal comes across very well. The market clearly agrees, with the shares having shot up to 855p at the time of writing, up 41%. So well done to investors who held their nerve, or bought at the bottom (it's more than doubled from the low point yesterday).

One friend described shorting dossiers as "throwing as much mud as possible at a company, and hoping that some of it sticks".

My impression is that Burford seems to have successfully rebutted most of the claims in the MW report. However, a couple of things do seem to have stuck, namely;

1) The bulk of the profits do seem to come from just 4 cases. Were all investors aware of this? This means the total profits are higher risk than some investors might have realised, in terms of not necessarily being sustainable at such a high level once the 4 blockbuster cases have ended. How would it replace those big profit earners? The company says it has been open about this in its detailed reports, but it doesn't seem to have given prominence to this key point.

2) There does seem to be some validity in the criticism of Burford's accounting, that it might not be prudent enough in providing for likely losses, in cases that are still technically ongoing (but likely to be a loss).

There's been a terrific bounce from the lows, on a spirited defence by the company, addressing specifics, which is good. That said, some of the criticisms have stuck, and I wouldn't want to be long of this share from this point on. The halo has clearly slipped a bit, and it might struggle to regain previous levels.

Shorting attacks generally - this brings me on to the issue of the morality, and legality of shorting dossiers. On the one hand, all shares should be subject to scrutiny. We don't get anywhere near enough negative commentary on companies, because the City is full of people (brokers, PRs, etc) who are paid to almost exclusively talk share prices up! Having some balance from bears is a good thing in principle, to help keep share prices grounded.

On the other hand, the technique of opening a short position, and then publishing an apparently explosive & damning negative report on a company, in order to make profit from triggering a (sometimes temporary) collapse in share price, doesn't seem right, does it?

My feeling is that short sellers should be required to submit such a dossier to the target company, and give them say 7-days to respond privately. This would allow companies to point out the mistakes in the draft report. It does appear that the MW report might have misinterpreted some of the cases it comments on. Or at least, Burford seems to have provided reasonable explanations in most cases.

The bottom line, is that if you attack a litigation specialist, expect to end up in Court, as I suspect is now looking rather likely here.

This kind of extreme volatility is really tough for private investors. Some might have stop losses in place, and others might have panic sold, and missed the bounce. You certainly don't expect such extreme volatility with a share valued in billions rather than millions.

No doubt we'll get a part 2 report from MW fairly soon, so the saga is likely to continue.

I've just signed in to the Burford conference call, should be interesting.

(about 45 mins later) I think management are coming across well on the conference call. They're giving full answers to some detailed questions. It all sounds open - subjectively, it doesn't feel like they're hiding anything, or making things up.

Director purchases - the CEO & CIO have both bought shares today at 663.77p pence per share, a total of 474,390 shares, costing £3.15m. To my mind, this type of orchestrated buying at a time of crisis, is largely irrelevant, as it's done for show.

There again, they're damned if they do, and damned if they don't.

Vitec (LON:VTC)

Share price: 1085p (down c.3% today, at 15:18)

No. shares: 45.3m

Market cap: £491.5m

The Vitec Group plc ("Vitec" or "the Group"), the international provider of premium branded products and solutions to the fast moving and growing "image capture and content creation" market, announces its results for the half year ended 30 June 2019.

- Revenues are flat, and adjusted PBT is down 4.1%

- Net debt has shot up, from £43.0m a year earlier, to £108.4m at 30 June 2019 - due to acquisitions.

- Cyclicality - the company mentions this being a "non-Olympic year"

- H2-weighting expected this year

Outlook seems confident -

We are pleased to confirm that our outlook for the current year is unchanged, whilst we remain mindful of geopolitical challenges and FX movements.

Notwithstanding these uncertainties, we continue to expect a strong 2020, benefitting from the summer Olympics, US Presidential elections and the targeted growth initiatives already underway."

Balance sheet - I think debt is getting a little bit too high for my personal taste.

NTAV of £27.3m doesn't seem much for the size of the group.

Cashflow statement - looks very good. Decent, genuine cashflows by the looks of it.

Note that £5.3m of development costs were capitalised in H1 this year, up sharply from £2.4m in H1 LY. Nothing wrong in that, but it boosts profits compared with companies that write off all development spending.

It looks to me as if the group has the capacity to reduce debt from cashflows, so perhaps a break on further acquisitions might be a good idea?

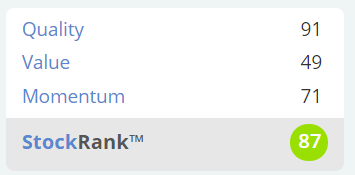

My opinion - I like the look of this share. It's a favourite of Lord Lee, and he's always worth listening to.

Stockopedia likes it too - quality scores are high, and the forward PER of 11.4 seems good value. It pays a 3.67% dividend - worth having.

Today's update is reassuring, and it reiterates that 2020 should be a good year too. Therefore this share gets a thumbs up from me too!

That's all for today, I hope you found it interesting.

As always, I encourage reader participating by sharing your thoughts in the comments section below.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.