Good morning, it's Paul here.

Amazingly, over 2,000 subscribers people have entered the 2020 Stock Challenge. Here is the link to the leaderboard, which you might like to bookmark, if you entered the competition.

Estimated completion time today is 2pm, but it's mostly done already (at 12:24)

EDIT at 12:53 - today's report is now finished.

Sending large payments

Whilst I remember, here is a really useful tip for when you, or your solicitor, need to move large amounts of money, e.g. to buy a house, or car, etc.. What I do, is input the payee's bank details onto my online banking, then send them £1 through faster payments. That's virtually instant, so the payee confirms receipt within a few minutes usually. Once they've confirmed receipt, you know their bank details are correct, and can safely send the rest of the money.

Sorry if this is obvious, but I've mentioned it to a few friends, who all said "What a good idea, I'll do that!". This was prompted by a recent newspaper article about a pensioner who gave the wrong details, and sent his £140k to the wrong account. The couple who received it, promptly spent half of the money, claiming that they thought it was an inheritance they were due (yeah, right!). The pensioner is now struggling to get his money back.

Consumer confidence

Since consumer spending makes up a large part of the UK economy, 66% of GDP on average, according to Google, then it makes sense for investors to track consumer confidence stats.

I follow the monthly press releases from GfK here (worth bookmarking). I've mentioned before recently, that the decisive general election result should be very positive for consumer confidence. My view for a while has been that political uncertainty, and the nightmare scenario of a Corbyn Govt destroying the economy, was a far bigger worry than Brexit.

This link is also worth a look, for longer term consumer confidence charts, which helps put recent data into perspective.

Hence I've been eagerly awaiting the latest consumer confidence stats for Dec 2019. The usual table is as follows;

As you can see above, consumer confidence improved by 3 points in Dec 2019, but is still negative at -11 - it's a simple index, where a score below zero is negative, anything above zero is positive.

As we've seen for a long time now, there is a huge gulf between people's expectations for their own personal finances (which is positive, at +3) over the next 12 months, and an extremely gloomy net view of the general economic outlook (very negative, at -27 - although that is a good deal less bad than the Nov 2019 score of -34, and the even worse -38 score from a year ago).

I was expecting a much sharper recovery in consumer confidence. The reason that hasn't happened yet, is because polling took place before the general election result, from 2-11 Dec 2019, whilst the 12 Dec 2019 general election produced a decisive result on 13 Dec 2019.

Commentary from GfK is upbeat, e.g.

Joe Staton, Client Strategy Director at GfK, says: “There’s a clear sense of a change in consumer sentiment this month. The picture for the year to come is much stronger with a two-point improvement in how consumers view their personal financial prospects and a very healthy seven-point jump on how they see the wider economy next year.

It is also positive about the outlook for 2020;

"The Overall Index Score has failed to break into positive territory for the past four years due to confusion and uncertainty about the future direction of the UK. A great many people will be gazing into their crystal balls right now; ours indicates a rebound in confidence in 2020 based on renewed optimism and energy for a post-Brexit Britain.”

My view - I'm no statistician, but the upbeat comments from GfK ring true to me. Actually, I reckon the consumer confidence stats in Jan 2020 could well be a barn-stormer, since that will be based on polling post-general election, for the first time.

This underpins the strong recent recovery in UK equities. With greater Govt spending now promised, including more infrastructure spending to reward the Midlands & Northern constituencies which turned blue at the election, then the risk of a UK recession looks to be receding. I think that's what has helped to trigger such a big rally in many sectors (e.g. housebuilding, contracting companies, etc).

Middle East tensions

This issue rears its ugly head from time to time. I'm definitely concerned about the recent escalation of tensions, after the USA assassinated a key figure in Iran's military. That has triggered a rise in the oil price (fears of supply disruption through the Strait of Hormuz), and apparently gold (still seen as a safe haven, for some bizarre reason) has reached a 7-year high.

Higher oil prices obviously triggers higher inflation, and sucks spending out of other areas - e.g. if a workman has to spend more putting diesel into his van, then he has less money to spend on discretionary things like eating out, or holidays.

I don't know what the outcome will be - although it's fairly predictable. The human urge to retaliate has got to be our most destructive urge - it's what causes so many wars. Although sadly, some wars are necessary, to right a serious wrong. I think the remarkable thing is that the USA and Iran have not had a war in the last 40 years (although there have been proxy wars), after Jimmy Carter & America's humiliation in the Iranian revolution.

Therefore this is a potentially serious situation, depending on what the Iranians do next. They're obviously going to retaliate, then America is likely to hit them with potentially major airstrikes. Hopefully, once they're on the brink of full scale war, then Iran backs down, and continues its low level attacks on USA & Israel. I just hope the UK doesn't, yet again, get sucked into another middle eastern conflict when the end situation is arguably worse than the starting situation.

I find it difficult to see how markets can progress further, whilst all this is going on. Although the obvious beneficiaries from a war in the Middle East are oil stocks, as supply potentially tightens, or fear of it doing so. Plus maybe defence companies.

Personally I tend to ride out things like this. I remember in 2003, when the second gulf war was looming, markets took it very badly. Although the circumstances at the time, were the very bottom of a 3-year bear market. The build up of tensions (and USA massing troops in Saudi Arabia) caused a (roughly) 6-month downturn in shares. Once the war started, in fact a few days before it even started, once it was inevitable that war was going to happen, then shares began a strong recovery, which turned into a 4-5 year bull run (from a very low base, it should be said).

Mind you, militarily the Iraqi forces crumbled in days. Looking at the situation now, it's difficult to imagine the USA launching an invasion like that again, targeting Iran. Air strikes & sanctions are more likely. Retaliation by Iran could involve sinking, or seizing oil tankers. It's all a considerable worry. Usually, the world muddles through, so let's hope that's the case this time.

EDIT: as always with this type of thing, we're only interested in the impact on markets here, not the political side of things - keep that on Twitter!

Mid vs Small Caps

My other worry is that so many stocks are now looking expensive again. Over the last weekend, I did some trawling through my stock screens on Stockopedia, looking for ideas for new shares to buy. Given my focus on small caps, I hadn't realised just how strong the rally in mid caps had been. Many are now looking really expensive, in my view.

I can see why shares like Frasers (LON:FRAS) and Dart (LON:DTG) have shot up so much, as they've recently announced stunningly good earnings upgrades. However, a lot of other mid caps make me scratch my head and wonder why they've risen so much? It looks a good time to bank some profits, in my view. Risk:reward, especially with macro tensions, doesn't look good once any stock achieves a PER in the 20s or 30s, despite not having particularly good earnings growth or outlook.

There again, maybe the market is pricing in a reversal of outlook from a likely UK recession, to a more buoyant economic outlook? That's a one-off though, and I can't see why such rises would continue.

Check out this graph, of mid caps (the main green/red line) with small caps (SMXX) - the feint beige line, which I've highlighted in parts to make it clearer;

This shows how closely correlated mid caps & small caps were from Jan 2018 to Jan 2019.

Then they started to diverge. Small caps had a double dip, selling off again over the summer of 2019, as there seemed to be a buyers strike for small caps due to Brexit/political worries. Strangely, this did not affect mid caps.

From Oct 2019 onwards, both mid and small caps began recovering, but note how small caps are still lagging behind. For this reason, I'm mainly looking for bargains in the small caps space - particularly companies which have not yet rallied. Hence I'll be setting up a new screen later this week, to search for fundamentally sound small caps (e.g. high stock ranks) which have had poor relative strength. This could be due to a profit warning, which has not yet been forgiven by the market. So I'll need to take care to avoid dogs which might warn again on profits.

Good, on to today's news - this looks to be the only stuff of interest, on my first sweep of the RNS post 7 am;

BKS - Scottish Govt grant

ACRL - half year results

CARR - trading update

MRW - not a small cap, but if I have enough time, will check out its trading update - EDIT - changed my mind on this, as you can get analysis of mid/larger caps from loads of other places, and I've run out of time. Although it is noteworthy how much value there is in MRW's freehold property portfolio - a pretty stunning deal has been done on its site in Camden - 8 acres! Generally my feeling on supermarkets is that they're very vulnerable, and maybe even worth considering short positions? That's due to the impact of higher minimum wage, combined with a very low operating profit margin. Plus of course the relentless increase in competition from Aldi & Lidl. I'm wondering about shorting J Sainsbury (LON:SBRY) actually, as their prices are outrageously high in my view, mind you I do visit a London branch of SBRY which probably has premium prices. Plus, product quality is getting worse - it's obvious where they are cutting costs by reducing portion sizes in ready meals, etc., so you need to eat 2 to feel full.

Beeks Financial Cloud (LON:BKS)

Share price: 121.5p (up 5% at 08:14)

No. shares: 50.9m

Market cap: £61.8m

(at the time of writing, I hold a long position in this share)

Change of broker - Cenkos are out, and Cannacord are in, as sole broker & NOMAD. Sometimes a change of broker can be a precursor to a fundraising or secondary placing. No reason is given today. Beeks doesn't need to raise cash (unless it is planning an acquisition?). The CEO holds a very large stake, of 54%, and having sold some shares in Oct 2019, agreed not to sell any more for 12 months.

Scottish Enterprise Grant - this grant is worth just over 3% of the company's market cap, plus the benefit of speeding up its R&D work;

7 January 2020 - Beeks Financial Cloud Group Plc (AIM: BKS), the Glasgow-based leading cloud computing and connectivity provider for financial markets, is pleased to announce it has received a Scottish Enterprise R&D grant to invest in its Network Automation project. The funding will allow for acceleration of the project, which will facilitate growth and expansion at the Company's Glasgow headquarters and enable Beeks to broaden its product offering, in particular to the Tier 1 financial services market.

The grant is payable in instalments over the next three years and is expected to contribute up to approximately £2.0 million based on an overall project spend of up to £4.2 million.

I wonder if this is in addition to the generous system of R&D tax credits, which are already available?

My view - This looks a positive development, although not earth-shattering in terms of the share price. Today's 5% rise looks about right. This is one of my favourite long-term shares - great management, and a profitable, growing niche. I really must buy more of them at some stage.

Accrol Group (LON:ACRL)

Share price: 33p (up 5% today, at 10:35)

No. shares: 195.2m

Market cap: £64.4m

Accrol (AIM: ACRL), the UK's leading independent tissue converter, announces its Half Year Results for the six months ended 31 October 2019

This announcement contains a header which declares;

Strong revenue growth, improving profitability3 and increasingly cash generative

I've got mixed feelings about this type of header. Is it the truth, or just PR spin? Each case is different, so I'd rather make up my own mind, but at least this gives me some pointers to verify myself.

Footnote 3 doesn't inspire confidence, with profitability defined like this;

3 Defined as gross profit before exceptional items. This is a non GAAP metric used by management and is not an IFRS disclosure

Profitability should be PBT, not gross profit! So already I'm suspicious that this statement might have been over-PR'd!

Background - Accrol floated on AIM in June 2016. It was a complete dud, and the shares collapsed, as the business model unravelled like one of those runaway loo rolls that you accidentally drop, or that a puppy chases around the house. It almost went bust, but was rescued and is now undergoing what management call a complex & comprehensive turnaround plan, under new management. There really should be some stiff sanctions against the people who floated this company originally, I feel. It's just not right that investors can be fleeced through opportunistic floats of lousy businesses. And/or badly structured deals which float businesses with far too much debt, e.g. Aston Martin Lagonda Global Holdings (LON:AML) is another example, reporting today, of a thoroughly bad float which ran into financial difficulties very soon after floating.

Do we need even more regulation, or is it just a case of buyer beware with IPOs? I'm incredibly cautious about new issues, and hardly ever go near them, until a decent track record of several years has been built up. After all, the seller knows the business better than anyone else, so is usually getting the best deal. The buyer of new issues, is often a lamb to the slaughter.

Summary of progress - sorry for copy/pasting this section in full, but it's got some interesting stuff in it, which makes me challenge my very negative preconception, given the company's terrible history;

The Board is pleased to report that the operational aspects of the complex and comprehensive turnaround plan, initiated by the new management team in February 2018, are now fully complete.

The financial benefits of these changes are now flowing through to the bottom line at an accelerating rate and these H1 results show the improving monthly run rate being achieved by the business.

With the turnaround complete and a strong management team in place, the Board is now focusing on further automation of the Group's operations and strategic opportunities to diversify, scale and grow the business.

Whilst there will always be improvements to make and sector challenges to address, the Board believes that Accrol is more fit for purpose than it has ever been. Net debt is reducing at an accelerating rate and the Company remains on track to meet market expectations for the full year ending 30 April 2020 ("FY20").

Not bad. There's enough substance in the above to make me want to look deeper.

Interim results - some key numbers. I'll go with the "underlying" numbers, which exclude some discontinued activities from last year, which is fair enough - after all, we're only interested in the ongoing operations;

H1 revenues up 20% to £64.5m

Gross margin - improved, but still low, at 20.0% (LY H1: 17.2%) - I can't see any appeal to investing in a capital-intensive business that can only eke out a 20% gross margin

Adj EBITDA - as Graham pointed out recently, we have to be very careful about EBITDA, since it is skewed upwards by IFRS 16 in some cases. Footnote 4 suggests that is the case here, hence to get a true picture, we might have to adjust the EBITDA figure to make it comparable with last year.

My feeling that this announcement has been over-PR's is further confirmed by the highlights bullet points cherry-picking the best % rise from each of the actual, and the adjusted figures! That's poor, and undermines trust.

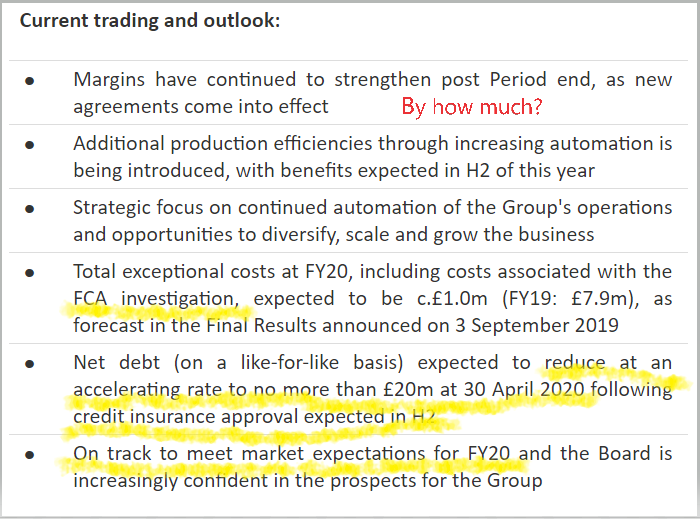

Outlook - some good stuff in this. I'm trying out 3D Paint, and could probably do with a tutorial in how to use it!

I'd forgotten about the FCA investigation - I wonder what the potential risks/costs are relating to that?

The business continues to be supportive with the ongoing FCA investigation and shareholders will be updated on any developments in a timely manner.

Good news about trade credit insurance being expected in H2 - although bear in mind that trade credit insurers are notoriously fickle, and can switch facilities on & off, at a whim. Therefore this is not elimination of debt, it's actually moving some of the debt from ACRL's bank, to its suppliers instead. Although that helps reduce risk for ACRL shareholders, and reduces its interest costs (which suppliers usually try to recoup, by increasing prices once they're no longer being paid up-front).

Profitability? - it's all very well providing adjusted numbers, but the bottom line, literally, is that it still generated a statutory loss of £3.05m for H1. Which is pretty rubbish. The company is employing almost £30m of tangible fixed assets, for a negative overall return, once all costs are taken into account.

Input cost fluctuations - this is the Achilles Heel of Accrol's business model. Its input, bulk tissue material can vary considerably in price, whilst end customers want fixed priced contracts. This is one of the reasons the whole business model went so disastrously wrong not long after it floated - the exceptional profits it had been making disappeared, once tissue shot up in price, but customers wanted to keep paying existing prices.

The company says today that it has reduced its exposure to input cost fluctuations, but I'd want to know chapter & verse on this - by far the most important point when analysing this share. In particular, it must have the capability to either hedge input prices, or be able to vary contract terms with customers to recoup increased costs within a reasonable timescale. Otherwise, it's a hostage to fortune if the same issue arises again. With such low starting margins, I see this as unacceptable risk.

My opinion - this has been a very good salvage job, of a previous basket case. However, I wouldn't necessarily see that as a turnaround. They managed to stop it going bust, which is an achievement, but is it really worth a market cap of £64m, given that the balance sheet is still quite highly geared, and it's employing a ton of assets to make products on wafer thin margins, for notoriously tough customers (supermarkets)?

The trouble is that, we don't really know if the low, but improved margins, are sustainable, due to its vulnerability to input cost changes.

Scraping beneath the surface of a nicely buoyant & polished announcement, I really don't see an attractive investment here at all. However, other people might buy into the turnaround, if they expect strong further improvements. It certainly seems as if the new management team are very much better than the old one!

Carr's (LON:CARR)

Share price: 148p (down 4% today, at 12:32)

No. shares: 92.4m

Market cap: £136.8m

Carr's (CARR.L), the Agriculture and Engineering Group, is issuing a trading update to coincide with its Annual General Meeting being held in Carlisle today at 11.30 am. This update relates to the 18-week period ended 4 January 2020.

Should AGM updates be timed to coincide with the actual meeting, i.e. at 11:30 in this case, or be issued at 07:00 on the day of the AGM? It's an absolute no-brainer to me, all trading updates should be issued at 07:00 - that way it's a level playing field for everyone. People going to the AGM can read it before they set off to travel to the meeting, along with everyone else, and we all have an hour to digest its contents. So it's good to see Carr's doing it the best way, and issuing this update at 7 am.

Overall, it's an in line update for FY 08/2020;

The Board continues to expect the performance of the Group to be in line with its existing expectations for the full year.

There is an H2 weighting comment, which explains why the share price is down a bit today;

Trading in Agriculture during the last three months was behind the Board's expectations driven primarily by mild weather.

In Engineering, as previously reported, contract phasing has also led to a slow start but, with the benefit of a strong pipeline, we expect an improved performance for the remainder of the financial year.

As a result of this and lower central costs we continue to expect the full year performance to be in line with expectations, albeit with a greater weighting than normal to the second half.

That's not necessarily a bad thing. My view is that, if sensible reasons are given for an H2 weighting, and crucially if management has a good track record of telling the truth and being realistic, then it can turn out OK.

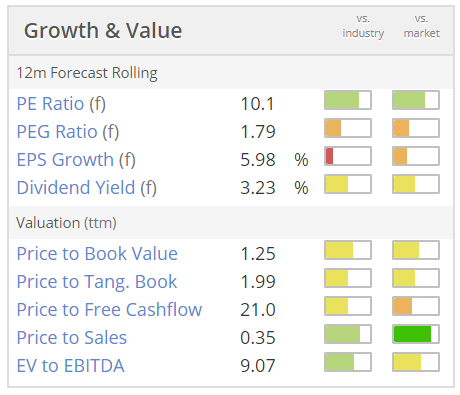

Valuation - given how expensive many shares are at the moment, this looks comparatively good value, albeit for a fairly boring business with seemingly limited organic growth potential;

In a seemingly permanent ultra-low interest rate environment, there's a good argument for seeing a share on a PER of 10, with a 3x covered dividend yield of 3.2% as being actually quite attractive.

My opinion - worth considering, for a long-term portfolio maybe?

I see that it is making acquisitions, so it might be worth having a look into what they've bought, why, and what potential it might have.

At some point, I probably ought to meet management, to get a better understanding of the business model & strategy.

That's enough for today I think.

See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.