Good morning, it's Paul here with Tuesday's SCVR.

Please see the header for the running order.

Estimated time of completion - 1pm

Edit at 12:51 - today's report is now finished.

Please note that I ran out of time/energy to look at off topic stuff, namely AA., CNEL & OCDO, so will probably write up something about them this evening, for tomorrow's placeholder, as that seems to work quite well - giving you something to get stuck into first thing tomorrow morning!

BBC licence fee

Before we start today, I just need to get one thing off my chest, about the BBC licence fee. I can’t do that through Twitter any more, since they didn’t appreciate my banter, and their computers mis-classified it as “hate speech”. I mean, honestly! Anyway, it’s probably for the best, so I haven’t appealed.

De-criminalising the BBC licence fee (as is being mooted) does not make payment voluntary, as is being widely mis-reported (fake noooz!). It simply means that any unpaid licence fees would be chased in the same way as any other unpaid bill - e.g. a court summons, CCJ, etc, instead of being punishable (ludicrously) by imprisonment. Therefore, it’s a common-sense reform, that’s long overdue.

Subscriber feedback

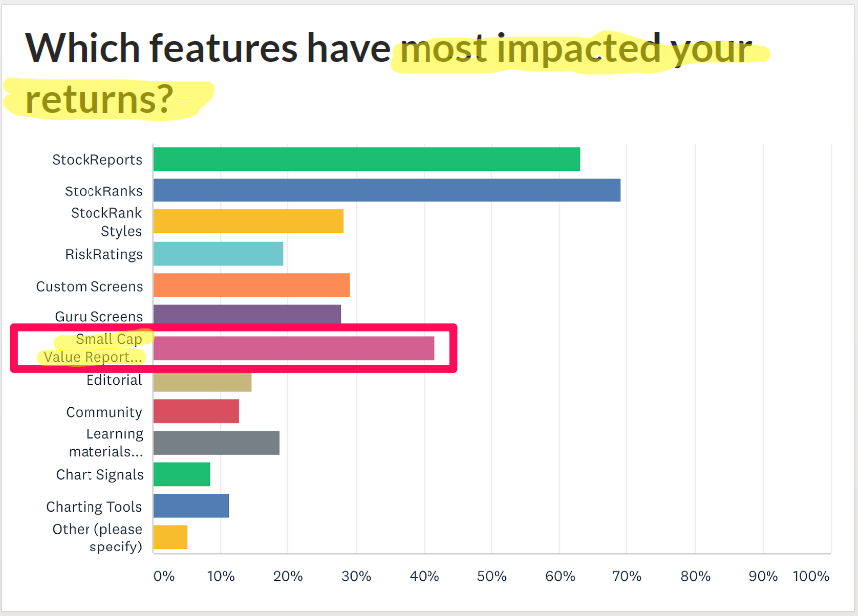

I was delighted to read Ben’s article here, and even more thrilled to see how highly the SCVRs scored in a recent Stockopedia subscriber survey. Look at this:

This is not just people saying they like the SCVRs, they’re saying we’ve boosted their returns! Or at least I think that’s what they mean? “Most impacted your returns” could mean the opposite! :-O

A couple of bits left over from yesterday to start with...

Water Intelligence (LON:WATR)

Share price: 337.5p (up 6% yesterday)

No. shares: 16.9m

Market cap: £57.0m

2019 Full Year Trading Results

Water Intelligence plc (AIM: WATR.L) (the "Company" or "Water Intelligence"), a leading multinational provider of precision, minimally-invasive leak detection and remediation solutions for both potable and non-potable water is pleased to provide an unaudited Trading Update for full year 2019. Audited results for 2019 are expected during mid-May as traditionally released.

There’s quite a lot of detail in today’s update, making it not the easiest to interpret.

Thankfully, WH Ireland have done the work for us, with a useful update note (on Research Tree). The upshot is that this is a 9% beat against forecast revenues and profit for FY 12/2019.

The FY 12/2020 forecasts now look modest, given out-performance in 2019, so I imagine we could see forecasts raised again – which could be a catalyst for further share price rises, perhaps? Or maybe it's already in the price? Obvious things usually are.

My view – I’m warming to this one, as it’s established a very good track record in recent years. Consider this sequence of EPS growth in US cents;

12/2016: 7.8c

12/2017: 10.3c

12/2018: 12.7

12/2019: 16.4c (beat forecast of 15.3c) = 12.6p EPS, a PER of 26.8

That’s impressive – more than doubling earnings in 3 years. The valuation reflects that, so shareholders now have the quandary that strong growth is already factored into the price, so growth has to continue.

Overall, this looks an impressive company, that is out-performing. I can see why bulls like it.

Xpediator (LON:XPD)

Share price: 28.25p (up 1% yesterday)

No. shares: 136.1m

Market cap: £38.4m

Xpediator (AIM: XPD), a leading provider of freight management services across the UK and Central and Eastern Europe…

It’s an in line update;

... is pleased to confirm that trading for the year ended 31 December 2019 is expected to be in line with market expectations.

Revenues up 19% to £212m, of which 10.4% is organic, and 8.6% from acquisitions

More importantly;

Adjusted pre-tax profit expected to be slightly above £5.0 million, in line with management guidance provided in the Company's 2019 interim results.

Note that forecasts were reduced considerably in the autumn 2019, from c.5p to c.2.93p EPS – that’s a PER of 9.6

Net cash looks OK, at £6.9m

My opinion – I don’t invest in haulage companies, because the profit margin is wafer thin (2.4% here), as there’s so much competition.

I had a chat with the CEO a couple of years ago, at a Mello investor event. He was telling me all about an exciting new product they were developing, something to do with aggregating eCommerce deliveries, I think. There doesn’t seem to be anything about that in today’s announcement, so maybe it’s fallen by the wayside, or isn’t so exciting any more? Do readers know anything about this? If so, please comment in the comments below.

Anyway, this share doesn’t interest me, because generally I want to invest in growth companies with decent margins.

On to today's news...

Walker Greenbank (LON:WGB)

Share price: 73p (up 3%, at 08:10)

No. shares: 71.0m

Market cap: £51.8m

Trading update (full year)

Walker Greenbank PLC (AIM: WGB), the luxury interior furnishings group, announces its full year trading update for the financial year ended 31 January 2020.

This is a reassuring update, given how bombed out the share price has been since the big profit warning in late 2017 (see 5 year chart below);

The results for the year are expected to be in line with the Board's expectations.

In line is good, for a low-rated share like this, because a low rating suggests the market is expecting more bad news. Absence of bad news is therefore quite bullish.

.

Looking at valuation, here are the usual stats below. As you can see, this is an attractive value share;

- Low forward PER of 8.1

- Dividend yield of 3.77% is pretty good, and importantly it's covered over 3 times by earnings

- Decent asset backing - Price to Tangible Book of 1.38 is good (generally speaking, the lower this figure is, the better)

- Cash generative

Quality scores are middle of the road, as denoted by the yellowish colour bars below (or lighter shaded bars, for those who struggle with colours)

.

Overall, Stockopedia likes it a lot (as do I);

.

Why is it cheap?

- Lack of growth - e.g. revenues of £111m for FY 01/2020 are down 2%

- Current trading - market conditions are generally difficult, especially in the UK

- Not yet recruited a replacement CFO - people often get jittery when CFOs walk away (as it can be a precursor to problems emerging)

- Turnaround strategy not yet proven (although things do seem to have stabilised at least)

- Niche products which can go in & out of fashion - some brands can be viewed as either iconic, or very dated, it's down to personal taste (although the commentary today does mention revival of interest in the arts & craft movement, which helped its Morris & Co brand grow sales by 22.3%)

My view - there's a brief broker update out today, saying no change to forecasts, and reiterating that it looks cheap.

I agree, this is a decent company, on a bargain rating. I've long suspected that it might make a takeover bid target for a larger group.

The downside risk is that current trading could continue to be soft, and bring with it another profit warning in 2020.

As you can see below, forecasts have lurched down twice in the last year, although held steady for the last year, which combined with the in line update today, does reassure that things seem to have stabilised.

Y-axis clarification - light blue line falls from 16.4p to 8.8p, dark blue line falls from 14.95p to 8.15p, going left to right.

NB. Ed has promised me that fixing the y-axis on these charts is top of the list for the coding boffins! I'm nagging them relentlessly on this, so I think they want to get it done just to shut me up LOL!

On balance, I feel risk:reward looks favourable for this share.

Nmc Health (LON:NMC)

A quick update from yesterday. This is the Middle Eastern hospitals group that has been shorted. It said yesterday that two large investor groups had initiated early stage bid talks.

Today, one of those investors, GKSD (which is apparently backed by Italian hospital chain, Gruppo San Donato (GSD)) has confirmed it is;

... in the preliminary stages of considering an offer for NMC.

NMC shares put in a huge rise (c.30%) yesterday afternoon, with a strange delayed reaction to the bid news. Who knows where the price goes next?! The short closing trade seemed quite obvious to me, as mentioned yesterday morning, but sadly I didn't pluck up enough courage to follow my hunch.

EDIT at 09:56 - Breaking News! My broker has just advised that KKR (mentioned in yesterday's RNS from NMC) has announced it is not bidding for NMC. So that just leaves GKSD in the running. Share price is all over the place, down 14% today, at 797p. End of edit.

I've been playing with the new chart features, and have managed to work out how to do callouts on charts - nifty eh?!

Bidstack (LON:BIDS)

Share price: 6.5p (down 16%, at 10:24)

No. shares: 244.5m

Market cap: £15.9m

I'm keeping an eye on this one, as it looks an interesting concept.

Bidstack Group plc (AIM: BIDS), a leading provider of in-game advertising technology for the video games ecosystem, provides a trading update for the year ended 31 December 2019.

Urgh, this is a catalogue of woes;

Revenues only £150k (although previously disclosed that 2019 revenues would not be significant, so this is as expected)

Operating loss of £5.3m!

"Available" cash of £3.14m - caution needed here, as "available" can mean including overdraft facilities. Although I cannot see any debt on the last balance sheet, and no mention of banking facilities in the interim results. So it looks like the £3.14m figure is genuine cash.

Looking back, I see that it raised £5m in a placing, May 2019 at 12.5p, plus £0.7m raised from warrants at 20p. Cash balance was £6.0m at 30 June 2019. So it has burned through half the cash it had at end June. Therefore by extrapolation, it's probably going to run out of cash in mid-2020. Therefore, expect another fundraising.

Outlook - not good;

The Company is also progressing discussions with other global advertising agencies. However, giving the world's leading advertising agencies the comfort to buy and report on this new inventory takes time and the Board believes further building blocks are still required before those revenues can be fully exploited. While this may be frustrating for investors, the Board and Bidstack's commercial partners can see evidence of positive benefit ahead for the Company.

Immaterial revenues in H1 2020 too - pity, as the cash looks likely to have run out by the end of H1 2020;

The Board expects that revenues in H1 2020 will continue to be minor and that material revenues for 2020 will occur only in the second half. Bidstack's focus remains on securing significant commercial and technological deals that will position the Company well for growth in the medium to long-term.

My view - yet again, we have a tiny AIM blue sky company, which has promised the world, whilst being under-funded to execute its business plan.

I think announcements in the last year have been far too rampy, causing an insane spike in share price. The company now needs to raise more money, from a position of weakness, which is likely to lead to considerable dilution.

Maybe the company's plan is too ambitious, for the limited funding it has available?

Time for a tea-break! Next up I'll look at;

Arena Events (LON:ARE)

Share price: 26.25p (up 7% at 11:01)

No. shares: 152.7m

Market cap: £40.1m

Unaudited Interim Results for the six-months ended 31 December 2019

Arena Events Group plc (www.arenagroup.com) is a provider of temporary physical structures, seating, ice rinks, furniture and interiors. The Group has operations across the UK, the US, the Middle East, and Asia, and current clients include Wimbledon Tennis, The Open, PGA European Tour and Ryder Cup.

Many thanks to Lord Gnome who flagged up this share to me in the comments below, at 07:36, pointing out that interims look fine, and that it might be a recovery situation. That aroused my curiosity, so I've taken a look, and it does indeed look potentially interesting.

Graham's notes here in Jan 2018 provide useful background, as he touches on the structure of the IPO.

My notes here in Sept 2019 show me unimpressed, after a mild profit warning.

Change of year end - this is a bit confusing, but it looks like the company has published 2 sets of interim results, due to a change of year end. So we have;

Interim results for the 6 months to 30 June 2019 here.

Interim results fo the 6 months to 31 Dec 2019 here.

Audited results for the 15-months to 31 March 2020 will be issued in due course.

Seasonality - this is causing me a few headaches. The 6m to 30 Dec 2019 are the busy, more profitable half. Hence analysing these numbers alone is not terribly meaningful. 12 month figures to 31 Dec 2019 are also provided, so I'm going to focus on those, and prior year 12 month comparatives, to eliminate seasonality.

IFRS 16 - as we know, this boosts EBITDA, and then shoves a load more costs down the P&L into finance costs. So we have to make sure we're comparing like with like. In this case, the prior year figures are not adjusted for IFRS 16, so the apparent increase in EBITDA isn't real. Operating profit is also misleading, for the same reason, because it's one line above finance costs, where some of the property rental costs now rest.

Profit before tax (PBT) - Therefore, the most meaningful number to me is the £1.8m PBT for 12m to Dec 2019. Nowhere near as impressive as the numbers in the highlights section!

You could add back any of the following costs if you wish;

Exceptional costs £0.3m

Acquisition costs £0.1m

Intangible amort £0.7m

That would take (my calculations) adjusted PBT up to £2.9m for the year, which looks a fair benchmark.

I'm struggling to work out how that compares with FY 12/2018, because the company's adjustments are different, and I really don't want to have to put all this into a spreadsheet to work it all out. Let's see if there are any broker notes out today? Hooray, we're in luck, good old Cenkos (I'm long) have crunched the numbers for us.

Cenkos is coming up with adjusted profit of £2.6m for 12m to Dec 2019. I'm not sure why that's slightly different from my £2.9m adj profit above, but it's near enough, so let's park this bit.

Overall, it's a small earnings miss at the EBITDA level (down 2% vs forecast), but a 27% percentage miss at EPS level (1.7p actual, vs 2.3p forecast, for 12 months to 12/2019).

Forecasts - new forecasts for FY 03/2021 have been reduced today - adj EPS down 25% to 2.9p - for a PER of 9.1 - which looks about right.

Balance sheet - has heavy fixed assets (as you would expect for this type of business), part funded by debt.

NAV is £71.7m, less intangibles of £55.7m, gives NTAV of £16.0m - adequate, but not particularly strong.

Depreciation policy would be key here. That would need to be looked into. Are the PPE assets useful, or does that contain assets which are no longer generating revenues? We have to rely on the auditors being on top of that issue, as it's a key risk with what is basically an equipment hire business.

Outlook - Jan-Mar is seasonally quiet, which is handy because of the potential disruption which could emerge if coronavirus gets a lot worse.

We expect this to lead to a broadly flat year on year result in the first calendar quarter, which completes the reporting period for the fifteen-months ending 31 March 2020.

Looking further forward, despite some concerns about the general trading environment in a number of markets including the UK and Hong Kong, the Group expects to see further revenue growth in the year to March 2021 as a result of several major events already secured. These include the return of the US Open, the Ryder Cup, the Dubai Expo 2020 and further work for the Tokyo Olympics. Further progress year on year is also expected in Saudi Arabia on the back of the significant events delivered in 2019.

My opinion - obviously the main concern is whether coronavirus spreads, and leads to major events being cancelled? Particularly as a conference in Singapore seems to have been the source of the virus case in the UK. Investors would need to look at the geographic spread of Arena's events, and the type of events - e.g. indoor events in the Far East would probably be seen as more likely to be cancelled, than outdoor events in the USA. We just don't know do we?

My other concern here, is that the highlights & commentary for these interim results, presented them as if everything is going great. But on closer inspection, this was actually an earnings miss, and next year forecasts have been cut today. That seems misleading to me. Companies should not issue positive-sounding announcements, whilst simultaneously guiding brokers down. This does raise the question of whether we can trust future commentary from this company?

Overall, I think it looks quite an interesting company. But I would have preferred a much more straightforward presentation of the results, rather than buffing them up to shine so brightly, that the truth of this being a small earnings miss, and a downgrade, was obscured.

All done for today, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.