Good morning, it's Paul here, with the SCVR for Tuesday.

Timings today - mostly up by lunchtime, but I'll do a bit more after lunch, so let's say final finish at c.3pm.

Update at 16:34 - today's report is now finished.

Today I'll be looking at updates from the following companies;

Cerillion (LON:CER) - Largest ever contract win

Beeks Financial Cloud (LON:BKS) - Final results

Filta Group (LON:FLTA) - Interims, 6m to 30 June 2020

Simplybiz (LON:SBIZ) - Half year report

Avingtrans (LON:AVG) - Q1 trading update

.

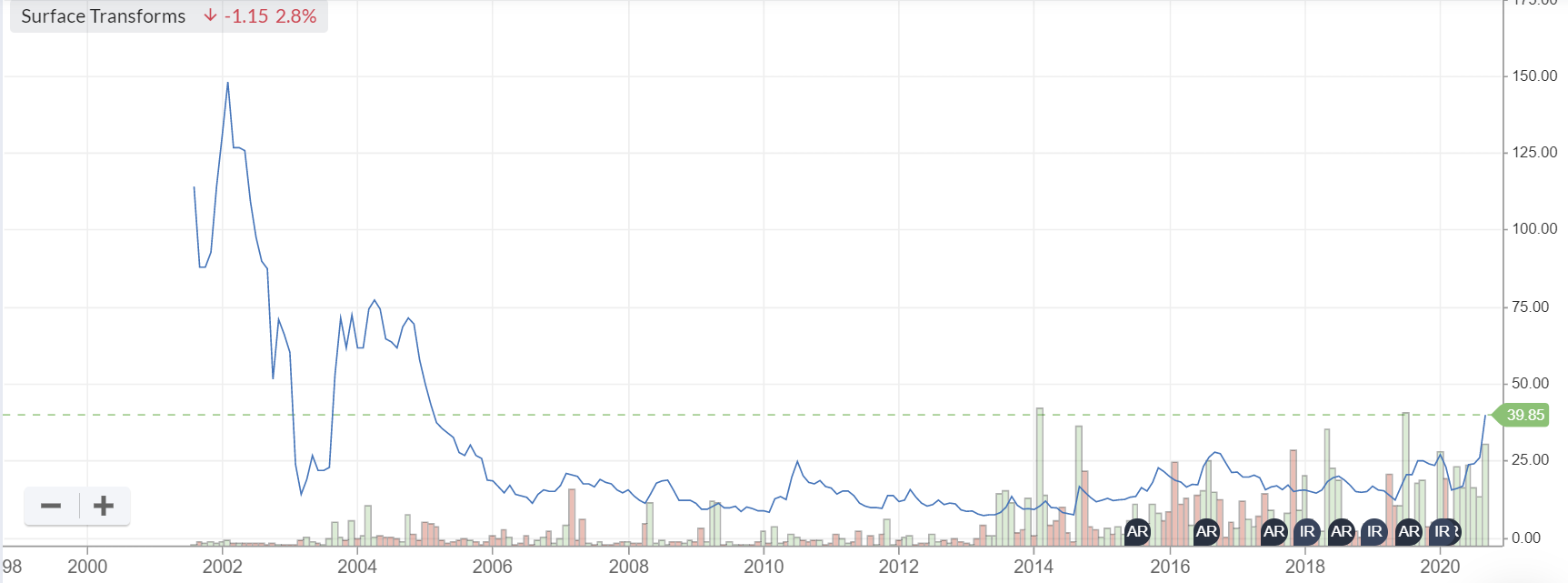

Surface Transforms (LON:SCE)

41p - Market cap £63m

Registration link for today's webinar this Thursday at 16:00 - apologies, I misread the announcement earlier, and thought it was today, which was wrong.

A reader suggested yesterday that I need to improve my understanding of carbon brakes, so this looks like the ideal opportunity - a webinar from SCE today this Thursday at 4pm, should be interesting. Anything to do with cars interests me.

This company floated at almost exactly the time I became a full time investor in Sept 2002. Since then its track record has been lamentable - e.g. it took 10 years just to reach annual revenue of £1.0m. It's lost money every year, and forever promised a bright future for its carbon ceramic brakes, which never seemed to materialise. Until now.

News yesterday of what looks like a decent sized contract, could mean its time may have finally come. I always say that blue sky shares nearly always take far longer, and cost far more than originally planned. 18 years is really pushing the boundaries, but who cares - the contracts now appear to be rolling in for supercars by the looks of it.

So I'll be taking a closer look.

18 year chart below - patience is a virtue!

.

.

Cerillion (LON:CER)

295p - market cap £87m

This is an RNS title that grabs the attention!

Cerillion, the billing, charging and customer relationship management software solutions provider, is pleased to announce its largest ever contract win in an agreement worth £11.2m with a major UK provider of enterprise connectivity solutions. The majority of income, including software licences and services, is expected to be recognised in the next 12 months, and the contract has an overall term of five years....

The contract was awarded following an extended competitive selection process, and delivery is scheduled to begin immediately.

That sounds more like a perpetual licence type of deal, than SaaS, given that the majority of the income is going to be recognised in the next 12 months, although maybe some will be recognised in FY 09/2020 also? This suggests FY 09/2021 is looking to be a blow out year.

To put this in context, current consensus is for revenues of £22.1m for FY 09/2021, so this is a big deal, quite literally.

Clearly good news, but we're not given enough detail to work out how much the share price should go up.

This is the latest demonstration of the ongoing momentum of the business and increasing recognition of the quality of our solutions."

It certainly is. CER shareholders look set to have an enjoyable day (I'm writing this before the market open).

This does look a very good company, which is already decently profitable. This extra major contract should see results rise considerably. I'm impressed.

Broker update - there's a helpful note from Liberum just out, providing additional colour on this contract win. Although I don't understand why Liberum has not raised its forecasts. Maybe this deal was already baked into its forecast, I don't know. It says the pipeline is strong, and expects further contract wins.

Looks like a company on a roll.

.

Beeks Financial Cloud (LON:BKS)

Share price: 92.5p (up 1.7%, at 11:02)

No. shares: 51.2m

Market cap: £47.4m

Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its final results for the year ended 30 June 2020.

I've followed Beeks for a few years now, and it is an impressive little growth company, in an unusual niche.

I last reviewed it, here on 4 Aug 2020, on publication of a trading update. I noted that broker consensus earnings had come down a lot, and because of that felt the share was looking pricey at 96p, a PER of 43.5 at the time - too high.

Results for FY 06/2020 have come in a bit better than expected, with underlying EPS of 2,52p (down slightly on 2.58p LY). That's a PER of 36.7 - still high, but a bit more palatable.

Revenues are up a respectable +27%, and gross margin up more at +30%. That's good. Increased costs seem to have absorbed most of the benefit of that, with underlying PBT up only 8%. Short term profitability isn't everything though, and it can make sense for tiny companies like this to increase spending if that's going to drive future growth. I see that it has opened 7 new data centres internationally, rising from 11 to 18, which is quite a step change.

Outlook - sounds confident about further growth;

· Positive market environment and considerably increased sales pipeline

· Confident in securing additional Tier 1 customers in the year ahead

Share based payments of £312k are questionable as an adjustment. I see that as a payroll cost, not a one-off.

Balance sheet - OK, but note that debt + contingent consideration now total £5.4m, not a problem level, but up quite a lot in the last year.

Cashflow statement - OK, but note increased capex, now at £2.8m for the year, and it capitalised £720k in development spend. So it's not really an asset-light business model any more.

My opinion - a very interesting little growth company. I think it's likely to take several more years to gestate, so I can't see any particular reason to rush out and buy now. Probably priced about right for the time being, but with good long-term potential. Covid is bound to have slowed down new client acquisition.

Here's the chart below of Beeks since it floated in Nov 2017. As you can see, investors got excited about growth a couple of times, but expectations then moderated.

.

.

Filta Group (LON:FLTA)

Share price: 98.5p (unchanged)

No. shares: 29.1m

Market cap: £28.7m

Details here of a private investor presentation from the company, on 24 Sept at 14:00 - well done to the company for engaging with investors, and to all the other companies that are now also doing these tremendously useful online results presentations. It really should be standard practice for all companies.

Interim Results - this company provides services to commercial kitchens, so I would expect it to be having a bad year, given closures of restaurants from covid, and the many restructuring/insolvencies in the sector.

H1 numbers look reasonably OK in the circumstances;

Revenues down 32% to £8.3m

H1 loss before tax of £782k (vs H1 LY profit of £474k). This is after charging £468k amortisation, which I'm happy to add back, so the adjusted loss was £34k - near enough to breakeven, so that's OK.

Balance sheet is weak, but not alarmingly so, with NTAV of just £0.2m.

Liquidity looks OK, with cash of £3.2m, although note that this is more than offset by borrowings, giving net debt overall of £0.6m.

Outlook comments are quite vague, and talk mainly about the uncertainty surrounding covid.

My opinion - it should recover in time, and I don't think there's any risk of insolvency. I think the business needs to grow considerably, in order to reach scale where it would interest me as an investment. At this stage, I don't see any appeal to owning this share. I think there are better opportunities elsewhere. Sorry about that.

.

This is a bit of chore today, because I'm not really interested in any of these companies reporting today. But let's plough on regardless.

Simplybiz (LON:SBIZ)

Share price: 155p (up 5% today, at 14:55)

No. shares: 96.8m

Market cap: £150.0m

I'm quite surprised this share has not bounced back after the general market plunge in March. I would have thought its services on recurring revenues, would be quite robust i a downturn.

SimplyBiz (AIM: SBIZ), a leading independent provider of compliance, technology and business services to financial advisers and financial institutions in the UK, today announces its unaudited results for the six months ended 30 June 2020.

Revenue is almost flat at £28.9m (H1 2019: £29.1m). It looks as if this was boosted by an acquisition kicking in this period;

... six full months trading from Defaqto which helped offset a significant reduction in valuation income during the period.

Various performance measures, such as operating profit, and EBITDA are mentioned, but since IFRS 16 came in, these can be distorted. So personally I prefer to work on profit before tax (PBT), and then adjust out goodwill amortisation. By this measure, PBT was £4.4m + £1.0m amortisation related to acquisitions = £5.4m (vs LY of £6.3m). That looks a reasonable result in the circumstances, as some parts of the group were impacted by covid.

EPS is the simplest figure to use, adj H1 EPS was 4.22p (LY H1: 5.57p)

Full year guidance is provided, at no less than 11.0p - a PER of 14.1

Dividends - no interim divi is proposed (LY Interim divi was 1.41p)

Outlook - continues to be in line with expectations.

Cashflow statement - it doesn't look very cash generative, which surprises me a bit. Of the £8.3m increase in cash in H1, £7.0m derived from drawdown of a loan. Although it did pay out £2.76m in divis. £1.36m in development spending was capitalised in H1, thus making EBITDA an optimistic number.

Overall, I think the group should forget divis for a few years, and instead concentrate on paying down some of the debt.

Balance sheet - is weak. NAV is £68.8m, but this includes a massive £106.0m in intangibles, from all the acquisitions. Take that off, and NTAV is heavily negative, at £(37.2m). This gap is financed by bank borrowings, with long-term debt of £44.7m. Liquidity looks fine though, as it is also sitting on a cash pile of £18.9m. Net debt looks more reasonable, at £25.8m, and that is coming down.

A recurring revenues business like this, with little in the way of fixed assets, can arguably operate OK with a negative balance sheet, but it increases risk, and means there's less cash available to pay out in divis. So we do need to adjust for that in the valuation.

My opinion - neutral. The balance sheet is the main negative for me. A PER of about 14 looks about right, in my personal opinion. Adjust for the debt, and that would rise to about 16 or 17, which seems about right. Overall then, I don't see enough upside to get me interested. It's an OK business though.

.

Avingtrans (LON:AVG)

Share price: 240p (up 5%, at 15:54)

No. shares: 31.4m

Market cap: £75.4m

Notice of results;

Avingtrans PLC (AIM: AVG), which designs, manufactures and supplies original equipment, systems and associated aftermarket services to the energy and medical sectors, announces that the Group's preliminary Results for the period ended 31 May 2020 will be published on Wednesday 30 September 2020.

A reader complains in the comments below that today's update from Avingtrans tells us nothing. I'm not keen on the wording used below - it says order intake is in line with expectations, which is not necessarily the same thing as trading being in line with expectations. So this is a little ambiguous.

Overall order intake during the first quarter of the financial year (1 June - 31 August) has been in-line with management expectations and trading conditions are gradually normalising.

Various new contracts are mentioned, but these look quite small, relative to forecast revenues for FY 05/2021 of £135m.

Broker updates - many thanks to N+1 Singer, and Finncap, who have both made available on Research Tree useful update notes today. N+1 point out that the company has previously given guidance for FY 05/2020 at 15.2p EPS, a PER of 15.8 - which seems a reasonable valuation.

Guidance for FY 05/2021 is currently still withdrawn, but expected to be resumed at the time of the results being published on 30 Sept.

My opinion - I've only got limited information to go on, but I can't see anything alarming in any of this. It seems quite a decent group of companies, and trading reasonably well through covid by the sounds of it.

.

Cohort (LON:CHRT)

653p (up 6%) - mkt cap £267m

This is a group of defence-related businesses. It seems to be doing well, and the market likes the update today.

Cohort continued to make good progress in its financial year ended 30 April 2020, achieving a record adjusted operating profit despite the impact of COVID-19 restrictions in the final two months.

Order book has risen from £183.3m to £210m in the last 4 months.

83% of FY 04/2021 revenues now secured

Liquidity is fine.

We continue to expect that our trading performance for 2020/21 financial year will be in line with that achieved in the year ended 30 April 2020, as indicated at the time of the final results announcement in July. We expect net debt to remain flat for the year, after taking account of the acquisition of ELAC.

In the longer term, the Group continues to expect to return to growth, as it recovers the orders and revenue delayed due to COVID-19, whilst benefiting from the acquisition of ELAC.

My opinion - I don't know enough about the company to form a view either way. If the broker forecasts are reliable, then a forward PER of about 17 looks fair.

I'll leave it there fore today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.