Good morning, it's Paul and Jack here with the SCVR for Monday.

Mello

This evening Jack will be joining the panel for Mello BASH (Buy, Avoid, Sell, Hold), with 5 new investment opportunities up for discussion. It’s part of the popular virtual Mello Monday event that runs from 6-9 pm and includes a variety of insightful presentations.

If you are interested in attending, Stockopedia subscribers can get 50% discount from their tickets by using the coupon code MMStocko21 at the checkout. You can register here or see the full lineup here.

Pfizer vaccine news

Breaking News - I’ve just heard on the BBC TV that Pfizer has announced positive results from its covid-19 vaccine trial, with c.90% effectiveness in preventing the disease apparently. It is already in production, with a stockpile being built up, to hopefully be released once it finishes testing, and has hopefully got all the necessary regulatory approvals.

Coincidentally, I commented here last week, that I think we’re overdue another rally on shares that have been hit hard by covid. The market is meant to look forwards 6 months, and it seems that we should have made substantial progress against covid in 6 months’ time, with better testing, and vaccines possibly. We’re spoiled for choice in terms of bargain small caps that are priced almost to go bust, yet have strong recovery potential. I reckon a lot of money could be made from buying the right shares around now.

Also look at all the takeover bids happening now. That’s another indicator that there are pockets of value in the UK market. I do think small cap investors generally seem to be far too cautious at the moment, not looking beyond the current situation of temporary lockdown & rising covid cases. There’s a good chance that this thing could be under control quite quickly, which means we’re being offered some terrific bargains by Mr Market. Sorry if it’s unfashionable to sound upbeat, but rightly or wrongly, that’s how I see things right now.

Wow - The Dow futures are up c.1300 points to 29,600, and FTSE 100 up 240 pts to 6140 (around noon). It will be interesting to see if those levels stick, or if we’re just seeing shorters carried out on a stretcher?! Clearly the market is taking this news from Pfizer very positively.

.

Agenda

Here are today’s most interesting small cap updates that we're writing about here;

Ekf Diagnostics Holdings (LON:EKF) - Trading update (Jack, done)

Gym (LON:GYM) - Operations & trading update (Jack, done)

Walker Greenbank (LON:WGB) (Paul holds) - Licensing agreement with NEXT (Paul, done)

Countrywide (LON:CWD) - Statement re possible offer (Paul, done)

On The Beach (LON:OTB) - Full year trading update (Paul, done)

Smiths News (LON:SNWS) - Refinancing (Paul, to do)

Dignity (LON:DTY) - Trading update (Paul, to do)

.

Timings - Jack has done the morning shift, I (Paul) will be working this afternoon, so 4pm finish.

** This section written by Jack **

EKF Diagnostics Holdings (LON:EKF)

Share price: 78.75p (+1.61%)

Shares in issue: 454,993,227

Market cap: £358.3m

(Jack writing)

The strong Ekf Diagnostics Holdings (LON:EKF) share price sees the company enter mid cap territory in recent weeks, so congrats to holders on spotting the opportunity and the outstanding performance. The shares were as low as 17p in March but are now pushing 80p, driven in part by booming COVID-related business.

EKF is a global medical manufacturer of point-of-care (POCT) devices and tests for hemoglobin, glycated hemoglobin (HbA1c), glucose and lactate. It focuses on three core areas:

- EKF Point of Care (POC) analyzers are used in doctors' surgeries, clinics, hospitals and laboratories to provide fast, accurate, and affordable results.

- EKF Central Laboratory division manufactures reagents for use in hospital laboratories.

- EKF Life Sciences specializes in producing enzymes and contracted custom products for use in medical diagnostics, pharmaceuticals and industry.

It’s a sweet spot right now. You can clearly see the uptick in buying volume this year - a sign that the investment case has been transformed.

Today’s trading update sees the shares up another 1.8% to a new all-time high of 78.75p, so let’s see what it’s saying.

The group kicks off confidently with: ‘Full year performance to further exceed market consensus’ thanks to a record October and high expected orders for the remainder of the year. Market expectations have already been revised upwards several times this year.

Trading has improved ‘significantly’ in the core business in the final quarter, thanks in large part to continued orders for the PrimeStore MTM COVID-19 sample collection device.

This device was invented in 2006 in preparation for a worldwide pandemic and is designed to de-activate pathogens rapidly and stabilise the RNA for up to four weeks with no requirement for cold storage.

It also allows samples to be tested by a greater number of laboratories, as the handling risks for the deactivated virus are reduced.

Conclusion

It’s a short but confident update and confirms EKF as a company worth looking into more closely.

Expectations are currently set at £60m for revenues and adjusted EBITDA of £23m. The group suggests it will be comfortably ahead of these. Add 10% to both - which is hopefully very conservative - and you get revenue of £66m and adjusted EBITDA of £25.3m. That values EKF at 5.4x sales and 14.2x adjusted EBITDA.

No doubt what holders are hoping is that the company can blow current estimates out of the water.

We can see that forecasts have been upgraded considerably - when that happens, there’s always potential for a further beat as analyst estimates can prove conservative in these instances as they ‘anchor’ to obsolete historic numbers.

And at this valuation, EKF does probably need to confirm blockbuster trading figures. The statement today is so brief that it’s impossible to have an informed view on that right now.

The company has net cash on the balance sheet and looks in good shape but the forecast PE ratio (which can’t be trusted given the ongoing growth) puts EKF at 41.2x earnings. If top line growth can exceed expectations and translate into margin expansion, then this could fall in short order.

Primestore MTM has recently been successfully evaluated by Public Health England in a peer-reviewed comparative study, which concluded it was the only commercially available sample collection device where no residual virus was detectable out of 23 tested.

And of course global demand for the PrimeStore MTM sample containment device has increased significantly due to COVID-19.

We all know governments around the world are throwing silly amounts of money at COVID testing right now. So if EKF has one of the best devices on the market, there’s every chance it can continue to surprise to the upside.

At 79p I’m priced out currently but tempted to do more research - there is always the possibility that current forecasts are just way off base.

** This section written by Jack **

Gym Group (LON:GYM)

Share price: 139p (+1.31%)

Shares in issue: 165,941,580

Market cap: £230.7m

Gym (LON:GYM) operates 183 low cost gyms nationwide.

At some point winning Leisure and Retail stocks will have an almighty comeback. Not right now, though, and in the meantime it can be stubbornly difficult to find stocks in the sector that are marked down enough to provide sufficient risk:reward.

A couple of pub groups perhaps, Restaurant Group if it makes it through, and I’m seeing a few property companies like Town Centre Securities (LON:TOWN) trading at steep discounts to net asset value. But then there are some other operators whose share prices have not sufficiently adjusted to the new reality, IMO.

I’d put the Gym Group in the latter category for now - a great roll out story in normal markets - but one whose share price does not reflect the risk of prolonged trading disruption or a possibly permanent shift towards more at-home exercising.

Counter arguments are welcome, but even if that’s an overstatement and Gym Group immediately reverts to 2019 trading levels in 2021, that would still price it at 21.5x normalised EPS and 1.5x sales.

The update confirms that GYM closed its 167 gyms in England on 4 November 2020, following the introduction of the 4-week lockdown announced by the UK Government on 31 October.

The Company's three gyms in Wales closed on 26 October as part of a 2-week lockdown announced by the Welsh Assembly but its 13 gyms in Scotland remain open.

It expects monthly cash burn during closure to be around £6m.

Net debt actually reduced in the period to £32m ( 31 July 2020: £35.7m) versus £100m of total borrowing capacity. So it looks like close to a year’s worth of liquidity. GYM is also in discussions with its lending banks about resetting future covenant tests.

In addition, £4.5m of the £9.4m of rent deferred from H1 2020 has now been repaid.

What’s more, GYM traded profitably and cash generatively after re-opening, which shows that it can bounce back quickly.

Conclusion

New sites are expected to open in Q1 2021 and the group ‘continues to see an opportunity to access attractive potential new sites and is building a pipeline for new openings in 2021.’

On balance it looks like GYM is in reasonably good shape - certainly not in panic mode, although circumstances are far from ideal. It’s likely that the sites that do go bust are independents, while larger entities with better access to capital should be able to protect themselves and invest for the recovery.

These are exceptional times though, and it is uncertain to what degree the market will recover. Have people’s habits changed for good? Maybe we are a nation of runners and cyclists now. Or maybe those concerns are overstated.

Given ongoing uncertainties, I would want a bigger margin of safety here.

.

** This and all subsequent sections written by Paul **

Walker Greenbank (LON:WGB)

Share price: 68p (up 12%, at 12:36)

No. shares: 71.0m

Market cap: £48.3m

(Paul holds)

Walker Greenbank PLC (AIM: WGB), the luxury interior furnishings group, is pleased to announce that its Sanderson, Sanderson Home and Morris & Co brands have signed a licensing agreement with major retailer NEXT for an extensive range of clothing, homeware and accessories for an initial term of two and a half years. This agreement follows the successful collaboration between NEXT and the Company's Scion brand announced earlier this year.

With the Morris & Co brand, NEXT will produce apparel, including womenswear, men's shirts and childrenswear, with an anticipated launch date of June 2021….

All of the products under the licensing agreement are expected to become available, once launched, both online at NEXT.CO.UK and in selected NEXT retail stores.

Simon Wolfson, NEXT Chief Executive, said: "We are delighted to be working with Walker Greenbank to develop new products for these wonderful brands. We believe that the combination of their exceptional design work with NEXT's product development, online and retail infrastructure can deliver some new and very exciting product ranges."

My opinion - clearly this is good news, but we’re not given any financial details, so at this stage it’s impossible to work out how this might help WGB’s future profitability.

Some clues - I like the choice of wording for an “extensive range of clothing, homewares, and accessories” - suggesting that this could be a decent sized deal.

Initial term of 2.5 years suggests it could become an ongoing partnership, long term, if it works. It also suggests there’s significant commitment to the ranges, because if it was just a trial, then it would only be for a few months, or maybe one year.

“Selected” stores, gives us no indication of how many stores will receive these ranges, nor how they are deciding which stores to send it to.

Overall then, a lot of question marks, we’ve no option but to wait until next summer, and see how the new ranges perform. Plus monitor broker notes, who are given more detail by companies.

Two points from me;

- This deal highlights the value of WGB’s extensive, historic back catalogue of designs & prints, especially classic arts & crafts styles. I’ve always thought these have considerable value, not reflected in the current valuation.

- The obvious next step would be for NEXT to buy WGB, to fully exploit its valuable brands & back catalogue. So there must be a higher chance of a takeover bid, hopefully at a decent premium.

I think there’s considerable potential in WGB, and to my mind, the shares still look cheap (I hold).

.

.

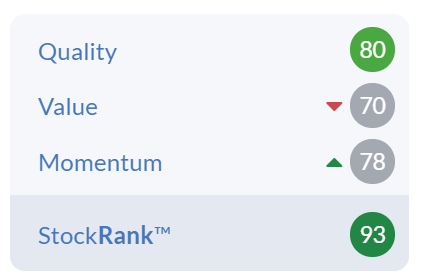

Stockopedia likes it too, and the broker forecasts seem to have been updated, so we can probably rely on this;

.

Countrywide (LON:CWD)

Share price: 202.3p (up 40% today)

No. shares: 50.6m

Market cap: £102.4m

Statement re Possible Offer and Postponement of General Meeting

Countrywide plc ("Countrywide" or the "Company") has received an indicative approach from Connells Limited to acquire the entire issued and to be issued share capital of the Company, in cash, at a price of 250 pence per Countrywide share (the "Approach"). The Approach is at an early stage and Connells Limited has indicated that any offer is conditional upon, amongst other things, completion of confirmatory due diligence and the recommendation of the Board of Countrywide.

Things are certainly getting interesting here! I last reported on Countrywide with its proposed refinancing with Alchemy, at 135p per share, here on 22 Oct 2020. Clearly the takeover approach today from Connells is much more attractive, at 250p. Although obviously with a takeover, the upside is capped at your exit price. Whereas with a refinancing, the longer term upside could be greater. A bird in the hand, and all that?

The meeting to approve the previous Alchemy deal has been put on hold, which makes sense if a better alternative is available, and the company is consulting with shareholders. Generally, private investors are frozen out of these things, but there’s no reason why you cannot write to, email, or telephone the company. I think letters addressed to the Chairman are best, because they receive so few physical letters these days, it’s a very good way to get through to the key people.

My opinion - there’s not really a lot I can add to this. The company now seems to be in play, and we’ll just have to wait and see how events pan out. It's an interesting reminder that having a weak balance sheet need not be an impediment to bidding interest. It could even make companies more vulnerable to opportunistic approaches?

.

.

On The Beach (LON:OTB)

Share price: 330p (up 24% today, at 14:17)

No. shares: 157.4m

Market cap: £519.4m

On the Beach Group plc (LSE: OTB.L), the UK's leading online retailer of beach holidays, today provides an update on trading for the 12 months to 30 September 2020 ("FY20") ahead of announcing its Preliminary Results on 10 December 2020.

There’s been a stunning rebound in share price in the last week, particularly today, after the positive-sounding news on Pfizer’s covid vaccine;

.

.

We’re seeing some staggering, coiled spring type share price surges today, for travel, hospitality & retailing shares, on the Pfizer vaccine news. I’m also noticing some plunges in WFH shares, like Loopup (LON:LOOP) (I hold). It’s really surprising that such big moves are happening so suddenly, on news that isn’t exactly unexpected - the big pharmas have been saying for a while that promising progress is being made.

Also, I see that some of the fashionable covid testing shares are down by about a third today - e.g. Synairgen (LON:SNG) , Novacyt Sa (LON:NCYT) , Avacta (LON:AVCT) - I hope readers trading these things had stop losses in place.

Prior to covid, OTB seemed to be growing revenues strongly, but profitability levelling off;

.

.

Here’s what OTB says today, summarised by me;

Year ending 30 Sept 2020

- Short-lived boost to trade over the summer

- New restrictions on travel, and winter seat capacity “significantly reduced”

- Booking volumes down 75% in Q3 (April, May, June), and 53% in Q4 (July, Aug, Sept)

- Adjusted profit before tax is around breakeven for FY 09/2020 - not too bad, in the circumstances in my view

- Cancellations - worse than expected over the summer, at >90% - similar rate expected over the winter

- Exceptional costs are large: £10m in H2, taking it to £45m full year

- Customer funds fully ring-fenced - I very much like this, as it’s more ethical, and is a strong selling point, it also means OTB is well set up to survive downturns when it has to refund customers

- Substantial delays in getting refunds from airlines

- Cash & liquidity looks fine: £44m cash on 6 Nov, and undrawn £75m credit available

- Cash burn is up to £2m per month (at zero revenues) - which looks easily survivable - no insolvency risk here, in my view

My opinion - this travel company has got through the crisis so far, with plenty of liquidity (following a fundraising earlier this year).

Investors are now clearly looking beyond covid, to a resumption of the travel/holiday sector in 2021, probably with a lot of pent-up demand, I reckon.

With the share price now back up to nearly its pre-covid level, I don’t see enough upside to want to buy OTB.

I see much better upside elsewhere (my top pick for travel-related companies is Saga (LON:SAGA) which is now one of my largest positions. Once its 2 brand new cruise ships sail again, they’re forecast to generate £40m p.a. EBITDA each. Plus the resumption of its travel agency business, on top of the profits already being made by its insurance division. The current mkt cap makes no sense at all to me (i.e. far too low), since it’s just been refinanced). That one looks like a potential long-term 5-bagger to me, whereas OTB doesn't.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.