Immunodiagnostic Systems Holdings (LON:IDH) has been on my watch list for about 12 months, as this medical diagnostics equipment maker has performed very well historically. However, its trading performance went wrong in late 2011, and the shares crashed from over 1000p to a low of around 250p. They're not a great deal higher at 281p now, having slipped back down after a rally late last year.

Here is a 2 year chart (Stockopedia puts in a 200-day moving average (the red line) by default, which I find quite useful to show the trend, so have left it in). Also please note it has a logarithmic Y-axis scale.

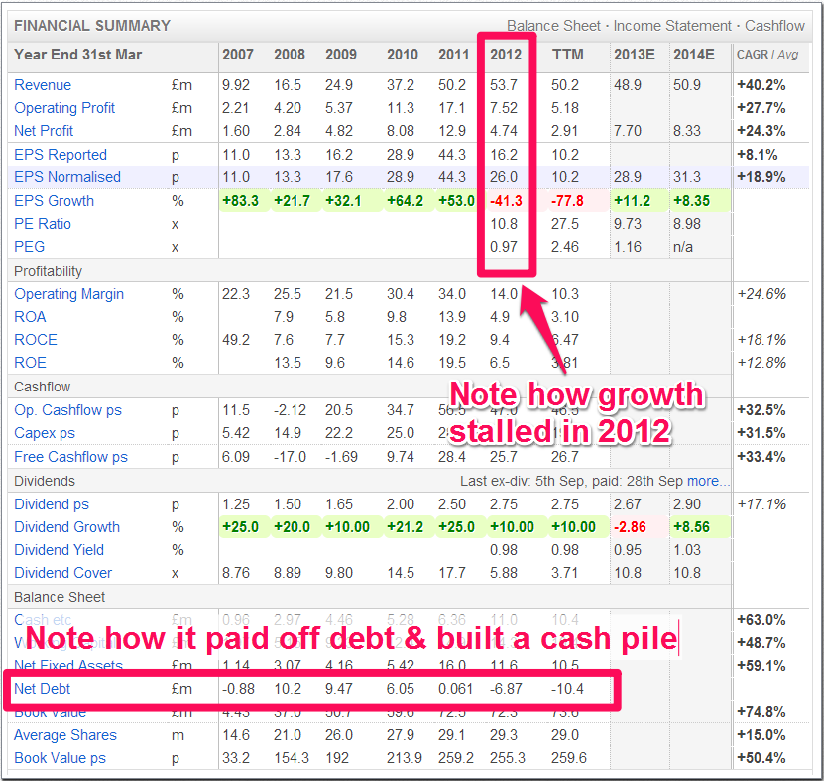

IDH has net cash, and is on a forward PER of 9, so looks interesting. The big problem is that new entrants to their markets have eroded what was a profitable niche, so it's difficult to determine whether IDH is a company in decline, or whether they can once again resume growth. So because of that, I found it impossible to value - because understanding the most likely future trend in sales & profits is absolutely crucial to valuing any company, but is unknown here.

It is also complicated by some of IDH's prouduct lines (manual testing kits) being replaced by automatic ones, which further muddies the water.

IDH have issued a statement this morning concerning a collaboration agreement with a French peer called Diagnostica Stago.

Stago are to pay IDH E3.5m in milestone payments, and will also "contribute" (implying that this is only part of the cost) E1m to the development of a new product over the next 2-3 years.

Unusually, a Director of IDH is personally entitled to 30% of the milestone payments, due to a 2005 agreement at a subsidiary acquired by IDH in 2007.

It all sounds nice (apart from that last bit about the Director), but as is often the case with this type of announcement, I'm left none the wiser about how this should affect the valuation of IDH. There is no mention of how this agreement will affect profits (since we don't know what costs are associated with this deal) or what growth it may or may not trigger.

However, we are in a bull market, so the purpose of this RNS might simply be to puff up the share price a bit by getting people excited? I can't draw anything useful from it, in terms of how to value the company, so it's rather frustrating. FinnCap have stated this morning that their forecasts & recommendation on IDH is unchanged on this news.

It's always interesting to see results from hugely hyped shares, to see if reality is catching up with the hype. I've never liked Monitise (LON:MONI) because it's heavily loss-making, yet has a premium valuation. So it's really an all-or-nothing bet on their mobile banking software becoming profitable in the future.

Looking at their interim figures to 31 Dec 2012, issued this morning, I'm scratching my head to understand how on earth this thing is capitalised at £525m? It's showing growth, sure. But anyone can grow sales if you sell a product or service for less than what it costs to make.

They report H1 revenue of £27.8m (up 63% on H1 last year), an EBITDA on live operations slightly worse at £5.3m (isn't EBITDA supposed to improve as you grow?), and an overall EBITDA loss of £14.7m. Their group loss is £24.4m, and cash outflow of £21.6m, and this is in six months remember!

I can't see why Banks would use Monitise in the long run. Surely they will just develop their own mobile platforms? On the plus side, Monitise does at least have enough cash to last another 2 years at this burn rate. But as for the shares, they don't interest me at all. Call me old fashioned, but I like companies to make a profit, and am not interested in punting on the likelihood of this making a profit, possibly, at some point in the future.

There was meant to be a radio expose of scammy online dating companies this weekend on Radio 5 Live - companies which allegedly fake user profiles, and trick people into subscribing, thinking that they are chatting to a potential partner, when actually it's someone in the office faking it. I listened to the show, but there was no report on online dating, just stuff about boiler room scams, and disreputable dog breeders.

Cupid (LON:CUP) shares have been in freefall lately because of worries about this radio show, and a bearish Blog article which pointed out the negative trend in web analytics for Cupid's brands. As pointed out on the bulletin board here by MrContrarian, online reviews of some of Cupid's brands are extremely negative. Therefore it seems to me that, if these reviews are true, then Cupid is not a company I would want to be associated with, or invest in.

I learned the hard way, when I lost £250k on shares in a company called Invox a few years ago, that companies which scam their customers have a pretty short shelf-life once those customers realise they are being scammed.

Eventually they run out of suckers, or are closed down by regulators. Interestingly, large Director sales are also a recurring feature with this type of company, which sure enough has been the case at Cupid too. So this one gets a red flag from me, for ticking all the wrong boxes.

Note how in the past Cupid have stated that their profits are reliant on heavy marketing spend bearing fruit. That in itself is a risky business model - even if activities are 100% above board, what happens if potential customers fail to respond to the latest marketing push? I'm steering well clear of this one.

Blinkx (LON:BLNX) has issued a positive trading update, saying that Q3 trading contined to be strong, after a previously announced "exceptional first half". Full year revenue is expected to be ahead of targets at $180-185m (compared with market forecast of $163m), and the outlook is confident. No mention of profit though! Turnover growth has also been flattered by acquisitions, so there is not enough information in this update for me to form a view.

Certainly on the historic numbers, BLNX looks very expensive, on a PER of about 65, so the valuation (up 22% today to 83p!) really does hinge on big rises in profit. They are forecast to triple EPS to $0.035 this year (ending 31 Mar 2013), and another rise to $0.056 next year. That still puts it on a PER of 23 times next year's forecast earnings. Far too racy for me. I hope nothing goes wrong, or this will go into freefall. Peel Hunt like it though, and have raised their forecasts this morning. I looked at Blinkx's website, and it seemed to me to be an inferior version of YouTube - why would anyone use it?

Latchways (LON:LTC) makes industrial safety equipment, and looks a nice company - very high operating profit margins, and consistent profitability, although there hasn't really been any growth in the last few years, with EPS tending to fluctuate between 50-60p. The dividend has been steadily rising though, and now yields around 3.5%, and it has net cash too. I like the look of this.

They report in today's IMS record order intake for Q3, so they, "expect the second half to be considerably stronger than the first half", although they sound a cautious tone for Q4 outlook, but say they, "still expect to report a successful outcome for the year". Sounds quite good. Here is a picture of a Latchways product, which intrigued me. It's a suction pad that stops workers falling off the wings of aircraft, called WingGrip (picture courtesy of Latchways website)

Latchways are on a forecast PER of 14.6 times this year, and 13.4 times next year, so not amazingly cheap for a company with limited growth prospects. However, with almost 10% of the market cap being net cash, and indeed one of the best balance sheets I've seen in a long time (current assets are almost 5 times current liabilities! Negligible long-term liabillities too), this company certainly looks worthy of further research. I'm adding it to "Paul's Picks" on my Blog, where I flag up good companies on reasonable valuations, and it's something I'm considering adding to a long-term portfolio I manage, although there's maybe not huge short term upside. It's a 5-year+ type of investment in my view.

Time for a couple more comments before my brain becomes a mush of figures spinning round!

Forbidden Technologies (LON:FBT) announces a contract win, which they say, "The licence provides for a relatively small up-front payment to Forbidden, with the majority of revenue expected to arise from royalties as Atos clients licence the platform from Atos".

By the way, Atos in this case is a South African software company, not the UK company which is traumatising disabled people by withdrawing their Benefits.

Investors are betting here that there will be many years of strong growth, as that is already priced in. The £21m market cap looks very toppy to me, based on the historic numbers, so I'll sit on the sidelines with this one & wait to see how growth actually develops.

OK, that's it for today. It's my Half Marathon attempt this coming Sunday, 17 Feb. Training has been going well, and I successfully completed my first ever 13 mile training run 2 days ago, in a rather slow time of 2hr 39m, but at least it gives me a target to aim for 2hr 30m or less on the big day.

If you can spare a few quid for MacMillan Cancer Care, or the Sussex Beacon (who organise the Brighton Half Marathon), then please sponsor my run here on my JustGiving page, which I've found greatly helps my motivation, knowing that friends here have supported the event. Many thanks!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.