Events/Publications

Firstly, WH Ireland publish an interesting shares magazine every month, called WHI-Spy, which contains news & views on shares.

I find it an interesting read, and hence am happy to pass on the link here each month when it's published, so click here to read the April 2013 edition (no registration required).

Secondly, Master Investor have contacted me to offer some free tickets to readers here, which I'm happy to pass on. Click here and enter promotional code PP2013 to take up this offer. It's on Sat 27 April, in Islington, London. I shall be attending, so hope to see some of you there during the day. The blurb for the event is;

Master Investor 2013 will be held at the Business Design Centre in Islington, London, from 9am on Saturday 27th April. Organised by t1ps.com and now in its 11th successful year, the show features a unique line-up of top speakers, along with the chance to meet with over 100 top company executives, discuss investment opportunities and gain unique investment insights you won’t find anywhere else. For more information visithttp://www.masterinvestor.co.uk

Pre 8 a.m. comments

There is an interesting announcement from Deltex Medical (LON:DEMG), which is on my watch list following a recent presentation to investors by their CEO. It concerns the granting of a "unique ODM payment code" by the USA Govt, so that physicians will receive automated reimbursal every time they use one of Deltex's products in surgery.

I'm not going to pretend to understand the sector, but based on what the CEO said at the investor meeting I attended, then this sounds like pretty significant news. He asserted that their product improves results from surgery by bettering monitoring fluid levels in the patient, but that it was proving difficult and slow to commercialise.

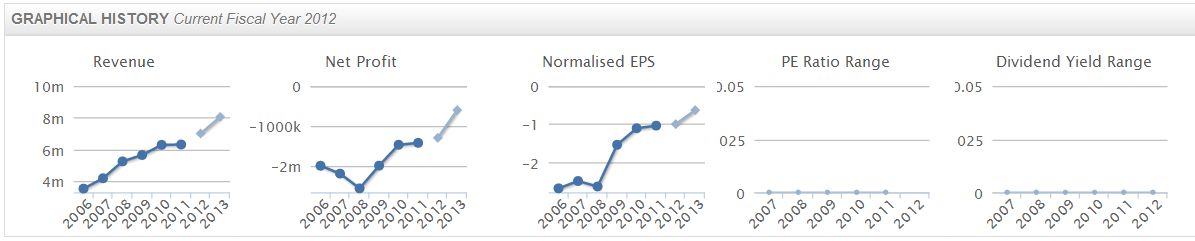

As you can see from the historic revenue chart above (where the lighter coloured lines are forecast), revenue has been stuck around the £6m level for the past four years. Perhaps this deal might give the company the impetus it needs to drive sales higher. It's a fairly high margin product too, so stronger growth could well take them into profitability. I've just bought a few at 14.38p, the £20m market cap does not look outrageous given the positive news today.

I remember being a big fan of shares in pizza/pasta restaurant chain Prezzo (LON:PRZ) a few years ago when they were about 25p. I made a bit of money on them, but they took so long to go up, that when they eventually did I sold out far too early (which is one of my main faults as an investor - not running my winners - always easier said than done though). Here is the five-year chart:

Anyway, my analysis of the company was correct, and the shares are now 84p. Excellent results this morning for the 52 weeks ended 30 Dec 2012 confirm what an excellent business this is. The founders (the Kaye family) have done it before, so very much know this sector inside out, and the business is very prudently financed with a very strong balance sheet, which interestingly (and unusually) includes a fair old chunk of freehold property (£33.8m net book value at 1 Jan 2012 is the figure in the last Annual Report).

Prezzo's results are just great - a quality business this, delivering steady growth despite consumer spending being under pressure. It's a straightforward roll-out, so they opened 31 new restaurants, taking them to a total of 211. I like retail businesses that are expanding at the moment, because they're getting fantastic deals on good sites, at reasonable priced rents, often with large landlord incentives paid to quality new tenants. It just shows how Prezzo's previous caution on new store openings, and prudent balance sheet financing, has proven very wise in the long run.

I'd like to linger over these accounts, as they are just such a pleasure to read - revenue up 17% to £144.5m, EBITDA up 16% to £25.5m, and adjusted pre-tax profit up 11% to £18.3m.

Adjusted EPS is up 13% to 5.9p, so that puts the shares on a PER of 14.2, which is certainly not expensive for such a quality business that is expanding well, has an excellent profit margin, and a very strong balance sheet. Freeholds make up about 17% of the market cap, although of course the lack of any rent on freehold stores mean that those sites boost profits.

I would have no hesitation putting PRZ shares into a very long term portfolio, even though this might not be the best point to buy, after they have already gone up significantly in the last few years. The outlook statement doesn't give any specifics, just saying that they are confident of further progress this year.

Post 8 a.m. comments

It's been an interesting market this morning in Deltex Medical (LON:DEMG), with a nice initial rise in the first few minutes of trading, then a clumsy seller has snuffed out the rise, so it's an unusual situation where we're now able to buy at a barely changed price, despite a very positive sounding announcement. So I've been back three times for more shares - I like an overhang from a seller, as it enables me to buy in whatever size I want, and without having to chase up a rising price. Eventually the seller is cleared, and the price should then move up. In theory, not always in practice!

Next I'm looking at Immunodiagnostic Systems Holdings (LON:IDH). It's a company I looked into in reasonable depth a few months ago, as the shares crashed from a big height when this former growth company suddenly found that new entrants entered the space it previously dominated, and the growth conked out, margins fell, and the shares lost the bulk of their value (follows on nicely from what myself & Ed were discussing in the comments to my article here yesterday).

This is what happens when you get the double whammy of lower earnings forecasts, and a lower PER multiple to reflect it going ex-growth:

On reading their trading statement today, I must admit to being unable to form a view either way, there are too many moving parts to be able to arrive at a quick conclusion. The market seems to like it though, with the shares up 10% to 320p at the time of writing.

The cash generation of £13.6m in the year, and £20.5m closing net cash are very impressive when put in the context of the market cap of £89m (calculated as 28.3m shares in issue, times 313p share price).

It's been a very successful company in the past, so if you think management can turn it around, then the shares could be cheap. If you think more decline is likely, then they may not be cheap. I think it looks interesting, and will try to dig deeper when time permits.

My purpose here is to flag up shares which might have an interesting investment case, for readers to do their own research, and this is one such situation.

Drug discovery companies are not usually my thing, as they take so long to commercialise anything, most projects fail, and they just generally make terrible investments. Plus I cannot verify anything that management say, as I'm not a scientist.

Accounts for Vernalis (LON:VER) caught my eye though, and might be worth a look. The market cap is £100m at 22p a share, but following a big fund-raising in Mar 2012 most of that is cash backed, so they have almost £82m in net cash on the balance sheet at 31 Dec 2012.

Moreover, the cash burn is relatively modest because most R&D spending is recouped from research collaborations & licence income. So they only burned £4.5m in 2012. I'm not sure whether that is expected to repeat, but superficially it looks quite interesting. One assumes the drugs they are developing must have promise, otherwise they wouldn't have been able to raise such a big chunk of money from investors in 2012.

The balance sheet shows a staggering retained loss of £647m! (i.e. the aggregate losses for the whole time the company has existed). I might add this to my watch list & look into it in more detail when time permits, but I like the idea of a speculative drug company which is fully cash funded, as it's usually the repeated fund raisings that dissipate the upside through dilution.

That's all for today. See you same time tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has this morning taken a new long position in Deltex Medical (LON:DEMG), and has no other long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.