Good morning, it’s Paul here with the first SCVR for 2021. I trust you had a relaxing break over Christmas & New Year, such as it was. Plenty of repeats to watch on TV anyway, we were spoiled for choice!

Stockopedia NAPS

Ed has recently published his 7th annual Stockopedia NAPS (no-admin portfolio system) article here, well worth a read. This system (based on StockRanks) delivered an excellent +27% in 2020, and has also significantly out-performed its benchmark in the previous 6 years. It demonstrates very well that a well-thought-out mechanical stock-picking system is a good way to beat the market, if you are time poor, or don't have confidence in your own stock-picking ability.

Trading updates in January

Out of curiosity, I looked back at last year’s SCVRs to see what companies I wrote about in the first half of January 2020. It was mostly Xmas trading updates from retailers. Given that, late last year so many non-essential shops were forced to close, plus the hospitality & travel sectors were largely locked down again too, in many parts of the country, then I’m not sure how things are likely to pan out this year.

Newsflow is likely to be short term grim, but the market is already looking beyond covid, since the positive vaccine news came through, rightly so I think. Will the big rally of late 2020 hold? Answers on a postcard - I haven't got a clue, as it's not my role to guess at short term market sentiment, anything can happen.

Some things (especially companies perceived as growth shares) do look pricey now though, and have maybe gone up too much? Tesla & Bitcoin, plus plenty of other areas of the US market are clearly now in euphoria or even mania, bubble territory. It's only a matter of time before things go pear shaped in the frothiest part of the market. We've seen all this many times before, and it always ends the same way.

.

.

Given that short term company trading is likely to have been awful in some sectors, then balance sheet strength is the most important thing to me. Can companies survive, without having to do another placing, until conditions return to something like normal (best estimate on that seems to be some time in April, once enough vulnerable people have been vaccinated)?

Will investors baulk at the huge debts some companies have run up during the pandemic? Or will that be ignored, as people focus instead on rising earnings?

IFRS 16 adjustments

... are likely to cause more chaos. I was talking to the CFO of a bars group, who explained to me how it works at the moment. The asset side of the IFRS 16 entries are likely to be based on awful current trading at balance sheet dates (i.e. heavily written down). That's likely to make balance sheets look horrendous in the short term, for multi-site retail & hospitality.

However, the key point to remember, is that once trading returns to normal, hopefully in Q2 2021 onwards, then those leasehold assets are likely to be greatly increased in value again, as sites return to profitability. Hence the IFRS 16 entries are particularly problematic, and it's more important than ever to completely disregard them, in my view.

This hopeless accounting standard really does need to be repealed as soon as possible. It's messed up P&Ls, by moving some rental costs into finance costs, rendering operating profit meaningless. Ditto for EBITDA. The whole cashflow statement is largely useless now, as it doesn't reflect reality. Finally, balance sheets include a mish-mash of some future years' liabilities (but not others, such as business rates, staff costs, utilities, for future years etc), and highly volatile notional assets which are not real. It's a complete mess.

EDIT - as an example, Revolution Bars (LON:RBG) (I hold) will show awful IFRS 16 balance sheet entries probably until the 30 June 2021 balance sheet is published, whereupon the IFRS 16 leases deficit should vanish (i.e. leasehold assets should be re-rated back up to roughly match lease liabilities). This is because RBG has ditched all but 1 of its loss-making sites, by renegotiating problem leases, re-gearing (longer new lease, in return for lower rent, making it profitable again), and a disposal of a batch of problem leases with one landlord. The way IFRS 16 works, the 31 Dec 2020 H1 balance sheet, when published, will reflect the situation as at that date, i.e. showing huge liabilities & not much in the way of assets. That will not reflect the future at all, so will be highly distorted & very unhelpful. End of edit.

.

Brokers & PRs please note - trading updates

I know that a lot of city advisers read these reports, which is great, and I have constructive relationships with many people in the city. They sometimes ask me what information investors need? I can’t answer for everyone, but thought it might be useful for me to publish a list of things that would be useful to include in forthcoming trading updates, in no particular order;

- Gross cash, and net cash (as recent as possible)

- Stretched creditors - many companies are reporting unusually high cash, because they’ve taken advantage of extended payments terms. That's fine, but investors need to know how much, and when are stretched creditor payments due (e.g. extended VAT, payroll taxes, rents, and any other extended creditors). This information needs to be specific, and should be provided even if it’s a zero amount, because omitting it arouses suspicion that liabilities are being hidden to overstate cash.

- Combining the above 2, what is normalised net cash now?

- Bank facilities - how much drawn down, headroom remaining? Expiry date of facilities, and headroom on covenants - are covenants likely to be breached (going concern type notes are very useful on this, e.g. severe but plausible scenarios - I think auditors have done a good job insisting on this info in 2020)

- Profit guidance, for companies with Dec 2020 year ends should be provided - subject to audit adjustments. If not sure, then give a range of possible outcomes. Something is better than nothing.

- Profitability versus market/Director expectations - NB must include a footnote as to what those expectations are, because this information is particularly hard to find at the moment with smaller caps, due to lack of market forecasts, or some brokers withholding that information from private investors

- Outlook - assuming that business can return to normal at end Q1, then it should be possible to give some meaningful guidance for 2021. Saying it’s too uncertain is not helpful! Estimates can always be revised in future, if things chance, so just give us your best current base case estimate for 2021 please. Again, a range of numbers is good, if being precise is too problematic.

- Tables of numbers are far easier to interpret than waffly text explanations - I’m a big fan of tables, let’s have more of them please

- Abbreviations - if you must use them, please include a footnote to say what they mean, as it’s not always obvious to people outside a company’s sector

.

What to avoid - rambling, imprecise text.

Above all - please make trading updates clear, and balanced - giving a realistic overview of performance & outlook. It’s not an exercise in PR, to embellish the truth. People can usually see through that sort of thing. Investors just need the straightforward truth, which is what builds trust in companies & their management.

I hope that helps.

What else is happening today? Very little, almost nothing in small caps. A couple of larger companies;

Entain (LON:ENT)

This company used to be called GVC, it's a betting & gambling company. Mid cap or large cap, depending on what figures you use (mkt cap now £8.4bn) - it's up 26% today, on news of a possible takeover bid from MGM Resorts, "its partner in the US market".

The proposal seems to be using MGM shares not cash, and values Entain at a 22% premium, 1383p per share (which will fluctuate in real time, as the price of MGM changes). A "limited partial cash alternative would also be made available".

Note that Entain's share price is now above this possible offer price, at 1434p - suggesting that the market sees potential for a higher bid(s).

Entain has informed MGMRI that it believes that the proposal significantly undervalues the Company and its prospects. The Board has also asked MGMRI to provide additional information in respect of the strategic rationale for a combination of the two companies.

We were recently discussing here the likelihood of a tsunami of takeover bids being likely, now covid vaccines are being rolled out, and most of the Brexit uncertainty has been removed. This approach from the USA for Entain seems to confirm this trend.

Expect a lot more takeover bids. This could make US mid caps an interesting area to trawl through, in addition to small caps.

.

S4 Capital (LON:SFOR)

Mkt cap £2.7bn

This is a great story - Sir Martin Sorrell (who created ad/marketing giant WPP) is now creating a rapidly expanding "new age/new era" digital marketing group. It puts out an in line with expectations update today, which is dressed up to sound breathlessly exciting.

It expands its pretentiously named Content practice. Further moves will be announced shortly, how exciting.

I find the update today really rampy & over-excitable.

It tries to steer us towards gross profit as a key performance measure, which is laughable.

Acquisitions - note that S4 doesn't use earn-outs, which is interesting. Instead it buys companies half in cash, and half in S4 shares, with a lock-in. That's quite interesting as it challenges conventional wisdom that management at acquired companies need to be motivated with earn-outs to keep producing strong growth. I suppose if you can convince acquired companies that S4 shares will be rocket-fuelled, and show them a strongly rising share price chart, then that could work well, and builds loyalty to the larger group (or "family" as it's slightly nauseatingly called in today's announcement).

Liquidity sounds good;

Even after allowing for the cash consideration paid and due in respect of Decoded Advertising and Metric Theory, the Company will still maintain significant net cash balances.

My opinion - investors are lapping up the story here, and the share price has been strong. I suspect the published results might throw a bucket of cold water over excited punters here. Whilst respecting that Sir Martin knows his stuff, how much of a premium are people prepared to pay for that, given his advancing years?

Looking back at the last interims, it made paltry profit before tax (statutory) of £118k (bear in mind the market cap is £2.7bn!). This was massaged into an H1 £13.9m adjusted profit (see note 13 of interims). However, £6.1m of the adjustments relate to "share based compensation", which in a people business, I would just regard as payroll costs, as it's likely to be ongoing, to retain the brightest talent. Adjust that back in again as a cost, and H1 profit was really only £7.75m, the way I look at things.

Hence it seems a significantly over-valued share at the moment. Maybe the figures will grow into the valuation in future, but for now it's clearly over-hyped. You only have to read today's announcement to see how frothy it all sounds. Whether the market will know, or care, is another matter.

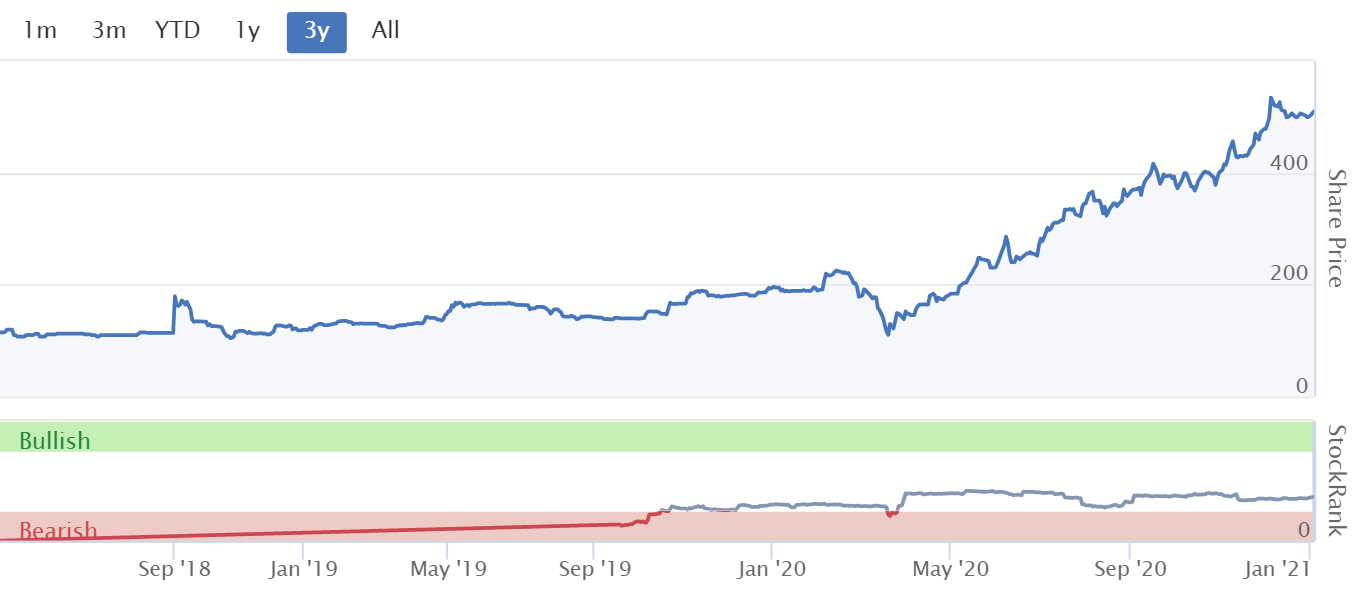

Note that the StockRank system is also sceptical (below), so it's not just me being a grinch!

If I wanted to back digital marketing, the obvious way to go is buying Facebook shares, which owns the two platforms that are most in demand for advertisers, because they deliver the best results, namely Facebook and Instagram. Why buy anything else in the sector, when $FB trades on a forward PER of 26, and is sitting on pots of cash, and should deliver strong growth for years to come? Break-up & regulatory risk is an issue though with FB.

.

.

M&c Saatchi (LON:SAA)

New CEO appointed. Moray MacLennan is a long-serving internal candidate. That's a wonderfully Scottish sounding name, so I had to google it! "Moray" means sea, apparently, and is also a type of fish. "MacLennan" is apparently a Highland Scottish clan, historically populating the north-west of Scotland.

Personally I'm giving SAA shares a wide berth for now, due to accounting problems, and some nasty dilution potential from poorly structured options-based acquisition payments. Although advertising & marketing are obviously good cyclical sectors in an economic recovery.

.

I've probably scraped today's thin news barrel as far as humanly possible, so will leave it there for today. See you tomorrow!

Thanks for the thumbs ups, it really does help motivate the writers here, when we see people like our work.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.