Good morning, it's Paul & Jack here with the SCVR for Wednesday.

Timing - today's report is now finished.

Agenda - let's start with some sections I prepared earlier (last night):

Quiz (LON:QUIZ) - review of its Interim results

Heiq (LON:HEIQ) - 2020 trading update

Simplybiz (LON:SBIZ) - 2020 trading update

Flowtech Fluidpower (LON:FLO) - 2020 trading update

Today's news:

Scapa (LON:SCPA) - recommended cash takeover bid at 210p

Scs (LON:SCS) - trading update at end H1

Strix (LON:KETL) - 2020 trading update - you may not like my view on this one!

.

Jack's contribution:

Wynnstay (LON:WYN) - Final results FY 10/2020

.

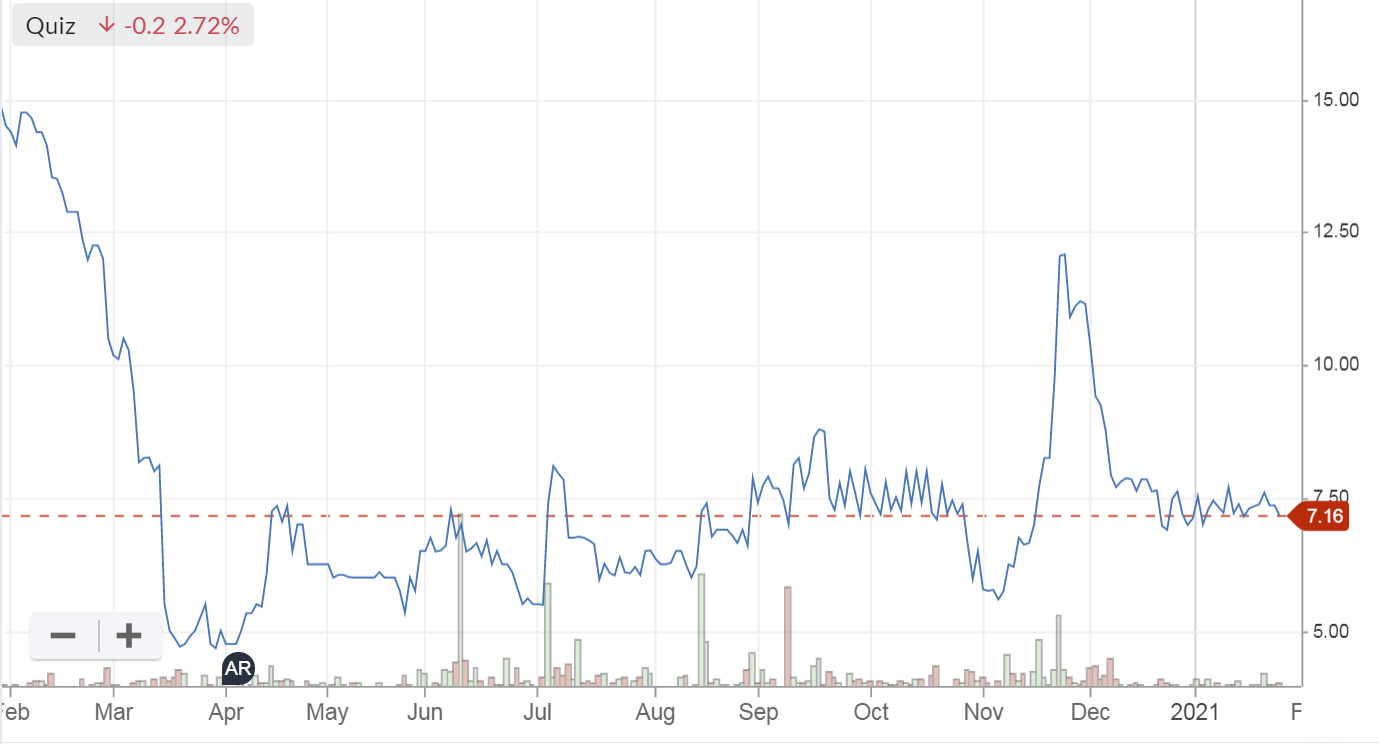

Quiz (LON:QUIZ)

(I hold)

Mkt cap £9m at 7.2p

Interim results - NB this is a special situation, which did a pre-pack administration in June, to ditch all loss-making shops, and put the remainder on turnover rents. Hence the figures will look awful for now, because the shops were shut for a lot of the time. What matters is whether the business can survive, and rebuild once shops can open normally again, plus the progress of its online offering.

In a special situation, it's all about survival, so cash is king. This looks OK - £5.5m at 30 Sept 2020. Latest cash is £3.0m net cash as at 25 Jan 2021, with additional £3.5m undrawn banking facilities. Hence the liquidity position remains OK, and is better than I anticipated. Bulletin board experts who confidently predicted (with no evidence of course) that Quiz would run out of cash, have been wrong so far.

Concessions - I was worried that QUIZ might have bad debt exposure to Debenhams and Arcadia. It says that of its 142 concessions, 85 are in Debenhams, and 29 in Arcadia, all are expected to close. That would only leave 28 concessions remaining, so this side of the business is more-or-less over. Sad for the people involved of course, but new jobs are being created elsewhere by online & logistics companies. We can't stand in the way of progress, and there's really no longer much demand for many existing physical retailers, especially department stores, a concept that's arguably had its day. Pleasingly, re Debenhams & Arcadia, Quiz says -

There is no financial exposure to outstanding balances due from these businesses and the redundancy costs that would arise from these store closures would not be significant.

Online sales - down 50%. I’m disappointed with that, as I’d hoped Quiz online could take up the slack from closed stores. Of course its point of difference is special occasionwear, the worst possible category in a pandemic when special occasions can't happen. Pivoting to casualwear has only partially helped plug the gap.

Gross margin down sharply, from a previously very good 61.7% to 51.7%, again a bit disappointing, but I’ve seen worse.

Outlook & current trading - still poor, as you would expect when the shops are shut!

Balance sheet - this looks much stronger than I was expecting. It looks remarkably good actually. The pre-pack admin has got rid of most of the lease liabilities. NAV is £22.6m, less intangibles + deferred tax asset of £5.2m, gives NTAV of £17.4m - I don't’ understand how these figures are so good, so need to do some more work on this.

My opinion - pending, I need to do more work. I'm happy that my original reason for investing is intact - that the business would survive, and eventually prosper because it has restructured with a pre-pack administration, thereby getting all remaining shops onto turnover rents. That's absolutely key. Whether the product/brand are good enough? The jury is still out on that.

The finances are sound (see the good latest balance sheet), and with the founding family still owning about 50%, then I reckon this could recover. They've recovered before remember, from administration in 2008, to relieving the city of about £90m in a partial sale in 2017.

I'll do some more work on this, and report back in due course. Obviously not for widows & orphans, like any other struggling retailer.

.

.

Heiq (LON:HEIQ)

Mkt cap £229m (down 23% yesterday at 182p)

This innovative, technical fabrics company did a presentation at Mello Monday this week, then plunged in price 23% the next day. Did everyone at Mello open short positions then?! Possibly, but it seems the damage was done by this:

HeiQ Plc (LSE:HEIQ), an established global brand in materials and textile innovation which operates in high-growth markets, is pleased to provide a trading update for the financial year ended 31 December 2020 ("FY 2020" or "the Period").

Revenue for the year exceeded expectations

Operating profit for 2020 in line with expectations, despite record “investment”

FY 12/2021 so far has started in line with market expectations, confident about prospects

Liquidity said to be strong

Management speak all sounds upbeat

My opinion - why has the share price plunged 23% then? I don’t know, as nothing in the above strikes me as negative. People must have been expecting more.

The Mello presentation was enough to convince me I wouldn’t touch this share at anything like the current price. It’s had one decently profitable year, which could have been a one-off from covid-related products. There’s no track record of profitability anywhere near enough to justify a £229m market cap.

Hence I think it’s still wildly expensive, given we don’t really know what long-term profitability would look like. Hence not of any interest to me, but I’ve only done superficial due diligence, so I'm braced for angry shareholders telling me what an idiot I am!

It's a recent float, Dec 2020, having reversed into a cash shell by the looks of it. Speculative frenzy-looking chart:

.

.

Simplybiz (LON:SBIZ)

Mkt cap £175m, at 184p per share (up c.1% yesterday)

SimplyBiz (AIM: SBIZ), a leading independent provider of Fintech and Support Services to financial advisers and financial institutions in the UK, today issues a pre-close trading update for the twelve months ended 31st December 2020.

I last reported on its FY 12/2020 trading update here on 10 Dec 2020. That indicated “not less than 11.0p” adj EPS.

Yesterday’s update looks in line with that, and a decent reduction in net debt too -

.

Outlook - confident, nothing specific said.

My opinion - as mentioned last time, I think this share looks potentially interesting.

It’s certainly proven that its business model is resilient in an incredibly difficult year, so that increases the appeal, if you’re worried about the future. 2020 was the ultimate stress test for many companies, and we now know a lot more about how all companies perform in a crisis - valuable information.

I’d prefer to see a stronger balance sheet, and think the valuation currently looks about right.

Maybe it will need to do more acquisitions to more convincingly grow earnings? That wouldn’t sit well with an already negative NTAV balance sheet.

.

Flowtech Fluidpower (LON:FLO)

Mkt cap £61m at 100p

Specialist full-service supplier of technical fluid power products and services

FY 12/2020 revenues down 15%, with an improving trend in H2

“Small underlying profit”

Net debt down to £11.7m (£12.6m if delayed payment to HMRC is adjusted for)

Liquidity - sounds alright - bank facilities of £25m renewed in Nov 2020 for 3 years, and covenants adjusted

Cost-savings - some have been implemented, others are deferred into 2021 due to covid

Outlook - uncertainty means difficult to forecast, hence no guidance. Dividend policy under review. Cautiously optimistic.

My opinion - a bit uninspiring.

.

Xlmedia (LON:XLM)

Mkt cap £64m at 33p

XLMedia (AIM: XLM), a leading global digital performance publisher, today provides an update for the year ended 31 December 2020.

It did $27.7m revenues, and $5.1m adj EBITDA in H1.

Today it says the full year figures are $54.5m revenues, and $11.5m adj EBITDA.

That seems to show a sequential improvement in H2 over H1, from $5.1m in H1, to $6.4m in H2 adj EBITDA.

The company is trying to recover earnings from the lucrative casino sector, which it lost when Google penalised its sites in early 2020.

My opinion - it seems to be making progress. However, it doesn’t interest me at all, because earnings cannot be relied upon. Earnings have to be sustainable, as the first step for me wanting to invest in anything. Profit here largely evaporated when Google spotted that it was gaming their advertising system. That's a very flimsy business model.

.

Scapa (LON:SCPA)

Party time here! Recommended takeover bid at 210p cash.

18.6% premium to last night's close - not amazing, but this is double the lows of 6 months ago.

Kicking myself here, as I spotted the value and wrote about it here, at around 100p, bought some, but got shaken out of them, probably on a margin call as usual.

I remember speculating whether Scapa would be a bid target, as it has substantial operations in the USA. The acquirer is: Schweitzer-Mauduit International, Inc.

Inc. usually means it's American, which would make sense.

Shareholder support - is only at 16.65% so far, not enough to get it through. So I'd say there's no certainty this bid will proceed. Is the premium enough to convince shareholders to sell out? Will a higher competing bid crop up? Who knows.

My opinion - Scapa has had problems in the past, especially losing a lucrative customer contract, and legal action which is not yet resolved. There's a lot to be said for banking a nice profit in the last 6 months, and moving on. There again, an 18.6% premium is not madly exciting, so even if the bid fails, the share price wouldn't drop that much. A higher competing bid is possible. Tricky one, what to do? Sell in the market now to lock in the gains, or hope for a higher bid? That's your call. I sometimes sell half in this type of situation, then you win either way.

It feels like the Americans are cherry-picking good UK listed companies, and leaving us with what they don't want! Lots more possible takeover bids are in the pipeline, one of my city contacts tells me. He reckons many big investors (e.g. private equity) feel they missed out by being too cautious after 2008, so are much more gung-ho now.

.

.

Scs (LON:SCS)

(I hold)

Market cap £80m at 210p

ScS, one of the UK's largest retailers of upholstered furniture and floorings, today issues the following trading update ahead of announcing its interim results for the 26 weeks ended 23 January 2021 on 16 March 2021.

I don’t think there’s anything to be gained by trawling back through previous updates, and scrutinising how sales statistics have changed. The reason being that on/off/variable lockdowns render comparisons meaningless, and we see pent-up demand kicking in after lockdown periods.

So let’s look at the whole 26 week period, which contains a mixture of trading conditions -

Gross sales in the 26 weeks to 23 January 2021 increased 13.9% to £182.3m (2020: £160.1m). This increase is due to the significant order intake growth seen in June and July 2020 following the first lockdown, together with the strong trading in the first quarter of the current financial year. Unlike the first national lockdown, and in line with government guidelines, our distribution centres have remained operational throughout the period and continue to deliver goods to our customers.

As at 23 January 2021, the Group's order book is £90.5m (including VAT), £16.8m larger than at the same point in the prior year.

I’m happy with that. H1 revenues up 13.8%, and a closing order book up 23% on LY. Very good.

Online sales - are up 98% vs LY in H1, but that’s not much use as they don’t tell us the actual figures. After all a minuscule amount +98% is still minuscule! I’m not saying online sales are minuscule, but we really do need to be told the actual numbers, as well as the growth rate.

That’s a general point, applicable to all companies. Far too many of them try to hide the poor level of online activity by just talking about online growth, but don't give absolute numbers.

Why does it feel like a constant battle, trying to find out what’s actually going on, when reading trading updates? Far too many advisers trying to be clever, muddying the water, if you ask me. Transparency is best, all companies should aim to emulate Next (LON:NXT) and its disclosures.

Balance sheet - a standout feature with ScS, as mentioned here before, is the wonderful balance sheet. Customers pay up-front, so it has pots of cash. Reported at £91.8m as at 23 Jan 2021. That’s more than the market cap (of £80m!).

The contrast with larger competitor Dfs Furniture (LON:DFS) couldn’t be starker - DFS plunders the customer cash to finance the business, with debt on top. ScS doesn’t touch it, leaving the customer cash piled up on the balance sheet. Maybe there’s a middle ground, where ScS could be a little more aggressive?

I’d like to see ScS buy up some struggling competitors on the cheap, once the target has gone into administration for example, and do deals with the landlords to operate more profitably on turnover rents. Or buy some freeholds, if they're cheap?

This is a time of opportunity, especially for a cash-rich company like ScS, to do some careful but lucrative deals, laying the foundations for future growth. It needs to grow, which would also help move the market cap up into a territory where more institutions would become interested, and hence the rating would probably rise. At the moment, ScS shares seem to be permanently stuck in value territory.

Divis - nothing said about this today. Given the huge cash pile, there’s no reason at all why the company couldn’t restore the previously generous divis. If the company restores the last 16.7p divi, in due course, then that would be a yield of 8.0%! That’s extremely attractive. Therefore, I reckon income seekers (e.g. SIPPs in drawdown) would do very well to consider this share as a future generous yielder.

A policy decision has been made to hold back divis (maybe the company doesn’t want negative publicity possible from rewarding shareholders at a time like this?), but that doesn’t matter. It’s the company’s capacity to pay divis in the future which counts, and on that front this share looks very good to me. Once generous divis are restored, that could trigger a re-rating, so the possibility of maybe a 50% capital appreciation too, for investors who are happy to wait.

This is what the company last said about divis, last year -

Despite the strength of our balance sheet, the Board did not feel it was right to pay an interim dividend at a time when the economy was facing such uncertainty and that the Group was receiving government support. It seemed inappropriate to use the cash for anything other than protecting the financial strength and resilience of the business at such a crucial time. The Board recognises the importance of income to the Group's shareholders and will continue to assess when it is sensible to recommence dividend payments.

[source, RNS 29 Sept 2020]

My opinion - very positive. It’s a boring, overlooked company that is trading well, with a bulletproof balance sheet, and high future dividend paying capacity.

The only thing missing today is any mention of profitability! It sounds like we're probably in line, but mgt is coy about saying anything, as the outlook re covid/re-opening is still so uncertain.

That fits very comfortably in the value section of my portfolio. I’m happy to sit tight, and probably might add more to my existing holding on any dips. It’s proven very resilient throughout covid. Don't expect any fireworks with the share price, as sellers always seem to overpower any attempt to rise. But who cares? That's only temporary - eventually strong fundamentals drive things up where they should be, it's just a question of being patient. Plus an advantage of sellers, is that we can buy as many shares as we want. That's not always possible once the sellers have finished. So a depressed share price, combined with strong fundamentals, strikes me as more of an opportunity than anything else.

The chart looks lacklustre, but if you add divis on, the total shareholder return has been better than it looks, and there's plenty of upside to come I reckon, if strong performance of the business continues.

.

.

Strix (LON:KETL)

Market cap £503m at 244p

Strix Group Plc (AIM: KETL), the global leader in the design, manufacture and supply of kettle safety controls and other complementary water temperature management components, is pleased to announce the following trading update for the year ended 31 December 2020.

Key points -

- “Marked recovery in H2 as anticipated”

- Adjusted profit after tax of c.£29.5m, up 2% on LY

- Strong order book visibility for Q1 2021

Positive commentary on both the core kettle controls division, and water filtration (LAICA acquisition). New products, and geographic expansion planned for 2021.

HaloPure - I’m not so sure about this acquisition. Looking back at its time as a standalone listed company, its performance was dismal - tiny revenues, and loss-making. So why would it suddenly become good?

Admin costs - looking at the 2020 H1 results, the P&L looks unusual, in that most of the gross profit flows through to the bottom line. There seems to be very low administration costs, only £1.4m in H1. Although considerably more (£2.5m) are classed as exceptional in H1 2020, and £4.0m exceptional admin costs in H1 2019.

The company says that it’s highly cash generative, and has a robust balance sheet (which it actually doesn’t, as if often the case when companies make such a claim).

Balance sheet - as at 30 June 2020, KETL had NAV slightly negative, at £(1.2)m

If we deduct £9.4m intangible assets, then NTAV was negative £(10.6)m

There was £49.0m borrowings in long-term creditors, a hefty chunk of debt.

This is quite obviously not a strong balance sheet. Whether that matters though? Probably not, if it can keep generating strong cashflows.

Cashflows are they really that good? The big divi last time seems to have been paid for through increased borrowings, not from profits. I see from the interims that in H1 2020 and H1 2019, more than half of the cashflows ended up going into capex, capitalised R&D, and purchase of intangibles. An amber flag here, it needs more work to get comfort on cashflows.

.

.

My opinion - I don’t like this one. Some accounting questions above, too much debt, a weak balance sheet, and a dubious acquisition of HaloSource.

In addition to that, the basic concept doesn’t make sense to me. Kettles are cheap, almost disposable, very simple items. There’s nothing high tech in a kettle. How come KETL can make so much profit, selling parts for kettles then? They seem to be made in China, so no respect for IP there. Hence surely the product would be ripped off & undercut by competitors? That’s what happens with everything else, so why would kettle controls be any different? It doesn’t make sense to me.

I’m sure the same question was asked by all the big name institutions who bought into the IPO, so there must be a persuasive answer to my question, which they will all have asked too, I’m sure.

Overall then, it doesn’t work for me, so I won’t be investing.

.

Jack’s section

Wynnstay (LON:WYN)

Share price: 340p (-4% at 09:30am)

Shares in issue: 20,051,043

Market cap: £68.2m

(Jack - I hold)

Wynnstay (LON:WYN) is a manufacturer and supplier of agricultural products that operates through two segments: Agriculture and the higher margin Specialist Agricultural Merchanting segment.

It’s one of those ‘boring’ stocks that often flies under the radar, but it has been flagged by the StockRanks for a long time now as offering great value across the board. The most recent stretch (highlighted) has seen its StockRank hit 100 several times:

With a market cap of around £70m, Wynnstay is unlikely to be turning the heads of any institutional investors quite yet, but what I see here is a very prudent and sensible company quietly executing on a proven strategy of organic growth and bolt on acquisitions. UK agriculture is actually quite a good space to be - this is a great land for farming - and Wynnstay has earned a valuable place in this ecosystem, built up over many decades.

While it might look like this share, and the profits it generates, never seem to go anywhere, there are signs of progress.

Breaking Wynnstay down into segments, Agriculture is resilient but undeniably low margin and at the mercy of commodity prices. Specialist Merchanting is higher margin and growing though, with improving returns on assets.

Although it only made up 27% of revenue in FY19, Specialist Merchandising contributed around 64% of group profit.

I think it’s an interesting company - modestly valued - with a history of cash generation, dividend payments, and a proven growth strategy, all underpinned by a hefty discount to net asset value. Probably one for patient, long term value investors. In fact, it provides a Scrip dividend programme for income seekers out there.

There are negatives of course. Low margins, commodity prices and the weather impact short term trading and it does look as though meaningful growth has been an issue over the past decade.

The winning word today is ‘resilient’, used five times. There are worse words, given the year that was.

Financial:

- Historically poor 2019 autumn planting season and 2020 UK harvest at 20 year low

- subdued farmer confidence and investment, reflecting weaker farmgate prices in H1 and Brexit uncertainty

- Revenue -13.7% to £431.4m (2019: £490.6m), affected by commodity deflation and reduced volumes in certain traded commodities,

- Increase in underlying PBT +4% to £8.37m but reported PBT down 8.2% to £6.98m,

- Basic EPS -11.6% to 27.73p,

- Net cash at year end increased to £8.42m; £14.71m before IFRS 16 implementation (31 October 2019: £3.84m before IFRS 16 implementation )

- Net assets increased to £98.18m/£4.92 per share at year end (31 October 2019: £94.95m/£4.79 per share)

- Proposed final dividend of 10p, meaning the total dividend of 14.6p marks a 4.3% increase.

Note 14 shows the bridge between reported and underlying PBT. Here it is:

Flicking over to Note 4 breaks out these non-recurring items.

That’s not the whole list of items, but it does make up the bulk of the charge. Store closures are understandable. The Goodwill and Investment impairment relates to GrainLink, Wynnstay’s specialist combinable crop marketing business.

This was largely due to trading volumes being impacted by the lowest UK wheat harvest since 1981, but the business still made a profitable contribution and Wynnstay expects ‘a significantly improved performance from GrainLink in 2021.’

Anybody familiar with Wynnstay reports will understand that this group is the opposite of the typical c-suite overenthusiasm. The top spots in companies often attract a certain type; students of the ‘Always look on the bright side of life’ school. It has its place. But it does also seep out into the tone of trading statements.

There’s none of that to be found in a company that originated as a co-operative of Welsh farmers, of course.

In fact you’re often left wondering if everything’s gone wrong until you look at the figures again a day later and realise they’re actually quite robust.

Conclusion

While the group notes poor conditions in the previous year, the numbers also show increased cash production, a rising net cash balance, increasing net assets per share, and a growth in full year dividend payment.

All this in a year where other companies have embarked on emergency placings at reduced share prices, and might be counting themselves lucky to be classified as a going concern.

These results bear the scars of the pandemic, but they also mean WYN trades on an historic PE of 12.6x falling to 10.7x, with an historic dividend yield of 4.17% rising to 4.25%. The net asset value of £4.92 a share is also worth bearing in mind.

I don’t think this company is going to rocket, but I do think it could rerate another 30% in the short term, and even double over a year or two if it can pleasantly surprise the market.

The shares are down today but Wynnstay continues to generate cash, invest for growth, and pay dividends to shareholders. The outlook section sees a notable change in tone from management, as well.

Now that a non-tariff trade agreement has been concluded with the EU, the picture for UK agriculture is significantly clearer and a major uncertainty has been removed. Wynnstay says the UK Agriculture Bill will change the way that farmers are supported by the Government and that it should benefit from opportunities to provide support here.

Agricultural commodity prices have generally improved over the past 12 months and the short-term outlook ‘remains strong’. Winter cereal plantings are significantly greater than a year ago, in line with a more normal sowing season. This will drive demand for arable inputs and yield a larger crop to trade post-harvest.

It says the new year has started well and it is assessing acquisition opportunities. This stock requires patience, but it also justifies a high Rank in my view.

.

All done for today! See you tomorrow.

Best wishes, Paul & Jack

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.