Good morning, it's Paul here with the SCVR for Tuesday.

Agenda -

Cloudcall (LON:CALL) (I hold) - yet another placing! (at 81.5p)

Boohoo (LON:BOO) (I hold) - Sky News article re Leicester supply chain (again!) and investigation in USA

Dx (group) (LON:DX.) - Interim results - shares look too expensive still

French Connection (LON:FCCN) - one down, but three more enter the fray - there are now 4 interested parties discussing a possible takeover. Formal Sales Process launched today.

Card Factory (LON:CARD) - Liquidity update, from last week

Hotel Chocolat (LON:HOTC) - Interim results

.

Cloudcall (LON:CALL)

(I hold)

Share price: 81.5p (pre market open)

No .shares: 38.8m + 9.2m new shares = 48.0m

Market cap: £39.1m

This was announced last night, with a follow-up announcement this morning, giving the result.

This is what I posted last night in the comments section of yesterday's SCVR, which many readers probably haven't seen yet -

Cloudcall (LON:CALL) fundraising - not again!!! Checking my notes, the last comment here was on 22 Jan 2021, where I flagged that net cash had fallen to only £3.6m, and expressed my displeasure with the company's performance.

On the upside, the recruitment sector which CALL mainly serves, seems to be recovering well.

Guidance provided in today's RNS for 2021:

Additionally, the Directors are now confident in providing new guidance for the 2021 financial year (for the twelve months to 31 December 2021) and now expect to achieve revenues of £14.0 million, representing an approximate 18 per cent. increase on 2020 revenues.

Not bad, but not amazing either, considering 2020 was suppressed somewhat by covid.

Guidance for 2021 costs is also provided:

The Company is also providing guidance for 2021 operating expenditure, which is expected to be approximately £16.9 million compared to 2020 which is expected to be approximately £13.9 million (including one-time COVID-19 related savings). More details are included in section 3 below.

I'm assuming we can deduct operating expenditure from revenues (as opposed to gross profit), so that would imply a £2.9m loss in 2021.

There's strong operational gearing here, with c.80% gross margins.

Longer term guidance:

Longer term, we continue to focus on achieving monthly EBITDA breakeven by mid-2023 and £50 million revenue run rate in 2026."

My opinion - it could have been worse, the main thing is that the 81.5p price isn't too bad a discount, once we ignore the obvious insider dealing that seems to have been going on!

Clearly, CALL has been disappointing, that's why the market cap is only £28m.

Personally, I'm going to hold this one to the bitter end, more through stubbornness than any strong conviction. It's not a big holding for me anyway. I think one of the American funds bailed out, or reduced, called Kinderhook.

Update today - results of fundraising

Yesterday it said a minimum of £6.0m would be raised in a placing at a fixed price of 81.5p. Plus a further £1.0m offer via PrimaryBid.

Result - additional demand has resulted in the placing being increased to £7.2m, but the PrimaryBid offer has only raised £0.3m, so £7.5m in total. I wonder how long it will take the company to burn through this latest dollop of cash?!

This will mean 9.2m new shares being issued, taking the total in issue from 38.8m, to 48.0m, an increase of nearly 24% - unwelcome, but not disastrously dilutive, and at least there was good demand for the fundraise.

CALL seems addicted to fundraisings, but must have spun a good yarn at the placing roadshow, otherwise it wouldn't have been supported by Instis.

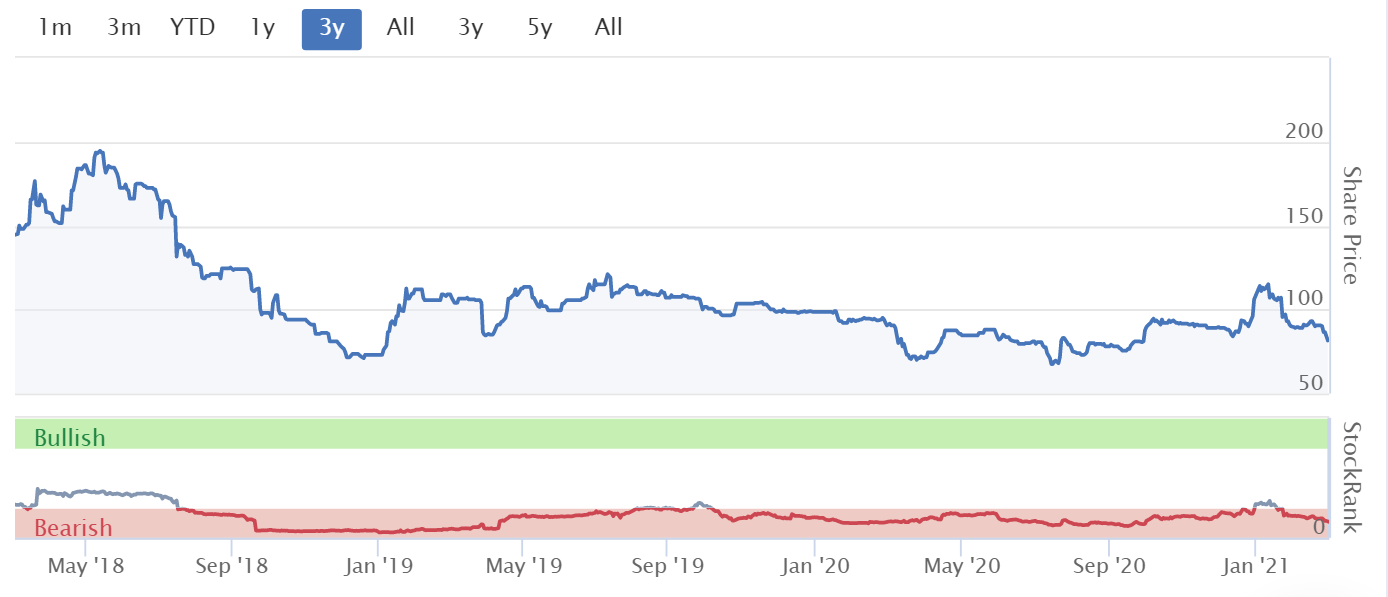

You can see from the chart below, that the share price began falling pretty much around the time the work would have begun on the fundraising in January probably. It's not good is it? I suspected something might be up, because everything else in my portfolio was rising, but CALL started going down.

We really do need reform of the system, to accelerate fundraisings, and suspend shares whilst they are underway. People buying CALL shares in the open market have been buying in a false market in recent weeks, since hundreds of people must have known that a fundraising was underway (and it looks as if somebody somewhere might have been insider-dealing, illegal of course, but rarely prosecuted). Why else would the share price have been falling in a rising market for smaller tech shares?

.

.

Boohoo (LON:BOO)

(I hold)

The Leicester supply chain issue has cropped up yet again. In this story, Sky says that a campaigning lawyer in the UK has stirred up trouble in America by reporting BOO to the US Customs & Border Protection, saying;

US Customs and Border Protection has seen sufficient evidence to launch an investigation after petitions from a campaigning British lawyer.

Sky says that this could lead to the possibility of a US import ban. Clearly that's an unwelcome risk, but this issue has been so comprehensively dealt with by BOO already, that it's in a very strong position to defend itself.

We already know that the third-party suppliers in Leicester were found wanting, with previous investigations, and that BOO has taken extensive action (a lot more than green-washing) to fix the industry-wide problem.

Sky quotes the lawyer as saying;

"What we'd all like, those of us interested in improving labour conditions, is for Boohoo to really get to grips with governance of their supply chain to ensure there is no wage theft and people have proper contracts.

Is he not aware of the extensive action that has already been taken to address this issue? I don't understand why BOO is being treated as if this is a new issue, when it's an old issue that is already being addressed. Therefore, BOO should be able to demonstrate very clearly that it's on the case, and is dealing with it.

I've no idea how US authorities deal with this kind of thing, so we'll have to wait and see how it pans out.

As Sky points out, more than a fifth of sales come from the USA. NastyGal in particular is a US brand that BOO acquired and seems to be trading well.

I suspect this might accelerate the shift of BOO production from Leicester, to lower cost producers in the Far East, where everyone else gets their clothing manufactured, e.g. by people being paid 50p per hour in Bangladesh. Leicester was used for speed to market, not low cost, because of course it's a high cost production area compared with Bangladesh, where apparently 4 million people are employed on far lower wages to make garments.

.

BOO has now issued a statement, which I summarise as;

- Not aware of any investigation, nor received any correspondence from US Customs & Border Protection.

- Confident in actions being taken to improve supply chain

- Continuing to fulfil orders to the USA

- Will work with any authority

- Alison Levitt QC's report stated that no evidence the company itself or its officers have committed any criminal offences

- Summarises all the things it has done to improve the supply chain under its Agenda For Change programme.

.

Dx (group) (LON:DX.)

30p (down 7%, at 10:08) - mkt cap £173m

Here are my notes from 2 Feb 2021, where I covered the interim trading update for this freight & logistics company. In summary, I liked the positive trading (materially exceeding market expectations), but didn’t like the high valuation nor the weak balance sheet. My conclusion then was that the run up to 36p looked a good opportunity to bank some profits.

The price is down to 30p now, including a 7% drop today, so it looks as if the results have not impressed.

A leading provider of delivery solutions,including parcel freight, secure courier and logistics services

Interim Results For the 27 weeks ended 2 January 2021

Rebuilding Profitability

Key numbers -

- H1 revenue £182.7m (up 7.4%)

- Adjusted profit before tax £3.8m (LY H1: loss of £(1.7)m)

- Adj EPS 0.65p (loss of (0.35)p)

- Net cash £14.1m (LY: net debt of £(8.4)m) - boosted by creditor stretch.

Cash generation of £12.8m is much higher than profits, with creditor stretch being a major factor. VAT of £11.4m has been deferred, and other (unspecified & unquantified) agreed deferred payments. Also note that this £12.8m cash generation figure isn’t real. That’s because lease payments of £8.3m appear further down the cashflow statement, thanks to IFRS 16, a huge distortion.

The first thing that strikes me is that, whilst it’s good to see a return to profits, the margin is very low, at only 2.1%. Although I wouldn’t expect much more from a freight company, it’s a low margin sector, because there's lots of competition. A lot of effort & capital, for not much return, hence why I don’t invest in this sector.

Divisional profitability - the figures shown are not very useful, because such a lot of costs, at £12.4m for the half year, are classified as central costs.

Outlook - sounds upbeat -

· Healthy pipeline of opportunities in the parcels market, building on our new ETA technology and expanding network

The second half of the financial year typically generates a greater proportion of annual earnings and cash flow than the first. With the planned easing of the national coronavirus-related restrictions, we now have greater clarity over when we can expect more normal levels of activity to return. This is especially relevant for our non-essential retail customers, which affects DX Express in particular. Given the robust current volumes and anticipated levels of new business, we expect the Group to make further strong progress with improving the overall level of operating margin and rebuilding profitability.

· Trading to date in H2 is significantly ahead of the same period last year, in line with management expectations, and the Board expects further strong progress in rebuilding profitability this financial year. It views prospects further ahead with an increasing level of confidence.

Balance sheet - looks weak. NAV: £26.6m, but deducting £31.1m of intangibles results in negative NTAV of £(4.5)m. Not disastrous, but flimsier than I would like.

Working capital - current assets of £43.6m (including £14.1m cash), compares unfavourably with £(67.1)m current liabilities, a very weak current ratio of 0.65. I we adjust for the overdue VAT, then the current ratio worsens to 0.6

The IFRS 16 entries for leases are noticeably large, with the current liabilities (annual rent roll) being £15.8m, which seems a lot.

Forecasts - Finncap has kindly updated us, with adj EPS of 1.4p and 1.8p for FY 06/2021 and FY 06/2022. That’s a PER of 21.4 and 16.7 - that’s too expensive for a low margin freight company with a weak balance sheet.

My opinion - a turnaround does seem to be underway, but I think the share price has overshot on the upside, and still looks much too expensive.

Personally I would value this share at 10 times next year’s earnings, so 18p.

Therefore at 30p, there’s no attraction to this share, unless you think the company can out-perform against forecasts.

Note that it’s not in a position to pay divis, due to the weak balance sheet, although Finncap does pencil in small divis in 2022 & 2023.

My other concern, is the declining DX service for solicitors. This involves renting a large number of small sites. Customers are using it less & less, due to email substitution. This is probably why the IFRS 16 lease numbers look so high, suggesting that DX has a long, and expensive tail of sites that it might struggle to exit from. These could become an expensive millstone, as customers drift away from the DX service. This service used to be highly profitable, hence why the shares were floated at a much higher valuation than now. Clever sellers, not so clever buyers, who obviously didn't understand that the high profits were unsustainable as email replaced physical papers being moved about by solicitors.

I don’t recall DX ever properly splitting out the figures for the solicitors DX service, it’s buried within one of the divisions. Things could turn very ugly, if customer business dries up, but DX is forced to maintain this large & expensive network of small physical sites. For that reason, I think this share actually looks quite high risk. So risky, and expensive.

.

.

French Connection (LON:FCCN)

(I hold)

25p (down 6% at 14:52) - mkt cap £24m

Two announcements today, both issued at 12:30, suggesting they were co-ordinated.

Gordon Bros & Spotlight Brands

Announce they will not be making an offer for FCCN. This was one of two groups which had previously been identified as having approached FCCN about a possible bid.

FCCN announces that it has been approached by, and held talks with, three more potential bidders. So that makes 4 in total now.

FCCN has agreed with the Takeover Panel (see the full code here) to launch a formal sales process (FSP). This enables interested parties to talk to FCCN confidentially, without a requirement to be publicly identified. That could flush out even more potential bidders, who knows? It also gives more time for Go Global (the original interested party) to consider its options, without the previous 5 March 2021 deadline applying.

Anyone interested in bidding for FCCN should contact WH Ireland for further information.

My opinion - hopefully this could be the end game for FCCN shareholders.

I’m sitting tight on my shares, as I believe that this is an internationally recognised, long-standing brand that has considerable value. The wholesale & licensing divisions are profitable, and the loss-making retailing division could be wound down, perhaps more quickly under a new owner. Then there’s the potential to drive internet sales harder.

Someone who claimed to know Stephen Marks, commented on a bulletin board (so it must be true!) that he’s been rattled by the insolvency of Arcadia, hence is amenable to selling FCCN now. That sounds credible to me. I think this would make a nice management buy-in - i.e. bring in new management as part of a deal, with fresh ideas & internet knowledge.

In terms of price, personally I would be happy with anything north of 50p per share, but ultimately it's worth whatever the highest bidder is prepared to pay, and of course it has to satisfy Stephen Marks' expectations, as he has a blocking stake.

Fingers crossed!

.

.

Card Factory (LON:CARD)

68p (up 22% at 15:26) - mkt cap £232m

This is a high risk, financially distressed greetings card retailer. The share price was bombed out at about 35p until about a fortnight ago, when something very strange started happening - the share price has doubled!

Has the company successfully resolved its problem bank borrowings? No! That's what makes it so peculiar. The latest update (Friday last week) says (key part) -

... we continue to engage in constructive discussions with our banking syndicate, who remain supportive of the Company. The banks have provided further waivers in respect of anticipated covenant breaches through until 31 March 2021, taking account of the Company's cash flow projections, subject to certain conditions.

We are engaged on a plan to refinance the Company, and will provide a further update in due course. Coupled with the expected reopening of the vast majority of the store estate during April, the Board is confident the business is well placed to deliver for the benefit of all stakeholders.

So the business is lurching from one month to the next, getting short term covenant waivers from its banks - a highly precarious position to be in. It sounds as if a placing is probably underway as we speak. Therefore the risk to anyone buying in the open market now, is that you end up gtting diluted heavily in a discounted fundraising. Personally, I would never chase a share price up where a fundraising is being done, in financial distressed circumstances.

Big shareholders probably cannot sell in the open market because they're likely to have been made insiders, if I'm right about a fundraising probably happening behind closed doors (it couldn't be much clearer from what the company says above).

My opinion - we're in a very frothy stock market at the moment, and share prices are not being driven by fundamentals any more. A good story is all you need. It's exactly like 1998-99, in terms of sentiment & market froth, in my view. The danger with that, is a lot of new investors, who don't really know what they're doing, are learning all the wrong lessons in this type of market, e.g. chasing story stocks, ignoring valuation, ignoring balance sheet risk, bunching together into bulletin board (Reddit?!) story stocks, frothy IPOs going to instant premiums, and all sorts of nonsense in the US markets like Gamestop, Tesla, Bitcoin, SPACs, it's all absolutely classic bull market top type of behaviour.

In that context, who knows what story the bulls in CARD are getting excited by? Could it be that the Moonpig float has reawakened interest in greetings cards? A bear might think that CARD has missed the boat. But a bull might say that CARD has a great opportunity to up its game by becoming the next Moonpig, with a load of nicely cash generative shops too, and low production costs of cards.

Once the shops are allowed to re-open in April, then they should start generating cash again, but with a pile of debt & other deferred creditors to be repaid. So forget about divis for the foreseeable future - that was the main reason for owning this share previously.

It's frustrating for me, because I focus on fundamentals, which is how shares are usually valued! Right now though, weird & wonderful things are happening, and I cannot explain why CARD has just doubled in price, after putting out a wobbly update, confirming that it is financially distressed, and that a placing is very likely to be underway right now, at an unknown price.

In normal markets, any rational investor would steer clear. We're not in normal markets though. For me risk:reward is out of kilter here, so I'll leave it for the speculators, and wait to see how the refinancing goes.

.

(insert chart here)

Hotel Chocolat (LON:HOTC)

377p (up slightly today) - mkt cap c.£460m

I'll have to finish this later, as my eyes have gone, so can't look at the screen any more.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.