Good morning, it's Paul here with the SCVR for Wednesday.

Budget Day today, so I'll be focused on that from lunchtime.

I've also got Hotel Chocolat (LON:HOTC) to finish off from yesterday, and 5 more companies reporting today that I want to look at (Norcros, Getbusy first, then Smiths, Cambria Autos and Barkby, if there's time). That's the plan, so I'll get cracking now!

Agenda -

Norcros (LON:NXR) - positive trading update, with guidance raised 12% for FY 03/2021. Looks good.

Getbusy (LON:GETB) - FY 12/2020 Final results. An interesting software business, with 1 highly profitable product, which subsidises 2 newer, loss-making products.

Smiths News (LON:SNWS) - Deep value share. In line trading. Looks very cheap, but has a weak balance sheet.

.

Norcros (LON:NXR)

235p (pre market open) - market cap £190m

Norcros plc ("Norcros" or the "Group"), a market leading supplier of high quality and innovative bathroom and kitchen products, is today providing a trading update for the ten month period ended 7 February 2021.

A positive update here, ahead of expectations -

Norcros continues to win share in its two main geographical markets, reflecting the Group's strong competitive and financial position. The Board remains confident that the Group's leading market positions, established brands, broad distribution channels and experienced management team will deliver further growth, notwithstanding that economic conditions are likely to remain uncertain as our main markets continue to adjust to the impact of the pandemic.

Consequently, it is now expected that reported underlying profit for the year to 31 March 2021 will be no less than £28m on a post-IFRS 16 basis and ahead of current market expectations of circa £25m.

That’s presented in a very clear way, giving us both profit guidance, and the figure for market expectations. It’s so simple, why can’t everyone report like this?

Revenues - Norcros was already reporting an improving trend, with Q2 (July, Aug, Sept) already up on LY on a constant currency basis, slightly behind in reported currency (for the South African part of the business).

Q3 (Oct, Nov, Dec) and the first month of Q4 (Jan) combined saw group revenues up much more strongly, at +114% reported and +117% at constant currency versus LY.

10 month YTD figures are now down 8% on LY, reported, and -4% at constant currency.

In summary, the group has now caught up with most of the previously lost sales from the worst impact from covid/lockdown/supply chain, in Q1. I’m impressed with that.

Net debt - down to only £(5.7)m at 7 Feb 2021. It was £(36.4)m at the start of the financial year, beginning 1 April 2020. That’s a big reduction, and gives scope to fund more acquisitions in my view. So far, Norcros seems to have made a good job of acquisitions, picking off good quality, profitable, complementary businesses, at reasonable prices. This helps gradually dilute the big pension deficit, into a bigger business, so the strategy seems to be working well.

Dividends - good news here, with divis resuming.

Diary date - scheduled trading update 15 April 2021.

My opinion - the share price has been strongly recovering, so the question is how much of the good news is already baked into the improved share price?

South Africa political/economic risks, and the big pension deficit, are negative factors that need to be taken into account when valuing this share.

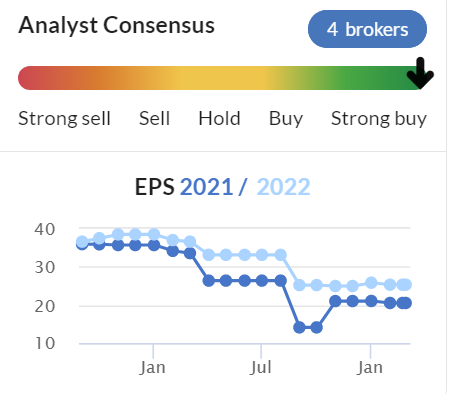

Existing broker consensus seems to be 20.5p, so if we assume actual is likely to be c.12% ahead of that, as implied by today’s update, then that’s a revised EPS of 23.0p. I can't see any revised broker notes yet.

At 235p per share, that’s a PER of 10.2 - sounds cheap, but Norcros is always cheap due to the huge pension scheme and its deficit. Therefore if history is any guide, there’s probably only limited scope for the PER to go higher than that. The StockReport graphs show that the PER range since 2015 has been between 4.4 and 12.6, averaging high single digits. Therefore the current valuation is probably about right. That said, I imagine this positive update today could inspire some buying, so maybe 10% upside on the share price might be reasonable in the short term.

Thinking longer term, if business can recover to pre-covid forecasts of c.35p, then a usefully higher share price could be justified. So this might be a decent longer-term value share to hold for a few years.

.

.

Note the high StockRank below the share price chart below. With broker upgrades feeding through in the next few days, this should remain high, currently 91.

.

Getbusy (LON:GETB)

107.5p (flat) - mkt cap £53m

GetBusy plc ("GetBusy", the "Company" or the "Group") (AIM: GETB), a leading developer of document management and task management software, announces its audited results for the year ended 31 December 2020.

"Our Group contains a combination of a proven, highly cash-generative market-leader [Paul: “Virtual Cabinet”], a rapidly and predictably scaling pure SaaS business in a large and valuable market [Paul: “Smart Vault”], and a new product [Paul: GetBusy] that solves increasingly relevant problems and that has the potential to open a significantly greater market.

There’s a lot of useful information in the highlights table -

Key points -

- Most revenues are recurring, giving good visibility & financial stability

- Modest overall loss, not a concern for a growth company

- Core business, Virtual Cabinet, is strongly profitable, but only 2% revenue growth

- Smart Vault business is growing strongly at +31% revenue, but losses increased to £(1.37)m

- Development spend is high, at £3.6m, mostly expensed - good, as it's R&D that drives progress, if spent wisely

- Lowish customer churn (see presentation slides for bridges)

- High gross margin, so more rapid growth would create excellent leveraged upside due to operational gearing

Results presentation slides are here (then click on “Download” under the third option, “Presentation”). These are useful for a quick introduction to the business & its 3 software products.

Slide 26 is particularly useful, in showing how the highly profitable product (Virtual Cabinet) funds the losses for the 2 loss-making products. Although I would personally take off the £1.5m central costs from Virtual Cabinet’s £3.9m profits, to arrive at £2.4m what I consider real world profits for Virtual Cabinet - still good though, and underpins a lot of the market cap.

The bull case is that we can value the shares on a multiple of Virtual Cabinet’s profits, then add in a speculative value for the 2 loss-making products. If the new products don’t work, then they could be jettisoned, leaving a nicely profitable core business that underpins the current market cap.

The bear case is that the loss-making products should be attributed a negative valuation, reducing the overall group value.

Balance sheet - is weak, unfortunately. NAV is negative at £(1.78)m. There’s only £0.8m in intangible assets, so NTAV is £(2.6)m. That’s not ideal, but for a subscription, recurring revenues company that gets paid a lot up-front, then it’s tolerable.

Remember that this group could move into profits & positive cashflow any time it wants, by curtailing the cash burn on the loss-making parts of the business. So it has flexibility, which is just as important as the actual numbers.

Also, I feel it is battle proven in 2020, being such a disrupted year, by covid/lockdowns.

Cashflow statement - a favourable £1,076k “income taxes received” stands out. Also £384k income from “forgiven PPP loan” helps.

My opinion - this looks an interesting little software business. It’s underpinned by a decently profitable core business. The profits & cash from that are being used to develop 2 new products - speculative upside if they work.

The share has done well recently, and the market cap has risen to £53m. Maybe that’s enough for the time being, based on fundamentals? But remember we’re in a roaring bull market for tech/growth companies, so bullish sentiment could take this share price up to higher levels, particularly if the newsflow is good this year.

Personally, I feel I’ve missed the boat, so probably won’t be buying any. Pity, as it caught my interest last year, but unfortunately (can’t remember why) I failed to buy any. It might have been lack of liquidity - I vaguely recall giving my broker a buy order, but we didn’t get filled. That’s the trouble with very small, tightly held small caps - it can be difficult to impossible to buy a meaningful stake, with similar problems when you want to exit if anything goes wrong.

Overall though, GetBusy gets a thumbs up from me. Well worth readers taking a closer look at it.

.

.

Smiths News (LON:SNWS)

29.2p (up 3% at 11:48) - mkt cap £71m

In April 2014 it changed name from Smiths News to the meaningless “Connect Group”, then recently in Nov 2020 reverted to the old name of “Smiths News plc”.

It’s a newspaper & magazines wholesaler.

Smiths News is pleased to report a robust operational and financial performance for the 26-week period to 27 February 2021, with profit and cash generation in line with market expectations…

The Company expects Adjusted EBITDA (excluding IFRS16 - leases)(1) to be £20.5m for H1 2021 and our Bank Net Debt(2) to be £71m at 27 February 2021, which would result in a Bank Net Debt to Adjusted EBITDA ratio of 1.9x.

Given the stable performance of the business in H1 2021, the Board continues to expect that full year financial performance will be in line with market expectations.

Bank facilities were a big worry, but were refinanced in Nov 2020, at a quite expensive rate of 5.5-6.0% over LIBOR.

Dividends - could be reinstated - update in May 2021. Personally I think it would be extremely unwise to resume divis, whilst its balance sheet is so ropey (negative NTAV). The group should be focused on debt reduction, and rebuilding its balance sheet. Surely the pandemic made that crystal clear, that companies need financial reserves to cope with unexpected events? Management here didn’t seem to get that memo. They sailed close to the wind in 2020, cutting it fine with getting the bank facilities renewed, but it worked out OK, so they were lucky.

Having said that, I've had a quick look at the FY 08/2020 results, which are surprisingly good, so management have justification for pointing out that the business is resilient.

My opinion - I was expecting to find something close to a basket case here, but not at all. It actually looks quite interesting at 29p per share. Obviously it’s always going to be cheap, because a newspaper & magazine wholesaler is a declining business. With the bank facilities sorted until late 2023, insolvency risk has probably gone for now, and shareholders didn’t get diluted in 2020.

Valuation metrics look attractive. I can’t see how a PER of 3.0 is justified! I’ve checked the figures, and it did 9.7p adj EPS for FY 08/2020, surprisingly good. So that PER of 3.0 is real, not an error or out-of-date forecast.

As a deep value share, this one looks worthy of a closer look by readers. I can see why it might be on a PER of say 5-6, but 3 is too low. I need to check the pension schemes more closely, but the last results seemed to show only small cash payments are necessary.

Dividends resuming, whilst I think that’s a mistake with a weak balance sheet, could provide a catalyst for buyers of the shares later this year. It’s quite tempting to have a nibble at these shares, even though it’s not a business I would normally want to invest in. The valuation does look quite compelling though, as you can see -

.

.

Have any readers looked into this one? If so, I'd be interested in your views. I'm writing this under time pressure, so am worried I might have missed something.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.