Good morning! Busy day for me today, as I have to get this report written, and then meet management of Spaceandpeople (LON:SAL) for lunch, to discuss in more detail what's gone wrong, and what they are doing to fix it.

Porta Communications (LON:PTCM)

Share price: 9.0p

No. shares: 229.7m

Market Cap: £20.7m

Interim results are published today, which look pretty good to me, although you have to be a bit sceptical with this company, as they've heavily over-egged results announcements before - which presented an overly optimistic view of performance in the past, in my view. This was most in evidence with stripping out "start up costs", which looked ridiculous, being defined as the first two years' losses!

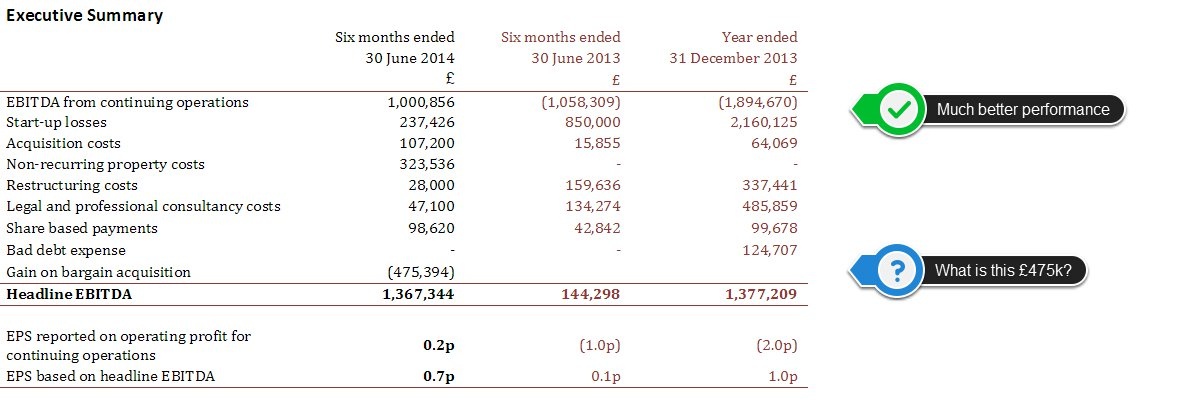

Profitability - I'm pleased to see in these interims that headline EBITDA of £1.37m benefits by only £237k by stripping out start-up losses, versus £850k start up losses in H1 last year. This suggests that all individual parts of the group are either profitable or close to profitable.

So it looks as if Porta is now a viable business, with a whisker over £1m in positive EBITDA in H1 of calendar 2014. That's a good turnaround from last year, as the following table from today's results shows;

There were some early buys first thing, as you would expect when much improved results are announced, but a big seller seems to be whacking the price at the moment (08:48), so I am pondering whether to buy some more? Although before pushing the buy button I'm trawling through the figures & narrative again, to ensure I haven't missed something that the big seller has spotted.

It looks as if the £1.0m continuing operations EBITDA figure has benefitted from the £475k "Gain on bargain acquisition", whatever that is? So altogether a rather confusing array of adjustments - what should we treat as bona fide, and what should be stripped out as genuinely one-off? It's difficult to decide, but at least it's clear that the company is trading a lot better than last year.

Ah, I've found a brief comment on the £475k credit to the P&L, which the company describes;

The acquisition of the WSM Digital business resulted in an estimated gain of £475,394 which has been included in the Income Statement in accordance with IFRS accounting requirements.

So I think that needs to be reversed out to ascertain proper underlying EBITDA, so we're looking at about £526k on that measure, for six months, so just over a million pounds in a full year. Note 6 in today's figures explains that this gain came from negative goodwill, by what looks like an arbitrary creation of an intangible asset for £510k for "brand and customer relationships", which as far as I am concerned is effectively fictitious profit. Hence the £475k credit definitely needs to be disregarded.

I'm relaxed about them using EBITDA in this case, as I've checked that nothing untoward is happening in terms of capitalising costs, and there was only £16k of costs capitalised into intangibles in H1, for software & websites. That's fine. There was a £405k amortisation of intangibles charged to the P&L in H1, which I am happy to disregard as the intangibles are mostly notional figures that the company has created for goodwill, customer relationships, brands, etc, all of which I regard as being best written down to zero.

Outlook - There are two sections in today's results with forward-looking remarks, as follows;

The Group continues to show rapid growth in both revenue and gross profit (fee income) reflecting the integrated product mix and the growing maturity of the start-up ventures together with the success of the expanding international capability. Organic growth is expected to be strong in the second half while the management team are looking to build critical mass in all the operational areas by selective quality acquisitions.

Given the improvement expected on the advertising side together with continuing strong organic growth in the public relations businesses both in the UK and overseas, the Board remain optimistic about the Group's future prospects.

So just a generic optimistic remark at the end, but note that strong organic growth is mentioned twice. That sounds encouraging, especially when combined with figures showing that the company is now in profit.

Balance Sheet - This is just about OK in my view. Net assets of £14.9m drops to just £0.4m when you write off the intangibles. The working capital position is just about OK, although WIP and Debtors look a little high to me, but not alarmingly so.

Net debt has reduced from £3.1m to £1.9m in the last six months, due to fresh equity being raised. The company seems well supported by big shareholders such as Hargreave Hale, who took part in Placings. That gives me comfort that growth has been achieved without excessive debt being taken on, and that possibly more Placings could be done if suitable acquisitions are identified. As long as they don't take the mickey with the discount on any future Placings, then I can live with that.

My opinion - The strategy here was to rapidly build an international advertising & PR group, and it seems to be going reasonably well. Today's figures are the first time the company appears to be making proper profit, i.e. not relying on accounting trickery to generate fake profits, which is what I feel they've done in the past.

You always have to be very careful with the accounts of PR companies, as it's their job to create positive things out of thin air for their clients, hence that approach will usually be taken with their own accounts too!

Overall though, this company is starting to deliver the goods in my opinion, and I'm encouraged by the move into positive EBITDA, and the outlook for H2 indicating strong organic growth. Therefore I'm happy to continue holding for another year. Note that there was a decent chunk of Director buying ££165k in total between 10-11p per share) in June 2014, so it will be interesting to see if the Directors dip into their pockets again now the share price is lower?

Note that the Directors are old hands in the PR sector, which is one of the key reasons I'm invested here - they've built a decent sized PR business before, so they already know how it's done.

It's been a rollercoaster for shareholders, see the two year chart below. My simplistic view of charts suggests that another wave up might be on the cards now, given that's what has happened in the past after a wave down:

Craneware (LON:CRW)

Share price: 528p

No. shares: 26.8m

Market Cap: £141.5m

This is a software company, based in Edinburgh, which supplies revenue collecting software to a quarter of the hospitals in the USA. That's a pretty jaw-dropping achievement, and this company must have significant strategic value to an acquirer. Hence I'm tempted to buy some just for the takeover potential. Imagine the cross-selling potential if you are embedded into a quarter of the hospitals in the USA with software that one imagines must be critical to those hospitals day-to-day operation?

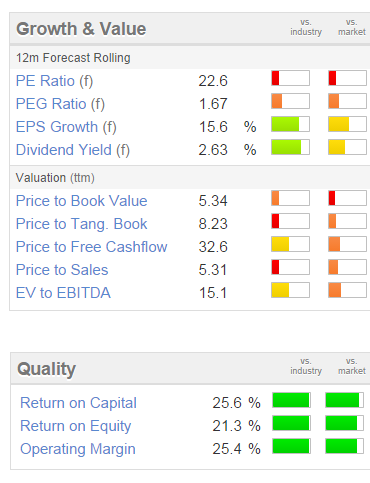

It's also a decently profitable business, making an excellent profit margin - see the green "quality" scores on the Stockopedia graphics below.

The trouble is, it's expensive on a PER basis, especially considering there doesn't seem to be much growth coming through, looking at today's results for the year ended 30 Jun 2014.

Turnover is up only 2.7% to $42.6m (NB. reporting in US dollars), and operating profit is up from $10.5m to $11.2m. That pedestrian growth is rather hard to reconcile with a PER over 20.

Outlook - sounds reasonable;

Investments in the business mean we have the people and the expertise in place to take us through the next stage of growth, building on our record sales performance. We have had a strong start to the current year, carrying on the momentum from the previous year and are confident we have the platform to deliver ongoing increased stakeholder value.

Balance Sheet - very strong, with plenty of cash.

Dividends - reasonable, with a yield of about 2.6%.

My opinion - if there was stronger growth reported, then I would buy some. I'm intrigued by the obvious strategic value of the business, so it might be one to pay a high price for, with the eventual outcome being possibly a highly priced takeover bid? Interesting.

Thalassa Hldg (LON:THAL) - the shares have plunged another 27% to 130p this morning on publication of lacklustre interim results. Disclosure of problems with some Russian contracts sounds like the trigger for the further move down, which looks serious - $10m of budgeted turnover for H2 won't happen. Given that H1 saw total turnover of $9.3m, then that's a massive chunk of H2 turnover now not happening. The reason is the sanctions imposed on Russia due to its activities in Crimea & Ukraine.

This all sounds a bit of a mess. However, I'm wondering if value might be appearing here, given the very strong asset backing, including plenty of cash.

I've not got time to look into it right now, but it's something I might return to when time permits, and ask around in my network to see what people with a better understanding of this sector think about the situation here.

Just thought I'd flag it to readers as something potentially interesting to have a look at, if you have the time & inclination. Your comments are as always, most welcome in the comments section below.

Got to dash, for this meeting with Spaceandpeople (LON:SAL). I shall report back my thoughts later, or maybe tomorrow?

Mello2014

Regulars will know that I am a keen supporter of David Stredder's "Mello" investor evenings, which he arranges for investors to meet many interesting company managements, and to network amongst ourselves. David has single-handedly built a wonderful network of investors, which has greatly enriched my life both through swapping investing ideas, but also making some terrific friends.

Anyway, David has decided to reinvent the market for investor shows, by launching his own one - where the companies presenting are interesting value & growth companies, not the usual collection of blue sky resource stocks.

The event is being held in Derby, over 3 days in Nov 2014, so not long now. Tickets have just gone on sale, and I am sure will sell out. Derby is only 1h 25m from London by train, and of course is much more accessible to all the investors in the North, who are normally frustrated by such events usually being held in London.

Stockopedia & myself will be there too, plus loads of superb speakers - not the usual culprits, but highly successful fund managers & millionaire self-made investors, hand-picked by David to share their wisdom with us all.

The event website has just gone live,and is here. It's the first such event (as far as I know) that has been organised for investors by a highly successful investor, rather than being done for commercial gain. So it's going to be fantastic. Hope to see you there.

Running late, got to dash.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PTCM.

A fund management company to which Paul provides small cap research ideas, has long positions in PTCM & THAL)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.