Good morning!

eg Solutions (LON:EGS)

Share price: 82p

No. shares: 16.5m

Market Cap: £13.5m

This is a small software company which sells back office optimisation software to large companies (e.g. insurance & energy companies). They had a stand at the Stock Market Show last Saturday, so I dropped by and had a chat with a Director about the company, and learned a bit more about what they do. I bought a little stock for my pension not that long ago after an intriguing contract win announcement - I like small companies which report large contract wins with large customers - that tends to be good evidence of the company having a valuable product which might continue to sell well elsewhere.

So even though the historic performance of EGS has been poor, I was satisfied from talking to the Director that there were known reasons for previous poor performance, and that the company was now getting onto the right track. Because of the lack of liquidity with these shares (very small market cap, and shares are tightly held) I would only ever have a small position in this company - it's important to be able to exit if something goes wrong, and that can only be done with a small position usually.

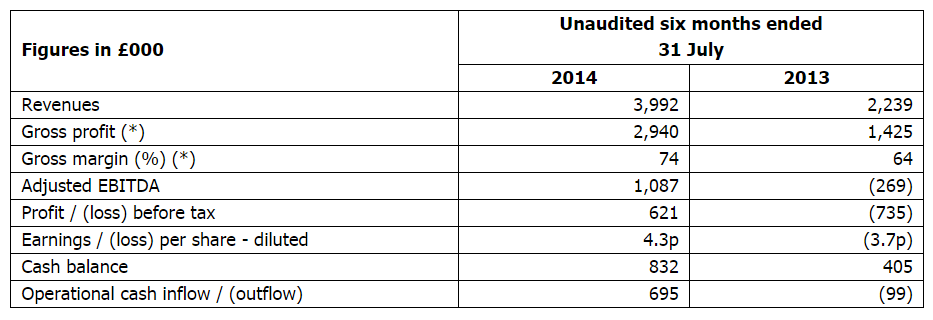

Interim results for the six months ended 31 Jul 2014 are published today. As you can see from the headline figures copied below, the numbers look good:

Although note that the company had already indicated that turnover would be around £4m, and profit above £600k, in its trading update of 20 Aug 2014, which I reported on here.

Outlook - today the company says;

The Company has made a strong start to the financial year, with significant growth in revenue, profits and cash generation. We are making demonstrable progress in the global workforce optimisation market, with multiple new and existing client wins during the first half. This improvement has been achieved with measured enhancements in our operating infrastructure. The Company has a substantial market opportunity and the leading software product. We will continue to invest to ensure we achieve the true growth potential of the Company and remain confident of delivering our full year financial performance in line with expectations.

Note that an H1-weighted year is expected, with the full year forecast only seems to be £0.3m, suggesting a loss for H2. That doesn't look right to me, and I vaguely remember seeing a forecast a few weeks ago suggesting just under £1m profit for the full year, so something like £300-400k for H2.

There were some large one-off contract wins in H1, hence we probably shouldn't get too excited about the H1 profit, or extrapolate it out.

Balance Sheet - is rather weak, with net tangible assets of negative £200k. Working capital is a tad on the weak side, with current assets being 100% of current liabilities, which is a little lower than I would like (over 120% is my usual minimum). So I wouldn't be surprised if the company does a Placing to strengthen the Bal Sheet at some point. That could be why the company is keen to talk to private investors, to get the share price up before a Placing? Maybe I'm being cynical there, but it is the usual pattern that we see time & again with smaller companies.

My opinion - an interesting little company, which seems to be trading well at the moment, so let's see how it pans out. It obviously has to be seen as high risk, being small, and with a poor historic track record.

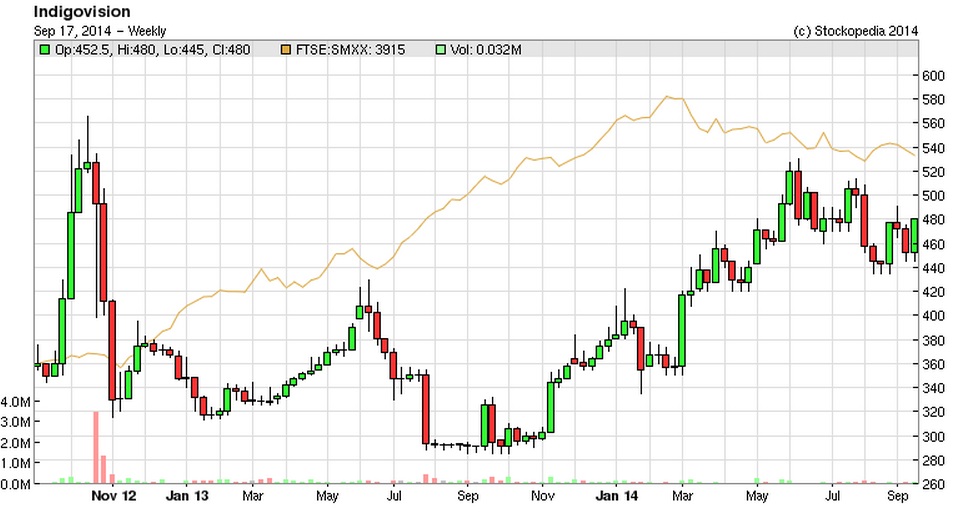

Indigovision (LON:IND)

Share price: 480p

No. shares: 7.6m

Market Cap: £36.5m

I read the results this morning, and then went back to bed, as all was well.

Results published today are for the twelve months to 31 Jul 2014. This was the old year end date, but this year the company has changed its year end date to the more normal 31 Dec, so there is a one-off 17-month period this time, hence today we have a second set of interim results, before finals for the 17 months ending 31 Dec 2014 will be published probably in Feb 2015.

It's a completely common sense move, which was announced a long time ago, in advance, so there is nothing untowards going on - i.e. a change of year end, if announced very late, is usually done to cover up poor results. That's not the case here though.

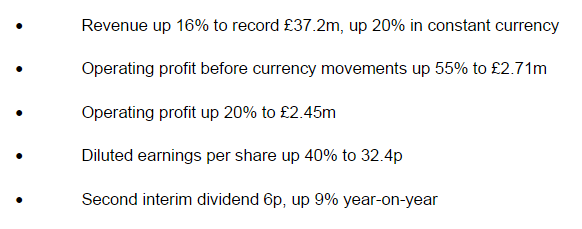

The financial highlights speak for themself, and look impressive in my opinion;

Currency - I am pleased to read that the company intends to change its reporting currency to US dollars, since it invoices customers mainly in dollars, and purchases its equipment (from outsourced manufacturers) from the Far East, hence are invoiced by them in US dollars, as is the norm. So it makes obvious sense to report in dollars for the company overall, which will stop the yoyo effect of currency tranlation. It also pre-empts any issues from possible future Scottish independence, which I rather like.

R&D - Note that the £2.4m operating profit is stated after fully expensing £3.4m of R&D, which is the right way to do things, not capitalising such spending, as many companies do. I am a firm believer in the value of R&D spending, and it's good to see IND spending 9.3% of turnover on R&D, as that spending today creates the competitive advantages (and hence profits) of tomorrow.

Valuation - with diluted EPS reported at 32.4p, and the shares currently at 480p, the PER is 14.8 - not a particularly demanding valuation given that underlying (i.e. constant currency) profit has just risen by 20%. So that's a PEG of 0.74 (where anything under 1 is usually seen as good value).

PEG only works if growth rates can be maintained of course! So let's dig out the forward-looking comments from today's announcement.

Outlook - this sounds positive;

The last twelve months has seen good growth throughout the business, record sales, and a strong operating performance. More importantly, IndigoVision's position as a key industry innovator has been enhanced through rapid development of our product range, and internal and customer confidence is high. Current trading is strong and we expect to report good results for the seventeen months to our new 31 December year end.

IndigoVision has delivered strong growth throughout the business in the twelve months to 31 July 2014. The final five months have started well and we expect to report good performance for the seventeen month period to our new financial year end.

Perhaps more importantly, the medium and long term outlook for the markets in which we operate continues to be favourable. Although there is effective competition, IndigoVision is well placed relative to its peers as far as product range and performance, reputation, innovation, global sales coverage, and distribution network are concerned.

It therefore seems likely that the excellent progress in the last twelve months has been the beginning of a more sustained period of growth and we look forward to the future with a sense of confidence.

I particularly like the sentence about this being the beginning of a more sustained period of growth, which reassures that this is not another false dawn, of which there have been several in recent years.

Balance Sheet - this is strong, with current assets being 251% of current liabilities, which warms my cockles.

Dividends - the company has a history of generous dividend payments, including a special dividend of 70p a few years ago, which I suspect was to deter predators who were circling at the time, from using the company's own cash to part-fund a takeover bid!

A 6p divi was paid in Apr 2014, and another 6p has been declared today, payable on 16 Oct 2014, with the ex-divi date being 26 Sep 2014.

My opinion - I meet the CEO & FD every six months, and have been tremendously impressed with the methodical, structured plan to turn the company around. So much has been going on behind the scenes to improve every aspect of the business, and we were always told that year 3 of the turnaround plan would be when things would come together, with growth resuming - and that's exactly what has happened now that we are in year 3. Therefore I remain an enthusiastic holder of these shares. Hopefully there will be more upside to come?

Spaceandpeople (LON:SAL)

Share price: 44p

No. shares: 19.5m

Market Cap: £8.6m

A couple of readers have asked for feedback from my meeting with SAL management yesterday, so here goes.

I should preface this by saying that I am supportive of management, but my sanguine view was not shared by another person in the meeting who I had a post mortem with at the pub, so there is a chance that confirmation bias might be creeping in with me? I'm trying to be objective, but fully accept that maybe I'm looking for positives?

The shares had been peaking around 150p in the spring of this year, after good 2013 results, and an excellent multi-year track record of growing profits & dividends. The shares have since dropped by more than two thirds, after two profit warnings. To refresh your memory, here are links to my reports on the profit warnings this year;

Profit warning of 17 April 2014

The meeting I attended yesterday started with the company giving a presentation, the main thrust of which was to explain what had gone wrong this year, and what they are doing to fix it - which is exactly what I wanted to hear.

What has gone wrong?

The company said that performance up to July had been in line with the revised forecast for this year, but that problems began to emerge in August, and worsened in Sept. So the company firmly refuted any suggestion that they had been slow in informing the market about deteriorating performance. I'm prepared to take that at face value, and one person in particular in the meeting grilled the company very hard on this point.

The specific problems causing the second profit warning in Sep 2014 were;

- German retail - some empty kiosks, combined with minimum rental payments due to landlords has hit the bottom line.

- S&P+ (the subsidiary which does experiential, i.e. face-to-face marketing campaigns) had a big contract deferred until the Spring of 2015.

So what are they doing to fix things?

- Negotiations are underway with German landlords to amend contract terms, which the company believes is in their mutual interests, so they are hopeful of success here.

- New business initiatives - including a new kiosk design which can be used by multiple vendors, hired out on a weekly basis, at much higher margins.

- The company has a much sharper focus on higher margin business now, and is not renewing contracts which generate turnover but little profit (hence the drop in UK business recently).

- Win new venues - contract negotiations are underway, but are more protracted than in the past, because SAL has tightened up its contract terms, and Malls are pushing back against this.

- Reduce overheads - £700k p.a. cost-cuts have already been implemented, which is a very material sum.

Budgeting process

Myself and others have been critical of the company's overly optimistic budgeting process. In particular lowered forecasts were issued to the market in April 2014, which also turned out to be too optimistic. The company accepted these criticisms, and made it clear they have now taken a much more conservative approach to forecasting, so the revised forecast of £ 800-1000k profit for 2014 is a figure they are happy to hang their hats on.

2015 forecasts have been prepared on the basis that new business will come in 6 months later than hoped for, and heavily risk weighting new business (i.e. putting things in at e.g. 25% probability of success). A couple of quotes - "we've stopped looking at the future through rose-tinted glasses", and "We're preparing budgets with a much more jaundiced eye". I think they accept the criticism that it should have been like this to start with, but as the CEO pointed out, the company has had disappointments before, but has always managed to recoup lost business elsewhere - but that hasn't happened in 2014.

Is the business model broken?

We discussed this at some length, and having run through some numbers (I didn't realise the rents on kiosks are so high!) it's clear to me that the revenue made by shopping centres from kiosks is far too important for them to forego for aesthetic reasons. So my concerns that kiosks might be on the wane, look misplaced. Although SAL do need to focus more on providing quality offerings to Malls.

SAL completely dominate this niche, with hardly any competition. The main competition is Malls taking the management of kiosks in house. Contracts are being amended so that Malls cannot simply poach SAL vendors, and put them into a permanent unit, without properly compensating SAL.

Management emphasised that they are winning new business, e.g. a large new mall in Birmingham.

I wondered if SAL might be a business that is counter-cyclical - i.e. doing well in Recessions, when Malls are desperate for revenue, but less relevant in more buoyant economic times? Management firmly refuted this suggestion, and stressed the capital value added to a Mall from the increased rents from kiosks. So the only issue is that some Malls will from time to time take the kiosk management in-house. That has always been the case, and those clients usually come back to SAL after a couple of years managing it themselves, and finding that they are not as adept as SAL at maximising the revenue from kiosks.

I asked if management have been fire-fighting this year? They replied yes. So the strategy is now to improve margins, and get the business back on track.

"We're the biggest & best at what we do in Britain & Germany".

"All the problems this year have either happened at the last minute, or have come from left-field".

New non-Executive Directors

The Chairman has bowed out due to being too busy to focus on SAL, and having been there 8 years felt his time was up. A heavyweight new Chairman is hopefully lined up for appointment in Oct 2014.

The company has also had a refresh of the Non-Execs, and the CEO spoke highly of the two new Non-Execs, Steve Curtis, and George Watt (currently the CFO of STV Group) who both have highly relevant experience & contacts. It is also an endorsement of SAL that high calibre people want to join.

Rebuilding trust

Management are open about this being a disastrous year, and they seem to accept that, and have learned from it. The CEO said, "I know we have to deliver this year's (revised) figures". It was pleasing to hear the CEO emphasise how he feels personally responsible to shareholders, and is gutted that things have gone badly this year. OK it's only words, but he meant it I think.

My opinion

With the market cap now only £8.6m, I feel that the market has thrown the baby out with the bathwater. The company is still profitable, and should deliver £ 800-1000k profit this year. It's not under any cash pressure, and will still pay a (reduced) dividend of 2p in the spring of 2015.

That said, after 2 profit warnings, you can understand the market now being very sceptical, and not being prepared to believe the revised forecasts. The latest forecasts (much more conservatively prepared) for 2015 are for a £1.5m profit (base case), with an upside case of £1.85m. This is a much better way to steer the market, and I'd be very surprised if they are not able to achieve those figures.

Therefore, if I'm right about next year's forecasts being achievable (which they should be just on the basis of the cost-cutting already done), then these shares should be at least 50% higher this time next year, maybe more?

So personally I am prepared to back management here, and let them get on with turning the business around, whilst acknowledging that this year has been extremely disappointing.

Got to dash now. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in EGS, IND & SAL.

A fund management company which Paul assists with research ideas, also has long positions in IND and SAL)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.