Good morning! A quick, and early report today, as I have a packed diary of meetings in London today! So I really hope just for once, the train will be on time.

Regenersis (LON:RGS)

I listened to the Webinar yesterday, and it struck me that the sell-off in these shares seemed overdone, so I bought a few as a trading punt at about 221p. Lucky timing, as the price rose nicely into the close yesterday afternoon.

An announcement this morning states that two Directors have bought shares. The FD bought 12,500 shares at 235p (splashing out £29k), but Hanover Investors (connected with two other Directors) bought a more meaningful 212,000 shares also at 235p (costing £498k). So two Directors spending £527k is a decent sized signal of confidence in my opinion, and I expect the share price will continue recovering today on the back of this news.

(Note that Hanover banked £17.5m by selling shares at 300p in Jan 2014!)

Mission Marketing (LON:TMMG)

Interim results to 30 Jun 2014 are issued this morning and look alright.

Headline operating profit is up 3% to £2.1m.

The Balance Sheet here is my main concern, as it is negative once you write off intangible assets. However, net debt has come down to £7.3m, although as the company states in the narrative today, H1 tends to see a stronger cash inflow than H2. I recall a meeting with the FD last year, when he explained that debt was under control again after a difficult patch, and that looks about right to me.

Outlook - positive, but they've given themself some wiggle room in case anything goes wrong in H2!

Our financial performance remains solid. As in previous years, our second half weighting creates challenges ahead but, as we stand, we are confident that our business remains on track to deliver against our year-end expectations.

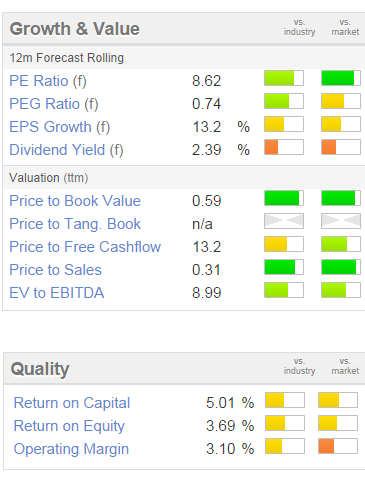

Valuation - it looks good value on a PER basis, but once you adjust for net debt, the valuation increases to a level that I think looks about right, maybe slightly on the cheap side? Note that the quality measures are on the low side, so it should be on a relatively cheap valuation:

Dividends - the yield is nothing to write home about, and there are better yields in this sector, e.g. Creston (LON:CRE) and Centaur Media (LON:CAU).

My opinion - I recall being bullish on TMMG shares last year, when they were about 26p, but they have almost doubled since then, so the big re-rating has already happened in my view. Given the still fairly high net debt, and the weak Bal Sheet, I'm not tempted to revisit this share at the moment.

With the UK economy now recovering quite strongly, but European economies weak, I wonder how sustainable the UK recovery is? For that reason I'm not prepared to assume that earnings will continue to rise at cyclical firms such as this. They may have already seen the bulk of any recovery that's likely to happen, at least in the short term anyway? So overall, the current valuation of these shares looks about right, or possibly with another 10% upside on it perhaps? That's not enough for me - I generally look for a clear 50%+ upside on the current valuation, as being sufficient reward to compensate me for taking on the downside risk.

Haynes Publishing (LON:HYNS)

Results look quite good, especially given that the share price has been weak of late.

Watch out for the pension deficit here. Also, there is something funny about share capital I think - are there 2 classes of shares? That needs double-checking, although I think it's OK if you base the valuation on EPS.

I quite like this company, as the march of technology will not affect the need for workshop manuals for DIY mechanics - it really isn't practical to use a tablet when you're taking apart a car engine. I know because I've done it, mind you tablets hadn't been invented then, so a Haynes manual was the only option! A battered, oil & brake fluid-splattered Haynes manual is a badge of honour for any young driver!! Long may that continue.

The dividend looks reasonable.

Overall, there's plenty of life left in this old-style publishing company, which is great to see. The shares are horribly illiquid though, so it's a long term position, if you can get hold of any shares at all.

Toumaz (LON:TMZ)

Interim results this morning show that it's still burning through cash like it's going out of fashion - cash at bank has dropped from £21.5m to £13.2m in the last six months. So the company will be back asking for more in the not-too-distant future, yet again.

That said, it has a great story to tell - their blue sky product is sticking plasters which wirelessly monitor patients vital signs, for use in hospitals. So it's a "this could be HUGE!!!" type of story stock, and that is reflected in a very racy valuation - nearly £100m market cap for a company hemorrhaging cash is not the type of thing I'd be comfortable with.

Sorry got to dash now. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in RGS, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.