Good morning!

Volex (LON:VLX)

The FD has resigned after just 18 months, which makes you wonder if the much vaunted recovery in trading is actually happening? I remain very sceptical.

The company couldn't resist the opportunity to include a little ramp for the shares, as it invariably does, saying;

This company needs to stop the PR talk, and just deliver some decent results. Maybe the FD agrees with me that the future is unexciting for Volex, so is seeking pastures new?

Low & Bonar (LON:LWB)

Share price: 47.5p

No. shares: 327.8m

Market Cap: £155.7m

As you can see from the chart below, shares in this building materials company have really come down a lot recently, so I'm wondering if it might be worth picking up a few?

Checking my notes here, the company warned on profits on 5 Sep 2014.

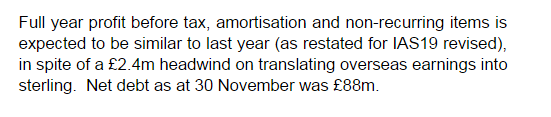

Trading update - today seems to pretty much confirm what was said in Sep 2014;

Checking back, the company reported 6.2p adjusted EPS last year, so assuming the same this year, then that puts it on an attractively low PER of 7.7. However, net debt of £88m is very high, and that works out at 26.8p per share, giving an Enterprise Value of 74.3p per share. So earnings of 6.2p puts that on a PER of about 12. I've not adjusted out the net interest cost, so the actual PER would be a bit lower than 12, but it gives a rough idea.

Balance Sheet - I've had another look, and I just cannot get comfortable with such a high level of net debt.

My opinion - I'm very tempted to have a little dabble here, as there could be upside from a European recovery in due course. But it would only ever be a very small position, as the company has too much net debt for me to be comfortable taking a position of any significant size in my portfolio. That said, I imagine there might be some potential upside from the current share price, perhaps? The divi yield looks good, at about 6%, if that is sustainable?

Moss Bros (LON:MOSB)

These shares have been steadily declining in price in recent months, which is good because the price got well ahead of reality when it peaked at about 120p. I maintain that the company is probably worth about 60p per share, so having dropped to 82p at the time of writing, it's not far from the area where I would start to get interested. Bear in mind it has a strong Balance Sheet with plenty of cash, and pays nice divis (although not covered by earnings).

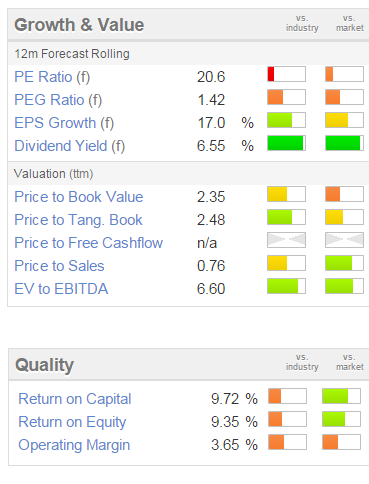

Looking again at the Stockopedia graphics, it's still looking very expensive actually, for what is not a good quality business.

Why is this rated on a PER of over 20? That just doesn't make sense in my opinion.

Trading update today sounds positive. Sales are up strongly, but margins are down, and overall the company expresses confidence about the full year outlook.

My opinion - it's still over-priced. I would probably not be interested above 50p per share.

Porta Communications (LON:PTCM)

I'm still holding this rapidly growing small PR group. It's a bit of a mystery why the shares have been sold off so much, since I thought the last set of results were quite good. Anyway, there we go - a lot of small caps have just drifted down this year for no particular reason, it just happens sometimes.

Anyway, as you can see from the chart there have been some small signs of life lately in these shares.

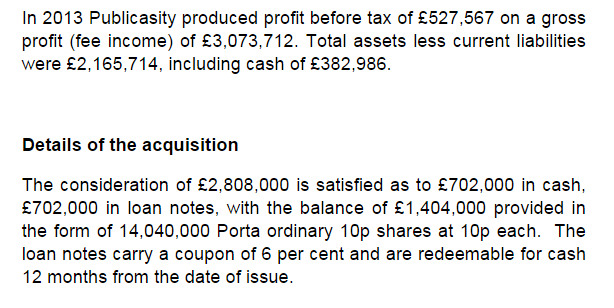

A small acquisition is announced today, and looks a good deal, bolting on another half a million quid onto profits, at a modest cost:

That's it for today, I have to dash off for another investor Xmas lunch. See you back here tomorrow mid-morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in PTCM, and no short positions.

A fund management company with which Paul is associated may have positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.