Good morning! Paul & Jack here. I'm working on a market comment section, so that should be up later. I know people like us to publish an opinion on markets, especially at times of great volatility.

Mello - tonight. There’s a free show tonight, starting at 17:30, with 6 company presentations.

Agenda -

Paul's Section:

Somero Enterprises Inc (LON:SOM) (I hold) - another upgrade to estimates, as I suspected might be the case when guidance was raised 21% on 8 Sept, but still looked light. We get another 7% earnings increase today. The PER is now only 10.7, and the divi yield over 7%. It's got pots of cash on hand too. The valuation looks crazily cheap to me.

Supreme (LON:SUP) (I hold) - interim results and outlook are pleasing. Balance sheet is solid. I like this company - entrepreneurial management, and it's establishing a good track record of decent & growing profits & cashflows. Valuation looks reasonable - looks a decent GARP share.

Sdi (LON:SDI) - very impressive interim results, boosted by one-off orders (as previously disclosed). I like this share a lot, and see it as an impressive acquisition vehicle, with experienced management. The valuation's a bit toppy for my personal taste though. It reminds me of Judges Scientific (LON:JDG) - which has been hugely successful for investors, pursuing a similar acquisition-driven strategy for niche, high margin small businesses.

Jack's Section:

Tandem (LON:TND) - (I hold) - Q4 revenue flat year-on-year (after being up 6% in Q4 2020) - a tough comp, as customers previously caught up on delayed orders from the first lockdown. Full year profit to be in line or slightly ahead of market expectations. Signs of cost pressures easing. Short term share price performance is difficult to predict as the low liquidity means relatively low levels of buying or selling can move the price, but the valuation remains modest.

Mercia Asset Management (LON:MERC) - positive momentum and the company’s core activity of investing in private, growing, regional enterprises in attractive sectors means it could play a useful role in portfolio diversification. Two aspects to consider: the direct investments and the third-party funds business. Not the most straightforward to value or forecast, but perhaps therein lies the opportunity.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Somero Enterprises Inc (LON:SOM) (I hold)

474p (yesterday’s close) - mkt cap £269m

This US-based company makes laser-guided concrete laying machines, to deliver perfectly flat floors, which are increasingly being demanded for warehousing (to allow for higher, stable, racking)

It’s one of my favourite companies, producing bucketloads of cashflow, divis, growth, repeatedly beating expectations, yet is still modestly priced. I just can’t understand why investors generally seem to eschew such a good company. There is a potential impediment with some brokers asking for a form to be filled in, for US tax purposes, although that’s very simple.

Somero® is pleased to provide an update on trading for the current financial year, ending 31 December 2021 ("FY 2021").

Raising guidance due to strong trading momentum to end H2

Strong trading, and consistent deliveries, mean guidance given on 8 Sept 2021 is now being raised -

It’s a pity they don’t provide a figure for adj EPS, because that’s the number I need to value the shares. EBITDA isn’t proper profit, so I loathe the current fashion to quote it as the main measure of profitability. Never mind, who’s quibbling when Somero once again surprises & delights investors with a further upgrade.

Checking my notes here from 8 Sept 2021 (interim results) - profit guidance was raised 21% then, to 40.0p EPS (converted from dollars into sterling). Although as I commented on the day, my own figures were much higher, with me expecting nearer 50p EPS for FY 12/2021. So actually, today’s increase isn’t a particular surprise, but is very welcome nonetheless.

Broker update - many thanks to Finncap for updated figures this morning. It’s now going for 59.0 US cents adj EPS for FY 12/2021. At £1 = $1.33 exchange rate, that’s 44.4p in sterling.

Valuation - at 474p per share, the PER is only 10.7 - that seems crazily cheap to me, unless you think earnings growth is likely to go into reverse, and there’s nothing to indicate that’s likely to happen.

Net cash of $39m is £29.3m in sterling, or 10.9% of the market cap. Strip out the cash (because it gets paid out in divis over time), and the PER would be below 10. How does that make any sense? This looks the wrong price to me, much too low.

Outlook - sounds alright -

In North America, market conditions remain healthy and positive, driven in part by demand for new warehousing, with customer workloads at high levels and reported project backlogs extending well into 2022.

My opinion - what a bargain this share is. I think it’s worth at least 50% more than the current price, which would only take it to a mid-teens PER.

Shareholders can sit back, and watch the divis roll in, as this is a highly cash generative business. The yield is now 7.1%, and we sometimes get special divis on top.

Yes it’s a cyclical business, but why is it being priced for a recession, when nothing else is?!

I think the market is overlooking the fact that SOM’s growth is not just cyclical, it’s also enjoying a long-term structural move towards warehousing with perfectly flat flooring - increasingly necessary for automated warehousing.

Hence overall my view is highly positive here. Can anyone else work out why the market rates this share so lowly? Have I missed anything?

.

.

SUP (I hold)

190p (flat today, at 09:00) - mkt cap £222m

Supreme (AIM:SUP), a leading manufacturer, distributor and brand owner of fast-moving consumer products, announces its unaudited results for the six-month period ended 30 September 2021 ("HY 2022" or the "Period").

Strong profit performance driven by organic growth, M&A and product launches

Highlights table below looks good - in particular there’s been a large fall in net debt - which occurred in H2 last year, it’s risen slightly in H1 this year.

As with all companies, we have to be careful about prior year comparatives due to the pandemic, which generally makes the prior year figures easier to beat.

Note the decent profit margin in both half years.

Gross margin rose from 25% to 30% - a big increase, “due to enhanced product mix and increased in-house manufacturing”

An inaugural dividend of 2.2p is also positive.

.

Outlook - sounds encouraging, and it’s good to see inventories increased in order to protect against supply chain disruption -

.

Balance sheet - inventories are up from £19.8m to £26.7m - as explained in the commentary, that’s to stockpile to prevent shortages - that’s fine by me, and looks a sensible move.

Working capital - is strong, with net current assets of £20.9m, a current ratio of a healthy 1.65 (in my view, anything over about 1.3 for this type of business is good).

NAV is £26.4m, less £3.8m intangibles, gives NTAV of £22.6m, which is absolutely fine - this business is healthily financed, and the numbers overall look very clean to me - no unusual items, or large adjustments.

Cashflow statement - I can’t see anything untoward here, it all looks fine.

Broker research - there’s an inaugural note here from Equity Development.

Forecasts are 11.7p for FY 3/2022, and 13.4p FY 3/2023.

At 190p per share, that’s a PER of 16.2, and 14.2 - which looks reasonable value to me, for a decent quality company with rising earnings.

Investor presentation - is at 11:00 tomorrow, 8 Dec 2021. Registration with ED is here. The CEO Sandy Chadha comes across particularly well on webinars, in my view - an energetic, proven entrepreneur - which is what I look for.

My opinion - this looks a good company to me, on a reasonable rating, so it receives a thumbs up from me. I already hold a small position, and it’s now on my buy the dips list.

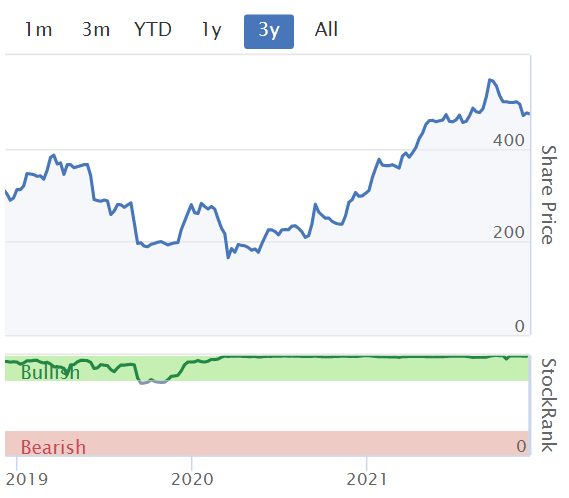

Note also that SUP shares have been resilient in the recent small caps sell-off. It has an upper-medium StockRank, which is how I see it too.

.

Sdi (LON:SDI)

190p (down c.3%, at 10:30) - mkt cap £188m

SDI Group plc, the AIM quoted Group focused on the design and manufacture of scientific and technology products for use in digital imaging and sensing and control applications, is pleased to announce another strong set of results and solid operational progress for the six months to 31 October 2021.

Very impressive numbers today, a lot of which is organic growth, but also boosted by acquisitions, and one-off covid-related contracts - as disclosed previously.

H1 revenue up 75% (42% organic) to £24.7m

H1 adj profit before tax (PBT) up 89% to £5.7m - note the excellent 23% profit margin, indicating SDI’s businesses have considerable pricing power.

Adj diluted EPS is up 76% to 3.43p

Net cash is £1.1m (hardly changed in H1)

Bank facility of £20-30m (accordion) provides scope for further acquisitions, and the company seems very accomplished & experienced at making good acquisitions.

That all looks really good.

Outlook - is in line with expectations, with a helpful footnote too -

1 Analysts from our Broker finnCap Limited and from Progressive Equity Research regularly provide research on the Company, and the Group considers the average of their forecasts to represent market expectations for FY 2022 being Revenue of £45.05m and Adjusted2 Profit Before Tax of £9.2m

As we have previously disclosed, we expect sales and therefore profit in the second half of the year to be lower than in the first half, as the COVID-19-related orders at Atik have been mostly completed. Apart from this, we expect a continuation of favourable trading conditions seen in the first half and look forward to delivering a full year performance in line with market expectations.

This comment by the Chairman is interesting, and reminds me of Judges Scientific (LON:JDG) which of course has been a fabulously successful long-term investment -

I am more convinced than ever that SDI's business model, involving smaller niche businesses operating with a high degree of autonomy in technical, scientific and medical and life science market segments, offers a route to sustained value creation, and allows us to respond rapidly to events.

One-off covid orders - more information is given on this, and it does need to be adjusted for - i.e. don’t expect such rapid revenue or profit growth to continue -

Our Atik Cameras business continued to deliver, at a higher rate than in previous periods, cameras for use by a global OEM in RT PCR machines, which are (amongst other uses) the gold standard instrument for COVID-19 testing. We expect current orders, paid for in advance of shipment, to be fulfilled by January 2022, and we have no visibility of further orders.

This is a known factor, so not a cause for alarm. People just need to be careful not to extrapolate out H1 growth, and assume it continues at that rate when valuing the company. SDI has managed investor expectations well, being transparent about this issue, now and previously.

Balance sheet - looks OK to me. Highly profitable companies don’t need particularly strong balance sheets. This is fine, with a current ratio of 1.4, and no onerous long-term creditors.

NAV is £30.9m, less intangible assets of £25.7m (high because it’s an acquisitive group), leaving NTAV of £5.2m - that’s fine. As long as NTAV is positive, then I’m happy.

What I wouldn’t be too keen on, is if the company runs its NTAV negative by borrowing heavily to make more acquisitions. There again, given its track record & expertise in making good acquisitions, maybe shareholders might prefer SDI to push the boat out a bit, with debt fuelled acquisitions, to avoid dilution? With a market cap of £188m, and quite highly rated equity, I can’t see the harm in the company maybe raising £10m in fresh equity for the next acquisition(s) and matching that with debt. Anyway, that’s a decision for management.

Cashflow statement - looks very good, in H1 and comparative periods. No funnies in there, these look clean accounts, and it’s a genuinely cash generative set of businesses, which is using the cash to fund acquisitions - a nice strategy.

Valuation - thanks to Finncap for its update this morning. FY 4/2022 is 6.6p adj EPS, benefitting from the one-off orders. FY 4/2023 falls to only 5.3p, which I would hope to see beaten.

If next year’s forecast of 5.3p is not substantially beaten, then the 190p share price would be a PER of almost 36 times - which is too high.

There again, the company says it’s hoping to complete more acquisitions - “at least one in the financial year.”. More acquisitions could follow next year, so together with hopefully out-performance against the existing forecasts, might see it deliver say 6-7p EPS in FY 4/2023 - which would lower the PER (at 190p per share) to 27 - 32 - still quite high, but not outrageous for a high margin group of companies with a strong track record.

NB. Please note that unfortunately there is a data error on the broker forecast section of the StockReport here on Stockopedia. It erroneously says that 2 brokers have a strong sell recommendation on SDI shares. That’s wrong, please ignore, sorry about that.

My opinion - I do like SDI a lot. The valuation looks full for now, so it stays on my watchlist, as something that I’d like to add to my long-term portfolio at some point. It doesn’t feel the right time to be pushing the boat out on valuations, given current market conditions, so for me personally, I’ll happily sit on the sidelines for now, but with a firmly positive view about the company fundamentals.

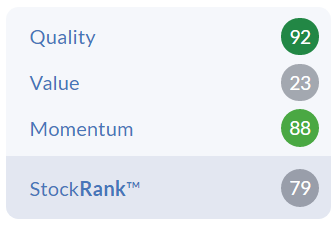

Neatly summarised by the StockRank system, as always!

.

Jack’s section

Tandem (LON:TND)

Share price: 601p (-4.6%)

Shares in issue: 5,244,116

Market cap: £31.5m

(I hold)

Tandem was one extremely neglected micro cap, struggling to generate meaningful revenue growth. This perception has changed over the past year or so, with shares rerating aggressively as demand grows. That means expectations have increased.

Covid has actually been an important catalyst (although management has worked hard behind the scenes for many years now) as the group sells bikes, ebikes, and outdoor leisure products - all of which have been in demand over lockdowns.

Tandem has its hands full managing supply chain disruption and rising costs, but it’s still finding room to push forward substantial growth opportunities. A key example is the new c80,000 square foot warehouse being built next to the head office in Birmingham. The project should create a more efficient and profitable business with greater capacity for expansion.

Still, this remains a Speculative, illiquid micro cap, and there has been a real opportunity cost to holding these shares in the past. Management and shareholders have previously found themselves at odds, too, so there are clear risks to consider (that said, tangible improvements have been made in this area - communications to the market are more frequent, and the group now has a broker providing research).

As reported in September 2021, Q2 revenue to 30 June 2021 was c14% ahead year-on-year. This improved in Q3 to 30 September 2021, with revenues 17% ahead of the prior year.

Q4 to 30 November 2021 revenue was broadly flat across the group when compared to the first two months of quarter four 2020, as the comparative period in 2020 was ‘particularly strong’ (back in Q4 2020, revenue was up 6% yoy).

There’s been a ‘robust’ performance from the toys, sports & leisure business with a number of licences including Peppa Pig, Paw Patrol, Spider-Man and Batman ahead of the prior year. Disney Princess, Barbie and Nerf have also grown strongly and Tandem’s own brands, including Stunted, Hedstrom, Kickmaster and uMoVe were all ahead of the prior year.

The group’s entry level golf brand, Ben Sayers, also continued to show ‘significant growth’ compared to the comparative period.

Stock availability in bicycles has improved, resulting in more despatches and increased bicycles revenue in November compared to September and October. Demand for Tandem’s lightweight Squish branded children's range remains very strong.

In e-mobility, the Wired range of e-scooters performed very strongly. Tandem expects this category will continue to expand in 2022 and has invested additional resource and capacity to meet the anticipated growth.

Home & garden products (mostly sold from Tandem’s online platforms), has been under greater pressure. This is a seasonal business, so that’s no surprise. Heating products and other indoor homewares are performing well.

As previously reported, increases in input costs, shipping and transport rates and adverse currency movements have placed pressure on gross profit margins in 2021 year to date. Notwithstanding these challenges, margins have held up well and we are beginning to see some early indications of improvements in costs, particularly with regards to freight.

Overheads remain tightly controlled and within our expectations, and as a result we expect profitability for the full year to be in line with or slightly ahead of current market expectations and we look forward to updating shareholders further in January 2022, following the Christmas trading period.

Conclusion

Some were expecting more definitive signs of growth at this point, but the update reads well once you consider Tandem’s lowly FY21 PER of 8.4x. Looking back, it makes sense that Q4 is a tougher comp: national retailers postponed orders in 2020 as the pandemic took hold, with delayed orders placed towards the end of the year.

And management has done a good job in ensuring the supply of its products and in managing costs, which are now easing. These past few quarters have not been a straightforward trading period and the team has proven its competence in running the day to day business.

The news that costs are improving is positive for other companies in similar situations. Not everyone is reporting this yet though, so Tandem seems to be slightly ahead of the curve.

Given that full year results could be slightly ahead, then the company might be slightly cheaper than the StockReport indicates. Of course, a lot of that depends on whether Tandem can maintain a step-change in revenue and the improved margins it brings, but I note brokers are penciling in an increase in FY22 earnings per share to around 78p.

The group is benefitting from some structural trends in bicycles, ebikes, and escooters, sparked by lockdowns but set to continue into the years ahead by some accounts. Tandem has done well to increase stock availability in bicycles, where revenue has grown, and its toys business is trading well. It is investing in escooters to meet anticipated increases in demand.

Perhaps holders were hoping for more but the signs are positive, in my view. It’s hard to say how the market will react, but Tandem stock has a history of frustrating holders in the short term. Illiquid stock moves can be extreme and I wouldn’t be surprised to see the price marked down. There are all the usual micro cap risks, such as poor liquidity.

But, ultimately, the shares are supported by a very modest valuation, resilient profitability, and some promising growth initiatives.

Mercia Asset Management (LON:MERC)

Share price: 37p (+1.37%)

Shares in issue: 440,109,707

Market cap: £162.8m

It seems as though community interest has been picking up in Mercia Asset Management.

The company provides ‘proactive specialist asset management’ and gives venture, private equity, or debt finance to regional small and medium-sized enterprises (SMEs) with growth ambitions. With so much activity centering around London, there could be good opportunities further afield for specialists.

Mercia provides capital across its four asset classes of venture, private equity, debt and proprietary capital: the group's 'Complete Connected Capital'. It initially nurtures businesses via its third-party funds under management, then over time Mercia can provide further funding to the most promising companies, by deploying direct investment follow-on capital from its own balance sheet.

The majority of its assets under management (AUM) is presently venture capital:

The vision is simple: to become the first choice for investees, investors and employees. Alongside this, it has stated twin strategic objectives over the next three years (from 1 April 2021) to achieve £60m in cumulative pre-tax profits and c.£600m cumulative growth in AuM.

Mercia currently has c.£948m of assets under management, so that would be a nearly two-thirds increase over three years.

Highlights:

- Revenue +20.7% to £10.1m,

- Adjusted operating profit up from £1.1m to £2.4m; operating profit +33% to £10.7m,

- Net fair value in direct investments +30% to £8.7m,

- Profit after tax +35.2% to £11.2m,

- Basic earnings per share +35.2% to 2.53p,

- Cash and short term liquidity investments of £52.1m,

- Net asset value per share of 42.4p.

There’s a big gap between adjusted and statutory operating profit. This is because the adjusted measure is operating profit before things like performance fees net of variable compensation, realised gains on disposal of investments, and fair value movements in investments.

Here’s the reconciliation (the highlighted row to the left is the current period, with the prior year comp to the right):

Much of the difference comes from ‘Fair value movements in investments’ - I understand why this is left out of the adjusted results, as it must be volatile, but it also reflects a fundamental aspect of Mercia’s business and so should be considered.

From the chief investment officer:

One of our two new strategic objectives over the next three years is to generate average pre-tax profits of £20.0million per annum, from a combination of the profits from our fund management operations plus the performance of Mercia's direct investment portfolio. Although I do not expect the contributions from fair value movements and realised gains to be delivered uniformly, I am confident that our assets have significant intrinsic value and we will see this unlock over the three-year period, as technical and commercial progress accelerate.

It is notable that the small net £8.7m increase in AuM comes despite c£39m of distributions to fund investors and shareholders.

The period under review saw net upward fair value movements of £8.7million, driven by significant commercial progress at Faradion Limited ("Faradion") and Intechnica in particular. Soccer Manager and Avid Games have also progressed well, and other fair value uplifts arose on the conversion of loans into equity at Medherant Limited ("Medherant") and progress against milestones at Sense. This was balanced against MyHealthChecked PLC's ("MyHealthChecked") share price fall from 4.4p to 2.0p.

Overall, assets under management ("AuM") increased 0.9% to c.£948m. Of this, c£762m is third-party funds under management, which is another aspect of the company to consider.

At the end of the period, we had c.£232million of liquidity across all our funds to support our future investment activity, plus a further c.£52million of cash on our balance sheet.

Investments

‘Investment momentum continues’ - in the six months to 30 September 2021, Mercia invested £55.1m into 74 businesses, including 38 new companies via its third-party managed funds' portfolios and £5.4m net direct investment into five existing direct investment portfolio companies.

The direct investment portfolio is valued at £110.3m (H1 2021: £101.6m; FY 2021: £96.2m) with 20 active companies (H1 2021: 22; FY 2021: 20). Further investments have been completed post-period end, with two new additions taking the total back up to 22.

The latest fast-growing companies added to the portfolio were Forensic Analytics Limited ("Forensic Analytics"), a provider of innovative software solutions to government and law enforcement agencies, and Pimberly Limited, a Manchester-based software-as-a-service company, ‘with both businesses being at a later stage to those historically invested in by our proprietary capital’.

There’s a useful breakdown of Mercia’s various investments in the chief investment officer’s review. Too lengthy to summarise here but worth a read, with c52% of portfolio investments in the Software and Digital Entertainment sector, c26% in ‘Deep Technology’, and c21% in Life Sciences

Outlook

As the 'COVID tide' starts to gradually recede, it leaves behind a new way of working for every UK business.

On the domestic front, we are finding that entrepreneurs in the UK regions have adapted quickly and coped well in many respects during the past 18 months… Mercia's ambitious resilience has enabled us to respond swiftly to these changes, guided by our vision of being the first choice for investees, investors and employees.

As the Group's positive momentum continues, we have a firm belief in Mercia's ability to make a valued difference across the UK, for the benefit of all our stakeholders.

Conclusion

This is the first interim period of a three-year strategic plan, so going back to that plan in more detail is probably a good starting point. It looks like there’s an investormeetcompany presentation today.

The valuation looks a little scary, with a forecast PER of 63.5x, but the unusually low EPS forecasts suggest to me that brokers are not modeling potential investment gains.

I’ve just had a quick look at some notes and that at least seems to be the case. That could lead to an opportunity, if you take a look at Mercia’s investments and conclude an out-of-consensus opinion on its prospects.

Or another way of thinking about it might be to simply multiply the forecast EPS by shares in issue (for FY22E), which gives about £2.5m of profit. The company itself says it is targeting pre-tax profit of £20m per year over the next three years. That would be more like 3.4p of EPS if you add in a notional tax charge of 25%.

So there’s certainly scope for your view to diverge with forecasts if you get digging into the portfolio companies and this third party funds business.

Mercia is an interesting company with exposure to high growth, specialist sectors, trading at a small discount to NAV of 42.4p. I think there’s two ways to look at the investment case: 1) to do a lot more work and have a high conviction view on the company’s direct investments and third-party business, and 2) to consider it from a portfolio perspective as diversification into high growth, regional enterprises.

The ex-London focus is a positive, in my view, and I think it’s worth doing more work here. It’s a difficult one to value but that might be where the opportunity lies.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.