Good morning. It's a fairly short report today, as I'll be heading to the Islington Design Centre shortly for a Cenkos/Shares investor forum, as there are a few interesting companies having stands there. There are also several companies which I have been rather uncharitable about in these reports, so I might need to dispose of my name badge before approaching their stands!

Low & Bonar (LON:LWB)

Share price: 52p

No. shares: 327.8m

Market Cap: £170.5m

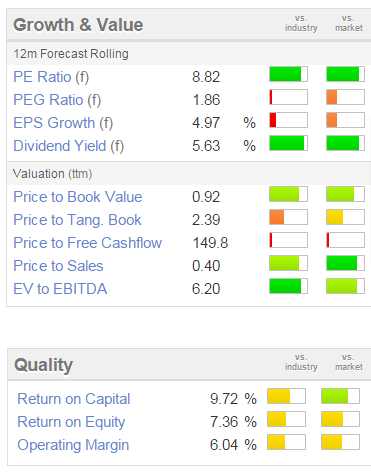

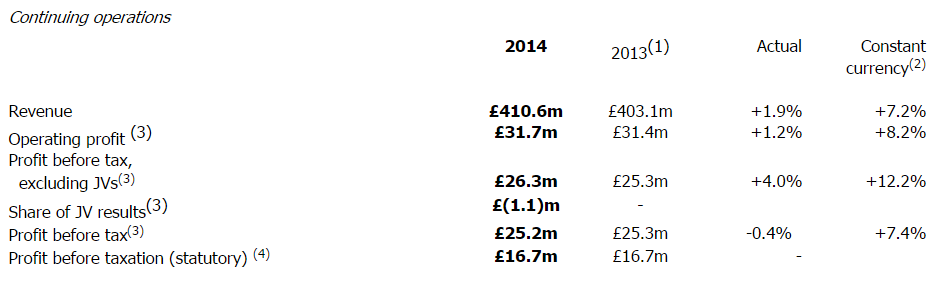

Final results for the year ended 30 Nov 2014 are out today. About two thirds of this group's turnover is in Europe, so they have suffered from a generally weak economy, and exchange rate weakness. So there was a profit warning in Sep 2014, but the company then put out a more reassuring trading update in Dec 2014, which I reported on here.

Looking at today's results, I'm moderately impressed that the company has performed alright, when up against macro & currency headwinds. As you can see from this highlights table in today's results, it had a reasonably good year before currency movements, with both turnover & profit solidly up in constant currency;

This seems quite a lot of business for a market cap of £170.5m.

It clearly has some pricing power too, as the operating margin isn't bad. The group makes a wide range of niche industrial fabrics, and coatings, e.g. advertising hoardings, artificial grass, flooring materials, etc.

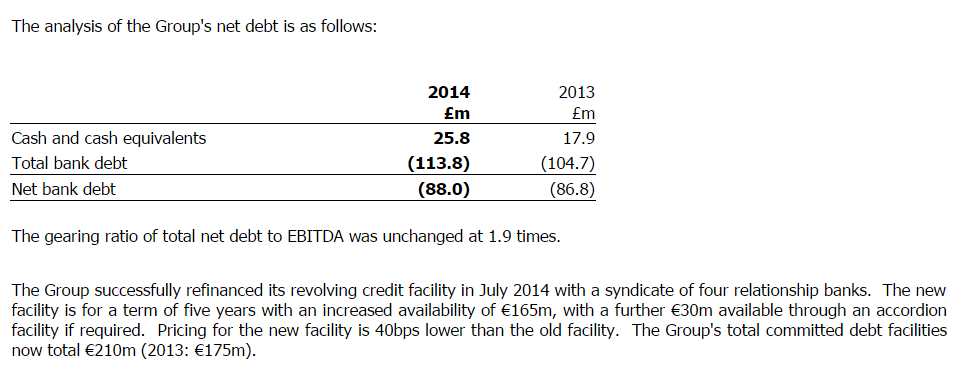

Net debt - as I've mentioned before, the level of net debt here is quite high, and the latest number reported is net debt of £88.0m. This has worried me in the past, but I've done a bit more digging, and note from the 2013 Annual Report that all borrowings are unsecured. That is a very good sign - as it means the bank is extremely relaxed with its exposure to the company, seeing it as extremely low risk.

The old bank facility was renewable in Feb 2015, so I've checked today's statement for more details on that, and am pleased to note that a new 5-year facility has been agreed, on improved terms;

This looks OK then. If the banks are relaxed, why should I be worried? Well, bank managers can easily change their minds, especially in a recession, so it's not a stock that I would want to hold in a deteriorating economy, and/or another banking crisis. Outside of those times though, it looks a reasonably good proposition.

Pension deficit - this looks under control, and isn't huge. Although I note that from the 2013 Annual Report, overpayments were quite significant, at around £3.6m p.a.. So I need to do a bit more research on this. Ultra-low bond yields mean that pension deficits are sticking around, and indeed increasing further in many cases, at the moment.

Dividends - are one of the main attractions of this share, giving a very healthy yield of about 5.6%. The final divi is maintained today.

It's a generally capital-intensive business, so you could just accept the debt as being there to finance fixed assets.

My opinion - I am gradually warming to this company. It has proven that it can finance the pension funds, capex, and still pay generous divis.

Trading in 2014, when up against considerable headwinds, has turned out alright - so I like a business that can get through a tough patch unscathed.

The high level of net debt does worry me still, but there is plenty of headroom on the facility, and it was recently renewed. The company has some freehold property, and generates very strong EBITDA, so the bank are likely to remain supportive on an ongoing basis.

Upside could come from a recovery in Europe (who knows when, but it will recover). Also I note that LWB is spending over £20m building a new factory in China, so that should provide considerable opportunities for future growth from 2016 onwards, as China is a huge market for these products.

Overall then, I think it's an interesting stock, with a very good dividend yield, and a reasonable chance of a capital gain if you take a 2 year+ view. As usual, I'm very interested to hear readers opinions in the comments section below. Do you share my cautious optimism for Low & Bonar, or are you more wary?

I also like charts where the shares have fallen a lot on bad news, which then turns out to be actually not that bad after all, and where the shares have seemed to bottom out over several months. If the stock is reasonably priced, then providing there's no more bad news, the trend might become an upwards one next, possibly?

Oil price

I'm keeping a close eye on this, as I'm sure many readers are, to try to determine if & when to take the plunge and buy some oil producing, or oil services shares. Some have already bounced quite nicely - e.g. I mis-timed my buy in Pressure Technologies (LON:PRES), but am now in profit on that one.

I note that engineering group Goodwin (LON:GDWN) which had appeared on my radar, bounced strongly in Dec & Jan.

Another one to bounce is Lamprell (LON:LAM) which was starting to get interesting when it fell to 90p, but has since bounced to 116p.

The big question is whether these bounces will last? Surely the newsflow is bound to be unrelentingly bad for some time to come, as it will take a longer term recovery in oil prices for capex to get back anywhere near previous levels. In the meantime companies providing equipment & services are going to be under enormous pressure to cut their prices.

I see that we've had the strongest-yet bounce in the price of crude oil in the last few days, as you can see from the candlestick chart (courtesy of IG) on the left. So all eyes are on this, wondering whether this is the beginning of a recovery in the price of oil, or just a larger than usual blip within a down-trend? Nobody really knows - one thing we've learned in the last year is that you can safely disregard the views of almost all analysts & experts about the price of commodities, as they haven't got a clue any more than the rest of us!

I note that quite a few low quality oil stocks (things where debt so outweighs equity that the equity arguably has little to no value) are spiking up, but those type of moves can reverse just as quickly as they start, so those are best left to gamblers only.

The plunge in oil price recently has just reinforced my aversion to the whole resources sector. Why invest at all in companies where their viability can be snuffed out in just a few months, if the price of the product they extract collapses?

Mello Bloomberg

Many of you know renowned small caps investor, David Stredder, who has been organising investor evenings & events under the Mello name for years. His latest idea is an evening at Bloomberg's London offices, with some excellent speakers lined up, including Mark Slater, who's always worth listening to. There is an entry charge, but that includes hospitality laid on, all for a relatively modest £49 fee.

I know tickets are selling fast, I've already got mine, so for anyone interested in coming along to this tech-themed evening, here is the link.

STOP PRESS! I've just asked David for a discount code for Stockopedia readers, and he's given us one! So please use the discount code: DISCSTOCK when buying tickets, and you will get £14 discount, reducing the price from £49 to £35.

NWF (LON:NWF)

Share price: 128p

No. shares: 48.3m

Market Cap: £61.8m

Interim results for the six months to 30 Nov 2014 are out today. They don't look much good to me. Operating profit fell from £3.6m in H1 last year to £2.8m this year, and that's barely above a 1% operating margin, on turnover of 24/7 Gaming Group (LON:247).1m.

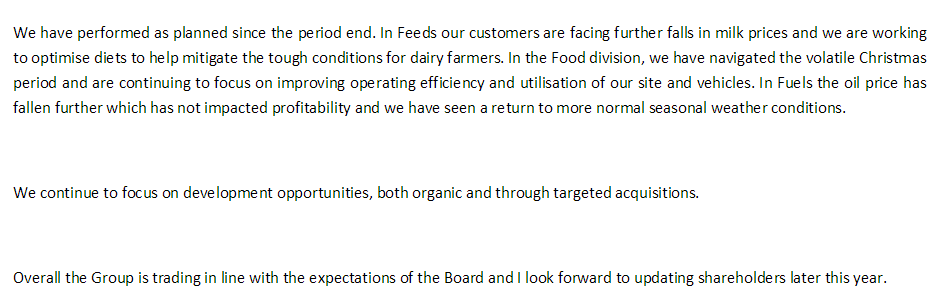

The falling milk price seems to be a particular issue, and it makes you wonder what they are going to put in the animal feed to make it cheaper? On balance I'd rather not know;

My opinion - I can't see any point in investing in a business which only ekes out a 1% profit margin. That's not enough to absorb any bad events. That said, this company does have a track record of paying decent divis, consistently.

However, I don't think it's sensible to invest in any part of the supply chain for supermarkets, as they will all be under unrelenting price pressure for the foreseeable future. The risk to this company is surely that they might see a rising incidence of bad debts, as more farmers go bust. If 1% of their customers by value go bust, that wipes out all their profit. It's not for me.

Northbridge Industrial Services (LON:NBI)

A cautious outlook today, due to the impact of reduced demand from the oil sector;

So with some uncertainty here over future trading, I'll probably give this share a wide berth for now. Although having said that, at 384p, the shares are down substantially from a peak of around 600p last summer. So it ties in with my comments above about oil services companies, that at some point there could be a favourable entry price, we just don't know when.

Alumasc (LON:ALU)

I don't have time to review them properly, but the headline figures for interims published today look good, so worthy of a bit more research perhaps when time allows.

It looks cheap on the Stockopedia graphics, but I seem to recall there is a pension deficit here to consider. If you check back in the archive here, for my previous comments, I've been through the accounts in detail several times.

The shares are up 9% today, so the market clearly likes these results. The outlook statement sounds upbeat too, so could be an interesting company to research in more depth perhaps?

Creston (LON:CRE)

Softer trading in their health division has resulted in expectations for the current year being trimmed a little. Doesn't look disastrous though.

Shares are off 9% today, which looks a sensible reaction to a mildly negative trading update.

I've noticed that a few advertising/marketing companies have been dropping of late, so confidence in economic recovery is perhaps becoming more fragile?

That's me done for today. Back tomorrow, with some comments on companies I see this afternoon at the Shares/Cenkos event, in addition to tomorrow's review of the RNS.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in LWB & PRES, and no short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.