Good morning, it's Paul & Jack here with the SCVR for Weds. Today's report is now finished.

I don't recall it being so manically busy in previous Januarys. Maybe we're covering more companies this year in the SCVRs? Or it could be that the general market plunge this year to date has made everything more intense?

Agenda -

Paul's section:

Somero Enterprises Inc (LON:SOM) (I hold) - 2021 ended with a flourish, and has yet again beaten previous guidance, which was raised as recently as 7 Dec 2021. Looks terrific value still. Outlook for 2022: another good year expected. Increased spending on S+M, and product development, so expect flat profits (which they'll probably beat). This remains one of my favourite shares - a high quality business, performing very well, at a remarkably cheap price.

Ig Design (LON:IGR) - another profit warning, it's down 52% today. Now only breakeven expected for FY 3/2022. Supply chain & logistics problems have crushed its margins. Is that fixable though? It might be in time. I don't think there's any rush to bottom fish here, but at some point it might become a turnaround, who knows? Balance sheet looks sound enough for it to get through these problems. The danger is that it has another profit warning in it. So I'll avoid for the time being.

Gaming Realms (LON:GMR) - a positive sounding update, but it actually looks a little behind forecast, and H2 was down on H1. Large EBITDA turns into small PBT! This company does look interesting, but in a more sceptical market, I'm not finding the valuation appealing.

Srt Marine Systems (LON:SRT) - a big contract win confirmed, looks like it was expected, as share price hasn't moved much. I question the market cap, given how there's been such a long track record of missing forecasts, and historically almost no visibility on the pipeline converting.

Sensyne Health (LON:SENS) - avoids insolvency, with an emergency cash loan from major shareholders. This is to provide enough time to (hopefully) sell the company. Incredibly high risk, with a high chance of a 100% wipeout for equity. Very dangerous, beware!

Jack's section:

Bloomsbury Publishing (LON:BMY) - trading is again ahead of expectations, with strong trading across both Adult and Children’s publishing, plus a major milestone of £5m in profit reached at Bloomsbury Digital Resources. The share price still does not look expensive assuming there has not been a temporary Covid-related boost to reading, so I think it’s well worth a look.

Restore (LON:RST) - FY results ahead of expectations. This looks like a good business - critical activities for customers, with high retention rates, customer satisfaction, and repeat trade. The balance sheet is a little weak, with nearly half of total assets as intangibles and goodwill, but recent approaches from Marlowe suggest others see value in the company at these levels.

Zoo Digital (LON:ZOO) - profits ahead of expectations and will be reinvested into the company to support further growth. No doubt Zoo is in an attractive space, localising streaming content with major media companies spending more than ever on their streaming content platforms. Revenue growth should continue. The ‘primary vendor’ announcement is a good vote of confidence and I can see the share price doing well on the back of this update, but the group’s lack of profits so far makes me pause given the £125.7m market cap.

Paul's Preamble - Valuations re-setting

Whatever the reasons, which I listed in yesterday's market commentary here, it's becoming clearer to me by the day that what we're seeing at the moment is a reset of valuations in the USA, which is spilling over into UK markets.

As a value/GARP investor, I've been worried for years, as to why valuations had become so stretched for growth companies. The only logical explanations were ultra low interest rates (driving investors into riskier assets), and the complacency that comes with a long bull market. Plus a lot of speculative money, and new punters coming into the market, who haven't experienced a prolonged bear market before, who believed that all you have to do is "buy the dip" - which worked brilliantly for a long time, to be fair! But it's not working any more.

It seems to me that all this is coming out in the wash now, with the market scrubbing off a lot of speculative froth, and over-valuations. That's music to my ears in a way, but of course it also drags down almost everything in its wake, even things that are not over-valued. So not a pleasant process. That said, my SIPP is currently down 13% year-to-date, which is a rapid move down, but I just see it as a sharp, but fairly normal market move. Things go down sometimes. Then they go back up again, if they're good companies, reasonably-priced. It's just a question of being patient. 13% is a walk in the park, compared with what happened in Feb-Mar 2020.

I'm not able to accurately predict general market moves, hence it's not logical to try to sell & buy back, attempting to time the market. I'll leave that to the traders with their charts - and good luck to them, but it's not generally my thing. My SIPP is long-term money, in decent companies, so the short-term gyrations in value don't matter at all, because I don't need the money for many years (hopefully). What does worry me, is if an individual company under-performs for any reason, that's when I need to think about selling it. So I remain completely focused on the individual companies I hold, and their fundamentals, not the background noise of general market moves.

I've been looking at the US market closely of late, trying to figure out what's going on. Reaction to large & mega cap results so far has been revealing. For example $MSFT last night - despite posting a beat against expectations for quarterly earnings, the shares dropped 7% in after-hours trading. They got some analysts onto CNBC to explain it, and the rationale for the fall was mainly that MSFT normally beats by more. Also growth was less than expected in the most valued parts of the company. However, a couple of hours later, MSFT shares rebounded to recover all of the initial after-hours dip. Probably due to confidence returning after an earnings call with management?

One phrase from an analyst last night stuck in my mind, about US stock markets right now -

"Fundamentals are strong, but valuation is in question".

I think that's good, and a sign of a healthy market, erasing the most speculative over-valuations. All very interesting, but where does this all leave us in the UK small caps space? Above all, I think this is a time to -

Ditch speculative, story stocks, if you haven't already, and don't get sucked into any more (this is mainly a memo to self by the way, that I'm sharing with you) - because there's less appetite for, and lower valuations on these things.

Avoid companies with weak balance sheets, that need to raise fresh cash from investors. It could be a lot more difficult to raise money now. Placings could now come at discounts, if they can be done at all?

Avoid (or at least be very sceptical of) recent floats, as they're probably over-valued - having floated in more speculative markets (e.g. Microlise (LON:SAAS) which I looked at earlier this week - nice business, but far too expensive for what it is, based on actuals & forecasts)

Watch out for fund managers, that may experience outflows in the coming months, because people tend to pull money out of the market when they see big falls. That could put some funds under pressure, and make them forced sellers, possibly.

Don't anchor to peak prices. Just because something is down 20-30% from its peak, doesn't mean it will necessarily rebound to that level any time soon. As we pointed out here last year, almost every day, many shares became over-valued when the big rally after vaccines were launched (began Oct-Nov 2020) and ran too far, and for too long. That's resetting now.

Decent companies, which are growing earnings, and reporting a positive outlook (and most importantly have pricing power, so can pass on cost inflation to customers), which are reasonably priced (a PER under 20), remain good investments, and shouldn't be panic sold just because they've fallen in price.

Even if you're not ready to buy yet, it's worth using the time in a market correction to compile a watchlist of things to buy. Then push the button when ready - bearing in mind that the best purchases are often the most uncomfortable purchases - i.e. buying when other people are panic selling. If you wait for things to settle down, you'll probably have to pay more.

If you can now buy Netflix on a PER of 25 (was 40), and Microsoft on a similar PER of about 25 (was 30), then why would you prefer some speculative minnow in the UK? And why would you pay a PER of 25+ for something with uncertain growth prospects?, when you can buy top quality US mega caps for a similar rating? I think we need to be very careful about not over-paying for UK small caps.

In conclusion: valuation matters, and has always mattered. We're just coming out of a speculative period where sensible valuation metrics were suspended. Hence we need to be much more careful about making sure we don't over-pay for anything.

Also, if you look at a long-term chart for good companies, you don't look at the low points, and think, "I wish I'd sold at that low point"! You say to yourself, why didn't I buy at that low point? Probably because fear had taken over at the time. It's so important to remember that good companies recover from big falls, and buying at the best time can often feel scary at the time.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Somero Enterprises Inc (LON:SOM) (I hold)

535p (at close, yesterday) - mkt cap £300m

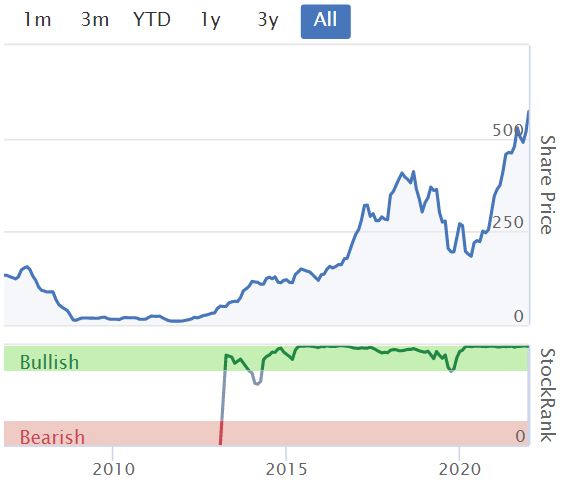

Somero is right up there, as one of my favourite value/GARP shares. It produced a series of positive trading updates in 2021 (despite issuing a cautious outlook at the start of last year).

I wrote very positively about Somero most recently here on 7 Dec 2021, when it upgraded guidance again for FY 12/2021.

It’s obvious from the Stockopedia graphics what to like about this share - a high quality business, with earnings & price momentum, that’s also cheap (I’m surprised the value score is only 66) -

.

Lots of long bars/green below too, feast your eyes on this -

.

For reasons unknown, the stock market seems to always apply a deep discount to SOM shares, sometimes blamed on it being cyclical. Plenty of other companies are cyclical, but don't have a steep discount applied. So that doesn't make sense to me.

There is an issue of US withholding tax, which deters some investors from buying SOM shares.

It’s beaten expectations yet again, in a final flourish to end the year -

Strong finish to 2021 that exceeds previous guidance, healthy North American market drives results

Revised guidance for FY 12/2021 -

Revenue $133.0m (old guidance: $130m)

Adj EBITDA $48.0m (old guidance: $45.0m)

Cash $42.0m (old guidance: $39.0m)

Finncap kindly runs the numbers through its spreadsheet, and forecasts 63.1 US cents EPS for FY 12/2021. That converts to 46.7p EPS at £1 = $1.35

PER is 11.5 at 535p per share - very cheap, assuming earnings are sustainable at this level.

Remember that surplus cash is paid out in divis, so we have upside there too.

Outlook - is positive, and more money is being deployed on product development (including new products to increase addressable markets), sales & marketing. Hence profits expected to be flat in 2022. Although they said something similar a year ago about 2021, then went on to smash forecasts!

... the Board expects 2022 will be a highly profitable year with healthy cash generation, modest revenue growth, and EBITDA comparable to 2021 that reflects the planned investment in resources for future growth and the full-year impact of 2021 staffing additions required to support the growth of the business.

My opinion - this share remains strikingly cheap, which is bizarre for such a high quality business.

Outlook comments sound positive for 2022.

Management strike me as experienced, capable, and trustworthy, with a long track record of success and looking after shareholders well.

This share could easily re-rate upwards to a PER of say 15, and would still be good value even then. So significant upside here, in my view.

As you can see from the long-term chart below, it's been a major multi-bagger. Although it did come close to going bust after the 2008 financial crash, so was high risk at that point. Scarred by this experience, management now retain a healthy cash buffer, to protect the business in the event of another major downturn - very sensible, I wish more companies would be that careful.

.

.

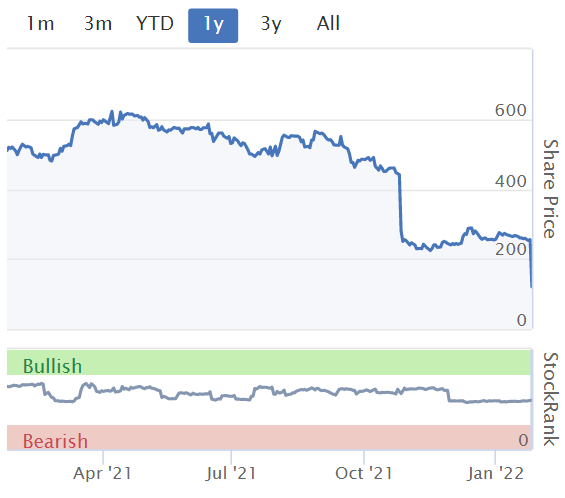

Ig Design (LON:IGR)

121p (down 52% at 08:29) - mkt cap £119m

This is a massive faller today, down by just over half, which follows from an already lamentable crashing share price from a previous profit warning in Oct 2021. IGR peaked at c.767p in Feb 2020, so now down 84% from the peak. It’s so surprising, as this was previously a good turnaround, becoming a multibagger from 2014 to early 2020, which has now almost completely unravelled. I can remember writing positive reviews of it, when the numbers were improving nicely in 2016-2018.

I turned negative on the share at 306p, here on 26 Oct 2021, concluding that the inability to pass on cost inflation to customers, had exposed the weakness in the business model.

It’s another situation where big Director sales (£25m!) was a clear warning sign before the rot set in.

IGR had previously warned on 24 Aug 2021 about “challenging cost headwinds”, at 522p per share. However, it reckoned then that it could mitigate these costs, and expected to trade in line with expectations.

Looking back, it’s difficult to see how anyone could have predicted such a disastrous fall in share price down to only 121p today. Is it now cheap enough to consider bottom fishing, catching this falling knife? Let’s find out…

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of celebrations, craft, gifting, stationery and creative play products, today issues a trading update for the nine months ended 31 December 2021.

The current financial year ends 31 March 2022.

Good revenue growth (up 12% on a LFL basis) at $828m - a substantial business, for a market cap of £119m.

Supply chain and logistics problems have incurred additional fulfilment costs.

It also mentions reduced sales of craft products in the USA, from previous peak driven by the pandemic.

Problems seem to be in the US division, and have hit group profit margin hard -

As a result, and despite the International business performing in line with expectations, the US division has incurred significant supply chain costs, specifically in relation to freight, labour and raw materials, which alongside the lower craft revenues has resulted in Group adjusted operating margins in the nine-month period of 4%, down 460 bps year on year.

That’s a big reduction in operating margin, it’s dropped from 8.6% to 4.0%.

Full year guidance - is only breakeven! That’s clearly bad news -

This year to date performance, together with the expectation of the continuation of the cost headwinds and lower craft sales in the final quarter, means the Group now expects its full year FY22 adjusted operating profit to reduce to a breakeven position, resulting in full year earnings significantly below current market expectations.

That must mean a loss, once all costs are included, as operating profit excludes finance costs, which can sometimes include an element of property rentals. Finance costs were £5.2m last year.

Dividends - cancelled for FY 3/2022, but hoping to reinstate in future.

Outlook - too early to say, as they’re busy trying to sort things out -

It is expected that these external challenges will continue into FY23 bringing heightened uncertainty and it therefore remains too early to give firm guidance on FY23 financial performance.

Consumer demand remains strong and discussions with customers and suppliers to mitigate the headwinds are progressing.

The Board will provide a further update to the markets in April 2022 as part of the year end trading update.

Board review of its US operations - not clear what this involves, but they want to restore profitability. Possible sale/closure of parts of the business, I’m wondering?

Liquidity - is fine for now, but remember IGR has a large borrowing requirement for seasonal peak, in the run up to Christmas each year. So I think investors need to look into the terms of the bank facilities, and in particular any interest cover, and debt:EBITDA covenants, which could come under pressure now the company is only trading around breakeven maybe?

Although banks are generally more relaxed about lending which only covers seasonal peaks, and is then repaid from seasonal cashflows, as they generally perceive little risk with that type of temporary lending.

CFO resignation - looking back for telltale signs of things going wrong, the announcement on 16 Aug 2021 of the CFO Giles Willits tendering his resignation for “personal reasons” could have been a warning sign.

Today’s update says he’s still with the business, extending his notice period until a replacement is found.

CEO commentary - nice to see a slice of humble pie appearing here, but I can’t help feeling this all sounds a bit behind the curve, and could result in exceptional restructuring costs maybe? -

Paul Fineman, Group CEO, commented:

"To say that I and the whole Board are disappointed with our financial performance over FY22 to date is a huge understatement. Without any end to the supply and cost challenges in sight we cannot simply wait for these external challenges to improve.

We have therefore instigated a review of our US operations, analysing our cost base and identifying improvements that can be made quickly.

We remain confident in our long term strategy but with the current challenges unlikely to ease in the short term we plan to undertake this review to ensure it remains appropriate. We will update on progress over the next few months."

My opinion - IGR made $19.9m adj PBT in H1, and had $58.8m net debt at 30 Sept 2021.

Therefore, it now saying FY 3/2022 is looking to be c. breakeven, suggests a hefty loss in H2 - clearly worrying.

I’ve reviewed the last balance sheet, and it’s quite strong. So I’m not worried about solvency, as things stand today.

That the outgoing CFO has stuck around for almost 6 months, waiting to be replaced, suggests there’s probably not much risk of something really ugly lurking in the accounts, but you never can be sure, with any company.

Are the problems fixable? It all seems to stem from supply chain disruption, which then seems to have triggered excessive warehousing & distribution costs, to get product out to customers in time for Christmas. I can picture in my mind an overflowing warehouse, with temps drafted in to work 24 hour shifts, which of course is very costly. A business that hinges so much on peak Christmas products, can’t tell customers they won’t get the goods until January, as they would be effectively worthless by then. Tricky.

Taking a longer term view, I imagine the logistics problems should be fixable. For that reason, I’m starting to think this share might have recovery potential. But there doesn’t seem to be any rush to buy, because situations like this often bump along for months before any signs of recovery become evident. Or if a major holder decides to dump them at any price, then it could keep drifting down.

Overall then, it’s not something I’m in any rush to buy, but can see possible recovery potential at some point later in 2022 maybe? That’s assuming things don’t get worse of course. It might have another profit warning in it, who knows? I am concerned that management don't seem to have things under enough control. Some companies have coped with supply chain problems. Others have fallen over. That could be telling?

.

.

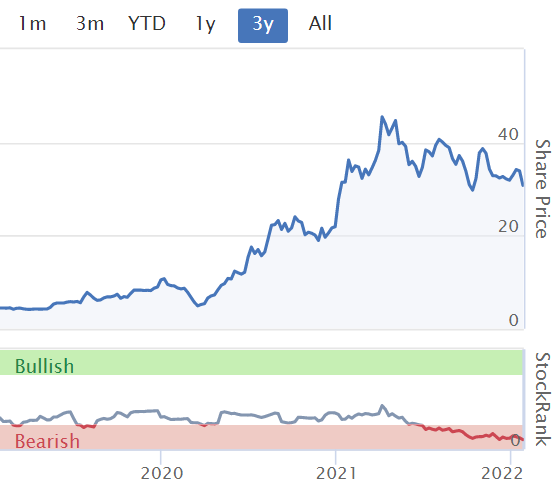

Gaming Realms (LON:GMR)

30.5p (down c.2% at 10:24) - mkt cap £88m

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile focused gaming content, announces a pre-close trading update for the full year to 31 December 2021 ("FY21").

The headline sounds good -

FY21 Revenue and EBITDA* Growth of 27% and 70% Respectively Complemented by New Regulated Market Launches

[their bolding]

Revenue of £14.5m - Stockopedia shows a forecast of £14.8m, so this looks a bit behind.

H1 revenue was £7.7m, so H2 lower at £6.8m

Adj EBITDA of £5.6m looks good, but the company capitalises development costs, which this number ignores (along with lots of other costs, eg share based payments, restructuring costs, plus of course depreciation, amortisation, interest, and tax!!!)

In H1 adj EBITDA of £3.1m turned into £0.8m profit before tax (PBT). So H2 EBITDA is £2.5m, which looks like it would only be about £0.2m PBT. Giving us perhaps £1.0m PBT for the full year - not much for a £88m market cap company in today’s more sceptical markets. That looks a tad warm actually, as a very detailed research note from Cannacord (many thanks for this) on Research Tree, suggests £0.6m adj PBT for FY 12/2021 (based on £5.4m adj EBITDA forecast published in late Nov 2021).

Outlook - no specific guidance on numbers, but this sounds positive -

Michael Buckley, Executive Chairman of Gaming Realms, commented: "We are delighted with the performance in 2021, where we launched in new markets and increased the distribution of our expanded Slingo portfolio. We have a strong pipeline of opportunities and the outlook is very encouraging, with further expected expansion of our international footprint coupled with additional deals within the markets where our content is already distributed. We believe that the strong momentum of last year will continue into 2022 which is demonstrated by entry into regulated markets announced today."

My opinion - the crux is how much of the dominant revenue stream (licensing) are one-offs, and how much is recurring revenue share? I can’t find the split in the Canaccord note, or any of the company’s announcements.

Canaccord does mention that contracts include a revenue share, so some of the revenues do seem to be recurring, but I need to know how much? Also I recall mgt saying in a webinar that the more customers play, the more revenue GMR receives, so there is definitely an element of repeating revenues within licensing.

There is something interesting here, GMR does intrigue me, because it’s growing revenues, has now moved from losses into (modest) profits. Plus its games seem popular (mainly “Slingo”) internationally, with new clients being won. Hence I wonder what the potential market size is? If it’s very big, then there could be nice upside.

Until I properly understand the revenue model, I wouldn’t want to take the risk here. The stock market tide has very much gone out, against speculative growth companies on high valuations. For that reason I perceive valuation risk here, so will give it a miss. Too much of the valuation (almost all of it actually) is based on revenues & profits continuing to rise strongly. That’s fine in a roaring bull market, but a lot less attractive when investors are being so much more cautious & critical on valuation. So this risk is that it could continue to drift down, with occasional spikes up on contract win announcements.

I'll keep it on the watch list, but don't see any rush, or an attractive valuation, to get involved now.

.

.

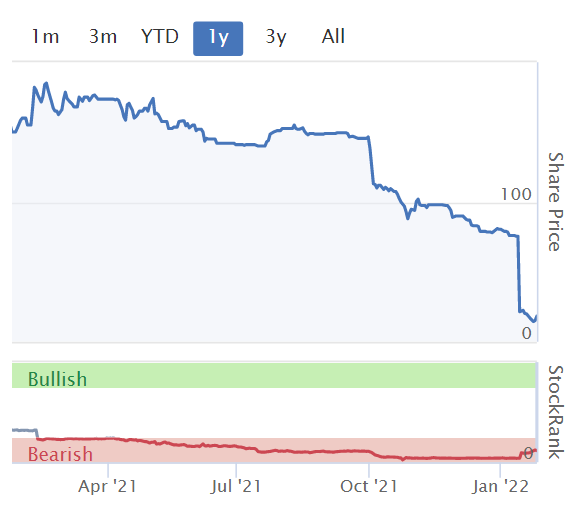

Sensyne Health (LON:SENS)

19p (up 24% at 11:12) - mkt cap £31m

This has spiked up today on completion of an emergency debt funding, to avert insolvency.

I just want to reiterate to readers my warnings here on 14 Jan 2022 - this company is teetering on the brink of insolvency, having run out of cash.

Institutional shareholders have loaned it (not fresh equity) short-term funding, to allow it to continue trading long enough to sell the company.

The new loan funding has warrants attached, so dilution at 10p from them, if the company survives at all.

This share is now incredibly high risk - and people buying the shares now, need to realise that there’s a significant chance of a 0p outcome. It all hinges on whether the company can collect in a disputed receivable balance, and find a buyer for the business, which is haemorrhaging cash.

We don’t know who potential buyers are, nor what value (if any) they see in the company.

Therefore, it’s an extremely high risk punt.

The downside risk, that equity gets wiped out, with a buyer of the business (if they can find one) maybe not prepared to pay very much, and of course the owners of debt rank ahead of equity, so you often see equity wiped out in a distressed sale.

If you want to take the risk of a wipeout, that’s up to you of course, I’m just pointing out how risky this situation is. It’s not worth risking all your money, just on the possibility of a favourable outcome for a company that is close to going bust. I wouldn't touch this with a bargepole.

.

.

Srt Marine Systems (LON:SRT)

47.5p (up 3% at 11:19) - mkt cap £78m

Good to see SRT has won a major contract - it’s been promising big deals for many years, and visibility seems non-existent, with p[ipeline rarely turning into revenues or profits as expected. That’s not the company’s fault - they’re dealing with numerous Govt agencies in other countries, which means wading through complex bureaucracy, and project delays that can run into years.

Simon Tucker, CEO of SRT Marine Systems, commented:

"I am very pleased to be announcing the signing and commencement of the first phase of this £40m SRT-MDA System project. Our project delivery team and in-country partner are well prepared and implementation will therefore commence immediately. This is an important new customer for SRT and we expect that further contracts will follow as they build up their national maritime surveillance capabilities in the years to come."

The track record is way too volatile for me to consider investing here, but good luck to holders. The £78m market cap looks very generous to me, given that we’ve had so many years of upbeat pipeline, but not much conversion into reliable, repeat revenues. that could all change, and a £40m contract win is a very good start!

.

.

Jack's Section:

Bloomsbury Publishing (LON:BMY)

Share price: 357p (8.18%)

Shares in issue: 81,608,672

Market cap: £291.3m

Trading update for the year to 28 February 2022

Bloomsbury is pleased to announce that revenue is expected to be comfortably ahead and profit materially ahead of market expectations for the year ending 28 February 2022.

Consensus is for revenue of £197.1m and profit before taxation and highlighted items of £20.1m.

Trading has remained strong in the Consumer division for both Adult and Children’s publishing. Meanwhile, in Bloomsbury Digital Resources, the group has reached a ‘major milestone’ of £15m in revenue and £5m in profit. That’s very high margin, well ahead of group levels. There’s also the benefit of recently acquired ABC-CLIO (£17.3m in cash) to come through in this division.

Conclusion

A short update, but one confirming ongoing positive momentum. The growth in Digital Resources is a real point of interest, while the group’s Consumer division continues to perform well due to its quality and depth.

The StockRanks still love Bloomsbury.

And the margins are improving. It looks like there could be a real opportunity here. I had been concerned about the potential of a lockdown reading boost that might wind down, but so far this has not happened.

The shares fell slightly after the recent market drop, but are now right back to where they were. Still, the valuation is not demanding and the group is trading very well. It’s really putting itself forward as a strong candidate for further research.

Restore (LON:RST)

Share price: 472.35p (4.03%)

Shares in issue: 136,674,067

Market cap: £645.6m

This is the UK's leading provider of integrated information and data management services, secure technology recycling, and commercial relocation solutions. It has recently been in the news for fending off a couple of approaches from Marlowe (LON:MRL) .

Trading update for the year to 31 December

Restore expects to report record levels of revenue and underlying operating profit for FY21

Activity levels continued to grow through Q4, with positive organic performance further enhanced by very strong commercial execution and ongoing efficiency gains.

The eight acquisitions completed in 2021 are all contributing financially and are either in line with, or ahead of, plan. That’s quite a pace of acquisition. Management says this buying spree has enabled the business to significantly extend its geographic footprint and service offering.

New debt facilities announced to support long-term objectives. A £200m unsecured, multicurrency revolving facility agreement ("RCF") on enhanced terms with a syndicate of six lenders, which replaces the company's previous £160m secured revolving credit facility.

Outlook

- Strong, scalable platform, ESG-friendly,

- Underlying organic growth, market share gains, and new customer wins in FY21,

- Expected market share gains and new organic wins in FY22 from significant customer pipeline,

- Ongoing cost reductions and synergies from acquisitions,

- Substantial and high-quality acquisition pipeline.

Conclusion

This looks like a nice business performing critical activities for customers, with high retention rates, customer satisfaction, and repeat business.

The share price has had a few false starts over the past five years, despite encouraging revenue growth.

Net income has been more volatile, but still trending upwards. Restore is acquisitive, so perhaps exceptional integration costs are obscuring underlying progress? That’s just a hunch to be investigated.

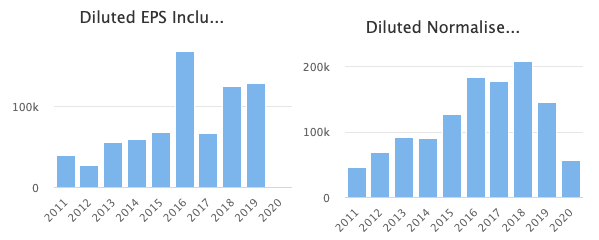

It looks like the group did not have to pay much tax until FY17, and there have been some exceptional costs reported. See diluted EPS pre and post-exceptionals below, on the left and right respectively.

There has been a degree of equity dilution here, and net debt has crept up recently although this is mostly down to around £104m of capital leases being added into the equation as of FY19. Goodwill and intangibles make up around 50% of total assets, which is on the high side.

A middling balance sheet I’d say, with some areas to investigate, a bit of a shame but perhaps not serious enough to take the sheen off of these results. There’s acquisition risk here, too, so it’s worth digging into management’s track record in this regard.

The group has fended off a couple of approaches from Marlowe (LON:MRL) recently (see the coverage in the most recent SCVR posts on Restore’s Discussions page), so it’s in demand and that appears to have provided a decent floor for the share price over the past six months.

A forecast rolling PER of 16.9x does not scream ‘cheap’ but neither is it particularly expensive. Restore is trading well and has consistently grown its top line over the years. All in all, the company comes across positively, albeit more fairly priced post-Marlowe approach.

Zoo Digital (LON:ZOO)

Share price: 143.3p (+10.23%)

Shares in issue: 87,684,094

Market cap: £125.7m

A world-leading provider of cloud-based localisation and media services to the global entertainment industry

Trading update for the year ending March 2022

Revenues for the year are anticipated to be ahead of market expectations, yielding additional profits that are being reinvested in staff, infrastructure, facilities and international operations to extend ZOO's capacity and support growth.

Zoo Digital says it is ‘cement[ing] its position as a leading provider of end-to-end services for the streaming video industry’. H2 trading has benefitted from the resumption of new productions, the ongoing migration of catalogue titles to streaming platforms, and regional territory launches.

FY revenue is now expected to be at least $57m (up 44% on FY21’s $39.5m), with H2 up 11% on the first half and at least 29% ahead year-on-year. The group also notes a ‘strong and growing’ pipeline of orders across all service lines.

Localisation revenues are expected to grow by at least 55% and media services by at least 30%.

ZOO has been appointed as a primary vendor for the forthcoming European launch of a global streaming video service and expects that this will lead to significant orders commencing in Q4 and delivering meaningful revenues in FY23.

That’s encouraging. I wonder who this global streaming video service is? The last part of that quote suggests to me further upgrades might be in store.

Conclusion

Zoo has struggled for profits previously, while shares in issue have more than doubled over the past five years. The group’s CEO remains its largest shareholder, however, so he is incentivised to build shareholder value.

And there’s no doubt that the group appears attractively placed with some strong tailwinds. Major media companies are building out their streaming video platforms and are seeking to offer greater volumes of exclusive content. Specialist media analytics firm Ampere Analysis reported that spend grew to a record $220bn in 2021 and forecasts further growth in 2022.

WarnerMedia, NBCUniversal, and ViacomCBS have launched streaming video platforms in North America and have all announced plans to make these services available internationally in 2022. So there’s unprecedented levels of demand.

There’s just the actual profitability of the enterprise to prove. The group is valued at £125.7m but is forecast to eke out a $2.5m net profit by FY23E, which is well above anything it has achieved so far. In fairness, Zoo does seem to reinvest in its tech.

How valuable are its services in a mature market, and does it have an edge over competition? Perhaps thoughts of maturity are too early given the strong market growth trends, but the degree to which intellectual property sets it apart from the rest strikes me as important. If there’s not too much in it, then competition and pricing will become a factor.

By the sounds of it, Zoo’s in-house software enables faster and cheaper subbing and dubbing services. So it could have enough about it to start generating meaningful profits. Presumably there will be a degree of operational gearing should revenue growth continue (which it looks like it should).

The story sounds good and I can see how additional upgrades might lead to a strong share price. Zoo could go on to do very well, but for now the valuation is a little too rich for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.