Good morning, Paul & Jack here.

Agenda -

Paul's Section:

Staffline (LON:STAF) - a reader request from last week. The latest trading update shows a greatly improved position, with better trading, and an equity raise having fixed the balance sheet debt overhang. So it's now a regular investment, rather than a distressed situation. Despite these improvement, it wouldn't be my sector pick.

Cake Box Holdings (LON:CBOX) - I've been through Maynard Paton's damning report again, in a fair bit of depth. Most of the accounting issues he's unearthed don't seem too important. However, the CFO selling 5% of the company 2 days before the auditor resigned with a critical departure letter, is outrageous. Entrepreneurial management was previously a strong attraction of this share. I don't trust them now, so am steering clear, despite the steep fall in price.

Studio Retail (LON:STU) (I hold) - oh dear, another problem. STU has warned on profits again - not a big deal given supply chain problems. However, far more concerning is that a working capital shortfall has emerged, due to over-stocking. This is such a basic lack of financial control, that I have no confidence in management, so have decided to sell. It's not a very good business, and now we know it's not very well run too. Although this is all reflected in a now ultra-low PER, so it could be a recovery share once working capital has been sorted, maybe?

Purplebricks (LON:PURP) - a catalogie of problems has smashed the share price here. I take a quick look at interim results. Bad - but mainly due to one-off charges. The key point is, it still has £58m cash in the bank, and the market cap is £64m. Could be an interesting one for special situation investors maybe?

Sthree (LON:STEM) - I quickly review the FY 11/2021 results, and am impressed. This looks a good company, performing well, with a decent outlook, and priced sensibly. Also a sound balance sheet. Very good! This is the type of thing we like best here at the SCVR - a decent company, reasonably priced.

Jack's section:

Belvoir (LON:BLV) - full year profit before tax to be comfortably ahead of expectations thanks to a strong sales market. While this has since shown signs of normalising post-stamp duty holiday, the outlook for lettings remains positive. A quality company on an undemanding valuation.

Tandem (LON:TND) - I hold - profit before tax expected to be slightly ahead of current market expectations. The current financial year has started off more slowly, but there’s good momentum in eMobility and the new warehouse should be complete by Q4 2022, which is a significant development. The valuation remains undemanding.

Sylvania Platinum (LON:SLP) - I hold - FY production target brought down from 70koz to 66-68koz as the group grapples with a couple of short term operational issues. Cash generation remains excellent. The critical factor remains PGM basket prices. These are hard to anticipate and it means models / forecasts are very sensitive to inputs, but the general outlook remains positive.

Friday's podcast

Jack & I are now recording a weekly podcast summary of the SCVRs on Spotify.

The sound quality at my end was poor, sorry about that. I've re-recorded my bits as a video here:

It's the same content as the podcast, but a bit more detailed, and better quality sound.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Staffline (LON:STAF)

56p - mkt cap £93m

(this announcement was from last week)

Staffing companies generally are doing well at the moment, as there’s plenty of demand for labour, and near full employment. Staffline has had a very chequered past though, and came close to going bust when lots of problems emerged. So I’m wary of this share.

There’s been massive dilution, from 34m shares in 2018, to 165.8m shares now, which was required to keep the company afloat. So realistically, the share price is never likely to return to anywhere near previous highs.

Note that the former CEO, Andy Hogarth, banked £10.3m in Jan 2018, at 1020p per share, which was 16 months before the share price collapsed (pre-covid) in July 2019.

There are so many examples of £multi-million Director sales preceding bad news, that it’s a big sell signal when the people who know the company best are bailing out - whatever the reasons given.

.

.

Trading Update (issued 25 Jan 2022)

Staffline, the recruitment and training group, is pleased to provide the following trading update for the year ended 31 December 2021.

The company’s summary says this -

- 2021 Underlying Operating Profit doubles year-on-year; c. 11% ahead of market expectations

- Strong FY 2021 performance underpins increased confidence for FY 2022

The highlights table below also looks good, although the footnotes show quite a lot of adjustments are made, so I need to dig deeper to get the full picture when the full results are published.

.

I tend to ignore the revenue line for staffing companies, as it includes the pass-through wages of the contract staff. So gross profit is better seen as revenue for the staffing company itself.

Summarising the rest of the announcement -

Strong trading in H2.

Revenue up slightly, despite exiting low margin contracts.

U/l operating profit (not my preferred profit measure) is said to be 11% ahead of market expectations for FY 12/2021, which seems pretty good.

Note that it made £4.6m in H1, so H2 is £5.4m adj operating profit.

Cash & liquidity - looks to be dramatically improved from when I last looked, when STAF was mired in debt & surviving due to deferring a large VAT bill, which now looks sorted. Adjusting for the temporary benefits mentioned below, STAF is really in an underlying net debt position of £8.9m.

Staffline's balance sheet was significantly strengthened during the year with the Group expected to report an increase in pre-IFRS16 net cash of £15.7m to £6.9m at 31 December 2021 (2020: net debt of £(8.8)m), despite repaying the majority (£40.7m) of its Deferred VAT Relief, with the remaining balance of £5.8m to be repaid on 31 January 2022. This substantial improvement was achieved through a successful equity raise of £46.4m (net of costs), and includes c. £10m of timing benefits, which are expected to unwind, alongside further improvements in trading cash flow and cash collections. The Group's financing headroom, relative to available committed banking facilities at 31 December 2021, was in excess of £75m.

Outlook - sounds generally positive, although note at the end it refers to medium & long-term. Which tends to suggest by omission, that the short term outlook may not be quite so rosy perhaps?

The Group has delivered an excellent performance in 2021, exceeding expectations in both profitability and cashflows, with upgrades to market expectations during 2021 against a backdrop of continued macroeconomic headwinds.

This momentum is expected to continue into 2022, supported by a strong new business pipeline, a lower overhead cost base and the expected post-Covid recovery of historically strong Staffline recruitment sectors, such as automotive, manufacturing, aerospace and travel.

The Board remains confident in the growth prospects for the Group in the medium-to-long-term…

The pipeline for 2022 is encouraging, underpinning the Board's increased confidence in the current financial year and beyond."

Diary date - 22 March for FY 12/2021 results.

My opinion - I’m also looking through the last interim results, and the figures look quite clean, with all the restructuring & exceptional costs looking to have been kitchen-sinked previously in 2019.

The refinancings have improved the balance sheet considerably, but it still had negative NTAV of £(11.3)m at 30 June 2021 - not strong, but not threatening solvency either.

Overall it’s gone from a basket case, to a reasonable position now. Hence risk has dramatically reduced, and STAF shares now look investable again. Would I want to invest though? Not really. It’s a low margin business, eking out a tiny margin from large revenues, but as we’ve seen before, with plenty of risks that accounting and regulatory issues can go wrong.

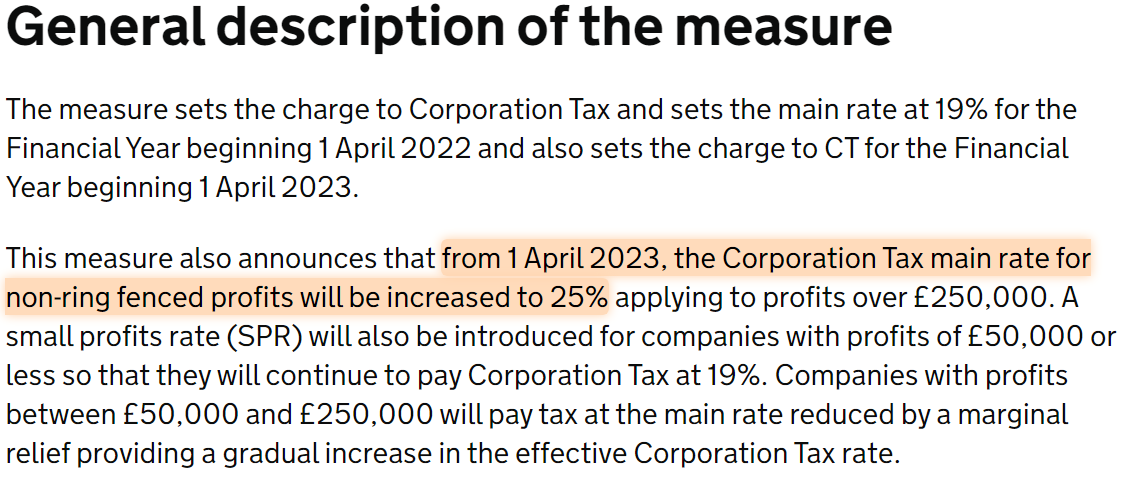

Many thanks to Liberum for making its forecasts available on Research Tree. EPS is forecast to reduce in 2022 to 4.71p, then rise to 5.84p in 2023, a PER of about 10 times 2023 forecasts. Note that tax rates rise, swallowing up a lot of the improved profit - that's a headwind for most companies, as corporation tax is set to rise significantly, from 19% to 25%.

If I wanted to buy a staffing company, then I’d be more inclined to look at Robert Walters (LON:RWA) or Sthree (LON:STEM) which are not much more expensive (fwd PERs of about 13), but with none of the historic problems which dogged STAF.

From the Govt's website (click below for link)

.

Cake Box Holdings (LON:CBOX)

236p - mkt cap £94.4m

This has been a fascinating situation. This is a very long section, so feel free to skip to the next item if it doesn't interest you.

It’s a franchise business, selling egg-free cakes, which floated on AIM in 2018. The shares traded sideways, until going on a tear in 2021, doubling from c.200p to peak just above 400p.

The founder & largest shareholder sold a quarter of his holding in a secondary placing on 25 Nov 2021, at 350p, a significant discount at the time, trousering £10.5m.

I reviewed the situation here on 25 Nov 2021, concluding that the founder remained the largest shareholder, so it didn’t look a cause for alarm that he wanted to bank some profit. However, I did feel at the time that this large Director sale put a cap on the share price, and limited the upside, hence concluding that CBOX shares looked fully valued for now, and I would only be interested in buying on any dips, to c.300p.

The next event was when respected shares analyst Maynard Paton issued a bombshell report here, on 21 Jan 2022. This is what has triggered a large sell-off in the shares of CBOX, coinciding with a nasty market sell-off in many shares. It reads a bit like a shorting dossier, but more concise, and I don’t think Maynard has shorted the shares. His motives appear completely genuine, revealing inconsistencies and concerns in the Annual Report, that everyone else seemed to miss.

I think Maynard deserves a hearty pat on the back, for doing such detailed work scrutinising the accounts, and finding a catalogue of oddities in the annual report. This must have been a huge job, and I reckon it’s at least a week’s work, putting together such a detailed report.

Maynard’s description of the company reminded me of Mrs Doyle, so here’s a gratuitous comedy link.

The business operates as a franchisor. It manufactures a “high end, secret recipe” egg-free sponge that is sold to numerous franchisees who in turn use the sponge to make the cakes. The franchisees presently sell the cakes from 200 outlets.

Going through Maynard’s report for the third time, I’m finding most of his queries on the accounts fairly trivial. It’s also quite normal for any errors which are discovered after the accounts are published, to be put through as prior year adjustments. However, the cumulative effect of lots of errors & inconsistencies, is that reading his report, I’m beginning to lose confidence in the company & its management.

It’s looking as if financial controls are not up to scratch, at best. At worst, there could be something a lot more worrying going on.

It’s the relationship with the auditor that is the most worrying aspect of this. CBOX issued an RNS on 20 Sept 2021, “Change of Auditor”, which gives the impression that the auditor is being changed due to a competitive tendering process, which is usually nothing to worry about -

Cake Box, the specialist retailer of fresh cream cakes, is pleased to announce that following a competitive and comprehensive tender process, overseen by the Audit Committee, it has appointed MacIntyre Hudson LLP ("MacIntyre Hudson") as the Company's auditor with immediate effect. The Company intends to put the appointment to a vote of shareholders at the Company's next Annual General Meeting.

The Company's previous auditor, RSM UK Audit LLP, submitted its letter of resignation to the Board of Directors on 16 September 2021. In accordance with the relevant Companies Act 2006 requirements, a copy of the resignation letter and statement of reasons will be sent to shareholders of the Company.

The stock market didn’t flinch at this, and why would it? It sounds perfectly normal. But as it turns out, things were not normal at all. CBOX did not issue an RNS of the letter of resignation from its outgoing auditor, which turns out to be damning. It is on CBOX’s investor relations website, but it seems few people noticed it, or read the letter (if they received it at all, because so many shares are held via nominee accounts). Also, auditor resignation letters hardly ever contain anything of note, so nobody reads them.

This is what RSM’s resignation letter said -

Statement of reasons relating to the resignation of RSM UK Audit LLP as auditors to Cake Box Holdings Plc – Company Number 08777765 (“the Company”) In accordance with section 519 of the Companies Act 2006, we consider that the following matter connected with our ceasing to hold office should be brought to the attention of the company’s members and creditors: During the course of the audit engagement, we became concerned about the robustness of the Company’s control and governance frameworks due to delays in the provision to us of audit evidence, which was not provided on a timely basis. Such delays did not, however, prevent us from issuing an unqualified audit opinion on the Company’s financial statements for the year ended 31 March 2021.

That’s as close as an auditor will get to saying that they don’t trust management. Outgoing auditors generally don’t rock the boat unless there is something seriously wrong.

What shocks me, is that there were worrying things published in CBOX’s annual report’s audit report, which nobody seems to have spotted, until Maynard flagged it in his report last week.

How many of us can truthfully say that we read the audit reports in company annual reports? I should, but in truth, I look at so many companies, that I tend to rely on the preliminary results statements, and only dip into the annual reports online when I need to look up specific details that are not usually published in the preliminary results statements (e.g. breakdown of trade receivables & creditors, bank facility details/covenants, freehold property disclosures, share options detail, etc). Only sometimes will I glance at the audit report. That needs to change. Anyone who did read the audit report, probably would have sold out near the top.

Part of the problem is that audit reports are written in such complex, legalistic language, that even people like me (I trained as an auditor for 3 years, for Price Waterhouse, from 1990-93) find the reports very difficult to understand. There’s surely an urgent need for auditors to make their reports more accessible, and write them in plain English, which would greatly enhance their use. Being cynical, a lot of it seems to be written in complex legal language, so that the auditor can wriggle out of any legal liability when things go wrong. Plus a fundamental question as to what audits are for? If they're not designed to detect fraud (as auditors claim when they fail to detect fraud), then they're largely pointless in my view.

The bottom line in this case, is that the auditor seems to have resigned because of their concerns about management & disclosures, not due to a competitive tender process. It’s quite obvious that CBOX management have not been open & honest with the auditor, e.g. by hiding the data breach it suffered, for about a year.

The big question is this - has CBOX fiddled the figures to any material extent? I think the jury is out on that. It’s not always easy to identify dodgy accounts. Look at Patisserie Valerie - unfortunately another vendor of cakes, which it turned out was a massive fraud - where management were hiding liabilities (undisclosed overdrafts & other creditors) off balance sheet, by running 2 sets of books. That’s almost impossible to identify from the accounts, because the auditor and investors, are only shown the dodgy accounts.

I must remember to check my change, next time I buy a cake from anyone.

With hindsight, the signs were there with Patisserie Valerie - mainly that it made an implausibly high profit margin, in a sector where nobody else seemed to be able to make a 10% profit margin. Also, the numbers looked too perfect - too consistent, with a smooth steady upward progression of revenues & profits. Liabilities on the balance sheet also, with hindsight, looked too low.

Could CAKE’s accounts be a similar work of fiction? We don’t know, it’s possible at any company - not just small caps, plenty of large caps also fiddle the figures, e.g. remember Tesco getting itself into hot water a few years ago, when they were cooking the books with creative accounting for supplier discounts, or something like that.

People take bizarre risks when pressurised to deliver results that the city, and investors, want to see. Plus hardly anyone ever goes to prison over this sort of thing, as investigations seem to take years, and usually fall apart, letting off the culprits.

Going back to frauds that I did identify in the past, the signs were usually very obvious, and it’s the balance sheet where the bodies are buried - usually obviously large & unusual assets, such as excessive receivables, bloated intangible assets, etc. Understated creditors are also a feature of frauds, but are harder to spot.

There were dozens of frauds on AIM, particularly from Chinese companies which listed on AIM a few years ago, almost all of which turned out to be frauds - which we spotted here, and put out a blanket avoid opinion on all Chinese AIM stocks, which turned out to be very sensible.

Also we picked up on Globo and Quindell, both of those frauds were blindingly obvious from the balance sheets, and dripping with other red flags. Gullible investors just chose to ignore the warnings, so tough luck if they lost money - hopefully they learned from the experience, and I have zero sympathy for people who shoot the messengers (like me) who explained all the detail about why these were obvious frauds, for a long time before they blew up. I don’t like his personal style, but Tom Winnifrith has done excellent work on many frauds - most of them very obvious things to avoid though, that we wouldn’t even bother to mention at all here because they're so bad - e.g. zero revenues jam tomorrow rubbish.

Going back to CBOX, I’m not concerned about it revaluing its freehold property upwards. I actually think freehold property should be revalued to market value, not kept at historic cost, as that way we get more accurate, real world ROCE calculations. A company which e.g. bought some freehold property just after WWII ended, and still has it shown in the accounts at cost, is arguably deceiving us about its returns on assets that are now seriously under-valued on the balance sheet.

Going through CBOX’s balance sheet, “Other financial assets” look unusual, but is not huge at £1.0m (see note 17 in the prelims) and this seems to be loans receivable from franchisees. Not unusual, or large, for a franchise business.

Inventories & receivables look fine to me, they’re not large, for the size of business, although note the auditor wasn’t happy with controls over inventories. But they did issue a clean audit opinion, so any queries must have been resolved.

The £5.1m cash pile must be real - as cash is the easiest thing of all to audit. Mind you, Chinese frauds got round that by pumping cash into the company just before year end from an undisclosed lender, then whipping it back out again shortly afterwards. You would hope that RSM would be smart enough to have checked the cash balances throughout the year, not just at year end.

Current liabilities as at 31 March 2021 rose a lot compared with the prior year. That doesn’t shout out to me that liabilities are being hidden.

Overall, I can’t see anything obviously odd or worrying about this balance sheet. That doesn’t rule out any problems later emerging, just that I can’t see anything untoward.

Response from CBOX - this statement was issued on 24 Jan 2022, and I find it rather unsatisfactory.

The initial sentence strikes me as haughty, and intended to belittle Maynard Paton’s meticulous report:

Cake Box notes the movement in its share price this morning and also notes recent commentary from a retail investor blogger.

CBOX describes the issues as “transcription errors”, which strikes me as odd -

The Company acknowledges some transcription errors between its 2021 Full Year Results announcement published on 30 June 2021 (the "Results Announcement") and the 2021 Annual Report and Accounts (the "Annual Report"). It also notes inconsistencies in prior period inventory reporting and comparative period disclosures relating to director interests in franchise stores. Where such discrepancies exist between the Annual Report and the Results Announcement, investors should refer to the Results Announcement.

It does however make this following valid point, so are we getting steamed up about things that don’t really matter? I can’t make up my mind on this point.

The errors noted have no impact on the Group's reported profits, cash flows or balance sheet and the Company received a clean audit opinion for the year.

It tacitly admits here that internal financial controls (and hence finance management) are not up to scratch -

As previously announced and as we continue to grow the business, a key priority for the Board remains underpinning growth with the appropriate level of experience and expertise for the Group's central functions, internal controls and processes. BDO has also been appointed to assist with implementing improved internal audit practices.

I think the CFO has to go, after presiding over clearly sloppy (and maybe worse) financial controls.

Also looking at the Director trades, the CFO banked £1.3m personally in share sales 2 days before the auditor resigned! That’s outrageous, and it makes him look dishonest. He has to go.

.

.

Going back to Maynard’s report, he questions the unusual disclosure of ageing of payables (as opposed to the more usual disclosure of ageing of receivables). He says he can’t remember seeing this before. Purely from memory, I think I have seen this disclosure before, and it’s not important, unless it shows stretched creditors, which this doesn’t. Getting too much information is not a problem.

Similarly, Maynard questions trade receivables, which are meant to be on 7-day terms, but look higher. I don’t think this is a concern, as during the pandemic, it’s entirely possible & reasonable, that CBOX may have given some leniency to franchisees which might have had cashflow problems, due to lockdowns, and given them more time to pay. So this doesn’t worry me.

Current trading - sounds OK. A reminder that this does seem to be a decent business, if we take announcements at face value (which inevitably now has a question mark dangling over it) -

The Board confirms that, since the Company updated the market with its half year results in November, trading in H2 has continued strongly and in line with expectations for the full year.

My opinion - what a fascinating situation, and big thanks to Maynard Paton for this superb report.

I’ve only reviewed it, Maynard is much closer to the detail than me, most of the details he raises are fairly minor.

However, the resignation of the auditor, with a damning resignation letter, and the CEO/CFO selling millions of pounds worth of shares when they knew there was a big problem over the accounts, puts too big a question mark over this company and the trustworthiness of its top Directors.

For that reason, I’m not prepared to take a risk by giving them the benefit of the doubt, at this stage.

I’ve changed my mind on that, having had a few days to think about this. Initially, thought it all looked a bit of a storm in a teacup, but now I’ve decided to play it safe. This could cast a cloud over the share for a long time.

To reflect the risk, I’d want a much cheaper share price, with a big discount. What level would tempt me to buy? Right now, it would have to be really low, maybe 100p or less?

Having said that, CBOX does look like a decent business. There hasn’t been any dilution since it listed almost 4 years ago, despite strong growth. Franchisees are lining up to open new shops, and pay hefty fees for doing so. I remain of the view, from the published numbers, that this is fundamentally a decent business. But can we trust management? That’s for you to decide.

The outgoing auditor clearly doesn’t trust them, so why would I?

Pity, as management came across so well on previous webinars. So I’d like to hear more from management. Ideally, a new webinar, where they openly ‘fess up to what they did wrong, apologise, launch a new range called “humble pie” maybe, bring in a new CFO, and draw a line under these issues. It seems a fundamentally decent business, but lots of investors are probably now worried that it could be a can of worms.

As a former CFO myself, there’s no excuse for sloppy financial controls. Everything should be pinned down, and reconciled to the penny. In my CFO days, I used to reconcile everything, every month, so the end of year procedures were a doddle. So I really baulk at CFOs that don’t know what they’re doing, or are in a muddle, or even worse maybe fiddling the figures. We all have a bottom drawer account, to smooth over any nasty surprises, but the basic accounting has to be accurate.

That said, Maynard hasn’t found a smoking gun, or anything seriously incorrect with the accounts, and despite disapproving of the financial controls, the auditor did sign off the last accounts as being accurate.

Follow the money, as they say. The main 2 Director/shareholders have banked millions, just before, or even after, these problems surfaced (but only Maynard noticed, to his credit).

They know the company best, and have taken millions off the table, so overall, I think I’ll avoid this share. Why take the risk?

.

Studio Retail (LON:STU) (I hold)

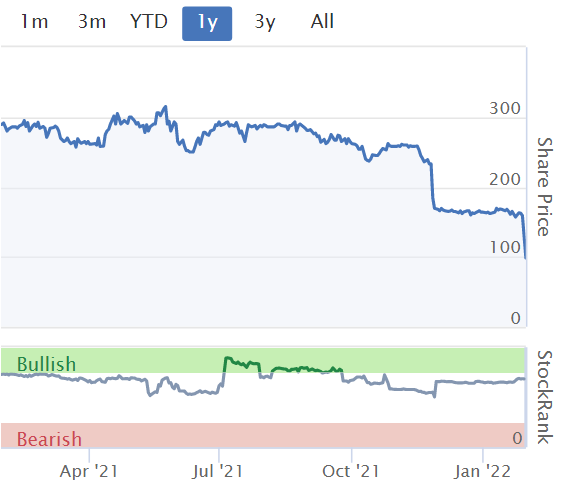

92p (down 42% at 09:46) - mkt cap £80m

I was half-expecting another profit warning from this online retail/ instalment credit business.

Previously STU issued a mild profit warning which I reviewed here on 26 Nov 2021. It wasn’t unreasonable, given supply chain problems that are affecting everyone - delays, and additional costs, so to be expected that profit expectations were trimmed a little. I concluded that it wasn’t serious, and the business looked adequately funded.

That’s changed for the worse today, with another profit warning (not in itself particularly surprising), but I’m more concerned that the company tells us today that it has run into a working capital shortfall -

… in addition to advising it is exploring a range of options to meet a short-term working capital funding requirement…including discussing the current level of our working capital facilities with our long-standing UK lenders.

It is also likely that some of the actions to improve short-term working capital discussed below will further reduce margin in the remaining weeks of the year…

What has gone wrong with working capital? It looks very basic to me - they’re just ordered too much stock -

… This has led to a higher level of inventory than normal at this time of the year. This is further compounded by commitments to current and future season stock needing to be made earlier than normal due to ongoing nervousness in supply chains.

Supply chain - still causing additional costs, as I would expect. Today's headwinds will eventually turn into tailwinds, once supply chains ease. But not any time soon -

We have also incurred some further costs linked to the shipping delays and port congestion…

We anticipate that the disruption to supply chains will continue throughout calendar 2022…

Profit guidance - has been reduced again, but is still healthy for a business that now only has a market cap of £80m.

As a result, our current expectations for Adjusted PBT(1) for the full year are now likely to be in a range of £28m to £30m.

My opinion - I’m disgusted at this. Trimming profit guidance is fine, and to be expected given the ongoing supply chain issues. But over-ordering stock, then apparently being surprised when you run out of liquidity, is appalling. It demonstrates to me that the CFO doesn’t have proper control over the business, and buyers perhaps operating independently of the finance department, and not having proper budgets, or controls. There's clearly inadequate forecasting & control going on. The whole point is that problems like this should have been anticipated, and avoided.

A good CFO would have prevented this happening, and would have lined up additional borrowing facilities in advance. Not drop a bombshell on shareholders, who now have to hope the bank decide to be helpful & flexible.

There’s now a chance the bank might dig in, and tell the company to raise additional money from shareholders. Hence a risk of a placing, and the trouble with those, is the institutions can just name their price. They might be supportive, and want to protect the value of their existing shares, or they might be brutal and demand a deep discount for putting in fresh capital. It’s an almost random risk factor where private shareholders don’t know the outcome. It could be fine (e.g. Card Factory (LON:CARD) somehow muddled through without diluting shareholders, despite looking quite precarious for a while, but better now). However Revolution Bars (LON:RBG) (I hold) shareholders got stuffed twice, with 2 deeply discounted fundraises. You just can’t tell how things are going to go, in situations where more equity is needed.

I’m seriously unimpressed with mgt at STU, and didn’t think it was a very good company to start with. Now we know it’s badly run, without effective financial controls over the buying & stock holdings, with the uncertainty of whether the bank will extend support, which might include a requirement to do a placing, I think this share has become very unattractive for the time being.

It was never a high conviction holding for me, and now I’ve lost confidence in management, am not prepared to sit around and wait for it to fix the funding shortfall, as that introduces a lot more risk than I originally planned.

So I’ve decided to ditch this share, and move on.

Bull case - at some point it could recover of course (probably just after I sell!). The update note from Liberum today (many thanks for this) reduces EPS for FY 3/2022 to 25.8p. At 92p, that’s a PER of just 3.6 times. So once the dust has settled and the all-important working capital crunch has been dealt with, I’ll take a fresh look at the share.

Although I’m not likely to buy back in until the CFO has been replaced. Preventing a company running out of cash is the absolute core duty of all CFOs. Having someone asleep at the wheel, and then telling the stock market that you’re exploring options to get hold of more working capital, is totally unacceptable.

There are plenty of charts that look like this at the moment. Some of them could be great buys, for a recovery. The jury's out on whether STU is one of those or not.

.

Purplebricks (LON:PURP)

20.9p (up 4% at 11:26) - mkt cap £64m

This is on my list of potential turnarounds. The share price has been smashed downwards by a catalogue of expensive problems that need sorting out. On the upside, PURP had plenty of cash in the bank, and a well-known brand name.

Purplebricks Group plc (AIM: PURP), the UK's leading tech-led estate agency business, announces its half year results for the six months ended 31 October 2021

H1 trading has been very poor, with a big increase in exceptional costs (of £8.3m) causing an operating loss of £(11.1)m.

Note that revenues was flattered by instructions from the prior period, so the underlying picture from instructions is a lot worse than the reported revenues.

Clearly the business is in trouble, and they say it’s been restructured, but crucially it still benefits from a big cash pile, of £58.3m. There’s a very healthy £50.7m of net current assets, so PURP looks financially strong enough to survive, as other online estate agents risk withering away as their funding dries up.

Provision for problems at its lettings division have been made at £3.6m, which is less than some press reports suggested.

Outlook comments - don’t have a lot of credibility in my eyes, given previous mis-steps, and this first bit sounds negative -

Since the period-end, we have continued to see a significant imbalance between the strong demand for housing and a very limited supply of stock, which has driven house prices higher. Although housing supply has increased in January, we expect these market dynamics to continue through the second half of our financial year, which will continue to impact instructions and gross margins. In addition, the comparable performance will also be impacted by the expected increase in costs associated with our transition to a fully employed model.

Set against these market challenges, we are greatly encouraged by the positive signs we are seeing in our operational performance since we implemented our new operating model. We are confident that the steps we have taken to improve the business will drive a return to growth and market share gains in 2023.

My opinion - this share looks a potentially interesting special situation. The key point is that it’s got pots of cash, so should hopefully be able to get through the various issues which have arisen.

Anyone buying this share needs to properly research it, and be fully aware of the various problems, and risks.

At £64m, the market cap looks cheap, given there is not far off that amount of cash in the bank, of £58m.

Does the cash deplete, from continued trading losses, and settling old liabilities? Or does the business stabilise, and return to growth? No idea! With the shares down at this lowly level, I think risk:reward could be coming into interesting territory, for special situations investors.

I'm wondering if there might be an opportunity for a trade here - targeting say a 50% gain, then moving on? The bad news is probably in the price now, but you never can tell for sure.

.

.

Sthree (LON:STEM)

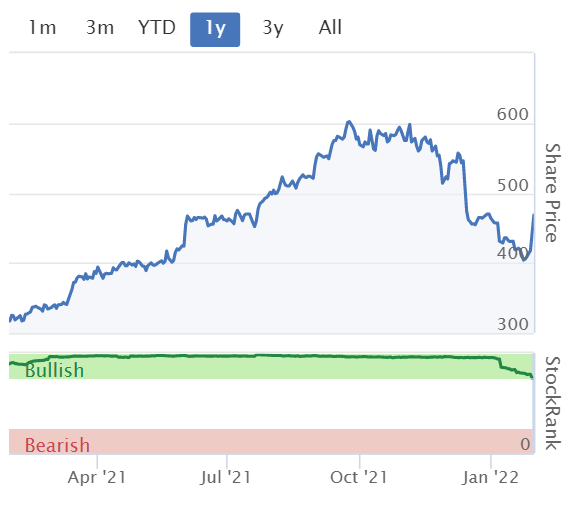

467p (up 12% at 11:53) - mkt cap £625m

This share has cropped up in the reader comments before, with our resident sector expert BnB previously flagging this as a good staffing company, reasonably priced. Jack has also written about Robert Walters (LON:RWA) several times, following positive trading updates. We prefer these shares to say Staffline (LON:STAF) (see above) or Gattaca (LON:GATC) .

Looking at the accounts today from STEM, it immediately strikes me how much better quality the business is than STAF. STEM makes a much stronger profit margin, which shot up from 10.1% in FY 11/2020, to 17.1% in FY 11/2021 - this measure is calculated as operating profit divided by net fees. Actually STAF is behind, but not horrendously so, at 12.1%

I’m wondering if STEM is getting a one-off return to normal margins, after weak margins during the pandemic? So maybe we shouldn’t be expecting profit growth to continue at the same rapid rate in future?

Basic EPS is 31.8p, up 129% on LY - excellent.

The PER is now 14.7, taking into account today’s 12% rise in share price. Seems reasonable still.

Outlook comments -

Our year started with strong forward momentum. We will continue to build sustainable growth and will resume our plans for internal investment during the year, particularly in the infrastructure that will allow us to expertly harness data and efficiencies, for example in further enhanced CRM and ERP platforms. We expect to deliver double-digit growth in net fees and profits in 2022, maintaining our operating conversion ratio at similar levels to 2021 to allow for the impact from investment of between 1% and 2% of net fees to further strengthen our operational and sales platforms. We anticipate payback on the investment, delivering an acceleration of margins from 2023.

I believe we have good reason to be confident: we are in the right markets, we are focused on the right sectors, and we have a team that is flexible and resilient enough to seize the opportunities ahead of us.

Balance sheet - looks fine to me, it’s ungeared, with £57.5m net cash.

No issues here at all, that I can see.

My opinion - just a quick, superficial look at the key numbers, but I’ve come away impressed. This looks a decent business, reasonably priced, and financially strong.

This looks a good place to park your money, so a thumbs up from me.

.

.

Jack’s section

Belvoir (LON:BLV)

Share price: 257.44p (+6.82%)

Shares in issue: 37,292,113

Market cap: £96m

This is a leading UK property franchise and financial services group. Along with M Winkworth (LON:WINK) and Property Franchise (LON:TPFG) (I hold), these stocks offer good profitability, financial health, and growth prospects at reasonable valuations.

I’m a fan of the business model here. Franchise income is high margin and the companies are cash generative. There is cyclicality risk if we see a downturn in the property market, which would hit share prices, but enterprises such as Belvoir would ultimately survive and continue to grow longer term, in my opinion.

Trading update for the year to 31 December 2021

Comfortably Ahead of Expectations

Revenue is up 36% in the year to a record £29.6m, meaning profit before tax will be comfortably ahead of management expectations.

2021 was one of the busiest years in recent times for the estate agency, with residential property sales transactions up 41% on 2020 and 22% ahead of the six-year average to 2019.

Against this strong backdrop, the group expanded both its property and financial services networks with the acquisitions of Nicholas Humphreys (a specialist student lettings franchise), and Nottingham Mortgage Services (the mortgage arm of The Nottingham Building Society).

Revenue from the financial services division increased significantly by 49% to £14.4m, having grown the network of financial advisers by 20% to 243. Conditions were buoyant in the residential property sales market throughout most of 2021, and towards the end of the year experienced a strong period for remortgage activity.

Revenue from the property division was up 27% to £15.2m. The acquisition of the Nicholas Humphreys network added £2.2m.

Management service fees ("MSF"), the key underlying return from franchisees, was up 18% for the year to £10.7m.

Sales MSF jumped by 56% to £2.5m, with the extension of the stamp duty holiday ensuring that the residential sales market remained highly active until September. After that, the market returned to more normal transaction levels but unfulfilled demand has continued to fuel house price inflation.

Lettings MSF increased by 10% to £8.2m* (2020: £7.5m) of which £0.3m related to the Nicholas Humphreys acquisition and newly franchised Lovelle offices. The underlying lettings MSF increase of 6% reflected a strong lettings market.

The demand for more space and a return of young people to UK cities as offices re-opened post lockdown resulted in insufficient supply of available properties to rent and as such rents on new tenancies were seen to rise by around 8%.

Net debt has fallen by almost two thirds to £1.3m (2020: £3.7m), despite £4.7m of cash spent on corporate acquisitions.

Dorian Gonsalves, CEO, commented:

With our significant recurring lettings revenue stream and our substantial financial services client base to draw upon during what is currently a strong market for remortgages, we believe the Group is well insulated from what could be a more challenging market in 2022. Given the resilience and diversity of our business model, we remain confident that we will continue to perform well relative to the market as a whole. Meanwhile, the Board continues to identify suitable acquisition targets to support continued growth and enhance shareholder value still further.

Diary date - The audited results for the financial year ended 31 December 2021 will be announced on Monday, 4 April 2022.

There’s also a 20 minute presentation, including Q&A from participants, at Mello on Monday 7 February, starting at 6pm. If you want to attend as a shareholder, you can register here for the event using code SHVIP for 75% off tickets.

Conclusion

Belvoir has grown its revenue at a compound annual growth rate of more than 25% over the past five years, with operating margins consistently around 30%.

The group has proven itself over the past couple of years as a well run company, one of the best in its space. It has done a particularly good job in growing its financial services division and seems to be ahead of competition here. I think the stock is probably too cheap at these levels and warrants a higher valuation multiple.

There are perhaps general concerns around the long term health of the property market, particularly as the Bank looks to nudge up interest rates. And the CEO does touch on this in his comment, with signs that 2022 might be more challenging.

Everything I’ve seen so far suggests a pretty buoyant rental market though. The group notes the return of workers to cities and ‘insufficient properties to rent’. Perhaps Gonsalves’s comment refers to the sales market then, which has contributed a higher-than-usual amount to gross profit this year.

Ultimately I continue to think the shares offer good value at 12.8x forecast earnings (likely less) and a forecast yield of 3.61%.

Tandem (LON:TND)

Share price: 509.6p (+1.92%)

Shares in issue: 5,284,116

Market cap: £26.9m

(I hold)

Trading update for the year to 31 December 2021

The Group expects to report FY21 revenue of £40.9m, with FY21 profit before tax expected to be well ahead of the prior year and slightly ahead of the current market expectations.

It looks like the current market expectation is for profit before tax of £4.6m.

The Christmas trading period saw continued robust performance from the group's toys, sports & leisure business and, whilst H2 growth rates did not match H1, turnover was still over 7% ahead of the same period in the prior year.

Revenue in the first half of the year was approximately 14% ahead.

Toys, sports & leisure - Revenue from the toy, sports and leisure business was ahead of the prior year. The Ben Sayers golf range continued to perform well, with revenue growth of 33%.

The group recently exhibited at London Toy Fair with positive feedback, especially on new licences including Bluey, CoComelon and Rainbow High. There was also general excitement about the new Disney Pixar Lightyear range, with the movie being released in June this year.

Bicycles - Revenue approximately 3% ahead of last year, with the lightweight Squish branded children's range performing strongly, (+31% turnover on the prior period). The challenge here remains stock availability, although this pressure has been easing in recent months and the group starts the current year with better availability.

Home & garden - Revenue was approximately 9% ahead of the prior period, with solid growth in outdoor ranges. These are mostly sold from Tandem’s online platforms.

eMobility - Revenue increased by over 70% compared to the prior year comparative, with our Li-Fe and Wired range of eScooters performing particularly well. Sales of eBikes under the Dawes, Falcon and Claud Butler brands also saw significant double digit growth.

Outlook - 2022 has begun more slowly, with some customers delaying orders into future months.

Tandem does expect its eMobility business to continue to expand in 2022 though and is investing further here. This includes a refurbishment of the group’s onsite shop at Castle Bromwich, planned for completion in Q2 2022.

Work has begun on a new B2C (business to consumer) website which will focus on all of Tandem’s eMobility products.

Formal planning permission was granted on 23 December 2021 for the new warehouse project with no pre-commencement conditions attached. Construction work has now begun and is anticipated to be completed in Q4 2022. This warehouse will provide the group with additional capacity, helping to grow its domestic business and enhance efficiency due to centralised operations. This should be a big step forward, operationally speaking.

The business continues to experience global logistical challenges, which are still impacting upon the supply of goods from the Far East to the UK. Despite this, our order book remains materially ahead of the comparative position in the prior year.

Diary date - FY21 results to be published on 28 March 2022.

Conclusion

Tandem has a habit of releasing updates that sound slightly mixed. Positives:

- FY21 profit before tax expected to be well ahead of the prior year and slightly ahead of the current market expectations,

- Stock availability is improving,

- The new warehouse is in construction and will bring extra capacity and cost savings from Q4 2022,

- Home and garden sales are up 9% year-on-year,

- eMobility is +70% yoy,

- Order book is 10% higher than last year’s, which was a record at the time.

Negatives:

- Global logistics issues remain,

- 2022 has begun more slowly.

On balance, there is more good than bad here and with the company’s current valuation (c6.4x forecast PER) there is probably upside. I think the valuation is an important consideration here. This is not a racey software multiple demanding high levels of growth. It is a £29.7m market cap company racking up £40.7m in annual revenue, with operating margins recently in excess of 10%.

All that’s required in order to lift the shares is steady progress, which is still on the cards. Tandem is well positioned to benefit from growth in eMobility, while its renewed focus on websites and online trading is good news. The group’s net asset value should continue to grow as well, and the new warehouse is a significant development for the enterprise.

Overall, I’m positive at these levels. It’s not in the company’s character to ‘wow’ the market with the tone of its updates, so the investment requires patience. But I do think several initiatives are moving in the right direction and it’s entirely possible for Tandem to grow over time given its brands, expertise, routes to markets, and cash generation.

Sylvania Platinum (LON:SLP)

Share price: 95.82p (-3.21%)

Shares in issue: 272,985,435

Market cap: £261.6m

(I hold)

Stockopedia’s own Investment Club has a holding here - in fact it is the club’s best-performing current investment, although the past six months or so have been less stellar.

Q2 update to 31 December 2021

- Sylvania Dump Operations ("SDO") achieved 16,605 4E PGM ounces in Q2 (Q1: 15,771 ounces),

- SDO Q2 net revenue up from $29.8m to $37.9m,

- Cash costs per 4E PGM ounce down from $862 to $772,

- Group EBITDA up from $13.6m to $22.3m,

- Net profit up from $8.6m to $15.5m,

- Cash balance of $110.1m (Q1: $132.7m).

It sounds as though there are a few short term challenges.

The Western operations have faced continuing challenges due to water shortages at the plant and water shortages at Lesedi were exacerbated by the temporary tailings deposition strategy. Another challenge is lower PGM feed grades in ROM at Mooinooi operation.

Full year production guidance has been pulled back to 66-68koz from 70koz as a result.

Production should lift in H2 as new projects begin to make an impact and Samancor restarts.

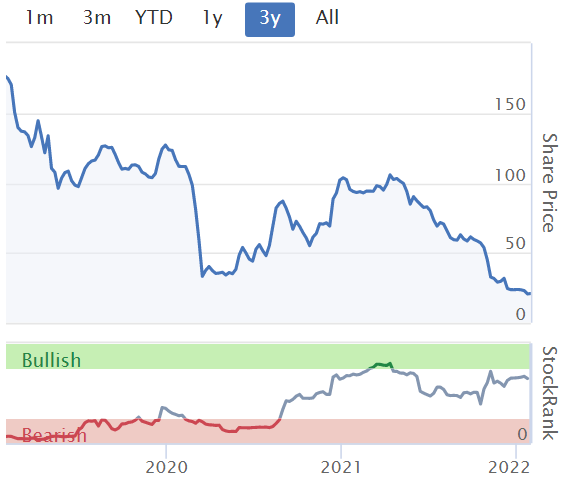

Offsetting some of this is an improvement in PGM recovery efficiency, up 5% in the quarter and resulting in reduced costs. There are signs of an improving PGM basket price, too, which is what led to SLP’s initial dramatic share price gains a couple of years ago.

The Grasvally sale is back on, with the $6.4m purchase price for SLP’s 74% stake to be paid over 15 instalments.

Commenting on the Q2 results, Sylvania's CEO, Jaco Prinsloo said:

Net revenue increased 27% to $37.9 million and net profit increased 80% to $15.5 million, with the PGM basket price realised from our smelters of $2,892/ounce remaining at similar levels as Q1. Our capital projects remain fully funded from current cash reserves and we are making significant progress in terms of access to additional chrome tailings resources at both the Eastern and Western Operations.

Conclusion

There has been quite a lot of share price turbulence here recently, but the underlying rationale remains the same: if the PGM basket price has reached a new equilibrium and the outlook is positive, then SLP is set to generate a lot of cash in the coming years.

The shares have risen from 20p to 96p over the past three years but still trade on a forecast PER of just 3.9x. It’s worth viewing the past 12 months’ share price performance in that context.

Still, the share price volatility is a consideration and I feel as though it might have caught a few investors out over the past six to eight months. There are some short term operational challenges which could mean that volatility continues now it has rerated from 2020 levels.

These operational challenges, assuming they can be handled by the experienced management team, pale in significance compared to views on medium term PGM prices. That is the critical factor here. Liberum is forecasting net cash flow from operating activities of $66.3m and $127.1m for FY22 and FY23 respectively, which are big numbers for a £270m company. Net cash is forecast to grow from $106m in FY21 to $217m by FY23.

The share price is at times noisy and a lot depends on the future PGM basket, which is a dynamic that Sylvania itself acknowledges is difficult to forecast. Recent trends have been positive though and the shares continue to look cheap at the current levels of cash generation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.