Good morning, it's Paul & Jack here with Tuesday's SCVR.

Agenda -

Paul's Section:

Smartspace Software (LON:SMRT) - trading update for FY 1/2022 is slightly ahead of expectations, but remember expectations were greatly lowered after profit warnings last year. Still loss-making, and I think it needs to demonstrate stronger growth to become interesting. Worth keeping an eye on it though, as office staff returning is helping boost the sales pipeline.

Loopup (LON:LOOP) - a very poor track record here. The original business hasn't worked, so now they're trying something else (cloud telephony for Teams). Difficult to say if it's likely to work or not. Conserving cash, but has £2.5m net debt. I wouldn't be surprised if it needs another fundraising.

Jack's section:

Rm (LON:RM.) - mixed preliminary results with adjusted progress but a statutory drop in profits. The company has struggled to grow in the past, in my view. The new CEO and strategic plan could rectify this, there has been good progress in the pension scheme valuation, and the valuation remains modest. The shares could rerate at some point, but I’m holding off for more concrete signs of operational momentum.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Smartspace Software (LON:SMRT)

66p (pre market open) - mkt cap £19m

SmartSpace Software plc, (AIM:SMRT) the leading provider of 'Integrated Space Management Software' for smart buildings and commercial spaces, is pleased to announce a trading update following the Company's year end of 31 January 2022.

Slightly ahead of expectations - but important to remember that expectations were considerably lowered last autumn -

.

Guidance for FY 1/2022 -

Revenue £5.3m (mostly recurring)

Adj LBITDA (loss, not a typo!) c.£(2.5)m

Gross cash £2.76m

Outlook - clearly the figures for FY 1/2022 look poor but the company looks set to be a beneficiary from staff returning to offices -

"Both SwipedOn and Space Connect have continued to achieve strong growth since our last two trading updates in October 2021 and January 2022.

We are encouraged by the strong growth in ARR and ARPU, despite the work from home policies which persisted in the UK and USA until recently. In other markets, such as Australia, we have seen a strong resurgence since coming out of lockdown in the Autumn.

The recent push to return to the office has seen a significant pick up in orders and movement in our sales pipeline, in particular in the UK.

Consolidation in sector - this is interesting - could there be hidden value in SMRT to an acquirer?

Consolidation in our market has continued apace, evidenced by a number of major competitors being acquired at exceptionally high ARR multiples over the past few months.

Forecasts - unusually for such a small company there are 2 good quality broker notes out this morning, from Singers & Canaccord.

They’re both forecasting around £(2.0)m adj loss before tax for FY 1/2023, on revenues up between 23-32%. This reinforces how small the company is, and it’s still a long way short of breakeven.

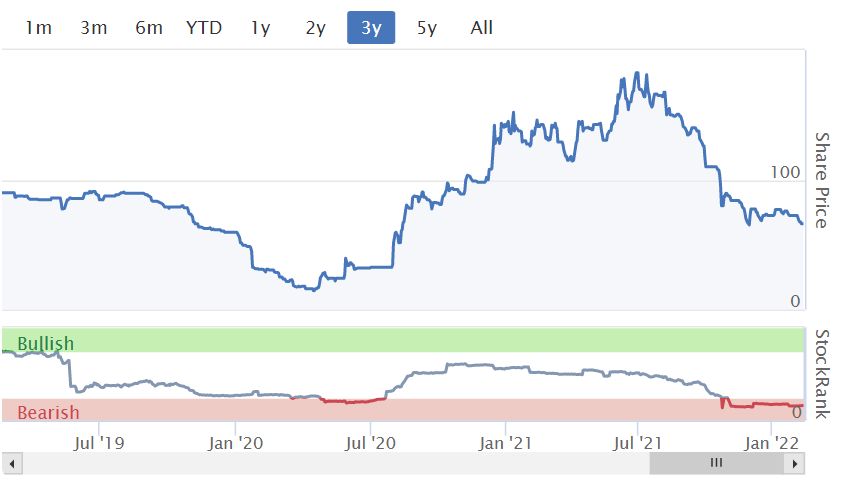

My opinion - the share price of SMRT has come down a lot, reflecting poor performance. However, with offices now apparently opening up again, and positive-sounding outlook comments, I imagine 2022 should be a better year than 2021.

I’ll keep an eye on it, for out-perform trading updates during 2022, but as things stand currently, I think the company needs to demonstrate stronger growth to interest me.

With so many bargains around in small caps right now, why chase a loss-making minnow like this?

It multi-bagged from the lows, but has since failed to live up to expectations.

Note the StockRank has reflected poor performance, by returning to the red.

.

Loopup (LON:LOOP)

9p (down c.30% at 08:16) - mkt cap £10m

LoopUp Group plc (AIM: LOOP), the cloud platform for premium external communications, announces a trading update for its financial year ended 31 December 2021.

Clear guidance for FY 12/2021 -

The Group expects both revenue and EBITDA for year ended 31 December 2021 to be broadly in line with market expectations with outturns at approximately £19.5 million (FY2020: £50.2 million) and £0.9million (FY2020: £15.3 million) respectively.

The Group ended the year with gross cash of £5.5 million (FY2020: £12.1 million) and net debt of £2.5 million (FY2020: £0.7 million), following the successful placing and retail offer for approximately £8.85 million in September 2021.

Outlook -

The Group expects FY2021's strong performance in Cloud Telephony new wins to improve further to at least an additional 50 during FY2022, and the integration of SyncRTC (acquired in October 2021) is progressing well. Due to the longer lag from bookings to revenue in Cloud Telephony, combined with continued expected pressure on its Remote Meetings business, the Group expects FY2022 revenue to be in the £15-16 million range.

The Group is managing its operations carefully during this strategic transition to preserve cash and maintain EBITDA profitability in FY2022, at a higher expected margin than FY2021.

My opinion - there’s more positive-sounding commentary provided, but it’s difficult to put it into context.

The way I see things, the original business of a remote meetings service is withering away, because it’s too expensive for customers.

LOOP’s strategy is to build up its newer cloud telephony service for Microsoft Teams.

Therefore this share currently looks a punt on the cloud telephony service generating enough revenues to allow the company to survive.

Being in a net debt position, even after a fundraising last year, is not ideal. I wonder what the terms of the debt are, and if breached covenants could become an issue?

At this stage therefore, this share looks a gamble. That said, £10m market cap could leave scope for upside, if the Teams cloud telephony service does take off, and they seem to be winning some significant sized contracts.

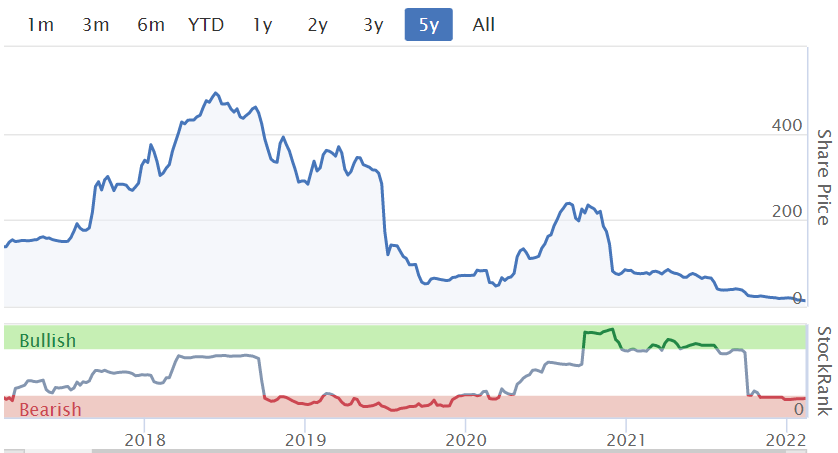

The company & management have such a poor track record, that it’s difficult to have much confidence at this stage.

Several false dawns in the past, make it difficult to believe the positive commentary this time.

.

Jack's section

Rm (LON:RM.)

Share price: 158.1p (-2.11%)

Shares in issue: 82,706,000

Market cap: £130.8m

Preliminary results for the year to 30 November 2021

Highlights:

- Revenue +12% to £210.9m,

- Adjusted operating profit +22% to £18.5m (adj. Operating margin up 0.8pp to 8.8%),

- Adjusted profit before tax +22% to £17.1m but statutory PBT -45% to £4.2m,

- Adjusted diluted EPS +21% to 16.4p; diluted EPS -45% to 5p,

- Proposed dividend up from 3p to 4.7p,

- Net debt up from £1.3m to £18.3m but pension has swung from deficit of £18.7m to surplus of £30.4m.

Following a strategy review, the group is changing how it reports.

- RM Resources remains the same. This is the provider of education resources for early years, primary schools and secondary schools.

- RM Results becomes RM Assessment due to its broadened product portfolio. This segment provides assessment software for exam awarding bodies and governments.

- RM Education becomes RM Technology due to its focus on improving the technology environment in schools with IT software, tech, and services.

Demand for the Resources division was understandably affected by school closures in Q1 but recovered in its UK market following the return to face-to-face teaching, with sales ahead of pre-pandemic levels. Some of this will be catch-up spend but RM does note that the segment ‘has enjoyed a useful gain in UK market share’.

The situation overseas remains trickier however, and supply chain issues have impacted operating costs and margins.

Digital Assessment - again constrained by the absence of formal school examinations in the UK and ‘difficulties in negotiating new contracts overseas’. Performance in 2022 will be affected by a low level of new awards in 2021 and the extent to which UK school public examinations return to normal.

Technology - a steady year as schools maintained their systems. The short-term performance will be relatively flat.

Good progress has been made on the warehouse consolidation project and the group-wide IT investment. The RM Resources distribution facility is complete and should begin to generate efficiencies.

Adjusted vs. statutory

There’s a big gap between adjusted and statutory results, some £11.5m between adj. operating profit of £18.5m and statutory OP of £7m. Here are the adjustments:

This is what the group says on that £8.3m of IT platform costs:

Following the IFRS interpretations committee ("IFRIC") agenda decision, we have changed our accounting treatment and policy for IAS38 Intangible Assets accordingly. The directors determined that £8.3m of SaaS related costs incurred during FY21 no longer meet the criteria for recognition as an asset under IAS38. Accordingly, this amount has instead been expensed to the income statement. A total of £6.9 million SaaS related costs incurred in the year have been capitalised and recognised on the balance sheet as an intangible asset.

I’m unclear on the ongoing impact of this accounting change. It is listed here as an adjustment to underlying operations, so presumably it will not be a feature in future accounts but that will be something to check.

Balance sheet

Around 35% of total assets are goodwill and intangibles, resulting in net tangible asset value of £15m (helped by the large swing in pension scheme valuation). There’s a large amount of payables but stable year-on-year. Cash at bank is a little low at £3.6m, particularly against £66m of current liabilities, but the overall current ratio is just about OK, hovering around the 1x mark.

New CEO:

Following my appointment as Chief Executive in the second quarter of 2021, it was clear that the priority for RM moving forward should be to establish a clear path to long-term sustainable growth for the benefit of all stakeholders.

This is a key point for me: RM has struggled to grow consistently. The CEO brings a new five-point strategic plan to address this, so we'll see if that makes an impact.

Pension Scheme

The notable improvement here was driven primarily by better than expected returns on scheme assets, together with an increase in the discount rate, partially offset by an increase in inflation.

Deficit recovery plan payments in 2021 were £4.4m (2020: £4.1m) - the triennial valuation is nearing completion though and this could result in reduced pension contributions in future.

Cash flow

RM generated cash from operations for the year of £8.4m (2020: £25.9m) after the £6.5m SaaS cost charge and the settlement of £3.5m of deferred VAT liabilities. However, net capex of £11.8m means an overall outflow.

Conclusion

It’s a mixed bag. Anyone with children will be understanding of the Covid impact, but it looks like some areas such as Technology are struggling relative to peers. Resources has done well though, gaining UK market share.

RM says its longer term outlook is positive due to increasing use of technology in schools, spurred on by lockdowns, and a trend towards larger school groups consolidating procurement. Increasing use of tech has been a dynamic for many years now though, and the share price has little to show for that particular tailwind.

The group does say that only around 4% of the $6.5tn global education and training spend is digital, and that ‘schools are at the start of a long digital maturity journey’, so perhaps digital adoption is less advanced than you might expect.

RM has a rich heritage in the education sector but has at times struggled to translate that into a cohesive opportunity going forward. I’m not 100% convinced that capital allocation has been optimal in the past, with some large acquisitions and not much yet to show for it, but a new CEO and revised growth strategy gives some hope. There could also be some good news approaching with regards to pension contributions. The group is cash generative, so if it can deploy that cash wisely then things could change.

It’s modestly valued at these levels, especially for a company included in the Software industry group, so that is an attraction. Perhaps it limits the potential downside from here, and the stock is under the radar so could potentially rerate at some point.

The share price momentum is poor though and the company needs to prove that it has a clear path for growth. I understand the Covid impact, but I’d still rather hold off until there are more concrete signs of positive operational progress.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.