Good morning, it's Jack & Roland here with Wednesday's SCVR. Paul's off for a couple of days while the news flow is quieter. If you see anything of interest leave us a comment and we'll see if we can get around to it.

Agenda

Jack's section:

Ra International (LON:RAI) - H2 Covid disruption means FY EBITDA has halved to $7m. The order book has also dropped by 50% year-on-year due to delays to contracts, and the group is moving away from commercial opportunities as a result. The valuation looks cheap on the face of it, and trading could recover, but the shares are illiquid and the update lacks detail, so I’m happy to remain on the sidelines for now as it looks high risk.

Ocean Outdoor (LON:OOUT) - an encouraging rebound in trading for this digital out of home specialist. The group has spent an awful lot of money on acquisitions, and Covid has obviously had an impact, so underlying progress is difficult to gauge. It could be that an enlarged group is poised to rapidly become much more profitable, but it remains a relatively unknown entity for me so I’m currently neutral. There's an ongoing strategic review as well and the company has received offers for a potential sale, so we could hear news on that front at some point.

Roland's section

Filta Group (LON:FLTA) - a recommended all-share offer from Franchise Brands (LON:FRAN) values Filta at a shade under 171p and looks almost certain to succeed. I think this could be a logical and reasonably priced deal, assuming both businesses are able to maintain historic rates of growth.

Arbuthnot Banking (LON:ARBB) - this unusual family-controlled banking group has issued a brief trading statement confirming a strong end to 2022. The Stockopedia metrics present a mixed picture, but I think the group’s record suggests it might be worth further research for patient long-term investors.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Jack's section

Ra International (LON:RAI)

Share price: 30.25p (-20.39%)

Shares in issue: 171,791,843

Market cap: £52m

RA is a specialist provider of complex and integrated remote site services to Humanitarian, Governmental and Commercial organisations around the world.

Trading update for the 12mths to 31 December 2021

RA expects to report FY revenue of $54m and underlying EBITDA of $7m, with the reduced level of revenue set to impact gross margin and profit. The group says revenue is in line but I actually have it as slightly ahead of the £52.1m Stockopedia consensus figure.

Gross margin sounds less reassuring, however. This has been impacted not just by the revenue reduction, but by travel restrictions, quarantine requirements, and supply chain delays. G&A costs are up by $2m in the year and EBITDA has more than halved from $14.2m to c$7m.

The order book as at 31 December 2021 was $100m, just half of the $200m reported at the end of the last financial year. Some contracts and tenders have been delayed, so a resumption of more normal operating conditions might see these come back. It’s likely not enough to make up the $100m difference though.

Net debt of $1m excluding lease liabilities, with cash on the balance sheet of $9m.

CEO Soraya Narfeldt comments:

This has been a frustrating period, with client and COVID-19 related operating constraints continuing to cause inefficiencies and exceptional delays in executing projects, in tender issues, awards and in project mobilisations. This has impacted our profitability for the last six months of 2021 and also stalled our order book momentum. However, the underlying business has remained profitable through this disruption and our solid balance sheet supports our forward looking requirements.

It sounds like the group’s commercial sector opportunities are largely to blame.

we have seen particular risks and delays with new business activity in the Commercial sector. As a result, going forward, we will be more selective in the projects we look to undertake in this sector, and it will be less of a focus of our business development activities.

RA will instead refocus on government and humanitarian projects.

Conclusion

This is a short update and I’m happy to stay on the sidelines as we wait for the full year results.

There’s no earnings guidance given by the management unfortunately, and the tone of the update hardly suggests it is worth digging through previous accounts to get a handle here. Directionally, it will be down so I’m just going to hold off until we get more commentary.

It looks like some holders might have been figuring this out in January.

Momentum has been hit hard by Covid disruptions in the second half, with several projects unexpectedly (and recently) delayed. That suggests a poor level of visibility. The $100m order backlog is presumably some way below target. There’s also been a knock-on effect of increased net debt due to elevated levels of Mozambique-related inventory.

Lower capex as a result of delays suggests the balance sheet will remain ok, but that’s a small positive in context.

Having said all of the above, the valuation here is notably low already. There’s a forecast yield of 4.27% (now up to around 6.9%) - that wasn’t mentioned at all in the update, so presumably this is still on the cards. I think there's now a question mark over the forecast PER measure.

The share price is very illiquid. You can only reliably buy around £1k with a 526bps spread, and the free float is just 18%. No surprise then to see the shares marked down c20% currently, volatility can be expected. The company is quite capex heavy during normal operations too, and net cash has fallen.

There is a chance of a recovery over the next year or two if things pick up, but for now I’m waiting for the dust to settle and a chance to get more detail from management. It seems high risk to me.

Ocean Outdoor (LON:OOUT)

Share price: $9.80 (+6.52%)

Shares in issue: 53,930,223

Market cap: £390m

This is a leading operator of premium digital out of home (DOOH®) advertising in the UK, the Netherlands, the Nordics and Germany, focusing on iconic assets like flagship shopping centres in high footfall locations.

- Revenue +44.3% to £124.4m

- Adjusted EBITDA up to £18.6m from a loss of -£0.4m

An encouraging recovery here, with a strong bounce back in demand for Digital Out of Home (DOOH) advertising from Q2 onwards (tracking the vaccine rollout and phased lifting of restrictions). This includes appointments for its digital advertising products and services in Edinburgh, Copenhagen, and Canary Wharf.

Importantly, Ocean also experienced a renewed confidence among the high-spending advertising categories, with the 'power brands' committing a greater proportion of their budgets to DOOH® as well as an increasing number of new adopters, reflecting the long term structural tailwind within the sector.

But it’s not just familiar faces driving demand. The group says it is seeing an increasing number of new adopters too, giving some weight to what it describes as a ‘long term structural tailwind within the sector’.

Strategic review

This is interesting:

On 15 November 2021, Ocean announced that it had initiated a strategic review to evaluate potential strategic and financial alternatives to maximise shareholder value. This decision was taken after the Board and management felt that Ocean was undervalued, with the share price continuing to face technical trading challenges unrelated to Ocean's strong business fundamentals and intrinsic value. The Board is continuing to evaluate a number of options, including a potential sale, following interest and conditional offers received which may or may not lead to a transaction. Another update will be made when appropriate.

The shares are up by nearly 50% since November, so if offers are still being entertained then presumably the figures being discussed are above today’s share price.

Current trading - some ongoing restrictions in leisure and hospitality but trading has started ‘very strongly’ and FY22 revenue and adjusted EBITDA is expected to be ahead of FY19 levels of £104m and £52.7m respectively.

Balance sheet - Stockopedia flags this up as a risk. The liquidity ratios do look low and there are a fair amount of liabilities, so I’d want to be more comfortable with the financial health. Particularly given Ocean’s penchant for large acquisitions.

Conclusion

Some 90% of Ocean Outdoor’s income is from DOOH, and it looks to be a leader here, which makes it a relatively unique proposition. It’s a shame Covid disruption over the past two years makes the company’s prospects hard to gauge.

This is compounded by the fact the group has spent a lot on acquisitions in its short listed life. In fact, it’s spent more than its market cap on buying businesses.

Ocean says it remains on the acquisition trail, but that its Europe markets present organic growth opportunities as well. It’s apparent that the group provides a premium service across popular locations and yet it remains under the radar of most investors.

The Covid recovery has played out in the share price though, so we’re left considering the growth potential of the company.

I’m neutral for now - an interesting company with what looks like a leading position in a growing market. Not one I’m familiar with though, and the substantial acquisition spend is slightly off putting, as are the low liquidity ratios.

Roland’s section

Filta Group (LON:FLTA)

Share price: 158p (pre-open)

Shares in issue: 29.1m

Market cap: £46m (pre-open)

Recommended offer from Franchise Brands

AIM small cap Franchise Brands (LON:FRAN) has made a recommended all-share offer for Filta, which provides maintenance services for commercial kitchens. Under the terms of the offer, Filta shareholders will receive 1.157 new Franchise Brands shares for each Filta share.

The deal values Filta at £49.8m or 170.7p, based on yesterday’s closing prices. That’s a modest 7.7% premium to yesterday’s close, but a more reasonable 23.8% premium to the three-month volume-weighted average price for Filta shares.

The valuation seems reasonable to me. Franchise Brands’ offer puts Filta stock on around 22 times 2022 forecast earnings - this graphic is based on yesterday’s close:

Filta released a strong trading update on 7 February, so that might account for the recent share price gains. However, looking at the share price chart for Filta, I can’t help wondering if the news slipped out early for some traders yesterday:

In any case, congratulations to Filta shareholders. However, as this is an all-share offer, shareholders will now have to make a further decision. Do they want to own shares in Franchise Brands?

With this in mind, I’m going to take a look at Franchise Brands and consider how the combined business might look.

Franchise Brands (LON:FRAN)

Share price: 147.5p (pre-open)

Shares in issue: 95.9m

Market cap: £141.4m (pre-open)

Franchise Brands owns a group of businesses operating on a franchise model. B2B brands include drainage and plumbing specialists Metro Rod and Metro Plumb. The company’s B2C operations include ChipsAway and Ovenclean.

The group’s largest shareholder is well-known UK investor Nigel Wray, with 23.3%. Chairman Stephen Hemsley also owns around 23%, so his interests should be aligned with those of shareholders.

Franchise Brands has continued to grow throughout the pandemic. The recent FY trading update reported a “continued strong trajectory” and struck an upbeat tone.

Broker forecasts suggest Franchise will report record profits and sales in its 2021 results (due on 3 March):

Franchised businesses can be wonderfully profitable and cash generative. Franchise Brands’ seems to be a good example of this so far - the group’s free cash flow per share has consistently exceeded earnings since its 2016 flotation:

That cash flow isn’t cheap, though:

Ahead of today’s news, Franchise Brands was trading on around 23 times FY22 forecast earnings:

So where does that leave the combined Franchise/Filta business?

Rationale for the deal: Franchise Brands’ existing operations are mostly reactive - fixing blocked drains or plumbing problems, for example. Filta’s main business is scheduled maintenance. Franchise’s management believe that combining the operations would enhance UK growth opportunities and enable the company to develop a broader “Water In, Waste Out” service for commercial clients in the UK. This sounds reasonable to me.

Alongside this, Franchise hopes to be able to capitalise on Filta’s stronger US presence to expand the combined group’s operations into this market. I’d guess this might be more challenging, but not impossible.

The combined group: Combining the group’s operations and eliminating duplicated overheads is expected to generate some cost savings. But there’s no figure provided in today’s offer document, so my feeling is synergies may not be all that material. Growth seems to be the main aim of this deal - rightly so, in my view.

Valuation: The combined group is expected to have a market cap of around £190m, based on yesterday’s closing share prices (which haven’t moved much this morning).

Based on broker forecasts for 2022, the merger could create a business with £90m of revenue and around £8.8m of net profit. My sums suggest that’s equivalent to a P/E of around 22x FY22 earnings, with a dividend yield of around 1%.

Profitability: My sums suggest an operating margin of around 12% is likely for the combined group in 2022.

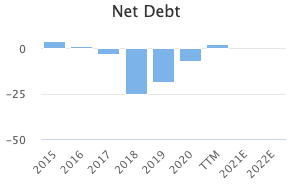

Balance sheet/cash flow: Franchise Brands has reported a small net cash position since 2020, while Filta has a minimal amount of net debt. So I’d expect the combined group to report a small net cash position.

Both businesses have historically demonstrated strong free cash flow conversion. I don’t see any reason why this should change.

I’m quite comfortable with the financial strength I’d expect to see in the combined business.

My view: Franchise’s offer appears to be almost certain to go through, as shareholders controlling more than 80% of the stock have already provided irrevocable undertakings to accept.

Unlike Franchise, Filta’s business has suffered badly during the pandemic due to widespread hospitality closures in the UK and US markets. However, performance appears to be bouncing back. If the Filta business can recapture its pre-pandemic form, I think that this could prove to be a reasonably-priced acquisition by Franchise Brands.

My feeling is that combining these two businesses is logical. The valuation of the combined business doesn’t seem excessive to me, if the combined business can maintain the growth both companies have shown individually in the past.

If I was a Filta shareholder today, I would be inclined to accept the Franchise Brands shares and continue to hold.

Arbuthnot Banking (LON:ARBB)

Share price: 940p (unchanged at 08.45)

Shares in issue: 15.0m

Market cap: £141m

This must be a contender for the shortest RNS of the year, but I don’t think shareholders will be too concerned.

This private banking group traded well during the fourth quarter and expects to report pre-tax profit in line with market expectations for the year. Full-year results are scheduled for 24 March.

Arbuthnot Banking Group is a private banking and wealth management group which operates under the Arbuthnot Banking and Arbuthnot Latham & Co brands. The business is controlled by chairman and chief executive Sir Henry Angest, who owns 56% of the stock.

Trading update: I have pretty much quoted today’s trading update verbatim in the paragraph above. There really was no other information provided. However, we can learn a little more about the market expectations mentioned by the company using Stockopedia’s invaluable archive of forecast data.

This tells us that analysts FY21 estimates improved steadily last year, while the outlook for FY22 turned a little more cautious:

Valuation & profitability: The valuation of this closely-held stock looks a little strange at first glance.

The combination of a high P/E and a fairly high dividend yield might normally suggest a business that’s highly profitable. That doesn’t seem to be the case here. Arbuthnot’s return on equity is weak, according to Stockopedia data:

However, last year’s interim accounts showed a strong capital surplus position. I don’t have any immediate concerns in this regard.

One potential source of dividend cash may have been the gradual sale of the group’s previously large shareholding in Secure Trust Bank (LON:STB) (I hold). This was recently completed.

Another interesting development is the company’s recent move into commercial finance, through the acquisition of Asset Alliance Group Holdings, a commercial vehicle leasing group.

My view: I think it’s worth considering the performance of this family-controlled business against a better-known listed rival. Here’s a chart showing Arbuthnot’s share price performance against that of Lloyds Banking (LON:LLOY)

I wonder if rising interest rates and the move into asset financing might rejuvenate the profitability of Arbuthnot’s business? If so, then I’d guess the shares might be attractively valued at a c.30% discount to their last-reported book value of 1,292p.

I’d have to do more work to understand this business, but my feeling is that Arbuthnot might be of interest to investors who share the patient, long-term viewpoint of family management.

.jpg&w=384&q=75)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.