Good morning! It's Paul & Jack here with the last SCVR for this week.

Agenda -

Paul's Section:

Quiz (LON:QUIZ) - a positive trading update for FY 3/2022, moving back into a (small) profit, which compares favourably with a forecast £(2.9)m loss (from Panmures). Sound balance sheet. Looks to be getting back on track, and market cap of £18m seems stingy, even after today's c.36% rise.

Renew Holdings (LON:RNWH) - a reassuring H1 update today, everything is in line with exps. Renew has an excellent long-term track record, and is worth considering, on a reasonable forward PER of 12.4

Jack's Section:

Rbg Holdings (LON:RBGP) - a higher tax rate means fairly pedestrian earnings per share growth despite encouraging progress on revenue, EBITDA, and profit before tax. The valuation is undemanding and the strategy and growth potential are there, so I’m happy to hold with the 4-5% dividend.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Quiz (LON:QUIZ) (I hold)

14.5p (up 36% at 08:54)

Market cap £18m

QUIZ, the omni-channel fashion brand, is pleased to provide a trading update for the financial year ended 31 March 2022 ("FY 2022").

Some good news, which is welcome in a very difficult market for small caps. Consumer discretionary shares, especially smaller ones, have been absolutely destroyed in the last 6 months, as inflation begins to squeeze household incomes (and looks set to get worse). That said, there comes a point where everyone likely to sell probably has done, and valuations become irresistibly low for all those people holding cash.

What makes QUIZ attractive to me is -

- Its specialism of special occasionwear is now booming, given all the pent-up demand from delayed weddings, parties, etc.

- Store portfolio completely restructured through a CVA, with all stores now on cheap turnover rents

- Decent balance sheet with net cash, and very low lease liabilities (2 year leases typically)

- Greatly reduced competition in physical stores

- Well-known brand

- Successful online operations

- Family-owned & run, experienced management

- Very low valuation, with the City having given up on it

Trading Update for FY 3/2022 -

Positive sales momentum has continued into Q4 (Jan-Mar 2022)

All sales channels doing well (stores, online, concessions [stores within a third party’s store])

Like-for-like (LFL) sales now “broadly consistent” with pre-pandemic (FY 3/2019)

FY 3/2022 revenues ahead of expectations, at £78m

Gross margin good - Q4 back up to pre-pandemic level (was 60.7% in FY 3/2019 - high for the sector)

Guidance: EBITDA at least £4.3m, and PBT at least £0.5m

Net cash £4.2m at 30 March 2022 (gross cash £5.6m, bank debt of £1.4m)

Bank facility has no covenants, and due for renewal in Sept 2022 (which should be a formality I reckon, as it was renewed without a hitch previously during the pandemic)

Results - due out in July 2022

Valuation - the last broker note I have is from Panmures, Dec 2021. It pencilled in £74.0m revenues, and PBT of £(2.9)m loss for FY 3/2022.

Therefore today’s company guidance of £78.0m revenues and a profit of £0.5m is a significant beat, especially on profit.

My opinion - this is pleasing. Remember that this year was badly impacted by the pandemic in the first 2 months, April & May. That’s offset by Govt support measures, especially business rates.

It’s good to see the business return to a modest profit. Historically QUIZ was highly profitable, but ran into problems with product pre-pandemic, causing profits to crash. Let’s hope the business is back on track now. With much lower rents, following the restructuring through a CVA, its stores should be decently profitable going forwards. Although other costs, eg. wages & utilities will be higher.

As I’ve said before, QUIZ is not the best in class, but the valuation looks far too low, for a business that could be getting back to making decent profits again. There’s growth coming through from international, and new concessions too.

The long-term track record is awful, but bear in mind the share count hasn't changed (no dilution), so in theory the share price could multibag from here, if previous levels of high profitability are regained (it was making c.£8m p.a. profit in 2017 & 2018). Maybe let's not run before we can walk!

.

.

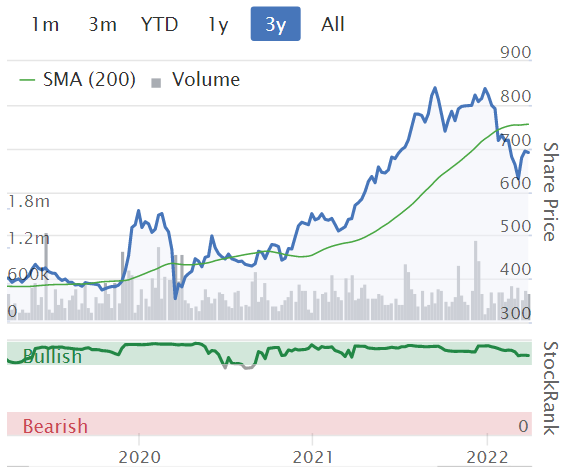

Renew Holdings (LON:RNWH)

689p (up 1% at 10:02)

Market cap £544m

Renew (AIM: RNWH), the leading Engineering Services Group supporting the maintenance and renewal of critical UK infrastructure, today provides an update on trading for the six months ended 31 March 2022.

This sounds reassuring -

The Board is pleased to confirm that trading for the first half of the year is in-line with management's expectations. The Group's order book continues to be underpinned by long-term framework positions and is expected to be in-line with that reported at our AGM in January.

We continue to successfully manage the industry-wide material shortages and inflation challenges effectively, without any material impact on trading.

Net debt and cash generation are also in line with expectations.

The Board remains confident of the Group's prospects in the second half of the year.

That all sounds fine. Mears noted yesterday that most of its contracts have built-in inflation uplifts, so I think it would have been useful for RNWH to give us a bit more information about how its contracts are structured. Probably the best type of contracts in an inflationary world are cost-plus type contracts. We need to ask management more about this issue, e.g. on webinars - i.e. what is the mechanism for them to pass on higher costs, and is there any delay?

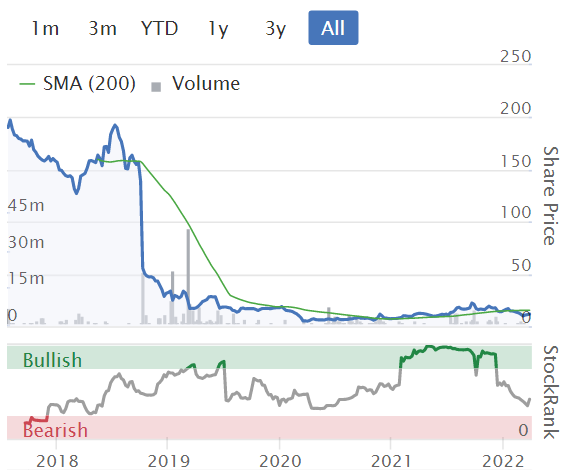

Renew has a decent StockRank -

.

The growth & value stats below look middling. A PER of 12.4 is good value I think, but this sector tends not to attract high valuation multiples, due to the risk of contracts going wrong.

I’ve highlighted the Price To Tangible Book field - if you see a “n/a” here, it means NTAV is negative - which is an amber warning to check the balance sheet, which is probably weak.

In the past I’ve had concerns with RNWH’s weak balance sheet, but it hasn’t stopped the company performing well, so having a lean balance sheet is not necessarily a deal-breaker, but it does increase the risk of something potentially going wrong.

.

My opinion - RNWH has an excellent long-term track record. Providing it can manage cost increases, then it might be a reasonable place to park some money.

.

.

.Jack’s section

Rbg Holdings (LON:RBGP)

Share price: 114.9p (+2.13%)

Shares in issue: 95,331,236

Market cap: £109.5m

(I hold)

This is a professional services group which has been busy buying high margin, niche businesses, as part of its strategy to build a larger and more diversified enterprise that relies less on its Rosenblatt contentious law division.

Now, RBG reports across the following:

RBG Legal Services - includes Rosenblatt, a UK leader in dispute resolution, and Memery Crystal, which offers legal services in a broader range of areas such as corporate, tax & wealth structuring and employment.

Lionfish - finances litigation matters run by other solicitors in return for a significant return on the outcome of those cases.

Convex Capital - specialist sell-side corporate finance boutique based in Manchester focused on helping smaller businesses realise their value through sales to large corporates.

Results:

- Group revenue (including gains from litigation assets) up 86.7% to £47.2m,

- Group organic revenue (excluding Memery Crystal) up 19.6% to £26.8m,

- Gains on litigation assets up 84.5% to £5.2m

- Adjusted EBITDA up 91% to £13.8m,

- Adjusted profit before tax up 111.7% to £10.1m,

- Adjusted free cash flow generation was £5.3 million (2020: £5.1 million)

- Net debt of £14.2 million (2020: net cash of £3.5 million) reflecting new £10 million term facility to fund the acquisition of Memery Crystal (of which £1 million has already been repaid)

- Total dividend paid to shareholders in respect of the 2021 financial year was 5 pence per share (2020: 3 pence per share), reflecting the Board's confidence in the Group's continued prospects

Earnings per share are not included in the headline results. Further down the report we see basic and diluted EPS up from 7.29p to 7.63p (+4.7%), which looks rather pedestrian given the revenue, EBITDA, and profit growth.

RBG paid significantly more tax this year, 21.3% compared to 13.1%, meaning profit before tax rose by 24.6%, whereas profit after tax was up by just 12.7%.

RBG Legal Services - Post-MC acquisition, legal services revenue is up 56.3% to £32.6m, with revenue now more evenly split across Dispute Resolution (35.8%), Corporate (35.3%) and Real Estate (28.9%). The integration of Rosenblatt and Memery Crystal support functions is now largely complete and has led to a sustained improvement in EBITDA margin to 27%, expected to rise towards 35% over the medium-term.

Average revenue per fee earner of £347,000 has fallen from £425,800, reflecting the enlarged workforce. Total staff has grown from 73 to 193, of which 137 are fee earners (2020: 43).

Total Lockup was 109 days (2020: 99) of which Debtor Days were 59 days (2020: 47, Rosenblatt only).

Lionfish - Successfully realised litigation asset sales in five cases, proceeds totalling £3.1m. Cash investment of £1.8m in 10 cases, with a full commitment of £10.5m (if funded through to trial over the next 2-3 years). First case successfully completed, delivering a return of 2x money invested as per strategy.

Convex Capital - a much stronger performance, as previously flagged. Completed 14 deals, generating revenue of £9.4m (2020: 2 deals, £1.6m) and generated EBITDA of £4.2m (2020: loss of £0.9m).

Post-period end, Convex Capital has completed two further deals, delivering revenue of £1.7m and has a pipeline of 20 deals, with six going through due diligence.

M&A

In line with our strategy, we continue to assess M&A opportunities to diversify the business and grow our service offering to clients. Our ambition is to create a broad, high-quality, high margin professional services group. As such, we focus on high-margin, specialist companies which can also create opportunities for cross-referrals. However, we will only do deals at the right price and with the right deal structure.

There’s a new EIP announced today, as well as a couple of growth share schemes. One part that sticks out is that the CFO has been granted 1,000,000 nil-cost options over ordinary shares which will vest over two years ‘and be subject to no further conditions other than for Robert Parker to remain employed by the Group’.

Turning up for work is hardly a stretch target, but the group does add this is ‘awarded in recognition of his three years' service with no prior equity allocation’.

Conclusion

There’s a lot to digest here, so I’ll wrap it up for now and if anybody spots additional talking points, leave a comment. There’s a presentation soon on investormeetcompany, at 10:30 I believe.

The main disappointment is the earnings per share figure, so it’s up to the group to generate per share value in the upcoming periods. RBG does have a clear, differentiated growth strategy to achieve this though.

In our core professional services businesses, we want to capitalise on the areas that offer the highest returns for shareholders, such as our high margin legal services businesses. Furthermore, we will use the Group's expertise to maximise the potential returns by selectively investing in contingent asset classes such as litigation.

All subsidiaries are growing, so the direction of travel is positive. There’s no guarantee that will continue - there rarely is - but the valuation remains undemanding (with an FY21 dividend yield of 4.4%), so I’m minded to hold as the company sounds out acquisitions and builds momentum across its high margin businesses.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.