Good morning, it's Paul & Roland here this morning. Today's report is now finished.

Agenda -

Paul's Section:

Ig Design (LON:IGR) (I hold) - a trading update for FY 3/2022 reassures that trading is not deteriorating any further (after a previous series of profit warnings), and thank renewal of bank facilities is imminent. Bears might latch onto the long 3-year timeframe expected to restore profit margins, and guidance for much increased average bank debt. Overall, I think there's turnaround potential here, which hopefully a new CEO might be able to deliver. For now though, the jury's out.

£SYME & Chill Brands (LON:CHLL) - prompted by MrContrarian's report flagging deeply discounted fundraisings at these couple of basket cases, I expand on the theme of how difficult it now is for speculative shares to raise fresh equity. Hence investors beware, if you hold any jam tomorrow shares that need money, because the funding window has slammed shut in these bearish market conditions.

Bidstack (LON:BIDS) - FY 12/2021 results are out, which show another hefty loss. The placing from mid-2021 is not going to be enough - see the going concern note. Too speculative at this stage, although I'm keeping an eye on it, due to strong forward contracted revenue growth. High risk.

Roland's Section:

Ab Dynamics (LON:ABDP) - this British engineering group makes testing equipment for car manufacturers. Today’s half-year results suggest a return to growth after the pandemic. The stock rarely looks cheap, but strong cash generation and a history of growth suggest to me that this could be worth a closer look.

City Pub (LON:CPC) - this upmarket pub group appears to be trading well, but a decision to absorb rising costs means margins are under pressure. I think it’s a decent business, but I’m not sure it’s a great investment opportunity.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to

Paul’s Section:

Ig Design (LON:IGR) (I hold)

79p (yesterday’s close)

Market cap £77m

Background - this group is -

One of the world's leading designers, innovators and manufacturers of celebrations, craft, gifting, stationery and creative play products

There’s a focus on Christmas-related products, such as gift wrap, therefore when supply chain & logistics problems hit them last autumn, the company had no choice but to absorb greatly increased distribution costs, just to get the product out to customers in time. Since Christmas-related products become virtually worthless after 25 Dec. With hindsight, that was a flaw in the business model which we didn’t spot.

A series of profit warnings caused the share price to crash, the CEO to exit, and the company’s reputation for competence went out of the window.

That followed a long bull run, from 2015-2020, where the shares roughly 10-bagged, and the business was seen as very well managed, and growing strongly. It just shows, we never know what’s around the corner, and amazingly the shares gave up all the gains in the last year, back down at 2015 levels again.

.

My notes from the profit warning on 26 Jan 2022 are here. At the time, breakeven was guided for FY 3/2022.

I do have concerns about the reliance on bank facilities, but also I reckon there’s a potential recovery (at least partially) here, as it’s a lot of business for the money now - only £77m market cap, with revenues approaching $1bn p.a..

Therefore, if management can restore profit margins, by passing on cost increases, then there’s obvious potential upside.

Downside risk is that business may continue to struggle, and possibly require a dilutive equity fundraising.

Therefore I would see this share as a possible turnaround (not yet proven), and higher risk.

On to today’s update.

Trading Update - for FY 3/2022.

Revenues good, at $963m (up 10% on LY)

Profit guidance -

Group operating margin is expected to be 0.5% delivering Group operating profit1 marginally ahead of previously communicated expectations, reflecting a stronger than anticipated performance in the USA. The Group expects to report a small adjusted loss before tax1 for the year.

1 Now includes the credit/(charge) relating to share based incentives.

Net cash of $30m - this is well down from $76.5m a year earlier, due to the need to increase inventories (raw materials) to support production for the forthcoming peak period. That makes sense to me, and seems a sensible strategy, to prevent supply chain problems recurring this year. Inflationary impact of rising materials costs is also pushing up inventories - something I expect we’ll see from many companies. Hence it’s very important to consider balance sheet strength, and bank facilities - will they be sufficient to finance additional working capital in an inflationary environment?

Bank facilities - this is my main worry with IGR, since it needs a big bank facility to finance peak seasonal trading each year. As mentioned before, banks like financing seasonal peaks, which is then paid off each year, which is what happens at IGR. This greatly lowers risk for the banks.

Today’s update sounds quite reassuring to me, and the shares could get a boost once bank facilities are renewed, which sounds imminent -

The Group is in the process of finalising a facility waiver amendment in anticipation of the 2022 seasonal working capital requirements and an extension to March 2024 of the existing banking arrangements which run currently to June 2023. It is expected that these will be completed in the near term.

Although there’s a risk this might not happen as expected. A “waiver amendment” is telling us that IGR is expecting to breach bank covenants. I wouldn’t want to risk too much money on this share until the bank facilities/covenants have been agreed. Although in terms of risk, that’s probably not too great here.

Management - both CEO & CFO departed. A new CFO (Paul Bal) has been found, starts imminently, 3 May.

There’s an interim COO in place.

Continuing to look for a CEO.

The Chairman, Stewart Gilliland, is in charge for now, as Interim Exec Chairman.

USA Strategy - doing obvious things to restore margins, targeting 5-6% by FY 3/2025.

That seems a long timescale to implement cost savings, passing on increased supply chain costs, and simplify product ranges. Why so long? I hope that the new CEO, when appointed, implements a much more aggressive turnaround strategy.

Outlook - not great.

Guidance is for flat (a small adj loss before tax) for FY 3/2023. I think investors would have expected better than that.

Average net debt throughout the year (an excellent figure, which all companies should report, as it gives the real picture, rather than an often distorted year end snapshot) is going to be much higher, at $75-80m in FY 3/2023 (versus c.$15m in FY 3/2022), due to higher inventories.

Demand remains strong, but supply chain is a continuing uncertainty.

Diary date - 28 June 2022 for FY 3/2022 results.

My opinion - I’m encouraged that the business seems to have stabilised, and isn’t getting any worse.

However, I don’t think management is doing enough to turn around the business in a reasonable timeframe, they need to step up a gear - hopefully that might happen with a dynamic new CEO, if appointed? I hope they choose a hard-nosed turnaround specialist, not a plodder, or a dreamer.

Bank facilities are an issue, so risk is elevated until those are signed off, which could provide a good catalyst for the share to rise.

The market has not reacted well at the open, with shares down 14% to 66p as I type, at 08:13.

At the moment I only have a tiny shareholding in IGR, and on balance, I’m probably going to buy a few more, but keeping the position small for the time being, as there probably isn’t any great rush.

There again, I could see this share doubling or tripling if a decent new CEO is recruited, and executes an accelerated turnaround plan.

So it’s potentially interesting, but does carry some risk.

.

Blue Sky/Jam Tomorrow companies - fundraisings

Many thanks to MrContrarian, as always, for his superb early morning snapshots of the news, posted in the comments below each day. We’re really grateful for this witty summary of the news, and it often helps me/Jack/Roland in spotting things that we might have otherwise missed, to expand on in our commentaries.

In today’s summary, MrC flags heavily discounted fundraisings from two dreadful (in my opinion) companies, Supply@me Capital (LON:SYME) and Chill Brands (LON:CHLL) . I want to pick up on this theme, and expand on it a little.

Today’s news on jam tomorrow company fundraisings is:

Supply@me Capital (LON:SYME) - complicated arrangements, with Venus Capital, to provide up to £7.5m in fresh equity, in tranches. The first tranche is priced at 0.05 pence. So 2.77bn new shares, raising £1.385m in cash. That seems to be a 50% discount to last night’s closing price of 0.1p. Venus also gets 1 Warrant for each 2 new shares, priced at 0.065p. There were 37.2 billion shares in issue before this deal! Where companies throw around warrants like confetti, it limits the upside for other shareholders, because if the share price rises then warrant holders tend to exercise them, thus creating more dilution for everyone else (and they often cash out, if the warrants are in the money).

As for SYME’s business, I’ve reviewed it a couple of times here, concluding that it’s little more than a startup, and the valuation is nuts.

Chill Brands (LON:CHLL) - my review of the company here on 28 Jan 2022 concluded (and sorry if it looks conceited, quoting my own stuff, but it saves typing) - “It needs to raise more cash, and the £26m market cap looks bonkers. So I wouldn't go near it, unless/until the business model has been proven.” [SCVR 28/1/2022, share price 12.2p]

After market hours last night, CHLL announced it is raising £583k in fresh equity at just 2p per share (29.17m new shares at 2p). There are 212m existing shares in issue. A further £2.92m is being raised from convertible loan notes. The loan notes can be converted into ordinary shares also at 2p.

What is the purpose of convertible loan notes? It gives the purchasers an each way bet - if things go badly, then lenders effectively control the company, and can wipe out equity holders in a future emergency fundraise. Or if things go well, then the loan note holders can convert into equity, and share the upside with existing equity holders. So risk:reward for existing equity just got a lot worse, with big dilution, at a low price, and more dilution from loan note conversion if things go well. Hence I would say at this stage, there’s little reason for existing holders to continue holding, because the upside has now probably largely disappeared. The company confirms it is continuing to operate at negative cashflow.

Note that this 2p fundraise is at an 84% discount to when I reviewed the company just 3 months ago, warning that it clearly needed to raise more cash.

My opinion - it’s very easy to spot when companies have a requirement for more cash. You just look at the balance sheet, and compare cash held, with the rate of cash burn. If there’s less than say 2 years cash burn in the bank, then dilution from an equity fundraising is likely. If there’s less than 1 years cash burn in the bank, then an equity fundraising is very likely.

In a roaring bull market, investors have cash to spare, and are often happy to participate in fundraisings, even if it’s a speculative company, where the share price is rising. Trouble is, those conditions are now a memory only.

We’re now clearly in a fairly brutal bear market for small caps, which means that investors may not have spare cash, and probably won’t want to part with it for a speculative fundraising from a loss-making company with a rubbish business model. Hence the only way such companies can raise money now, is to offer a massive % discount on new shares. If they can raise money at all.

As we saw recently with Sensyne Health (LON:SENS) it ran out of cash. An emergency fundraising was arranged, but it resulted in massive dilution at under 1p per share, and the share is de-listing.A year ago, the share price was over 150p, but it had a reckless business model, burning huge amounts of cash.

In a bull market, companies imagine that they can do repeated “rounds” of fundraisings, at ever higher prices. This is an import from the USA tech world, but of course the bubble has now burst, and in any case this approach didn’t travel well, and UK investors have often proven reluctant to fund repeated fundraisings, which often get into a downward spiral on AIM, leading to ruinous dilution, which means earlier investors get diluted away to almost nothing, and you’re guaranteed to lose money, even if the share price multibags. So the danger is you feel almost forced to keep averaging down, and supporting fundraisings, just to keep some upside. Upside that is rarely delivered.

What’s the lesson from this? Given market conditions, I think it’s vital to not be holding anything which might need to raise more cash, because the terms of any fundraising could be very harsh to existing holders.

Even companies which look adequately funded now, might need more cash an inventories have to rise, to ease supply chain problems (e.g. placing orders earlier, to guarantee supply, holding more physical volume of inventories, and of course the rising value of inventories per unit).

That comes at a time when banks are becoming more cautious, due to the increased likelihood of a recession.

As regards blue sky or jam tomorrow shares, it’s probably safest not to hold any! The track record collectively of these type of companies is diabolical. Very few succeed commercially. Although there can be spectacular bull runs, if a story is believed by enough excitable investors. We all like a good story, so despite my best endeavours, I do sometimes succumb to a jam tomorrow story - I’m only human - remember BigDish! That one 7-bagged, and like an idiot I didn’t sell any, eventually capitulating around breakeven - as much as anything it was consuming too much time & mental energy, so it was better to just ditch it & move on.

All too often though, investors have great difficulty in walking away from a failing jam tomorrow investment. My suggestion would be - cut the cord, and forget about it. Especially in this bear market, risk:reward is firmly against you, for most companies which are burning cash, have not proven their business model is viable, and are rapidly running out of cash. The next fundraising could be at a brutally low price, so why continue holding? I would sell now, and give the money to ZANE, rather than watch it go down the plughole.

Companies which are showing excellent growth can still raise money though. A good recent example is Beeks Financial Cloud (LON:BKS) (I hold - now in my top 3), which did a £15m fundraise at a very modest 3% discount. So providing there’s an excellent story to be told of a business powering ahead, and funds needed for expansion rather than to just keep the lights on, then money is still available on reasonable terms. Hence why I wasn’t worried about BKS needing additional funding, because I was confident they could get it, and they have. An RNS came out this morning, saying Canaccord (usually shrewd small caps fund manager Hargreave Hale, acquired by Canaccord) has gone up from 11% to 15.3%, so must have taken a decent chunk of the £15m placing, encouraging that it’s a fund manager with a strong long-term track record.

Having said all the above, I do have one jam tomorrow share in my portfolio, Loopup (LON:LOOP) - which I reckon is likely to need another fundraising fairly soon. I’m fully aware that it’s high risk, and running out of cash. Sod’s Law being what it is, the share price has doubled today, now the top riser. Although looking at bulletin boards, it looks like rampers are at work. So the tricky question is whether to sell into the spike, or just hold for the long-term. I’ve (probably wrongly) decided to sit tight.

EDIT: Another thing to consider with blue sky companies, as a very successful and cynical investor friend once told me is this. With some speculative shares, the actual business is raising money from shareholders, and profiting from that by insiders selling, once the share price has been ramped up to gullible punters. So once you spot insider selling, then that confirms the company could simply be a device to enrich founders, and management via ramping the story, then selling quietly at an inflated share price. Then when the story has gone so stale nobody's interested, then can walk away having banked a substantial profit, if they times their share sales well. These type of promotions often happen repeatedly, from the same cynical people.

Bidstack (LON:BIDS)

3.1p (down 4% at 12:12)

Market cap £29m

Continuing the jam tomorrow theme, we’ve looked at this speculative share a few times. The concept seems interesting, and if it takes off, could be lucrative, hence why people like punting on this share (well that sums up all jam tomorrow companies really).

A quick skim of the StockReport quickly shows up that this company has already had enormous dilution from repeated fundraisings. Despite that, book value has barely changed at c.£3m in the last 3 years, which demonstrates how fresh equity is being quickly burned through from operational losses -

.

.

Remember that, as stated, this is the average number of shares in issue. So we also need to check the current figure, which in this case has shot up further, to 931m more recently! -

.

.

Revenue up 53% to £2.6m - still small, but signs of life here.

Loss before tax at a whopping £(6.2)m is similar to last year.

Placing raised £10.9m before fees in July 2021 how long will that last? There was £7.1m left at end Dec 2021.

Balance sheet - note that receivables of £2.75m is more than full year revenues, which raises a question about whether customers are going to actually pay up?

Cash burn - I doubt we’ve seen the last placing. £7.1m cash at end 2021. That’s mostly going to be used up by end 2022 (not that long away). In a bear market will there be much appetite from investors to stump up more cash for them to burn through? Who knows. Maybe, maybe not. Hence very high risk of more dilution.

Going concern statement - reinforces this point -

...although material uncertainty exists in relation to the group's ability to raise funds to sustain its operations…

the Group forecasts assume that further equity fundraising will take place in the next twelve months in in order to implement its growth strategy and operate as a going concern. Although the entity has had past success in fundraising and continues to attract interest from investors, making the Board confident that such fundraising will be available to provide the required capital, there can be no guarantee that such fundraising will be available and, accordingly, this constitutes a material uncertainty over going concern.

It’s very important to read all going concern statements, as there can often be key information in there, overlooked by many other investors.

Outlook/upside - some good stuff in here, but I seem to recall that revenues contains a high level of pass-through revenue -

.

.

My opinion - the business model is still a long way from being proven yet.

This, and the requirement for more cash, means this share is very high risk, and most likely to result in a horrible loss, for anyone buying or holding now.

That said, the outlook and operational comments do seem to indicate the concept might be gaining traction. That would need much deeper research, and finding out what competition there is, how good or bad the product is, whether the ads annoy gamers, etc.

If what BIDS is doing is unique, you never know, it could become a takeover target, possibly?

At this stage, it looks very speculative, and far from cheap. However, I’m going to keep an eye on it, as there might be something interesting here, longer term, who knows?

Occasional bursts of interest, in a downtrend -

.

Roland’s Section:

Ab Dynamics (LON:ABDP)

Share price: 1,440p (+7% at 08.15)

Shares in issue: 22.6m

Market cap: £305m

“The board now expects the financial results for the current year to be slightly ahead of market expectations.”

AB Dynamics provides testing systems for car manufacturers. Examples include driving simulators, steering robots and driver assistance testing equipment.

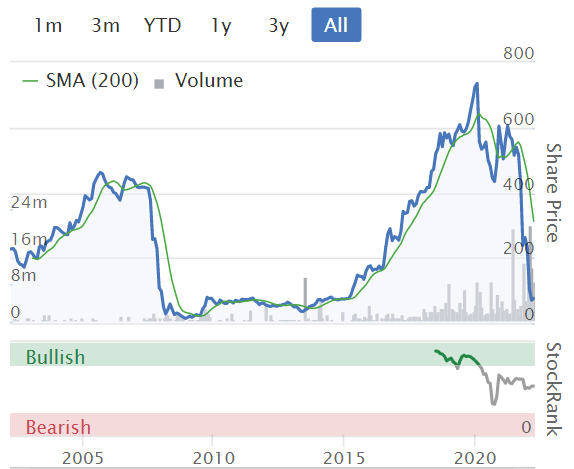

Although the share price has fallen by 50% from its 2019 peak, this stock has still been a 10-bagger since its 2013 IPO:

However, profits peaked in 2019 and have yet to fully recover:

Today’s half-year results include upgraded full-year guidance, and suggest to me that AB Dynamics may now be returning to growth after the pandemic. It seems like a good time to take another look at this business.

Financial highlights: Today’s results cover the six months ended 28 February 2022.

The numbers show strong revenue growth and an improvement in operating margins and cash generation.

- Revenue +39% to £37.8m

- Adjusted operating profit +63% to £5.7m

- Adjusted operating margin: 15.1% (H1 2021: 12.8%)

- Statutory operating profit: £2.5m (H1 2021: £0.7m)

- Adjusted cash flow from operations: £8.5m

- Adjusted earnings +52% to 19.9p per share

- Interim dividend +10% to 1.76p per share

Trading summary: The company says that strong activity in track testing led to “significant improvements” in orders and revenue during the half year.

Although supply chain disruption remains a factor, operations have not been adversely affected to date. Price increases are being pushed through to offset inflation.

The proportion of service-based and recurring sales rose to 41% of revenue, from 31%. That seems encouraging to me, assuming margins are attractive. Recurring revenue generally provides improved earnings visibility and reliable cash flow.

Efforts to diversify are ongoing, with the development of the ABD Solutions business. This division has won its first non-automotive contract, a deal in Japan to supply a retrofit driverless solution for mining vehicles.

Profitability: I mentioned above that AB Dynamics’ profits had peaked in 2019 and not yet recovered. What has happened is that adjusted profits have fallen slightly since 2019 (presumably due to the pandemic). However, statutory profits have slumped.

2019 | 2020 | 2021 | |

Adj op profit | £12.9m | £11.3m | £10.8m |

Statutory op profit | £10.8m | £4.8m | £4.2m |

This divergence marks the point in 2019 when the company began making regular acquisitions. AB’s management takes the common approach of adjusting out the amortisation charge on acquired intangible assets.

During H1, this charge was £2.7m, accounting for the majority of the difference between statutory (£2.5m) and adjusted operating profit (£5.7m)

I prefer to include the amortisation of acquired intangibles, as these accounting charges represent capital employed by the firm. Excluding them flatters return on capital employed calculations.

On the other hand, it’s true that these charges do not affect the cash profitability of the company going forward, so arguably are not important in our assessment of operating performance.

It’s a personal choice. What is clear is that this approach has lifted AB Dynamic’s H1 operating margin from a statutory 6.6% to an adjusted 15.1%.

That’s only slightly below the pre-2020 trend (Stockopedia always uses statutory operating profit):

Balance sheet & cash flow: One reason to ignore the amortisation of acquired intangibles is that it doesn’t affect free cash flow.

My sums suggest AB Dynamics converted £5.7m of operating profit into £6.3m of free cash flow during the half year – this appears to be a highly cash generative business.

The balance sheet looks strong to me, too, with net cash of £27.7m and no financial debt, only some modest lease liabilities.

Outlook: Strong momentum into H2 means that management now expects full-year results to be “slightly ahead of expectations”. No further guidance is provided.

The broker trend has been weakening over the last 12 months, so today’s upgrade could become a turning point for the stock’s momentum.

My view: AB Dynamics appears to be a good business in a growing market.

There are various ways of viewing the group’s profitability, but strong cash generation and a track record of revenue growth suggest to me that this is fundamentally a decent quality business.

I’ve always found valuation difficult here, as ABDP shares have usually looked very expensive. However, the stock is now 50% below the record highs seen in 2019. That’s changed the picture somewhat.

Looking ahead, ABDP shares are trading at around 35 times current year forecast adjusted earnings, falling to around 29x for FY23.

I’d need to do more research to understand the growth opportunities for this business. But my feeling is that the shares might not be too expensive at current levels, on a long-term view. Definitely worth a closer look, I think.

City Pub (LON:CPC)

Share price: 81p (+8% at 08.55)

Shares in issue: 104m

Market cap: £80m

“We are now confident that 2022 trading across the portfolio will exceed 2019 by the end of the second quarter.”

Despite rising inflation, people seem to be revelling in the ability to enjoy unrestricted socialising again. Leisure spending does not yet seem to have been affected by the rising cost of living.

In today’s full-year results, London-based pub group City Pub Group says that trading for the last nine weeks has been 98% of 2019 levels, on a like-for-like basis. The company is now confident that trading should exceed 2019 levels by the end of the second quarter.

City Pub operates 41 pubs, predominantly freehold. The group is continuing to expand, with a new location in Mumbles (Swansea Bay) opening this week. Three more locations are under development.

The group is also expanding through the phased acquisition of London/Birmingham firm Mosaic Pub and Dining Group. CPC’s stake in Mosaic was increased to 36% last year and the company expects to complete the acquisition in 2023. This will add 10 London pubs to CPC’s estate.

Financial highlights: Today’s results cover the year ended 26 December 2021. Naturally they are fairly poor, but they do show that the group achieved cash flow breakeven last year, despite continuing to invest in acquisitions and pub developments.

I’ve included 2020 and 2019 figures, so we can get an idea of what normality looks like for the business.

- Revenue: £35.4m (2020: £25.8m, 2019: £60.0m)

- Adjusted EBITDA pre-IFRS 16: £3.8m (2020: £(0.8)m, 2019: £9.1m)

- Operating profit/(loss): (£2.9m) (2020: (£6.5m), 2019: £2.5m)

- Net debt: £15.0m (2020: £32m, 2019: £13m)

N.B. Net debt has been reduced to £2m since the year end, through the disposal of six pubs.

Inflation: Rising costs are obviously an issue in this sector. The company reports “some impact” from industry challenges, especially energy and food costs. Management has opted to absorb these costs for now and hold prices. This means that margins are down. The impact isn’t specified.

My reading of this is that while trading (revenue) may have returned to 2019 levels, margins are likely to be lower, in the short term at least.

Outlook: Management says that large parts of City Pub’s estate are now trading well, but there are still some pubs “that need focus to re-establish normalised levels of trading”.

Efforts have been made to boost staff morale and improve the corporate culture. This is said to be helping with staff retention.

The staycation trend is expected to aid the firm, which has 220 letting rooms across its estate. Room sales are expected to account for 10% of revenue this year, compared to 6% in 2019.

The board continues to look for acquisition activities, as they believe this is “the best way to drive shareholder value”. CPC’s ambition is to have “65-70 quality pubs open by the end of next year”, including the Mosaic estate.

Based on CPC’s current estate of 41 and the 10 Mosaic pubs, this seems to imply that the company hopes to acquire or develop a further 14-19 pubs over the next year. That seems ambitious to me, but management says that opportunities are arising from “dislocation in the marketplace”.

My view: City Pub’s strong balance sheet and largely freehold portfolio provide a fairly safe starting point for an investment, in my view. There should be minimal debt risk and real asset backing if the operating businesses run into problems.

However, the group’s expansion plans suggest to me that gearing is likely to rise again over the coming year.

Similarly, the decision to absorb rising costs suggests to me that operating margins may come under pressure. I suspect the 2022 margin will be lower in 2022 than the 5% average reported from 2015-2019.

Given these concerns, I’m unsure how much value the stock offers at current levels.

When Paul looked at CPC in June last year, he commented that he was struggling to see the upside. This turned out to be prescient, as CPC shares have fallen by 35% since then:

After today’s results, CPC shares are trading on around 14 times 2022 forecast earnings. That still doesn’t seem overly cheap to me, in such an inflationary environment.

Although the stock still sits at a discount of around 10% to its tangible book value, I would argue this reflects the low profitability and high maintenance capex requirements of a typical pub estate.

I think City Pub is probably a fairly good pub business. But I’m struggling to get too excited about it as an investment opportunity.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.