Good morning, we have Paul & Jack here today.

More problems across the pond yesterday, with the recent bounce in US markets unravelling in one day. The trigger seems to have been disappointing results from big retailers Walmart and Target, both down sharply. Plus disappointment from Cisco. It's becoming increasingly clear by the day that the short term economic outlook is deteriorating. UK small caps have reflected that for a while, with prices really bombed out. I've got lots of thoughts gestating on the macro picture, so will try to type that up when time permits.

On to today's company news.

Agenda -

Paul's Section:

Headlam (LON:HEAD) - a very encouraging trading update. Slight softening of demand in April, but self-help measures mean this carpet distributor remains comfortable with full year expectations. It looks terrific value to me, although obviously macro uncertainties are not helping investor sentiment. Looks a really strong long-term investment to me, with a 6.5% divi yield to keep you happy in the meantime, arguably much better than losing 9% p.a. to inflation by holding cash, for long-term holders prepared to look through short-term market volatility.

Begbies Traynor (LON:BEG) - an encouraging year-end trading update for FY 4/2022. Profits 3.5% ahead of expectations. Everything seems to be going well, and remember this is before the avalanche of insolvencies that seem likely now Govt covid support measures have been phased out. I remain of the view that this share is cheap, and has excellent prospects. Good if you want some counter-cyclical exposure. Also it's now a proven acquisition vehicle, which is in for free.

Portmeirion (LON:PMP) - a trading update which I find quite reassuring. Cost increases are being passed on, and sales are up 2% in the first 4 months. However, PMP makes its profits in H2, which is obviously looking shaky on a macro level, although order books (including for key Xmas trading) "remain healthy". I reckon long-term holders should be fine, but there could be bumps in the road due to macro factors. Key point - energy costs are fixed until Mar 2024.

Shoe Zone (LON:SHOE) - yes, I finally got round to looking at this! It looks excellent, and I can see why readers like it.

Jack's section:

Tyman (LON:TYMN) - the group is trading well in a difficult environment, with supply chain issues and labour shortages driving inflation. Tyman has been able to pass on costs, so revenue is up even though volume growth is constrained. The valuation looks attractive after a bad run for the share price but cyclical concerns remain, so it’s a tricky one at these levels. Low enough to be tempting if you can handle volatility, but you would be increasing your exposure to an uncertain and unloved part of the market.

Knights group (LON:KGH) - sharp move upwards today after a previous collapse in share price. The shares still look cheap even after earnings downgrades, so potential for a trade, but beyond that I worry that a proper recovery might take time.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Headlam (LON:HEAD)

343p (yesterday’s close)

Market cap £292m

Trading Update (AGM)

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor, is providing the following trading update in respect of the first four months of the year ahead of its Annual General Meeting ('AGM') being held at 10.00am today.

Background comments - I wish HEAD would stop referring to itself as "Europe’s leading floorcoverings distributor", because it’s in fact mainly a UK business, and its European operations are insignificant given the large size of that market.

To my mind its business model makes a lot of sense, since carpets are bulky items, with a huge range of styles. So HEAD stocks them, and carpet retailers then buy them to order. Hence it’s a robust business model, with no risk of manufacturers cutting out the middleman (HEAD) due to the very small size of individual orders. Even bigger floorcovering retailers don’t want the hassle & cost of buying direct from manufacturers, and having to store huge amounts of carpet themselves.

Also, HEAD has been undergoing a root & branch restructuring, with a target of raising operating margin to about 7.5% from memory. Its presentations on this seemed to highlight that the business was full of inefficiencies! Still, that provides upside, as they sort out the issues, and so far this has been going well, with positive updates in the last year or so.

It also has strikingly good finances, with net cash, and a large freehold head office & warehouse, so you’ve got strong asset backing, and big dividend-paying capacity, combined with a modest valuation - so there’s lots to like with this share for value investors.

On the downside, same as everything, is how badly will it be impacted by the squeeze on consumers? Inflation shouldn’t be a worry, because HEAD can just raise prices to pass through additional input costs.

Overall then, I’m starting with a positive stance on this, but that could change depending on what today’s update says.

Today’s update - in the toughening economic circumstances, this strikes me as encouraging -

The overall revenue performance in the period was in-line with 2021. Profit performance was above 2021 due to strong margins continuing into 2022, supported by the Company's ongoing focus on operational efficiency through cost control.

This reinforces that HEAD is not static, because of its turnaround plan to raise profitability. So far that seems to be offsetting the well-known macro headwinds, that’s very encouraging actually.

Although the trend is slightly negative, and probably likely to get worse as inflation bites consumers -

Q1 2022 revenue was broadly in line with plan, followed by a slightly weaker performance in April 2022 due to overall softening in the residential sector and some delayed orders. In the four months, residential sector revenue for the group was down 0.5% against the prior year period on a like-for-like basis. However, the Company's branded, higher-end and higher-margin products performed above plan, and delayed orders are now coming through.

HEAD’s commercial sector (which suffered a lot in the pandemic, as offices were shut & didn’t need new carpet) saw some recovery, with sales up 5.8% vs LY.

Strategic progress - repeats previous self-help measures, which are working well - I've summarised the text -

- Efficiency gains

- Increasing market share

- New customer wins

- Digital - an impressive 25% of business is now online

- Trade counters being improved, sales up 13% vs LY for revamped sites

- New product launches imminent

This is a useful reminder that there’s a lot going on to improve the business, plenty of which seems like low hanging fruit to me, in what was previously not a well managed business, but is becoming well managed I would say (although we’ve only got the company’s word for that, but the figures do support that).

Outlook - this is very encouraging I think, in the difficult circumstances -

As expressed at the time of the March 2022 Final Results announcement, the continuing inflationary environment is likely to impact consumer spending during the year, thereby suppressing underlying volumes and revenues in the industry. However, the Company's strategy, set out above, should provide a countermeasure and some protection against the weaker underlying market. Additionally, the continuing manufacturer-led price increases due to cost inflation will continue to provide a support to revenue performance and help offset operational cost inflation.

The summer months are an important period for the commercial sector activity owing to refurbishment, repair and maintenance particularly in educational and other establishments. With a severely impacted industry-wide commercial sector performance in the previous two years, there is an expectation that some of the work previously not undertaken will take place this year.

Given the above, and the performance to date, the Company continues to be comfortable with profit expectations¹ for the year.

¹Company-compiled consensus market expectations for revenue and underlying profit before tax, on a mean basis, are available on the Company's website at www.headlam.com.

[Paul: the actual link is this, to save you wasted time rummaging around on the website trying to find it: https://www.headlam.com/investors/shareholder-information/analysts/ ]

Webinar - at 3pm today, on InvestorMeetCompany

Valuation - we have 37.4p consensus EPS for FY 12/2022 here on Stockopedia, which is consistent with the broker forecasts shown on the company’s own websites. Incidentally, why can’t all companies report broker forecasts on their websites? If HEAD do it, then it’s clearly possible.

At 343p per share, the PER is only 9.2 - that’s really cheap, given the solid performance, in line with expectations, and the superb balance sheet. Note that the divi yield is now 6.5%, and the company is not stretching itself to pay that.

Obviously the stock market has factored in a downturn in demand, but I think today’s update confirms that HEAD has plenty of tailwinds from self-help measures. Plus it can easily pass through price rises, so there’s lots to like here, if you’re prepared to look through the current cost of living squeeze - which is mainly impacting the poor, not the middle class. So I suspect demand could be more resilient than we might think, but time will tell on that.

Even in uncertain times, this share looks particularly good, and very cheap, taking a long-term view. If you sit in cash, you’re losing close to 1% per month. With HEAD shares, you’re getting a 6.5% yield, and long-term upside. The question is, can people stomach the short-term volatility?!

With a fragmented shareholder base, it looks vulnerable to a takeover bid, which is another good reason for holding.

.

.

Begbies Traynor (LON:BEG)

135p (up 8% at 08:50)

Market cap £207m

Begbies Traynor Group plc (the 'company' or the 'group'), the business recovery, financial advisory and property services consultancy, announces an update on trading for its financial year ended 30 April 2022.

- FY 4/2022 adj PBT c.£17.8m (market expectation was £17.2m), so a 3.5% profit beat vs expectations.

- This is a big profit increase of c.55% vs LY (last year), driven by acquisitions.

- “Improved operating margins”

- Net cash £4.7m at 4/2022 (after paying out £7.5m re acquisitions

- Insolvencies now increasing, back to pre-pandemic levels, as Govt support measures phase out.

- Acquisition of MAF Finance has traded well, growth in line with earn-out thresholds.

- Property services division has traded well, and acquisitions in line with expectations.

- Plenty of liquidity, with £30m bank facilities, renewed to Aug 2024.

- Diary date - 19 July 2022 for FY 4/2022 results.

Outlook - confident-sounding -

Ric Traynor, Executive Chairman of Begbies Traynor Group plc, commented:

"We performed strongly in the financial year with results comfortably ahead of market expectations and significantly ahead of the prior year. This reflected the material increase in scale and scope of the group since 2021 following our acquisitions and investment in both divisions.

"Our strong financial position has further improved and we retain substantial resources to make further acquisitions to build our scale and range of complementary services. We have started the new financial year confident in our outlook and anticipating a year of further progress."

My opinion - as regulars here will know, I’ve been extolling the virtues of BEG for some time now. It’s a counter-cyclical share, so as the economic outlook deteriorates, Begbies prospects improve. Therefore there’s a strong argument for owning some BEG shares right now.

Today’s update is strong on all fronts. What it only touches on, because I suppose it would be insensitive to delight in the misfortune of others, is that withdrawal of Govt support measures now means that large number of zombie companies are likely to go bust. Hence increasing demand for Begbies highly specialised mid-market insolvency practitioner services. This is high margin work, because it’s so difficult & requires fiendishly difficult exams to be passed, plus close relationships with banks.

Shore Capital & Equity Development have both put update notes on Research Tree, many thanks for those. ED has upped its forecast from 8.7p to 9.6p EPS for FY 4/2022. That’s a PER of 14.1. However, the likelihood seems to be that FY 4/2023 could be substantially higher than that, maybe taking the PER down to about 10, would be my guess.

Overall then, I’d say BEG is a really good, safe place to park money right now, confident that as the economy deteriorates, BEG prospects improve.

BEG has never been given any credit for its skill in making multiple, good, acquisitions. So this is more than just a counter-cyclical share, it’s also a proven, successful acquisition vehicle. This is the type of sector where everyone knows each other, so acquisitions are quite low-risk - BEG will know exactly what acquisition targets it should aim for, and to date it hasn't put a foot wrong.

BEG deserves a higher rating, in my opinion.

.

Portmeirion (LON:PMP)

435p (down 8% at 09:59)

Market cap £61m

The trouble at the moment, is that with much higher inflation, and a consumer squeeze unfolding, there are bound to be profit warnings from numerous companies. The stock market has already anticipated that, especially with small caps, but as I’ve moaned before, we seem to get a double drop - firstly in anticipation of a profit warning, then secondly when the actual profit warning happens. Worse still, investors seem incapable of looking beyond current macro conditions, so are valuing shares on lower multiples, of lower profits. Whereas arguably we should be valuing companies at the long-term value of the business, including a recovery in profitability once inflation normalises.

At some stage that should present us with wonderful buying opportunities, but it doesn’t feel as if the de-rating process has fully played out yet, does it?! On the contrary, we seem lined up for a relentless tidal wave of profit warnings, so things are really tough right now, in terms of decision-making.

Buying fancy new crockery is very much a discretionary spending thing, so it’s no surprise that PMP shares have sold off recently, down by about a third this year-to-date, but then so are loads of other shares in cyclical businesses.

I exited PMP a while back, on worries of rising energy costs (kilns being expensive to run), and consumer spending falling back possibly. Set against this, there are a lot of positives within the business, under the newish CEO, who’s executing well with a sensible turnaround & expansion strategy.

Overall then, my preconception before reading today’s update is that this should be a good long-term share, but there are highly likely to be some bumps in the road for maybe the next year, due to macro conditions. I find that bear markets are a great time to research companies at your leisure, and prepare a list of things to buy once you can see the outlook improving. Although remember that shares often start rising strongly, before that becomes obvious. So if we’re too cautious, we miss out on the best part of the recovery. That doesn’t feel imminent yet though, but nobody knows, it’s all guesswork really.

Trading update (AGM)

Portmeirion Group PLC, the designer, manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester, Pimpernel, Wax Lyrical and Nambé brands, announces the following trading update ahead of its Annual General Meeting to be held at 12:30 pm today.

The current financial year is FY 12/2022.

I’m a little surprised that the share price is down 8% today, which I suspect is probably more about panic selling again after large falls in the US overnight (the FTSE 100 is down 179 points as I write this).

PMP’s trading update strikes as quite reassuring. Here’s my summary of the key points -

Sales for Jan-Apr 2022 are up 2% vs LY

Gross margins up 50bps (for anyone not familiar with this terminology, a random example would be if gross margin rose from 50.0% to 50.5%, that’s what 50 bps (basis points) means)

Passing on input cost increases through price rises.

“Significant change to consumer sentiment and spending..”, although this sounds more like a generic comments, than anything specific to PMP, because it contradicts solid sales YTD, and later comments on the order book, which are more positive.

Further covid disruption to supply chains (in China).

Successfully mitigated supply chain issues by forward-ordering stock.

Energy - long-term contracts in place until March 2024 (I’d call that medium term!) - a key point that reassures.

New websites & products due to launch shortly.

PMP has a traditional heavy H2 weighting to profits, so mgt is “cautious & watchful” re macro.

Outlook - sounds pretty upbeat to me, with good self-help measures underway -

Against this backdrop, the Board is encouraged that the Group continues to grow and we are confident that our ongoing strategic investments in factory automation and online platforms will enable future growth in top line sales and that ongoing improvements in productivity will further enhance margins over the long term.

Additionally, order books for both our key Christmas trading period and our wider international markets remain healthy…

Whilst we remain mindful of ongoing disruption to global supply chains and inflationary cost pressures, I am confident that our continued investment across key areas of the business, the strength of our heritage brands and our exciting roadmap for new products and ranges ensure that we are well placed to continue growing the Group and delivering long term value to our customers and our shareholders."

That’s actually not bad at all. Although "long term value", suggests shorter term may not be great.

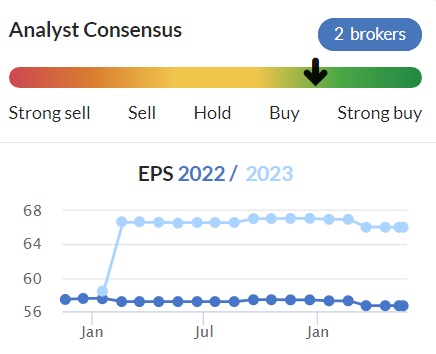

I'd like to see broker forecasts come down, to build in some wiggle room for a likely deterioration in H2 -

My opinion - I reckon PMP shares are getting into buying range again now, for value investors. Or we can sit on the sidelines and hope it’s get cheaper.

It’s probably safest to assume that the ambitious 56p EPS forecast for this year needs to come down, as it’s barely budged, despite the macro picture deteriorating. Analysts are, as usual, looking behind the curve in not slashing forecasts, despite the worsening economy. For that reason, I’m wary of saying this looks cheap on an earnings multiple, as actual earnings are more likely to below estimates than above.

Long-term holders should be fine though, I reckon, this is an improving company under strong management. Shorter-term, I’ve no idea what the share price is likely to do.

With healthy order books for Xmas, it sounds like the risk of a profit warning has gone down a notch, but a lot could change as this year progresses, so it’s all guesswork at this stage.

If PMP continues falling, then I might dip my toe in with a small initial purchase, then add to it if things develop OK. It would be a pity to miss out on a takeover bid.

.

Shoe Zone (LON:SHOE)

139p

Market cap £70m

A lot of subscribers have asked me to report on this one, from earlier this week, so here goes.

For the 26 weeks to 2 April 2022.

Note the prior year comps are very soft, because that was during the last lockdown in spring 2021.

H1 revenue & profit bounced back, with £3.1m PBT (of which, £0.3m is one-off from sale of freeholds)

Seasonality - I checked back to pre-covid, and noticed that SHOE had a very strong H2 profit bias in more normal times. See the screenshot below, which you can find under the “Account” tab on any StockReport, then click on “Income Statement”, then click “Interim”. This little-known, but really useful feature on Stocko then splits out historic results by H1, and H2, sequentially, highlighting the seasonal trends (make sure to look pre-covid, which started c. Feb 2020).

.

This changes the investment case for SHOE completely. I was about to say that I wasn’t madly impressed at £3.1m H1 profit this year, because this would have included a probably significant boost from business rates relief.

However, if seasonality follows anything like the historic pattern, then we should be looking at H2 producing profit of considerably more. Strangely, Zeus’s update note today hardly factors in any H2 seasonal uplift, saying they’re being prudent. It looks way too prudent to me. I think there’s a possibility SHOE could thrash existing forecast of £6.5m full year adj PBT (that’s 10.4p EPS). Based on prior years’ seasonality, we might even be looking at nearer 20p EPS, than 10p.

Headwinds - maybe I’m getting ahead of myself? There are of course well-known cost headwinds, e.g. having to pay staff a lot more, and supply chain problems. Most of all, the current consumer squeeze is hitting the poorest the hardest - e.g. 3.1% increase in State benefits, and inflation probably over 11% for the poorest, who spend more on food & energy as a % of their household budgets, which are the highest rising items (confirmed by an economics professor from Kings College last night on the news). This is a massive squeeze for low income families, who are probably SHOE’s main customers. So I suspect it might struggle to maintain sales and margins as the year progresses.

Some people have the opposite view - that lower price retailers do better in recessions, as people trade down. We don’t know, let’s see what happens.

Other points I noted down (not comprehensive) -

Strong growth in net cash, now £13.9m with loans paid off, so it can now pay divis.

Interim divi of 2.5p announced.

Commentary says special divis & buybacks are up for discussion - what an amazing turnaround from the deeply gloomy talk from SHOE during the pandemic!

Rents falling at renewal/expiry, down 37% on average - very helpful.

Short leases (avg is only 1.8 years) too, we’ve always liked that flexibility SHOE has - avoiding the main retail pitfall, of being stuck in over-rented leases, which is nearly always what causes retailers to go bust.

Digital - eCommerce has fallen back, as sales move back into stores, but it’s profitable, and the returns rate is only 10.9%, with many returns taken back to a physical store - the hybrid model is now looking much better than online only, who would have predicted that a few years ago, when online only was all the rage?

Strategy update - is very clear & logical I think.

Gross margin - very high at 60.8%, barely changed (down a little). That’s good business, retailing at such a high margin.

Energy prices - fixed until Sept 2023.

Balance sheet is strong now, and note the pension deficit has shrunk a lot - no solvency issues at all now, I’m happy with the financial position, even in a downturn.

Cashflow - massively distorted by the daft IFRS 16 entries. Actually, it didn’t generate any free cashflow at all in H1. But that’s fine, as it’s the seasonally quiet half.

My opinion - this looks excellent. I can see why readers like this share.

Obviously, as with all retailers, there are going to be big headwinds for a while, but this company looks one of the better ones, and attractively priced if you take a long-term view.

Management has loads of skin in the game, so this is shrewdly managed by owners, and it really shows doesn’t it!

So a firm thumbs up from me. With the caveat that I suspect its lower income customers are likely to be the worst affected by the disposable income crisis that is now unfolding.

.

.

.

Jack's section

Tyman (LON:TYMN)

Share price: 274.5p (-0.9%)

Shares in issue: 196,300,000

Market cap: £537.9m

AGM trading update for the four months to 30 April 2022

Tyman is an international supplier of engineered components and access solutions to the construction industry. It makes and supplies things like seals for windows and patio doors.

Underlying demand remains strong four months into the financial year against an ‘an exceptionally strong comparative period’ and the group expects full year adjusted operating profit to be in line with market expectations.

Revenue is up 10% like-for-like to £233m (with the same period 2021 +14% on pre-pandemic 2019), largely reflecting pricing action taken to recover cost inflation. Volume growth, on the other hand, is constrained by supply chain issues and labour shortages dating back as far as May 2021. These pressures are improving though, according to Tyman.

Regarding pricing:

Commodity costs have continued to rise, and further price increases have been implemented in all three divisions in early 2022. Further pricing actions will be taken as necessary to recover inflation.

That's good, but can Tyman implement price increases indefinitely or is there an end of the road there? The answer there probably depends on other moving parts, such as wage inflation.

All sales to Russia and Belarus have been stopped - these accounted for 1% of group revenue in 2021.

The order book at 30 April 2022 was ‘significantly ahead’ of April 2021, with US single-family housing starts up 2% and repair and remodelling activity up 12%. Demand continues to outstrip supply, credit availability is good, and consumers still have an elevated level of savings, so Tyman expects this momentum to continue despite rising interest rates. The first phase of the ERP upgrade in North America has been completed and work is now underway on the second phase.

The UK & Ireland RMI market has continued at historically high levels, although is showing signs of softening, reflecting cost of living pressures and reduced consumer confidence.

However, the significant level of consumer savings and backlog of activity should act as an underpin for the rest of this year. Core European markets remain buoyant, supported by various government stimulus measures.

There’s a pension fund at Tyman, rising rates should help there. I see £149m of long term debt on the balance sheet, set against £57.7m of cash. Looks fine.

Conclusion

A reassuring update given the recent share price performance - Tyman has a one-year relative strength measure of -44.7% - although the interest rate situation remains a consideration in the medium term, even if positive factors are currently offsetting any increases.

I think at this level the company starts to look interesting. A forecast PER of 8.2x, forecast divi yield of 4.94%, operating margins around the 10% mark, and same with ROE and ROCE (although the latter two have been lower, around 5%, in the years preceding Covid). The group is cash generative, and the dividend is c2x covered. Although the track record of returns to shareholders is patchy.

The group is pushing price increases through in what is a difficult environment. Volume remains constrained but pressures are easing.

But this is a cyclical stock that has been experiencing exceptional demand. A rising interest rate cycle, an increasingly challenging consumer outlook, and the evolving global impact of the Russia/Ukraine conflict must all be considered. And net profit margins are still single digit % (as low as 2.9% in 2019 but expected to be c9% in 2022). With so many headwinds currently buffeting enterprises, I can see why investors are nervous of cyclical companies.

There is scope for a rerating here, but that depends on macro conditions. Tyman has done a good job of growing revenue over the past ten years. Is that because it’s been taking market share, or because we’ve been in a massive QE bubble for as long as a lot of investors can remember? I do find it interesting to note that a significant chunk of the market by now has no experience of a real rising rate environment.

As for Tyman - good results, and trading is going well, but managing inflation is an ongoing and evolving process. So it could be bumpy in the short term. It does have favourable tailwinds as well though, and the valuation has come down a long way so a decent amount of that is priced in and there is scope for a rerating. I just don’t think the market wants exposure to consumer cyclicals at the moment.

Stockopedia marks it as ‘Contrarian’ which sounds about right.

Knights group (LON:KGH)

Share price: 117.48p (+24.45%)

Shares in issue: 84,372,732

Market cap: £99.1m

Full year trading update, and acquisition of Coffin Mew

Knights is an acquisitive professional services group, mainly law. There’s a lot of M&A activity in this space, whether or not it creates lasting value remains to be seen and comes down to deal execution from the respective management teams.

Perhaps the main criticism of the sub-sector is agency risk - historical pay structures suggest that employees might feel entitled to a share of the net profits typically reserved for shareholders and business investment.

There’s been quite the collapse in value over the past couple of months, suggesting confidence in Knights’ business model has been badly hit. Paul covered it here.

Here’s what Paul said at the time:

Slower than expected H2, especially Q4… Reasons? Staff sickness due to omicron, slower benefit from return to office working, slowdown in corporate work due to downturn in business confidence. The only one that sounds credible to me is the last one.

The market appears to have agreed, with a brutal sell off. Margins are set to ‘rebuild to historic levels over time’, with the last two words suggesting some serious work needs to be done.

It’s worth noting as well that this update comes after an H1 in which management said to expect the usual H2 weighting. Then we had some fortuitous director selling in the run up to the profit warning, and today we have the chief operating officer leaving ‘to pursue other opportunities’ apparently, after the c50% share price crash. It feels like a degree of spin to me.

As for today’s update:

In line with the trading update made on 22 March 2022, the Group anticipates revenue for the full year of c.£125.5m, up by 22% compared to the prior year (2021: £103.2m). Underlying PBT is anticipated to be a minimum of £18.1m (2021: £18.4m).

Net debt as at 30 April 2022 is expected to be £29m (30 April 2021: £21m), £2m ahead of analyst expectations, reflecting a focus on cash conversion and maintaining lock-up and debtor days.

Coffin Mews acquisition:

As announced separately today, Knights has agreed to acquire Coffin Mew, a leading independent law firm, providing entry into new key markets, including Portsmouth, Southampton, Brighton and Newbury, and significantly expanding the Group's presence in the South of England.

Conclusion

This is a divisive sector and, as noted above, agency risk is a key concern. If the star performers aren’t paid well, then they might leave to set up rival firms.

But there is also a growth opportunity here for management teams that have the skillset to retain talent and consolidate in the sector. As for Knights specifically, on the face of it the share price crash looks like a pretty extreme reaction. Even after earnings downgrades, the valuation is striking (though the multiples are out after today’s share price rise).

Today’s reaction might be some kind of admission that the initial derating was too severe, but I think there are some underlying issues that will take time to fix, market sentiment is unforgiving, and the warning has highlighted the riskiness of a buy and build strategy of ‘people’ businesses. Other firms in the space share these risks but arguably have more differentiated strategies.

It also shows that these businesses, while they may generate high returns in good times, have precious little in the way of tangible assets that might provide a floor to the share price. The good ones can grow, but earnings visibility is another issue. Compared to another asset-light business model for example - a SaaS business - the lack of tangible assets is not supported by the security of multi-year visibility on earnings.

On the other hand, Knights shares could appreciate materially and still be optically cheap on a forecast earnings basis, so there could be a rerating trade, although it’s not one I’m considering.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.