Good morning! Paul & Jack here with you as usual today.

Day 2 of our 3 day week - I could get used to this! (is that as predictable as neighbours shouting, "Can you do mine as well?!" when washing my car, with a look on their face as if they're the first person to have thought of saying that? Laughing is a social obligation, even though it's not funny).

Agenda -

Missguided (a large competitor to Boohoo (LON:BOO) [I hold]) has called in administrators, according to Sky News. I ponder what this might mean for the fast fashion, and eCommerce sector.

Camellia (LON:CAM) - rather late FY 12/2021 results from this sprawling international group, mainly focused on agricultural production. Modest profits, which nearly all come from part ownership of an associate. Outlook for 2022 is better. Strong balance sheet, but so what, if it generates so little profit? Lots of risks to consider too, so not of interest to me.

XP Factory (LON:XPF) - FY 12/2021 results are out today. Historic figures are of only passing interest, since a recent acquisition of competitive games themed bars is set to transform the original escape rooms concept. Looks potentially interesting, but expensive at this stage, with economics still unproven.

Supply@Me Capital (LON:SYME) - a brief look at this crock is enough to repel me. Based on the facts & figures to date, this looks highly likely to end up at zero. Bargepoles need to be dusted down!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Missguided - sadly for the staff and suppliers, and shareholders, this privately owned fast fashion business has called in administrators, Sky News reported last night here. Thanks to my friend Miles for flagging up the story.

Missguided is a big competitor to Boohoo (LON:BOO) (I hold), and based in the same area - so a competitor for key staff, as well as customers. It traded very well a few years ago, but has struggled against tough competition in recent years. It also appeared shambolically run, when a TV series was made about it - although to some extent, that’s the nature of the sector. Demure it is not -

Several press reports have said that Boohoo (LON:BOO) (I hold) is in talks to buy the brand in a pre-pack administration, which could help sentiment towards BOO shares, taking out a competitor. BOO has obviously a very disappointing share (along with the whole eCommerce sector) over the last year, but is still a formidable business, with many brands.

At this rate, I think a lot of also-ran competition is likely to disappear in the fast fashion space, perhaps leaving just BOO and Shein (unfair Chinese competition, which takes advantage of loopholes to avoid UK tax & regulations).

eCommerce generally has been so battered in the last year, I think there seem to be some obvious bargains there now. So maybe the sector could surprise later in 2022, or 2023, particularly if freight rates begin to moderate? One year’s dog, is quite often the surprise winner the following year. Time will tell.

I think you could see structural growth in online resume this year, once the distortions of the pandemic fully annualise, around now. Demand was undoubtedly pulled through early in 2020, then dropped back in 2021, hence it appeared that growth had stopped. I reckon we could see a return to more normal, long-term structural growth this year. That might surprise the market, and lead to eCommerce shares re-rating upwards. Who knows, it’s only my theory at this stage, but it makes sense to me anyway.

.

Camellia (LON:CAM)

5950p (last night’s close)

Market cap £164m

Normally I avoid all UK listed companies which operate overseas, because so many of them turn out to be dodgy. Why take the risk? However I do make the occasional exception, if such a company has been listed in the UK for a long time, and paid decent divis along the way, then it’s probably OK (e.g. Somero Enterprises (LON:SOM) - I hold). Obviously some countries are less risky than others, you can decide that for yourselves. Mind you, we get plenty of dodgy companies and management in the UK too - but they’re easier to spot, because when you live in a country, you know where to look.

Anyway, Camellia caught my eye here in Dec 2021, when I reviewed it for the first time, and thought it looked potentially interesting - its an agricultural group (growing tea, avocados, etc), with a strong balance sheet, and a good dividend paying track record (although unremarkable yield of 2.4%).

Camellia acquired an English apple grower in mid-2021.

Revenue down 4.8% to £277m

Adj PBT down 45% to £8.8m - note that most of the profit comes from the share of profits in an associate company.

EPS 83.3p (based on unadjusted, statutory EPS) - PER of 71 times - so the market must be expecting future earnings to rise considerably, to justify the current valuation. Although you’ve also got asset backing with this type of share, so PER isn’t everything.

(adjustments are small this year, and look reasonable [relating mainly to non-trading items re acquisitions & disposals], boosting profit by £1.7m, vs ££8.2m boost LY)

Dividends - 102p final divi, making 146p for the year - a yield of 2.5% - OK, but you can get much better divis on other shares, so I wouldn’t say this is a compelling reason to buy/hold Camellia shares, unless you think future earnings & divis might rise substantially? Note that the divis are higher than EPS this year.

Outlook - sounds positive -

2022 has started well with good prices being achieved in the Kenya tea market and a strong opening for India and Bangladesh, albeit early in the season. The remaining crops are developing in line with our expectations for the stage of the growing cycle with volumes ahead of those of 2021. The impact of substantial rises in energy prices and in fertiliser costs is being felt across all our agriculture operations and we expect rising inflation to also lead to further increases in wages.

Overall however, we expect higher profits in the year ahead."

Balance sheet - one of the most complicated I’ve ever seen! Still, assuming all the figures are correct, then it’s very strong - NAV of £437.3m. That includes only £10.1m intangible assets. There’s also a £14.8m pension surplus, which would need looking into, to see if it’s actually a real world deficit, as they often are. There’s also a £8.6m pension deficit, presumably for a different scheme.

Working capital looks very healthy, with current assets of £181m (including £61.8m cash), vs current liabilities of £83.6m, giving a surplus of £97.4m net current assets - this means the group seems strongly financed, and has firepower for acquisitions possibly?

The trouble is, what’s the point in owning all these assets, if the group is only generating a tiny return from them?

My opinion - I’ve lost interest in Camellia, so will stop here. It’s a sprawling, complicated group, with 3 divisions, mainly agriculture, but also engineering & food services. It also owns investment properties, and part-ownership of a profitable associate.

The group is subject to all sorts of risks, including weather - crops failing, erratic selling prices of crops, inflation, legal claims (see note 4 - £16.1m legal expenses last year re litigation in E.African operations), developing country political risks, you name it, the list goes on & on.

So why invest in something so inherently unpredictable?

It’s not for me, as it would be nothing more than a punt. However, I do like the strong balance sheet, and given rising populations & shortages of food, maybe food producers might be a decent place to invest right now?

.

.

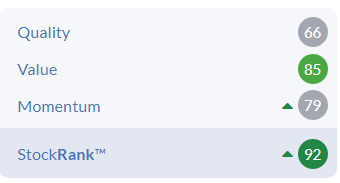

Note the StockRank system likes it -

.

XP Factory (LON:XPF)

26p (up 7% at 09:09)

Market cap £39m

This company used to be called Escape Hunt, it listed in July 2016, as a start-up, developing escape room leisure experiences. Performance was very poor, and the share price collapsed by 90% from c.150p to 15p just before covid struck.

Naturally, escape rooms (people locked into a themed room, in close proximity, solving queues to escape) couldn’t have been a worse concept in a pandemic, and the shares dropped to just 3.5p at the spring 2000 low. They more than 10-bagged in the subsequent bounce.

I lost interest in this share about a year ago, as I couldn’t see anything much in the business model. Taking a fresh look at things today, the business model seems to have improved significantly, so I’ll take a closer look.

A placing at 30p raised £15m (before fees) in Nov 2021, mostly being used to fund the acquisition of Boom Battle Bars. I really like the concept here, it’s mainly franchised bars, with a simple food offering, but the main attraction is competitive games, like axe throwing, pool, shuffleboard, augmented reality darts, karaoke, etc.

Funnily enough Revolution Bars (LON:RBG) (I hold) is also trialling a similar games/drinks/food concept, centred around retro arcade games. I think this is the way to go, because drinking out has now become so expensive, why would anyone pay £6+ for a cocktail, just to sit and talk in a noisy environment? Also, singles feel awkward on their own. Much better to provide some kind of active entertainment via games, to make a night out more exciting, and unique experience, a bit like a night out ten pin bowling. Good for team building corporate customers, birthdays, and general socialising. Plus probably popular with students. There’s one opening soon in Bournemouth, so I’ll mystery shop it & post a video in due course.

Sites are being rolled out, and a franchise model allows more rapid expansion, and without capex needed from the group. Landlords are providing a lot of the capex anyway through reverse premiums, and of course there are many empty sites available, often off-pitch (so cheap), since this format is more of a destination, rather than needing to catch passing trade. So far so good, this looks promising.

Plus it says the Boom Battle Bar sites can be combined with an escape room, so a clear benefit of making the acquisition, to create larger hybrid leisure sites.

Downside risk, as with the escape rooms, is that there’s no moat - anyone can copy the concept very easily.

Trading update - issued on 26 Jan 2022, indicating positive adj EBITDA for H2, ahead of market expectations. Although it’s not clear whether that’s nonsense EBITDA (under IFRS 16), or more sensible EBITDA (pre-IFRS 16)?

Also, a £1.5m cash boost was received for a successful R&D tax credits application.

Boom Battle Bars only contributed about 1 month into the FY 12/2021 results.

Final Results - for FY 12/2021, so of limited use, due to lockdown in early part of 2021, and little contribution from recent acquisition. Plus heavily distorted by Govt support measures.

Revenue £7.0m (up 163%)

Adj EBITDA (pre-IFRS 16) was £0.5m in H2 (I’m happy to ignore H1, as sites would have been closed for most of it)

Equity fundraise of £16.1m (net of expenses), of which £9.9m paid to acquire Boom Battle Bars.

Cash remains healthy, £8.2m at 12/2021, and £6.9m by end April 2022.

XPF has passed the concept stage, and is now rolling out (via franchisees mainly) new sites rapidly. So there’s no point in over-analysing 2021 results. It’s the future that matters. So what we really need to know, is what are the site level economics? This list of points below is helpful, and sounds positive, but since it contains no figures I can’t do any analysis. What I need to know, is how much profit each site is going to make annualised, and what are the franchise fees which flow to XPF ? -

Outlook - this all sounds good, but I have to question whether these concepts (escape rooms & competitive gaming bars) have longevity, or might just be seeing a boom as a fad. Also, competitors are joining in, so before long we could have loads of these themed gaming bars all over the country?

The customer demand we have seen since Covid restrictions were lifted has been overwhelmingly positive and has reinforced our belief that businesses like ours serve an important role in bringing people together. With the Escape Room category becoming much more a part of the mainstream consumer psyche, and with competitive socialising being such a fast growing sub-sector within the leisure market, we feel that XP Factory is perfectly positioned through its operating brands Escape Hunt and Boom respectively.

With such a well-developed pipeline of sites, such encouraging demonstrable unit economics in both brands, and such a well-positioned business in terms of customer demand, we have reason to be highly optimistic about the future for XP Factory."...

With our current pipeline of over 40 potential sites in development, we anticipate having 27 venues trading by the end of 2022, spread across franchise and owned units. We believe that this footprint will enable us to become a pre-eminent player in the industry.

[Paul: it’s not clear whether this relates to just Boom, or Boom + existing escape rooms?]

This is a great time to be expanding, as we’ve also seen for restaurant & bars groups elsewhere -

The opportunity to exploit a property market which has been at its lowest point in a generation has enabled us to secure an enviable pipeline of sites, at materially lower rents than would have been achievable previously, and this, combined with the capital contributions on offer, should allow us to make very strong returns on the capital we employ.

Management don’t seem to have much personal shareholdings, unusual for an early stage company, and experience seems to be more in larger companies, than entrepreneurial.

Balance sheet - NAV is £21.8m, but once £22.0m intangible assets are written off, NTAV is slightly negative at £(0.2)m.

The £8.2m cash pile looks good, but that’s largely offset by current liabilities of £7.3m.

In long-term liabilities, a “Provisions” liability of £9.25m stands out, and note 21 explains this is almost all contingent consideration relating to the Boom acquisition. Although this seems to be payable in up to 25m shares, if targets are achieved, rather than cash.

There are 150.4m shares currently in issue, so we should work on the basis that could be diluted, with 25m more, which is 16.6% potential enlargement of the share count, plus more for share options. So make sure you take that into account in valuation terms.

My opinion - a very interesting concept I reckon, rapidly being rolled out, mainly via franchisees. We need to find out the terms of the franchise deals, and how much recurring revenues XPF is likely to earn from them. The franchise fees in 2021 were negligible.

Also, I don’t see any figures on site economics.

Hence at this stage, the business model is still unclear, and unproven. That said, if franchisees are lining up to open & pay for new sites, then that’s telling us something positive.

Adding in the c.20% dilution from deferred consideration & share options, the market cap is knocking on the door of £50m currently, which seems a lot for a concept that’s only starting to be rolled out, and is easily copied.

So it doesn’t attract me as a value investment. However, as a punt, I think this could be quite interesting, due to the rapid pace of expansion. Definitely one to keep an eye on, so it’s going on my watchlist. What do readers think? I’d love to hear from anyone who’s done more research on it.

I’m motivated to do some more research on it now, whereas in the past it looked a waste of time. There’s an update note from Shore Capital on Research Tree, so that’s my next port of call. Hopefully management will do webinars, so we can learn more about the business, and ask questions.

.

Supply@Me Capital (LON:SYME)

0.07p (down 8% at 11:36)

Market cap £26m

I’ve commented here before on this absolute crock. It’s barely worth wasting any time on it. But just for the record, FY 12/2021 results out today are dire -

Negligible revenue of £0.5m

Adj operating loss of £(4.4)m

Loss before tax of £(12.2)m

Balance sheet as at 31 Dec 2021 looks insolvent to me. NTAV of negative £(1.4)m, includes £7.9m in intangible assets. Write that off, and NTAV is negative £(9.3)m, so the company is dependent on creditors not calling in their debts.

It badly needs an equity refinancing just to survive, let alone prosper.

Looking through the RNS for 2022, a refinancing was announced on 27 April 2022.

It's an equity drawdown type arrangement with Venus Capital SA, providing potential new equity of £7.5m in tranches. I don’t know the detail of this, but we’ve seen similar arrangements in the past being made possible by forward selling shares in the market, hence the term death spiral. So this deal would need to be closely scrutinised. There are billions of warrants issued too.

My opinion - I strongly urge readers to steer clear of this share. It looks absolute rubbish to me, and likely to end up at zero.

An extreme optimist might imagine a successful business might miraculously appear out of nothing. Even if it does, then dilution means existing shareholders are not likely to own much of it.

As an aside, I find it’s worth looking at the advisers who promote this kind of junk, and make sure to always start off highly sceptical about anything else they promote.

Stockopedia agrees, with a StockRank of a big fat ZERO!

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.