Good morning! It's Paul & Graham on duty again today.

Agenda -

Paul's Section:

Best Of The Best (LON:BOTB) (I hold) - Results for FY 4/2022 are ahead of expectations. The company also announces that shareholders can tender shares (total up to 11% of the company) at a c.50% premium price of 600p, which has put a rocket under the share price today. It's probably worth taking up the tender offer, given that management is doing so, but they remain very substantial shareholders. Valuation does look cheap, with a PER under 10.

Graham's Section:

Hornby (LON:HRN) - a successful turnaround story continues at the model railway company, after many years of pain for shareholders. Potential operating leverage could generate very significant profit growth in the years ahead, if the Chairman’s analysis holds true. The shares already price this in to an extent, but depending on your view of the medium-term sales trend, could offer some very nice upside.

N Brown (LON:BWNG) - this trading update doesn’t mention any progress with the Allianz litigation. Trading has softened compared to last year, due to the lack of any online retail tailwind from lockdown. Earnings expectations are unchanged. Looks extremely risky due to multiple factors, difficult or impossible to value.

£ANX (no section below) – this credit hire (car hire) and legal services group provides an AGM trading update. Trading is in line with expectations. Credit hire is growing rapidly with vehicles on the road up 52% compared to last year. The legal services division is seeing increased cash collections but it’s unclear if the other information given in this section of today’s update is useful or material. Negotiations continue with VW over the emissions scandal, where Anexo’s subsidiary is representing clients against VW.

ANX shares are superficially cheap versus earnings but investors need to have a strong view on the quality of the company’s £215 million in total assets, including £188 million in receivables (as of December 2021), as any writedowns could be very damaging to future earnings!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Best Of The Best (LON:BOTB) (I hold)

467p (up 24% at 08:15)

Market cap £46m

Best of the Best plc (LSE: BOTB), the provider of online competitions to win cars and other prizes, is pleased to report its preliminary results for the year ended 30 April 2022 (the "Period")

I last reported on this online competitions business here, when it issued a “slightly ahead of expectations” (for profit) update on 11 May 2022, re FY 4/2022. This seemed encouraging, and the valuation looked modest, hence why I decided to continue holding, despite a very disappointing previous collapse in share price.

EPS has come out ahead of what I was expecting previously (around 40p), and broker consensus of 41.7p. Actual is 45.3p - not bad. Note the exceptional prior year, pandemic boosted comparative -

Earnings per share was 45.30p (2020: 37.51p, 2021: 122.52p)

Current trading - in line with expectations.

Tender offer - I need to get my head around this separate announcement as a priority, to see if I need to do anything (buying or selling).

BOTB is returning surplus cash of £6.275m to shareholders via a tender offer for 11% of the shares, at a big premium of 52%, priced at 600p.

This will boost EPS.

It’s voluntary, so shareholders can opt to tender any amount of shares, I think. As it’s a large premium, then I’m guessing many shareholders are likely to over-apply, so it could be over-subscribed, which would result in applications being scaled back.

Cash of >£2.0m will remain in the company, which it says is “sufficient”.

Shares purchased by BOTB (via Finncap) will be cancelled, thus reducing the share count from 9.4m to c.8.37m.

Directors holding 48.6% of the company are taking up their basic entitlement (i.e. to sell 11% of their holdings) at 600p.

There’s also a trading update in the tender announcement -

As stated in the aforementioned announcement, the Company has delivered consistently strong results over recent years and management have been adjusting the various business levers at their disposal, to ensure that where revenues and customer acquisition are settling and normalising post pandemic, the business continues to produce strong profits and cash generation. Whilst this has not been without its challenges, with so many unknowns in this financial year, the Company is pleased to have produced financial results a little better than market expectations.

The Board remains confident that the Company is underpinned by very solid financials, a large and loyal database, and a proven business model. There will understandably be continued focus in the short term on both profit and cash generation to support and strengthen our platform as we then to look to further business development opportunities and growth.

My opinion - given the large premium in share price, then it seems logical to tender as many shares as I can, then buy them back cheaper in the market. The market price is currently about 470p bid price.

It’s a bit disappointing that management are taking up the tender offer, but they will still own c.43% of the company after tendering 11% of their holdings. Previous large disposals were made at £24 per share.

Finncap has upped current year forecast EPS to 53.9p (a 23% rise, about half of which looks due to the tender offer). Hence the PER would be under 10, at the current price of 478p - that looks too cheap to me. Although management selling some more at 600p does make the upside look limited for now, maybe?

As demonstrated in the pandemic year, BOTB has stunning operational gearing, in both directions! Plus, revenues are still running at about double the pre-pandemic level, so it’s held on to a lot of the growth. The main problem is that online marketing costs shot up.

Overall, I think it still looks interesting, and am glad I held on. It's understandably likely to take time for confidence in the company to return, but these numbers certainly help, as does the tender offer - reinforcing that it's still a very good cash generator.

What a rollercoaster this has been -

.

Graham's Section:

Hornby (LON:HRN)

31p (up 3% at 08:35)

Market cap £52m

This model railway manufacturer has been in turnaround mode for years, and did finally succeed in turning a profit last year.

Today’s results (FY March 2022) show further improvement in revenues and profits:

- Revenue £53.7m (2021: £48.5m)

- Operating profit £1m (2021: £0.6m)

- Earnings per share 0.89p (2021: 0.82p)

The results of the last two years will come as a great relief for shareholders, who previously endured nine consecutive years of losses!

Even so, very few investors will be sitting on capital gains:

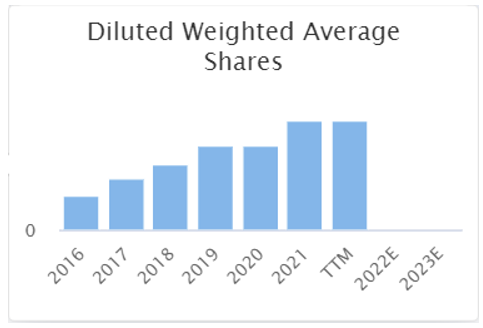

One obvious factor in the lacklustre share price performance is the quadrupling of the share count since 2015:

Those of you who are familiar with my work know that I hate dilution (and I love share buybacks, which are the opposite!).

Of course there are times when dilution is necessary, but it still makes life hard for existing shareholders. Hornby shareholders have seen the overall value of their company increase, but due to the rising share count, have not yet seen a sustained increase in the value of their shares.

Let’s dig into these results in a some more detail.

Supply chain – Hornby was affected by various delays, which both increased costs and held back sales. In particular, the company tells us that many Hornby and Scalextric sets did not arrive until after the Christmas season.

The Chairman provides excellent detail here, e.g. 70 days of transit time for shipments (previous 30 to 35 days), and container shipping costs rising in price from £3,000 to £17,000. These issues will have affected all companies. Some very useful information here.

I hope these issues aren’t also affecting Father’s Day! Hornby has a clear target audience in “gifts for Dads”, meaning that Christmas and (to a lesser extent) Father’s Day are key dates for the company.

Looking forward, Hornby wants to diversify production outside of China, but little detail is provided on this yet.

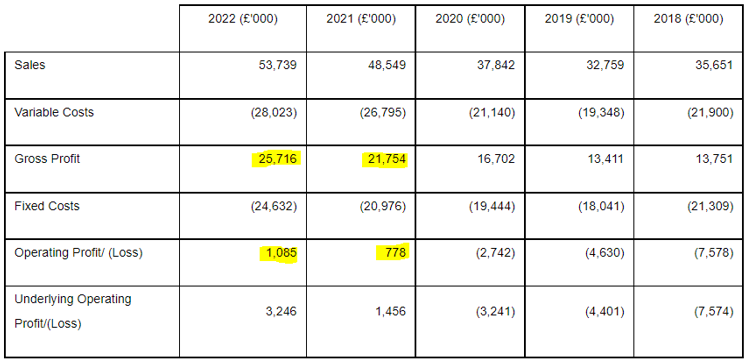

Financial performance – the Chairman provides a very helpful, plain English description of the company’s performance, with the help of the following table:

Hornby’s gross profit margin (gross profit divided by sales) is now 48%, up from 39% in 2018. In the long-term, the Chairman is looking for this to reach 60%. A very worthy goal!

Separately, the company is predicting a reduction in fixed costs as a percentage of sales, from the current 45.4% down to 40%.

Operating leverage - the funny thing about fixed costs is that everyone knows they aren’t really fixed. They naturally increase, as sales increase. The trick is for them to grow at a slower pace than sales do.

If you see the table above, you’ll see that I’ve highlighted some numbers. In 2022, the company has made an operating profit of £1.1 million, despite making a gross profit of £25.7 million (against £24.6 million of fixed costs).

If fixed costs were really fixed, then there would be scope for operating profitability to very quickly double or treble! Gross profit would only need to increase by 4% or 5%, in order to grow by more than £1 million.

Then, if fixed costs were fixed, that extra £1 million would drop straight through to operating profit, and the company would be twice as profitable!

But look at what happened between 2021 and 2022. Fixed costs grew by £3.6 million, wiping out most of the increase in gross profits.

The Chairman comments on this as follows:

In the last annual report, I reported that our current fixed cost base could service a business bringing in £50 million to £55 million of sales. Our fixed costs have now risen, as they must, if they are to support sales of £60 million to £70 million. These increases in fixed costs are in several parts of the business, but mainly in our Digital Team and the support that they require. This started to bring rewards in the second half of the 2021/22 financial year.

Online sales – these are limited, the Chairman appears frustrated with the lack of progress here but wants to improve.

Outlook – current trading is line with expectations, but this is the quiet season.

My view

I have a positive view on this one! I’m excited by the prospect that current fixed costs, according to the Chairman, might be sufficient to support sales of £60 million to £70 million. If that’s the case, then very significant additional gross profits might feed through to operating profits.

The market cap is around £50 million, which does already price in an increase in profitability. But if you can see operating profits grow by £4 - £5 million from the current level, then I think the value on offer is quite good.

If I was to put my pessimistic hat on, I could argue that the model railway market is a small, well-defined niche without significant growth prospects.

I could also say that while Hornby is the undisputed market leader in the UK, there is difficult competition outside the UK, particularly in the US. All of these companies are doing the same thing in the sense that they all import their wares from China/Korea/etc. International growth is likely to be very difficult.

So while I don’t see this company offering much long-term growth, I do think that it could offer investors quite lot of value in the medium-term, as the turnaround concludes.

91% of shares are owned by Phoenix (the majority shareholder) and Artemis. I know a little bit about Phoenix and have no concerns about their ethics, so I would not mind being a shareholder in a company where they are the majority owner.

N Brown (LON:BWNG)

27.6p (down 3% at 09:34)

Market cap £127m

Paul has ceased coverage of this online clothing retailer and lender, for understandable reasons.

I’m still curious to see what it has to say for itself today, so let’s just have a brief look.

Q1 revenue is down 2.1%, with financial services (i.e. lending) revenues down 4.8%, and product revenue down 0.6%.

Last year’s lockdown “provided a tailwind to online retail demand” (agreed!), so an equally strong performance could not be achieved this year.

And it’s another inflation story:

The trading environment has been challenging since the start of FY23, with inflation impacting consumer confidence, resulting in softer volumes and revenue than anticipated at the start of the year.

Strong balance sheet?

I’m not sure about this:

As at 28 May 2022 the Group had unsecured net cash of £30.8m. The securitisation facility was voluntarily underdrawn by £66.6m and can be redrawn if required. In addition, the RCF of £100.0m and overdraft of £12.5m are both fully undrawn.

As flagged by Paul, there’s a legal problem which hasn’t been resolved, which may affect the cash situation here.

It’s all explained in the twenty-second footnote of the most recent annual report. It appears that JD Williams (the N Brown subsidiary) and Allianz are blaming each other for what happened during the PPI mess.

From the most recent annual report (I’ve added the bold):

Should the matter proceed to trial, the eventual outcome is highly uncertain. The range of potential outcomes is very significant given the disputes between JDW and the Insurer as to which sums should be brought into account and what proportions of the liabilities they should each have to bear.

The likelihood of a Court finding wholly in favour of the Insurer, without taking into account the costs already borne by JDW, is considered remote. Accordingly, the maximum potential outflow is considered to be significantly less than the £66 million claimed by the Insurer.

N Brown has only made a provision of £28 million so far.

Outlook - unchanged.

The Board remains confident that over the medium term our strategy will support the delivery of 7% product revenue growth with a 13% EBITDA margin.

My view

Looking through the archives, I previously wrote that it might be worth “digging around for value” with this share.

I acknowledged that the company’s website brands – Jacamo, Simply Be, and JD Williams – weren’t top tier, but I still thought they could make some money for investors.

Unfortunately, this share has headed ever deeper into “value” territory over time, and now it has this dark cloud of litigation hanging over it, which looks set to linger.

There’s also a very complicated balance sheet to contend with, due to the large credit operations.

The most recent annual report shows £577 million under “amounts receivable for the sale of goods and services”, offset by £68.7 million under “allowance for expected credit losses”.

To finance these lending operations, there were £302 million in bank loans.

Since you have websites of questionable quality on the one hand, and large bank-backed consumer lending into a tough economy, with significant credit losses, on the other, there is now little doubt in my mind that BWNG shares should be very cheap. That’s without even mentioning the Allianz litigation.

At low enough levels, BWNG shares could make for an interesting “punt” or a trade, but I don’t see them as an investment.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.