Good morning, from Paul & Graham. Today's report is now finished.

Agenda -

Paul's Section:

Tribal (LON:TRB) - a quick look at yesterday's trading update for this educational sector software company. It's a mild profit warning for H1, expected to recover in H2, but the market didn't react yesterday, with the share price slightly up. Shares don't appeal on a forward PER of 18. Poor long-term track record too, so it doesn't interest me. Although the move to the cloud does look positive, with 3 clients upgrading.

McBride (LON:MCB) - we've been ringing the alarm bell about dilution/insolvency risk at this now loss-making, heavily indebted business since last year. Bank covenants are waived again today, just for another 3 months. It looks as if the clock is ticking here for a refinancing, which might involve a heavily discounted placing, or administration. I would treat this share as uninvestable. Terrible risk:reward in current circumstances.

Shoe Zone (LON:SHOE) - an impressive update, with profit guidance upped by 30% for FY 9/2022, as expected (it was obvious back in May that current year guidance was far too low). That's the right way to do it though - low forecasts, then a beat, greatly improving risk:reward for investors. It looks set up to repeat that in FY 9/2023 too. Still reasonably priced, and with a decent divi yield too. SHOE retains my firm thumbs up opinion here!

Lookers (LON:LOOK) - the bumper profits for car dealers continue (driven by supply shortages, hence higher margins). LOOK raises profit guidance again. The sector is cheap on forward PER (despite being based on earnings dropping a lot), and asset backed with freeholds too, so a fertile ground for value investors. Sector consolidation highly likely.

Shepherd Neame (OFEX:SHEP) - this Aquis-listed pubco & brewery caught my eye, with a perhaps surprisingly upbeat trading update today. Big discount to NTAV. Looks potentially interesting.

James Latham (LON:LTHM) - stunning figures, boosted by pandemic effects - higher prices, and higher margins. Half of the profits ended up being sucked into increased working capital. Taking everything into account, I reckon shares are probably priced about right.

Graham's Section:

Mulberry (LON:MUL) (£191m) - Final results from the luxury handbag brand show profits up strongly, boosted by some lease adjustments. Retail sales are doing very nicely in Asia Pacific, although the current financial year is difficult due to the Covid situation in China. Importantly, Mulberry has delivered an enormous gross margin performance, which bodes well for the future. Beware of the tiny free float: this listing may not be around forever.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Tribal (LON:TRB)

90p (up 1% yesterday)

Market cap £189m

Contract Wins & Trading Update

Tribal (AIM: TRB), a leading provider of software and services to the international education market…provides a trading update for the year ending 31 December 2022 and notice of its forthcoming interim results.

Contract wins - 3 existing clients (UK universities) are upgrading to Tribal’s cloud offering. Incremental annual recurring revenues of £0.9m. Plus another contract win. Not madly exciting.

Trading update - this reads more like a mild profit warning for H1, but the market shrugged if off yesterday -

Sales momentum has continued to be positive, and the Group now expects revenue for the year ending 31 December 2022 to be marginally ahead of current Board expectations and EBITDA to be broadly in line.

H1 EBITDA will be lower than the prior year due primarily to increased costs associated with a major customer implementation, following the extension of project timelines as a result of earlier Covid-19 related travel restrictions.

However, EBITDA performance is expected to recover through the course of the second half, reflecting the Group's continued focus on improved operational performance.

The Group expects to show further margin progression over the medium term as it executes on its growth and operational efficiency strategy.

Net debt - £4.5m as at 30 June 2022, expected to return to net cash by year end.

Growing pipeline. Sector moving to the cloud.

Diary date - H1 results due on 16 Aug 2022.

CEO comments confirms my view that H1 has disappointed slightly -

While we have experienced a temporary reduction in EBITDA performance in the period, due to a short-term impact from a major customer implementation, overall the picture for Tribal remains positive, with an expanding customer base, advanced service offering and continued contract and ARR momentum."

My opinion - I can’t get excited about this.

The Stockopedia graphics below show high quality scores, but middling to low valuation scores. Tribal has had a patchy history, with lots of problems, so I can’t see why it’s now commanding a premium rating, when so many small caps have sold off and offer better value. Not for me. Although software companies can be highly valued by acquirers, for their recurring revenues & being deeply embedded, providing mission-critical services, to clients.

.

The long-term track record for investors has been poor, and divis have been weak, suggesting to me that it’s not really a very good business, and doesn’t generate much cash. So not something that would interest value investors.

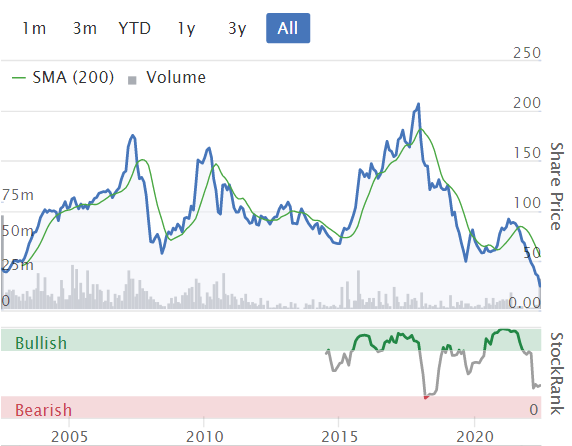

Over 20 years, it's gone down -

.

McBride (LON:MCB)

16.4p (last night’s close)

Market cap £28m

McBride plc (the "Group"), the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning and hygiene markets, today provides the following update to the markets.

Banks have waived June 2022 covenant tests until end Sept 2022 - helpful, but it suggests that covenants would have been breached (with potentially very serious consequences).

A similar covenant waiver was granted in Dec 2021, so we already knew the company is in financial distress.

Banks require McBride to maintain liquidity headroom of £40m+ (actual headroom: £75m at 28 June 2022) - this seems to be saying that the bank effectively won’t let it use the borrowing facility in full - to reduce risk for the bank of course.

Dividends suspended until McBride is in compliance with original bank covenants - fair enough.

Exploring all options, and note the use of the dreaded “stakeholders” -

The Group continues to explore and assess all avenues to maintain liquidity and create additional funding for the benefit of all stakeholders.

Current trading - not getting any worse, but bear in mind that forecasts are for a hefty loss for FY 6 2022, so "in line" is not good -

The Group continues to perform in line with market expectations and will provide a fuller trading update after the close of its current financial year ending 30 June 2022.

.

My opinion - we’ve been ringing the alarm bells about McBride being risky for a while now here at the SCVR - e.g. Jack here in Aug 2021, and me here in Oct 2021, and again here in Dec 2021. So hopefully no readers are still holding this high risk share.

What happens next? Today’s update confirms that the company is in a financially distressed state. This is often the start of a process whereby shareholders either have to stump up more cash (with heavy dilution for those that decline to do so), or control slips away to lenders (who rank higher than shareholders in company law, and whose priority is to get their money back, usually leaving unsecured creditors and shareholders with nothing).

Mcbride’s problems stem from large increases in raw materials costs, and delays in passing these on to customers, who naturally resist price rises. Margins were thin to start with, so this looks an ugly position to be in.

The question is, can the business survive? Probably, but maybe not under its current ownership - if losses continue, then lenders might pull the plug, and force a sale of the business to the highest bidder, via an administration process.

Upside on the shares looks low, and entirely speculative (sometimes shares in financially distressed shares can have sudden & irrational rebounds). Downside looks far more likely - I think this share is completely uninvestable at this stage. If you absolutely have to invest here, then it would surely make sense to wait for a proper refinancing, which might involve large numbers of new shares being issued at a deep discount.

Given tougher macro conditions, we’re likely to see a lot more situations like this - where profits turn into losses, and then bank debt suddenly becomes a crisis. Banks don’t like lending to loss-making companies, which can often then result in equity holders being diluted heavily, or wiped out.

Zero interest rates have lulled many investors into a false sense of security, since banks were happy to grant more time to problem borrowers. The biggest mistake right now, is to start buying financially distressed companies, imagining that the shares are cheap. They’re cheap for a reason - because risk has gone through the roof, and massive dilution or insolvency is looming. Look at what happened with McColls. The writing is nearly always on the wall, well before the shares implode, so it’s important to have the discipline to sell and take the loss, when you’re stuck in a share which is heading for zero.

If I have any doubt about solvency, or the likelihood of a discounted placing, then I calculate how much it would cost me, if the share went to zero. If that’s a painful number, then I reduce the position size to a lower level. Usually a few days later, the penny drops, and I think to myself, what the hell am I doing holding this share at all?! Then sell the rest. Or rather, that's what I should do! Although often stubbornness kicks in, and I hold a small residual position.

I’ve not had a zero in my portfolio since 2018. That was Conviviality, which I always thought was hopeless, but like an idiot I bought £30k’s worth when it plunged on a profit warning. Lost the lot a few days later. Never again! Buying financially distressed shares is a mug’s game, and the temptation to anchor to a previous valuation, hoping it will recover and be a multibagger, is nearly always a mistake.

It’s a different matter if there’s plenty of net cash on the balance sheet, and little to no cash burn, those can be quite lucrative on a recovery sometimes. McBride certainly doesn’t fall into that category - it’s in deep financial trouble, and shares could very easily end up being worth zero, or very little. Risk:reward looks terrible.

Averaging down in a financially distressed company is another terrible mistake - please don't do it!! It's nearly always far better to wait for a proper restructuring, strengthened balance sheet, turnaround strategy to be implemented, then it might be a good recovery. But MCB's nowhere near that point right now.

.

.

Shoe Zone (LON:SHOE)

170p (up 10% at 08:16)

Market cap £85m

A short, but sweet announcement today from this low price shoe retailer -

Shoe Zone is pleased to announce that since the publication of its interim results in May, the business has been trading well and has also seen strong margin improvements and cost savings, in particular as a result of rent reductions and good supply chain management, which are expected to continue into Q4 of the Company's financial year for the 52 weeks to 2 October 2022 ("FY 2022").

As a result, the Company now expects adjusted1 profit before tax for FY 2022, to be not less than £8.5m.

1 Adjusted to exclude the profit on the sale of freehold property

My notes here in May 2022 for the interim results are a quick way to get up to speed with the background for this share. I concluded positively (a coveted SCVR “firm thumbs up”!), thinking FY 9/2022 forecast of £6.5m looked far too low, based on strong interims & positive commentary.

Today’s update raises PBT guidance to £8.5m+ with, I suspect, a little bit more probably held back so they can announce the actual figures with a flourish, and another upside surprise. That’s what all good CFOs should do! (and it keeps a buffer for any unpleasant audit adjustments).

Broker update - many thanks to Zeus, which has given us access to an update note today. It raises profit guidance by 30%, which shouldn’t be a big surprise, given that previous guidance was too low, as I flagged in my last report in May - it was obvious, not any particular insight!

This becomes 13.5p EPS (PER of 12.6)

Forecast (by Zeus) divi is 6.8p (already in the pipeline is a 2.5p interim divis) - so the yield is 4.0%. That’s ahead of broker consensus showing on the StockReport (of 5.5p), so expect that to rise. More importantly, the dividend paying capacity is good at SHOE, because of its strong balance sheet, with net cash, and good current trading.

Zeus makes a great point that a lot of SHOE sales are probably non-discretionary, for customers that need new shoes for children, work, etc. I hadn’t thought of that before. Also, that some customers feeling the pinch (financially, and in their feet!) might trade down to SHOE from more expensive retailers, possibly?

Forecast for FY 9/2023 looks set modestly, and unchanged today, at a fall to 11.0p EPS - I like that, setting forecasts low - because the risk of a profit warning is low, and instead shareholders here are likely to be set up to receive positive trading updates in the coming year.

Modest forecasts mean the forward PER might look high-ish, at 15.5, but the real figure is likely to be much lower, once the soft forecast is beaten.

My opinion - the share price has been unusually strong at SHOE this year, a rare ray of sunshine in an overcast sector. Well done to investors who spotted this - I was late to the party, but got there in the end!

I think SHOE shares remain good value, and are set up very nicely now, with modest forecasts likely to be beaten, plus a (growing) 4% yield whilst you wait.

An interesting point, with wider read across, is that supply chain issues are now receding somewhat, and shipping costs reducing (albeit still high). Therefore, retailers are now coming up to lapping all the worst supply chain problems last autumn. Sure there are well known new headwinds (esp. weak sterling, higher costs, consumer retrenchment, etc), but these could end up being at least partially offset by improvements in stock availability this coming autumn/winter, and reduced freight costs. So maybe things might not be quite as bad this autumn as feared? Who knows, we’ll have to wait & see.

Overall then, I remain very impressed with SHOE, and certainly wouldn’t be even thinking about selling, if I held. This looks an excellent business, great management with tons of skin in the game, performing well, and it still looks good value too. With growing, decent divis. It retains the coveted SCVR firm thumbs up opinion!

Although looking at the long-term chart, maybe the biggest % gain has already been had? A return to c.200p+ looks entirely possible on fundamentals though.

.

Lookers (LON:LOOK)

76p (up 3%, at 10:44)

Market cap £299m

Lookers plc, one of the UK's leading integrated automotive retail and service groups, today provides a first half (the "Period" or "H1") trading update and its outlook for the remainder of the year.

This is for FY 12/2022.

I like the layout of this announcement, with the key information presented first in a summary -

Trading in the Period has continued to be strong and the Group now expects to report underlying profit before tax for H1 of approximately £45m (H1 2021: £50.3m).

Other points -

LY comparatives were boosted by lockdown ending in Q2

New & used car profit margins remain high, due to supply shortages - (volumes down on LY, but doesn’t matter because profit margins are so good)

Aftersales revenues “resilient”, with “good growth” - quite surprising, given lower new car volumes.

Inflationary cost pressures “significant”, especially staff costs, and utilities - partially offset by efficiency improvements (a “relentless focus”).

Net cash of £62.4m, up a lot from Dec 2021 year end balance of £3.0m.

New bank facility of £100m agreed, expiring Sept 2025.

Property - “valuable and flexible” property assets of c.£295m.

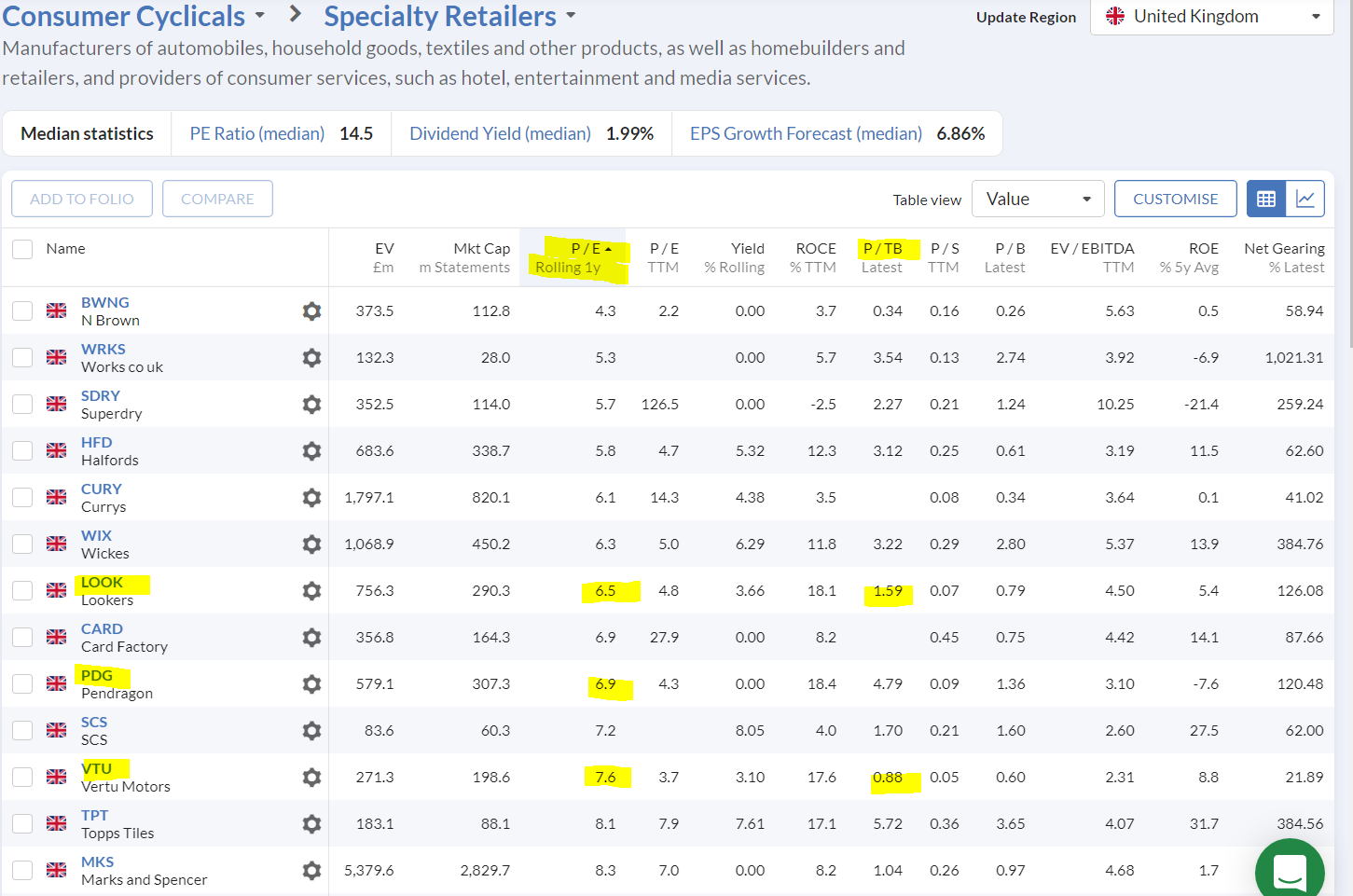

Property & cash worth 91p per share - but that’s cherry-picking. A more realistic number is last reported (Dec 2021) NTAV, which I calculate as £182m, or 46.5p per share. So the price to tangible net assets ratio is 1.63 - whereas my sector pick Vertu Motors (LON:VTU) (I hold) is way cheaper on this measure, at 0.88 - shares actually selling at a discount to its own NTAV, which doesn’t make any sense at all to me!

Also note that forecasts for VTU look more prudent, with broker consensus suggesting EPS will halve this year (FY 2/2023), against a drop of only 30% in forecast EPS for LOOK (FY 12/2022).

Therefore, superficially, VTU seems much cheaper than LOOK.

Outlook - uncertainty, but we’re still doing very well, is the main message here -

We are pleased with our strong H1 performance and have a good order bank going into the second half, albeit uncertainties remain on the availability of these vehicles and we are yet to fully understand how inflationary pressures may impact both consumer demand and our operating costs. We anticipate that the new and used vehicle supply restrictions will continue for the remainder of 2022 and beyond. Despite these factors, the Board believes the Group's scale, strength of OEM relationships, robust financial position and omnichannel model leave us well placed to navigate these challenges.

Given the unique trading conditions we are seeing across the market and in light of the performance to date, the Board anticipates the year will be substantially H1 weighted and that underlying profit before tax will be ahead of its previous expectations.

My opinion - the party is continuing in full swing, by the sounds of it! But of course it has to end eventually, which the market has already priced into share prices. As we now know, restricted supply is fantastic for profit margins at car dealers. So with that continuing into 2023, the profits look set to continue rolling in, which in turn continues strengthening the balance sheets, making these companies more valuable, and increasing their scope for expansion and shareholder returns.

Plus there’s good asset backing from the freehold properties.

I'm expecting the competitive threat from flaky new entrants to diminish, as they blow the cash piles provided by gullible private equity & venture capitalists, who seem more likely to pull the plug than throw away even more cash on business models that don't work. There could even be deals to be done, to buy job lots of cars from the administrators at a discount, who knows?

This is such a good sector for value investors right now. Even allowing for profits falling well backwards, the shares are still cheap, and with the comfort of asset backing too.

Takeovers/consolidation look highly likely - so there’s a good argument for buying a basket of similar car dealers, in order to catch the next takeover.

Thumbs up from me.

Looking at the sector (speciality retailers), I've sorted it below by PER. Note that the car dealers are on some of the lowest forward PERs, but also have unusually strong asset backing, as I've highlighted below. If you haven't before, I recommend having a play with the sector pages on Stocko - I've put in a clickable link on this screenshot below -

.

Shepherd Neame (OFEX:SHEP)

818p (up 2% today)

Market cap £122m

Off the radar, as it’s listed on the Aquis stock exchange. It’s a decent business though, operating 321 mostly freehold & tenanted pubs. Plus it has a brewery.

Also, continuing the theme of asset backing, SHEP shares trade well below NTAV, and the last accounts commentary said there’s further upside, since freeholds are worth 13% more than book value.

Pre-pandemic, it also had a good dividend paying track record, which should return.

Shepherd Neame, Britain's Oldest Brewer and owner and operator of 299 high quality pubs in Kent and the South East, today announces an update on trading following the close of its financial year on 25 June 2022.

This FY 6/2022 update, struck me as surprisingly upbeat, hence me mentioning it here.

Overall trading in line with expectations.

Strong cash generation.

Net debt reduced to £75.3m, the lowest level since 2018 (and seems low risk, by being way below the value of freeholds).

Actively looking at growth again.

Retail sales “encouraging”

Coastal locations doing well (outside space mentioned as important)

Central London pubs improving, but still below pre-covid.

Inflation - challenging, especially in supply chain & energy. Long term fixed priced contracts for “certain items”, but no indication given of materiality. Mitigating actions - menu changes & price rises.

Outlook - surprisingly upbeat I would say -

Jonathan Neame, CEO of Shepherd Neame said:

"Since COVID restrictions have been lifted, we have been encouraged by levels of demand and are enjoying strong performance across our business. In spite of external economic headwinds, we remain optimistic that we will continue to see similar levels of demand across the summer...

We are mindful of the many challenges ahead, but the business and our team have demonstrated extraordinary levels of resilience in the last two years, and we have no doubt we have the skills and platform to find opportunities to grow and develop in the future."

My opinion - worth considering, as a long-term investment. Not particularly cheap on a forward earnings basis, but has lovely asset backing. Worth checking the share structure, as sometimes very old, family controlled companies have difference classes of shares.

Checking out the sector, several other pubcos come up as discounted to NTAV -

.

.

James Latham (LON:LTHM)

1400p (up 4% at 12:48)

Market cap £281m

Absolutely stunning results, but as with the car dealers, Lathams has been a big beneficiary of external factors - supply shortages, enabling it to raise prices a lot, and increase its margins, combined with strong demand from the home improvement trend during the pandemic - meaning customers have been prepared to pay up.

Therefore, I don’t think there’s much point in dwelling too long on these one-off results which the company itself describes as “unprecedented”. If we apply a valuation based on one-off bumper profits, then we would end up over-paying for the shares when profits come back down again to normalised levels, that’s the big danger here. So I need to scrutinise the valuation carefully.

Key numbers for FY 3/2022 -

Revenue £385m (up 54%)

Gross margin 23.8% - low, but up strongly from 18.0% last year (LY)

Profit before tax (PBT) is stunning, at £56.0m (LY: £18.6m)

As always, lovely clean numbers, with no adjustments.

Diluted EPS 228.3p, versus 75.2p LY.

PER is meaningless on FY 3/2022 numbers, but for the record it’s 6.1

PER on more normal looking 75p prior year EPS, is 18.7 - getting a bit toppy, I’d say.

As you can see from Stocko’s normalised EPS figures (the data provider makes some of its own adjustments), then this looks as if valuing the share on c.75p EPS is probably sensible, to strip out one off bonanza year being reported today -

.

Outlook - all interesting, so here it is in full -

The strong results seen in this financial year have continued into the new financial year, with volumes and margins comparable to those achieved in the second half of 2021/22.

The supply of many of our key products has become a little easier but there are still a few notable challenges, including obtaining alternative supplies to replace products that previously were sourced from Russia.

We are starting to see signs that cost prices are weakening in some of our major product groups, but the continuing supply chain issues and supplier cost pressures on raw material, logistics, power and other overheads, are tempering these price weaknesses.

I would like to thank all of our key suppliers for supporting us during this financial year. I think the true partnerships that we have developed over many years have stood us apart from our competitors during what has been a challenging period for us all.

During the year we purchased Sarcon (No 155) Ltd which trades as IJK Timber in Northern Ireland. This acquisition and subsequent integration into our systems have gone very well and we now have a great platform to develop panel product sales on the island of Ireland.

Despite the positive start to the year there is increasing uncertainty surrounding the macroeconomic outlook and continuing inflationary pressures on our overheads.

At this stage the majority of our customers remain busy.

We are confident in our ability to deal with the challenges as they arise, but we do not expect to repeat the exceptional results achieved in this financial year.

Balance sheet - I was expecting this to have gone off the scale with cash, but it hasn’t. That’s because working capital has sucked in about half of the bumper profits. Remember that when businesses experience high growth or inflation, there are 2 debit (assets) entries which have to go up (inventories, and receivables), but only 1 credit entry (trade payables) which correspondingly goes up. Hence cashflow is sucked into working capital.

Current assets are up by £54.7m, up 44% on LY.

Current liabilities are up by a much smaller £16.7m, but similar percentage at +46%

Deduct the two, and you can see my point, that working capital increasing, absorbed £38m of cash. Oh no, hang on, that’s wrong, because cash is included within those numbers.

Recalculating, I’ve compared:

Inventories + receivables - trade creditors, which gives a more accurate figure of £30m cash absorbed.

NAV is £164m, up from £118m a year earlier. So the balance sheet is immensely strong. There must be scope for shareholder distributions at some point, maybe when working capital unwinds a bit in future?

NTAV is similar, as there are only £2.8m in intangible assets, so I’ll ignore that.

Cashflow statement - all as I would expect.

Note 5 explains (below) clearly the point about working capital sucking in about half of the profits. Also note the retirement benefits figure is quite high, at £3.4m, suggesting this could be an iceberg pension scheme, which is actually shown as an asset on the balance sheet, yet a significant cash outflow. That would need investigation before buying this share.

.

.

My opinion - stunning numbers clearly, but not sustainable.

That said, my guess (no forecasts or specific guidance is provided by the company or brokers), is that EPS is likely to come down a fair bit this year, who knows, it could be 100-150p possibly? Then down again in future years, as hopefully supply chains & margins normalise.

I still think it’s best to value the shares on a 75p forward guess for longer term EPS, or maybe higher if you think some of the bumper profits currently might stick? It’s all guesswork really. Or lower forecast EPS, if you think a more prolonged economic downturn is likely.

On this basis, I reckon the current share price of 1400p looks about right, and it’s not something that I personally would chase any higher in the current uncertainty.

.

Mulberry (LON:MUL)

Share price: 318.6p (+8%)

Market cap: £191m

This luxury brand’s stock has a tiny free float, as the two largest shareholders own 93% between them (one of these shareholders is Mike Ashley’s Frasers (LON:FRAS) ).

If you also exclude the stock held by the Chairman, the free float is only worth around £11 million.

So if any of you were hoping to build a £1m+ stake in Mulberry, you will find it difficult!

It should be possible to invest small amounts without much difficulty, though admittedly I haven’t tried.

My main interest in this stems from my ownership of shares in £BRBY. Burberry is also very strong in designer handbags selling for £1,000+. Through studying Mulberry, I think we can learn something about retail (and especially luxury retail).

Mulberry shares have spent years in the doldrums as the company’s financial performance has been, to say the least, unreliable.

Let’s get up to date now, for the financial year ending 2 April 2022.

· Revenue +32% to £152m.

This is being compared to FY March 2021. I don’t think the comparison is helpful, due to the very different circumstances!

A better comparison is FY March 2020, even though Covid did have some impact at the end of that financial year.

So I will compare each of today’s numbers against FY March 2020, and come up with my own percentage growth figures.

Starting with revenues, I compare today’s £152m result with the FY March 2020 result, which was £149.3. So revenues are really up by 1.8%.

According to the company’s calculation of like-for-like sales (i.e. adjusting for store openings), sales are up 15% compared to FY 2020.

· UK retail sales £89.8m

The corresponding figure for FY March 2020 was £93m. So total UK retail sales are down on a two-year view.

· International retail sales £40.4m

By contrast, international retail sales are up 25% compared to two years ago.

The exposure to China and South Korea is looking very clever now, as Mulberry’s international retail sales more than make up for the decline in the UK.

· Digital sales £47.5m

Since this figure is down compared to last year, Mulberry chooses to volunteer the number from the prior year (£36.3m). So digital sales are up 31% and now make up 31% of total revenue.

Operationally, there has been store growth in China and South Korea - not surprising, given the growth in international sales. There are now 37 retail stores in Asia Pacific (up from 35), and 40 stores in the UK (down from 45).

Gross margin

This bit is key, and helps to explain the strong growth in like-for-like sales. Gross margin comes in at a terrific 71.7%, explained by volume efficiencies and more full-price sales:

Our strategy to increase full-price sales helped improve our financial performance during the year. This combined with our agile supply chain resulted in significantly less end of season inventory and a reduction in discounting in the sale periods and our outlet stores compared to previous years.

Note that the historic gross margin at Mulberry is only around 60%. This has been true for many years.

If you go as far back as the early 2000s, you even find that the margin was only around 50%!

Granted that it was a much smaller business back then, with fewer economies of scale, but the point stands that margin of over 70% is unheard of at Mulberry.

This is the same margin delivered by Burberry, and is where I start to get very interested!

If it’s sustainable, then I think it’s a game-changer for the company and potentially for the stock, too.

Pre-tax profit is £21.3m, the best result for the company since 2013.

However, profits were boosted by significant gains (£6.8m) from adjustments to Mulberry’s store leases, which you can argue don’t reflect underlying business profits. So let’s remove this item and say that underlying profit was £14.5m.

Outlook is positive: revenue for the current financial year is up 5%, although this is primarily due to success in wholesaling. By contrast, retail sales are down 1% due to the Covid situation in China.

I find this paragraph encouraging:

We expect the business to continue to grow, albeit at a slower rate given the severe disruption being caused by the geo-political situation, inflationary pressures, and Brexit-related challenges. Notwithstanding the broader operating environment, we are confident in our strategy, have strong liquidity and continue to invest including further store openings across the network planned later this year.

The dividend is back for the first time since 2019. It’s 3p, giving the shares a yield of around 1%.

My view

I suspect that this share is being overlooked due to its chequered history, illiquid shares, and perhaps even the involvement of Mike Ashley is a factor.

At the current valuation, I think you can argue that there is good potential for upside, depending of course on how the company navigates the new inflationary environment. The slight dip in retail sales in the current financial year confirms that it won’t be plain sailing.

Stockopedia computers like what they see, too, and award it a StockRank of 90:

I would be tempted to dip my toe in here, and to research it further. If the company has developed a scale, a level of retailing expertise, and a brand that can command 70% gross margins consistently from now on, I think it will be a winner.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.