Good morning! Paul & Graham here again. Let's hope we don't have any profit warnings today (EDIT: I spoke too soon, unfortunately), although I think there are probably plenty more to come, where broker forecasts are still unrealistic in some places.

Agenda -

Paul's Section:

Sanderson Design (LON:SDG) (I hold) (£87m) - a surprisingly upbeat AGM trading update, with performance tracking full year expectations. Macro conditions don't seem to have dented performance, so maybe high end products is the place to be, to ride out tougher macro conditions that don't impact spending by the rich? Shares look cheap. Great balance sheet too.

Sosandar (LON:SOS) (£43m) - Fantastic growth, and it's now reached profitability. Given that, and a £6m cash pile, I think it shouldn't need any more placings. There's something special going on here, in my opinion. Fashion risk, so won't appeal to everyone.

Wincanton (LON:WIN) (£448m) - an in line trading update, so no great shakes. This share does look interesting, and I suspect a re-rating could be in the pipeline, if the pension deficit payments (currently massive) reduce as expected. Looks largely recession-proof too, and has pricing power from cost-plus contracts. Interesting. Overall, I like this share.

Graham's Section:

System1 (LON:SYS1) (£39m) - a disappointing and cautious Q1 update today, published with final results which appear to have slightly missed profit forecasts. The company has allowed costs to rise as it spends on a new strategy. While it used to behave more like a traditional ad agency, it has spent a few years attempting to automate as much of its work as possible and to build automated products that it can sell on a subscription basis to its customers. In tandem with this, it's also seeking to raise its industry profile. The strategy appears to be working, though is still at a very early stage. Shareholder patience is required to see if it can ultimately achieve its ambitions.

£CRL (£28m) - inflation has hit this manufacturing company quite hard, at the same time it integrates new companies it bought during the most recent financial year. Financial risk has increased with borrowings and other financial liabilities taken on at perhaps the wrong time. Revenues fell slightly in FY March 2022, but within that, its core business and its own labels performed well. This is another one where energy costs may need to reduce or at least stabilise long enough for profitability to normalise.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Sanderson Design (LON:SDG)

122p (before market opens)

Market cap £87m

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, will hold its Annual General Meeting ("AGM") at 10.00am today. At the AGM, Dianne Thompson, the chair of Sanderson Design Group, will make the following statement on current trading:

The current financial year is FY 1/2023.

Obviously the share price here has been marked down, as markets anticipate a slowdown in discretionary spending on redecoration. Also, as timarr pointed out yesterday in the comments, higher interest rates means lower PERs for shares. OR, another way of looking at it, is that speculative money has been leaving the stock market in its droves, and taking down almost everything with it. Things are not necessarily rational I find - prices move due to the flow of money in & out, which is sometimes rational, sometimes not.

I was fearing a profit warning at SDG, but the tone of the last webinar didn’t suggest any panic or serious deterioration. So I’ve also been holding out the hope that SDG might get through a downturn relatively unscathed, because there’s a good turnaround underway, with lots of sensible improvements having been made to the business. For that reason I decided to continue holding a reduced size position - for a recovery, and possible takeover bid.

In that context, today’s update is pleasing -

"Overall, trading at the Company in the financial year to date is broadly in line with the same period last year and profits remain on track to meet the Board's full year expectations.

Slightly below last year then. Although the broker consensus figure on the StockReport shows a rise in normalised EPS from 12.6p last year, to 14.1p this year, which doesn’t seem realistic to me, given the macro situation. It’s also not consistent with what the company says today, about being slightly below (“broadly in line”) last year.

There’s no footnote to explain what market, or the Board’s full year expectations are. That adds to the confusion. And no broker research. This is not going well. I like simple updates, with full information (which requires a footnote to explain what market expectations are).

The rest of the announcement sounds surprisingly upbeat, e.g.

The key growth trends outlined in our full year results on 28 April 2022 - including manufacturing, the Morris & Co. brand and the US - have continued strongly in the weeks following the results announcement. Licensing has also continued to perform well.

Recent product launches have “performed well”.

“Strong net cash position” but no numbers.

My opinion - looking back at last year’s results, its adj EPS was reported at 13.75p. So it sounds like we might be heading for something similar this year, hence at 122p per share, the PER looks below 10. That’s cheap, for a decent quality, niche business, with pricing power, and lots of heritage brands. Also a superb balance sheet, so no dilution or solvency risk.

I’m really pleased with this update, which is far better than I was expecting. So this gets a thumbs up from me. I suppose high end, luxury products, could be largely immune from macro problems, maybe?

Lisa Montague has worked wonders at SDG, an excellent, commonsense, turnaround in recent years.

.

Sosandar (LON:SOS)

19.25p (up 4% at 08:19)

Market cap £43m

Sosandar PLC (AIM: SOS), one of the fastest growing fashion brands in the UK creating quality, trend-led products for women of all ages, is pleased to announce its financial results for the year ended 31 March 2022 and an update on trading for Q1 of the current financial year.

PR headline -

Continued strong momentum drives substantial revenue growth and a profitable second half

This is another strong statement, confirming the business is now profitable - something that many sceptics wrongly believed would never happen! -

FY22 was a milestone year for the Group as it delivered an exceptionally strong financial performance, exceeding market expectations that were upgraded in April 2022, with nine consecutive months of profitability now delivered (H2 FY22 & Q1 FY23).

Here are my notes & comments from skimming the results announcement -

Stunning revenue growth, all organic, +142% to £29.5m. Bear in mind the context for this - that many online retailers struggled to even match the prior year revenues, due to the pandemic boost reversing. Hence +142% being all the more remarkable - something special is happening here, if growth can be maintained of course.

Gross margin - is absolutely key, maybe even more important than revenue growth. It’s strong here, at 56% (LY: 48%). That indicates to me good products, which customers are mainly paying full price for.

Near-breakeven overall result, at £(0.2)m EBITDA - which is very close to real profits here, as there are negligible depreciation/amortisation/interest charges. Big improvement on last year’s £(2.9)m EBITDA loss.

Loss before tax is £(554)k for FY 3/2022.

Net cash of £7.0m, which dropped to £6.1m at end June 2022. I think that’s enough, and it should not need any more placings.

Returns rate in line with expectations. The notes suggest a rate of 45% is assumed. That’s high, but typical for the sector. It would be worth asking management about any plans to start charging for customer returns, which some now see as inevitable.

Going concern note says that the Ukraine war has had no impact on consumer spending - so remember that when other companies in this sector blame it for their underperformance (whilst accepting that it is having some impact in other sectors, e.g. agriculture).

Very ambitious management - note the aspiration to “become one of the largest womenswear brands globally”

Sosandar was only founded in 2016. I think what they have achieved in 6 years, is astonishing.

Affluent customers, don’t seem to be impacted by the current spending squeeze.

Balance sheet looks fine to me, with negligible fixed assets (logistics are outsourced to Clipper), and decent NTAV of £10.6m. That looks comfortable to me.

Current trading & outlook - very strong Q1 for FY 3/2023 - same as Quiz (LON:QUIZ) (I hold) recently reported. SOS is up 81% on Q1 LY, which is a flying start to a year where forecast revenue growth is a lot less, at +44%. Hence they’re already ahead of that, so it looks as if the risk of a profit warning looks low, because SOS already has some excess performance in the bag. That’s the way we like it here at the SCVR - broker forecasts that are set up to be beaten.

Trading in line with expectations for the full year, and a lovely footnote to save us time & hassle, thank you! Everyone should be doing this. If not, why not?! -

* Sosandar believes that market expectations for the year ending 31 March 2023 are currently revenue of £42.5 million, an EBITDA of £2.2 million and PBT of £1.9 million.

As indicated above, I think this looks a soft forecast, that should be beaten. However, best not count our chickens just yet, given the deteriorating macro situation.

My opinion - this looks fantastic, and the market cap of £43m strikes me as a potential bargain, assuming growth continues (albeit inevitably at a lower % rate).

That’s obviously dependent on Sosandar continuing to perform strongly, which cannot be guaranteed. You either believe in management or you don't, it's that type of growth share.

Downside risk is that growth could suddenly slow, or even halt/reverse, if mistakes happen on product design. Sometimes fashion brands hit a sweet spot, producing designs that customers love, and snap up at full price. At other times, the designers & buyers go off the boil, and product fails to resonate with customers, and has to be sold at half price (e.g. Joules (LON:JOUL) (I hold)). That’s sector risk in fashion/retail.

In my view, the team at Sosandar have clearly demonstrated that they know their target market (which is wide & under-served), and repeatedly produce products that customers love. Key person risk is high here, as the business is so dependent on the joint founders. Although as it grows, that risk should reduce somewhat, as it becomes more about recruiting/retaining a talented team, rather than doing everything yourself.

If things go well at Sosandar, this share could be a multibagger in the long term.

Risk is greatly reduced now too, given that it’s reached profitability, and probably won’t need another placing. So risk:reward is probably now better than it's ever been for this share. No longer hoping for profitability & positive cashflow, because it's now achieved it.

Overall then, this gets a major thumbs up from me, for people prepared to tolerate some sector risk, and run with it long term.

I don’t currently hold any, because it was in my leveraged account, which sadly is now a crumpled heap of former glories. Hence I didn’t have a lot of choice about cutting my position in Sosandar. Based on today’s results though, I’m itching to buy back in.

Obviously, it’s fashion, so that won’t appeal to a lot of more cautious investors.

.

.

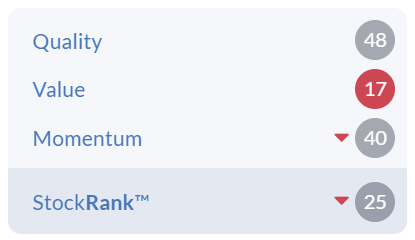

The StockRanks are still negative on SOS, but I reckon this is likely to improve considerably in a few days, as the latest numbers feed into the system -

.

Wincanton (LON:WIN)

358p (flat)

Market cap £448m

Wincanton plc, a leading supply chain partner for UK business, will hold its Annual General Meeting at 11:00 am today in person at the offices of Herbert Smith Freehills, Exchange House, Primrose Street, London EC2A 2EG. At the meeting, Dr Martin Read CBE, Chair, will make the following statement:

PR headline -

Continued growth and strategic progress, outlook unchanged

We’ve been impressed with WIN’s progress in recent years, and it strikes me as a decent business - experts in outsourced logistics.

Today’s update is in line -

Wincanton continues to make good operational and strategic progress and is trading in line with current market expectations despite the wider economic headwinds.

Management continue to wrongly believe that they have a strong balance sheet, which does worry me -

Backed by a strong balance sheet, the Group continues to focus investment into robotics and automation…

NTAV is actually negative, I went through all the detail here in its last full year results. It’s not necessarily a deal-breaker, but it’s useful to know if a company has a weak balance sheet, because it increases risk in a downturn.

Re-reading my notes from May, the pension scheme is still sucking in massive cash recovery payments, but there are signs that might be sorted in the next couple of years - actuarial deficit is rapidly reducing. If that’s correct, then I think this share could re-rate up onto a higher PER (which is currently low, due to the pension deficit & weak balance sheet).

WIN’s business model looks solid though, in that many customers are retailers & ecommerce, so business is likely to continue flowing pretty much regardless of the economy. It's winning new business, suggesting a competitive & good service. Also I like that it has mainly open-book contracts, so increased costs (such as fuel, wages, etc) just get passed through. That’s really important in a higher inflationary environment we’re currently seeing.

Outlook - sounds solid -

While it is mindful of the macroeconomic environment, the Board remains confident that the combination of a robust business model, new contract wins, disciplined pricing and a strong balance sheet, means the Group is on track to deliver full year results in line with current market expectations.

As set out in the full year results, a final dividend of 8.00p per share in respect of the year ended 31 March 2022 will be payable on 5 August 2022 to those shareholders on the register on 15 July 2022, subject to approval at today's AGM.

The yield is worth having, at 3.8%.

My opinion - this share strikes me as a decent place to be, in uncertain times. That’s despite its weak balance sheet, which doesn’t seem to hold back performance.

Today’s update confirms that trading is OK. There’s more detail in the announcement if you want it.

WIN has 3 key properties that I’m looking for right now -

- Ability to pass on cost increases to customers is built into most contracts.

- Recurring business with big clients, in FMCG - so recession risk is probably low.

- Repeated above, or in line trading updates.

I like the potential for this share to re-rate, as the pension deficit recedes in future, so it could be good for patient investors, and the risk of a profit warning strikes me as low.

Note also that Clipper was bought out on a much higher multiple than WIN not long ago, suggesting that it might look cheap to an acquirer maybe?

The defensive characteristics, and good trading updates, have see this share hold up better than most -

Graham Section:

System1 (LON:SYS1)

- Share price: 310p (pre-market)

- Market cap: £39m

Last month, I wrote favourably about this company's updated distribution policy. In essence, the company has decided that it prefers share buybacks over dividends, and will distribute 30%-40% of "through-the-cycle" net income to shareholders in this way.

What I couldn't say, at the time, was whether the company's strategy to improve the quality of its earnings would succeed.

In the past, it earned enormous profits from one-off projects which, by their nature, led to lumpy and unpredictable results.

But in recent years, it has been working hard to build its automated solutions designed to test and predict whether advertisements will succeed.

These automated products are less labour-intensive and produce (in my opinion) a higher quality of earnings.

Let's look at today's preliminary results (for FY March 2022) and Q1 trading update to see how it is getting on.

Key points from the full-year results:

- revenue +6% (£24.1m), gross profit +5%

- adjusted operating costs +18% (£19.2m) (actual operating costs +11%)

The "adjusted" numbers are the ones that management look at and use on a daily basis, while the numbers that I call "actual" are the ones that end up in the financial statements!

Unfortunately, the rise in costs means that profits get hit badly and are down by 65% (adjusted) or 54% (actual).

Prior to this morning, the company's broker was forecasting £24.1m of revenues and £1.1m of adjusted pre-tax profit. System1 has managed to hit the revenue forecast but the profit figure is a slight miss at £1.0m

What happened?

It's important to understand why operating costs were allowed to increase, and the company does have an explanation: it was "the planned investment in people, partnerships and platform".

Here is the complete explanation of operating costs:

The biggest area of increase was sales and marketing. Of the £3.0m cost increase year on year about a half was people costs and the other half external spend such as fame-building activity including Ad of the Week and the launch of Look out and Feeling Seen…

The next largest increase was in IT, primarily due to the growth in the number of in-house developers working on new platform features including Test Your Brand and Test Your Idea. We also expanded the number of categories on the TYA Premium database (previously called the AdRatings Database), which now 95% has coverage in the UK and nearly 60% in the US.

Strategy

To update my view on this stock, I've been checking out Sytem1's new initiatives - their Ad of the Week publication, the book launch by their Chief Innovation Officer, and the pricing on their new "Test Your Ad" products.

It's impossible to deny that there's a lot happening at the company. They've tested 80,000 ads and don't know of any larger database of "validated ad-effectiveness data".

From an investment point of view, it's attractive that their very first strategic goal is to Build Defensible Assets. They've built their database by automating tasks they used to have to painstakingly do by hand. This sounds like the type of work that could build a serious competitive advantage!

Their second strategic goal is to "Generate Fame", and I guess that can be expensive, too - but with significant payoff if it works out.

While it's true that profits in FY March 2022 are on the disappointing end of the spectrum, I think the company has made a strong argument to shareholders that the increased costs are justified, and could set them up for future success.

The outlook statement is on this theme:

There remains much to do, but we believe our marketing decision-making platform is far ahead of our competitors and combined with our ability to advise customers on how to improve the effectiveness of their marketing, leaves the company well-placed for accelerated growth and influence in the industry.

Trading update (separate RNS)

Q1 (April to June) revenue and profits are broadly in line with management expectations.

In this context, "broadly" can be understood as "less than, but not by much".

Issues faced by the company include "inflationary pressures, tighter marketing budgets for some customers and continued softness in bespoke consultancy revenues".

System1 also includes a warning that revenues and profits would be adversely affected by recession in major economies - it's obviously true, but what's noteworthy is that the company feels the need to mention it. Conditions must be tough!

My own view is that economic conditions are already recessionary in nature, regardless of whether or not we get a technical recession. I think many companies are feeling that way, too.

But let's get back to System1. Revenues fell 20% in Q1, compared to Q1 last year. Bespoke consultancy work has dried up, it seems, but the more automated "Data" revenues rose to their highest ever level, and accounted for 57% of revenues.

Conclusion

I've already shared many of my views on this stock, but it's time for a conclusion.

Here are the good points:

- Shareholder-oriented (the company announced today that £1.5m will be returned to shareholders in buybacks - and see my previous SCVR commentary on the company's distribution policy).

- Not just a labour-intensive ad agency. Working to build data assets that will allow them to sell subscription-based, automated services to customers. In this context the loss of consultancy services doesn't concern me too much.

- The company genuinely seems to be respected and admired in its field.

- The founder and CEO still owns 22% and should be well-aligned.

The bad points:

- Short-term profitability is lower now, partly because of the loss of bespoke consultancy work and partly because the company's ambitions require increased spending in the short-term.

- In a recession, marketing and advertising budgets get savaged. It would not be enjoyable to hold this through a recession (shares are already down c. 40% since the high in January).

It's hard to predict the ultimate success or failure of System1's current strategy. The company does have an excellent track record of earning profits and paying dividends to shareholders over many years. Therefore, on balance, I would trust management to either succeed with the current strategy, or else to fail gracefully and then try something new!

.

Creightons (LON:CRL)

Share price: 15.4p (-28%)

Market cap: £20m

Commiserations to holders here, as I know this is a widely-held stock among private investors. Indeed, I used to hold it myself! But I don't currently have a position in CRL, and haven't had a position in it since 2020.

Things have changed quite a lot since then.

The company spent big (relative to its size) on some acquisitions:

- £4.86m for skincare brand Emma Hardie Ltd, and this came with £2m of debt.

- £4.85m for Brodie & Stone, which has a portfolio of personal care brands. This also came with an element of debt (£700k).

Let's see the new balance sheet at Creightons, as of March 2022:

- Net assets £25.7m

- Significant intangible assets arising from the acquisitions. Strip out intangibles and NTAV is £12m.

There's a surplus of current assets over current liabilities, but inventories and receivables have both risen materially and helped to suck up the company's cash balance, which has reduced to less than £1m as of the accounting date.

Net debt is £6.2m (cash minus borrowings).

There's a feature of the Emma Hardie acquisition that sticks out to me: Creightons paid £1.36m in the form of 1.6m shares, at a price of 84.8p per share.

But in addition to this, Creightons apparently made a bet on its own share price, with the sellers of Emma Hardie:

The company has guaranteed to the sellers of Emma Hardie Limited a share price for Creightons PLC at £1.25 per share as at 28th July 2022… The ultimate liability can only be assessed 12 months after the acquisition date on 28th July 2022.

Unfortunately, the lower the Creightons share price falls, the more they have to pay out to the sellers of Emma Hardie. It's easy to say in hindsight, after the share price has collapsed, but there has to be a better way to structure a deal than this.

The CRL share price has fallen by approximately another 20p since the accounting date, so I reckon that the contingent consideration is likely to have increased by another six-figure sum, compared to the number on the balance sheet published today. The final amount will depend on what the share price does between now and 28th July.

If we add CRL's deferred/contingent consideration, we get adjusted net debt of £7.7m.

This may help to explain why the company has today cancelled its dividend:

The Directors do not propose a final dividend for the year ended 31 March 2022, (2021: 0.50 pence per ordinary share) due to the challenging and volatile economic conditions facing the Group and the need to be prudent about utilisation of cash resources.

Let's read more about the challenging and volatile conditions facing the group:

- revenue down 0.7% to £61.2m

- "core business" (excluding hygiene and acquisitions) revenue +21.8% to £57.3m

- operating profit down 19.1% to £4.37m

- operating profit margin 7.7% (2021: 8.8%)

- EPS down 32% to 3.98p, and benefits from a reduced tax charge (though one-off costs could arguably be adjusted out of this).

All of this is quite discouraging, except for the growth in sales in "core business". That genuinely looks very positive, particularly the 37.7% growth in own-brand sales (excluding hygiene). Remember that two years ago (FY March 2020), total sales at Creightons were just £48m. I think that significant progress has been made.

The big problem, again, is inflation. While it has plenty of ambition in brand development, it is still essentially a manufacturer. And manufacturing is not easy, in inflationary times:

In common with most manufacturing businesses we have had to deal with unprecedented increases in our input and energy prices together with significant disruption in the global supply chain. We have developed a detailed cost indexing system which monitors all cost increases and have engaged proactively with our customers.

Gross margin is still doing well, but the company says that it is being hit when it comes to distribution costs, energy and insurance.

There is no outlook statement, but there are concluding paragraphs which tell us what the company is doing:

…we have embarked on a programme of overhead cost reduction and of improving manufacturing efficiencies which should significantly reduce operational costs by the end of the year ended 31 March 2023...

In summary the Board believes that good management, strong customer relationships and financial position will continue to enable the Group to manage the current crisis and that the Group is well placed to proactively manage new challenges and take advantage of any new opportunities that may arise.

We are still keen to expand but will only do so when the infrastructure is fully repositioned to deal with the volatile conditions we are facing.

My view

I still have a fondness for this company, while remaining wary of some of the risks associated with it:

- generous employee schemes leading to significant dilution for outside investors

- previously, Creightons bucked the trend of manufacturing businesses earning low ROCE. Unfortunately, its ROCE has fallen to a more average 12.9% in FY 2022.

- there is now an increased element of financial risk as it relies on borrowing facilities to fund acquisition costs along with rising inventories and receivables. The company reports headroom of £6.3m as of March 2022.

On the more positive side, the long-term track record is, I believe, much better than the average manufacturing business. The growth it has achieved with its own brands is something I find particularly encouraging, and there is still plenty of time for the company to prove that it did not overpay for this year's acquisitions.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.