Good morning from Paul & Graham.

The big news continues to be sterling's rapid descent, with it having been given another kicking overnight, now down to £1 = $1.057 (at 07:01) . It will certainly be interesting to see how this pans out - no predictions from me, I'll leave that to others! Oh well apart from the obvious - that more takeover bids from the USA, for UK companies, are now looking likely, and UK companies with dollar earnings should hold up OK. That's all I can come up with at this time of the day. Let's have a coffee first.

Podcast - I'm relentlessly pressing on with my weekly audio recaps and macro commentary, no matter how bad things get. Episode 13 went up on Sunday lunchtime. It's available on podcast platforms (search for "Paul Scott small caps"), or using the link at the start of this paragraph. I've introduced a new mystery shares section, with a bespoke jingle, to hold back each week's best ideas just for Stockopedia subscribers, following some complaints about me giving away too much free content to the internet, that you lovely people are paying for, so point taken on that. About 500 people are tuning in each week, so it's well worth doing, I feel.

Mello is back! 5pm tonight, plus another show on Thursday looking at company results. Good news, as long as we have wifi, we can watch from our bunkers or under the kitchen table! More details here. We need to support things like this in the tough times, otherwise they may not be around when the good times return.

Agenda -

Paul's Section:

Pendragon (LON:PDG) - its largest shareholder has revived a previous bid approach, slightly higher, at 29p this time. The board are considering it. With huge property assets, sector consolidation looks highly likely.

Musicmagpie (LON:MMAG) - another profit warning. I've reported negatively on this recycler of mobile phones before. It now looks uninvestable to me, given profits have evaporated, and bank debt is set to increase. Definitely one to avoid, in my view.

Graham's Section:

Devolver Digital (LON:DEVO) (£354m) - this is an independent video game designer and publisher that floated on AIM back in November 2021. The game titles it released in H1 2022 have performed badly and today’s H1 results are financially very poor. On the more positive side, game titles being released in H2 have received good reviews and this should be a much better six-month period for the company. Overall, I’m not too impressed with this stock as a potential investment, although it does at least have a large cash balance, giving it plenty of runway ($74m), and the price to sales multiple is now sitting at a very modest level.

Microlise (LON:SAAS) (£178m) - another float from 2021, this company provides hardware, software and professional services related to transportation management. Unfortunately, I’m struggling to find reasons that might justify the current market cap. Growth is very modest and profit margins have deteriorated, suggesting to me that its professional services work is low-margin and the hardware/software solutions are replicable by competitors. Therefore, to me, this stock looks ripe for a de-rating.

Concurrent Technologies (LON:CNC) (£54m) (-12%) [no section below] - this is “a world leading specialist in high-end embedded computer products for critical applications”. Unfortunately, the ongoing supply chain issues have delayed shipments, and in turn delayed the company’s revenues that would otherwise have fallen in H1. Paul noted this overhanging problem affecting Concurrent’s prospects for the current year back in May. It has come to fruition with H1 revenues down 20%, a reduced gross margin (again due to problems acquiring components) and a fall down to breakeven in terms of profitability. Unusually for the company, it will not pay an interim dividend.

The company still has zero debt and a cash balance of £9.3m, and it states that the delayed shipping “is a short-term issue and in no way relates to the quality of the underlying business”. They are “well positioned for material growth as the situation resolves”. Valuation here looks reasonable: if the company recovers as it promises it will, there could be some medium-term upside. I’m neutral.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Pendragon (LON:PDG)

22.7p (pre market open)

Market cap £317m

Receipt of Unsolicited Proposal

The Board of Pendragon announces that, on 21 September 2022, it received an unsolicited, preliminary and highly conditional proposal from Hedin Mobility Group AB ("Hedin Group") regarding a possible cash offer for the entire issued and to be issued share capital of Pendragon at 29 pence per share (the "Proposal").

The Board of Pendragon is currently considering the Proposal together with its financial and legal advisers. Shareholders are urged to take no action at this time.

Auto Retail Agenda magazine says this morning that Hedin previously offered 28p for Pendragon, and then blocked a 29p approach from another bidder.

This sector is ripe for consolidation, as we’ve been saying here for ages. It would be a pity to see these companies taken out for a pittance, in a downturn. But ultimately, if the stock market undervalues companies in the short term, then bidders spot the opportunity.

This approach at 29p is a 28% premium to Friday's closing price - not madly exciting, but maybe in a bear market, shareholders might be happy to grab the cash and reinvest it in something cheaper without a bid premium in the price?

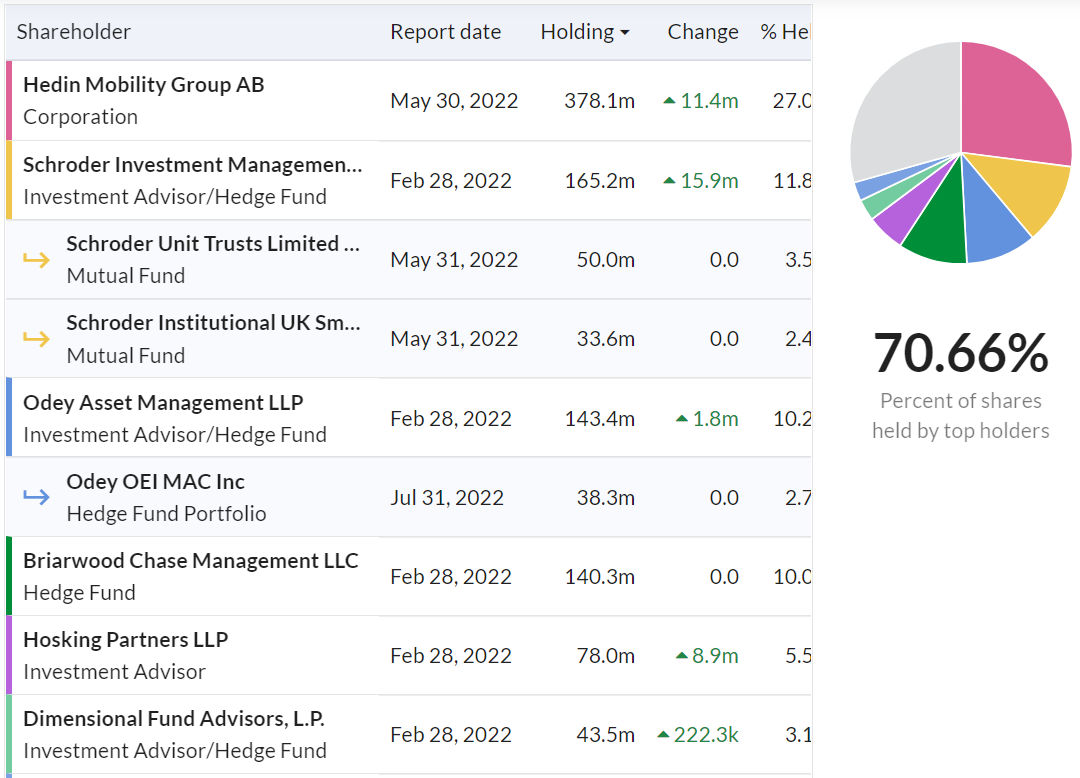

The shareholder register at Pendragon is concentrated, with Hedin already owning 27%. So it only needs to convince 3 or 4 fund managers, to make this deal likely to go ahead. Let's see what happens.

.

Musicmagpie (LON:MMAG)

15p (down 45% at 08:15)

Market cap £16m

musicMagpie, a circular economy pioneer specialising in refurbished consumer technology in both the UK and US, announces an update on current trading and outlook.

The outlook has worsened, as a result -

Whilst it still expects that second half profitability will be a substantial improvement on the first half, the performance of Consumer Technology (which represents around two thirds of Group revenue) has been weaker than anticipated and margin pressures have persisted…

Accordingly, the Group now expects that revenue generated in the second half will show lower growth over the first half than previously expected and that profitability for the year to 30 November 2022 will be below its previous expectations and those of the market.

Revised forecasts - the above leaves us in the dark, but Shore Capital helps out considerably with updated numbers. It’s grim - FY 11/2022 was expected to make an adj PBT of £3.4m. That’s now gone, and replaced with a small loss of £(0.3)m. Continued losses are expected for the next 2 years after that.

Forecasts also seem to show increasing net debt, fuelling a big rise in fixed assets, which looks to be related to this -

A new £30m committed revolving credit facility was entered into on 26 July 2022 to allow the Group to continue to invest in the rental offering and the SMARTdrop kiosk roll-out with ASDA, which remains on track to complete by the end of the financial year.

My opinion - this is now the third time I’ve looked at this disastrous recent float. Here on 2 Mar 2022, I covered its profit warning, and thought it looked expensive at 119p. Then on 29 July 2022 I thought it needed to halve from the then price of 44p.

So is it cheap now at 15p? Given that profitability has gone, then I question whether the equity is actually worth anything?

With debt expected to spiral, as it rolls out some kiosks in ASDA, and seems to be up-front funding rental phones for its clients, this looks a really bad business model. It looks to me as if the IPO was selling a pup to the fund managers.

So it’s uninvestable now, I feel.

Graham’s Section:

Devolver Digital (LON:DEVO)

Share price: 80p (-2.4%)

Market cap: £354m ($382m)

We’ve never covered this one before in the SCVR: it’s an independent (“indie”) video game publisher and developer.

Described as “the biggest US firm to trade on AIM”, the Texas-based company joined the market in November of last year at an IPO price of 157p. The admission RNS is here.

Key facts about the IPO:

- Managed by Zeus Capital.

- £191m was raised but this was mostly (£154m) for the purposes of letting existing shareholders out, not raising funds for the company.

- The IPO was said to be “oversubscribed” but the initial valuation (just shy of £700m) was much lower than the £1bn that the company was originally thinking about.

So it’s fair to say that the IPO was not particularly promising for potential shareholders.

And sure enough, the share price has collapsed by almost 50% in less than a year, and the market cap is now only around £350m:

People might find it strange that I am able to so confidently assert that IPOs - in general - are bad investments. Aside from the logic behind the statement, I also have firsthand experience of this from when I worked for an institutional investor. An IPO causes Wall Street (or the City) to bring out all of its marketing machinery, to apply maximum pressure, and to make whatever promises are necessary to get people to invest. It’s one of the biggest paydays for bankers, and they will do whatever it takes to get people to take part.

Shares on the receiving end of such immense marketing efforts are almost inevitably overpriced. How could they not be? There are exceptions, of course!

Anyway, let’s dig into these interim results for H1 2022, and see if the company might now offer some value at this level:

- H1 revenues +14% to $53m.

- “Normalised adjusted EBITDA” (yuk!) down 46% to $6.8m, “reflecting underperformance of 1H releases, and increased administrative and headcount costs”.

- Net loss of $16.6m.

- Cash balance $74m.

Let’s skip ahead to the outlook:

- Guidance maintained for 2022

- Full-year revenues $130m - $140m, adjusted EBITDA $27m - $32m

- 12 new titles this year, of which five are being published in H2. I note that good feedback has already been posted for two of them on the review website IGN (here and here).

- Over 30 titles in the pipeline for the next three years (i.e. ten per year, on average).

In addition to all the new titles, there is a back catalogue of 97 games which “continue to perform strongly”. It’s sometimes easy to forget about the long tail of income received by video games publishers, for titles that were released several years ago. Devolver says that some games released in 2021 “continue to perform like newly-released titles in 2022”.

Covid: I figured that the Covid situation was good for the video game industry, for obvious reasons (people spending more time at home). But strangely, Devolver suggests that the end of Covid restrictions is positive for it:

The second quarter of 2022 saw the relaxation of Covid controls and a normalisation in travel, meaning we were able to meet again with our colleagues, partners and game-developers, gamers, influencers, and everyone involved in the complex game-production ecosystem. This has made an enormous difference in terms of ensuring the quality and positioning of our games.

This resumption of normal activities has released great pent-up enthusiasm for Devolver's games. At Pax East held in Boston in April there was a two-hour queue for gamers to try out the demo of Cult of the Lamb, our recent new game release.

My view

I have mixed feelings about this one. I want indie games publishers to do well, in the same way that I want independent film studios to do well. But I’m unclear as to the investment merits of this one.

For H1 2022, its first six-month period as a listed company, Devolver has made a gross profit of $18m and incurred administrative expenses of $30m. So there’s a pretty wide gap to catch up on, to recover to profitability.

The new titles released in H1 performed poorly, which the company attributed to “a competitive release window and specific factors for each title which are being actively addressed for future titles”. The H2 games, judging off their reviews, should do better.

One thing that does bother me is the company’s focus on EBITDA. By emphasising this metric, they are asking investors to look past the cost of making games, as development costs are capitalised and then amortised over time (the “A” in EBITDA).

Devolver’s cash balance fell by $12m in H1, despite positive adjusted EBITDA, for this reason. As the saying goes, “you can’t eat EBITDA”.

I’m happy to keep this on my radar and monitor its progress, but for now I agree with the StockRanks, which suggest that this is one to avoid:

After stripping out the large cash balance from the company’s market cap, the price to sales multiple for the current year is only around 2.2x - 2.4x. At least the stock is not too expensive by this metric, giving it some speculative merit. But it still has a lot to prove.

Microlise (LON:SAAS)

Share price: 153.5p (unch.)

Market cap: £178m

This is another stock with a short history on AIM: it joined the market in July 2021, at 135p per share. Paul gave it an initial once-over in January.

It has done ok: no collapse below 135p yet.

Based in Nottingham, it is “a leading provider of transport management software to fleet operators”.

Here is its website, where you’ll get a more detailed explanation of how it “automates and optimises critical processes such as scheduling, routing, driver performance monitoring and resource allocation, while providing valuable, actionable real-time data”.

And here are the H1 financial highlights:

- Revenue +5% to £30.7m (of which recurring revenue is about £20m)

- Gross profit £18.4m - gross profit margin of 60%

- Operating profit down 6% to £1.7m - operating profit margin much more modest at 5.5%.

- Cash balance £15.8m

Operationally, the company sounds like it had a busy six months. 60 new customers were signed up, and there were renewals and extensions to contracts with major supermarket chains including Tesco and Asda. Overall, however, the growth rate in subscriptions was nothing to write home about, at just 3%.

One interesting and positive feature at Microlise is the lack of any customer churn. It is reported today at just 0.1%.

Outlook - in line with expectations.

Balance sheet - the company has balance sheet equity of £73m, but this includes intangible assets of £75m, mostly allocated to goodwill. Tangible equity is therefore negative.

My view - like Paul, I’m reluctant to spend excessive amounts of time on this one, as I’m not seeing much to like. Given the lack of current profitability (relative to the market cap), and the empty balance sheet, I want to see high revenue growth, or at least fat profit margins. Something.

I wonder if the company has any unique, proprietary IP that potential competitors can’t match? Or is the software and hardware easily replicable, and this is the reason its profit margins are so limited? I’m looking for an investment thesis and unfortunately I can’t find one here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.