Good morning from Paul & Graham.

Agenda -

Paul's Section:

Saga (LON:SAGA) (I hold) - rather lacklustre H1 figures. It's moved back into profit, but only £14m in H1, and full year guidance is reduced again, from £35-50m previously, to £20-30m now. Debt is high, as expected, but covenants & liquidity are fine, and the going concern note is positive. Overall, it's a bit flat, but what do you expect when the share price has dropped by about two thirds in the last year?! There's nothing of concern in the numbers, but it's not madly exciting either. I'm happy to continue holding (well, happy is probably overstating it!), as shares should recover in due course. More detail below.

Graham's Section:

Biffa (LON:BIFF) (£1,248m) (+28%) [no section below] - the offer for waste management company Biffa has finally been announced, having originally been notified back in early June. Unfortunately, the price is 8% lower than the original proposal: 410p (plus a 4.7p dividend), instead of 445p.. Only 14.4% of Biffa shares have been pledged to vote in favour of the deal, so there is no guarantee that it will go ahead, although the latest share price of 408p suggests there is confidence that it will happen.

The reason given for the lower offer price is the “weakening economic environment”, and I think Biffa shareholders can feel disgruntled on two counts. Firstly, the most recent results - FY March 2022 - saw record revenues, helped by a post-Covid recovery with seemingly good momentum (adjusted operating profits £97m), although of course the last six months have been difficult. Secondly, the pound has depreciated against the dollar by 14% since early June, when the possible deal with this United States-based investor was first revealed. In dollar terms, this offer is much cheaper than the original June proposal (roughly $4.43 per share instead of $5.56 per share). But it looks like Biffa’s shareholders are happy to offload it and aren’t overly fussy about the exact price of the deal. (no section below)

S&U (LON:SUS) (£254m) - strong interim results from this motor lender and property bridging lender, with a long history of management and ownership by the Coombs family. Growth in property bridging continues at a terrific pace, while collections in non-prime motor lending are surprisingly positive. While I’m as nervous about the economic situation as anybody else, I don’t think the market is giving this company enough credit for its superb track record, modest leverage compared to many other lenders, and high loan loss provisioning. I believe that S&U is undervalued.

Digitalbox (LON:DBOX) (£11m) (+5%) [no section below] - Digitalbox owns a collection of websites - Entertainment Daily, The Daily Mash and The Tab, and should soon own TVguide.co.uk (acquisition set to complete during H2). The outlook here is broadly in line with expectations, and so the feared profit warning has not yet materialised. As promised in the prior trading update, H1 revenues come in at around £1.9m, up 40% compared to last year. Adjusted operating profit and cash generated from operations are both in the region of £0.7m. Additionally, the company has a cash balance of £2.4m.

Entertainment Daily has performed particularly well, with traffic up 46% on last year. The situation at The Daily Mash is more complicated and its goodwill/intangible assets have been written off. I’m more keen on this share now than I was in August: the price/sales multiple (ex cash) has reduced to 2.2x. Additionally, the profitability of The Tab lends credence to the company’s acquisition model, and increased gross margins (87%) suggest improved operating efficiency. I’m now leaning towards a bullish view on this one, though I expect it to face a difficult headwind in the short-term as corporate advertising budgets come under pressure.

Smoove (LON:SMV) (£28m) (-10%) [no section below] - this company’s eConveyancer website is doing well in terms of activity levels but business is strong in the lower-margin remortgage segment, not in higher-margin purchases and sales. This means that Smoove’s gross profit has not improved in the financial year so far (the financial year beginning in April). Net cash at the end of August was just shy of £17m, versus £20m at the end of March. The company reassures that cash burn is “moderating”. The outlook statement points to stamp duty changes driving the first-time buyer segment, and claims that the group will, over time, become less reliant on eConveyancer. Unfortunately, whatever positivity I gleaned from this company’s full-year results appears to be more muted now. The cash burn is still too high for my liking and I can see the share price drifting towards that still-sinking £17m anchor.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Saga (LON:SAGA) (I hold)

109p (down 19% at 08:22)

Market cap £153m

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, announces its interim results for the six months ended 31 July 2022.

I’ve still got lots of detail to plough through, but have got the gist of the main points, so here’s my initial review -

H1 revenues up 65% (recovery from pandemic) to £258m

Underlying profit before tax in H1 of £14.0m (vs a small loss in H1 LY)

Full year profit guidance was £35-50m, this is now reduced to £20-30m - disappointing, but not a disaster.

Ocean cruise business is on target for this year & next year.

Insurance division “challenging”.

Liquidity is ample, with £179m available cash, plus a £50m undrawn RCF.

Net debt is high at £721m, but remember that it also owns 2 nearly new cruise ships, with a book value of £612m (tested for impairment, which wasn’t necessary).

Debt maturity - the next event is repayment (or refinancing) of the £150m bond, in 2024. SAGA already has enough cash in the bank to repay this in full, so not a concern to me.

No dividends, focused on debt reduction, as expected.

Big goodwill write-off, so statutory loss before tax is £(257)m.

Going concern statement is fine, concluding -

In both the base case and RWC scenarios modelled, the Group expects to operate within covenants in the ship debt and to maintain sufficient liquidity until at least March 2024, with no reliance placed on the availability of funds under the RCF.

When I last looked at the covenants for the ship loans, it basically required that SAGA overall trades ahead of breakeven, which it is.

Balance sheet is large & complicated! NAV is £397m, less intangibles of £496m, gives negative NTAV of £(99)m - room for improvement there, which should gradually improve from retained profits & cashflows in the coming years.

My opinion -

Overall, these figures don’t look too bad to me, in the context of what the share price has done in the last year, which hardly suggested that a sparkling result was likely -

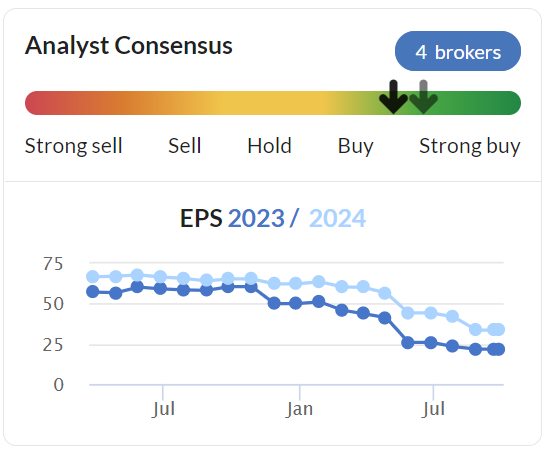

The recovery in profits is slower than expected, which is why the share price performance has been so poor - brokers have been guiding down expected profits, and there’s another reduction today, not yet reflected in the graph below -

So clearly SAGA is not performing particularly well, but it is profitable again. Travel should gradually rebuild. The commentary says that the cruise ships are performing well, but travel overall made a loss of £11.6m in H1, which doesn’t impress me at all. There should be decent upside on that, and the commentary sounds upbeat about bookings, although with some inflationary impact, and having to offer early booking discounts.

I don’t have any worries about solvency or liquidity. Yes, SAGA has a lot of debt, but it’s well structured, with quite long maturities, and it’s also sitting on a big cash pile, and should be nicely cash generative. Note that I’m pretty sure debt costs are fixed, so there shouldn’t be an issue with rising interest rates. Covenants only apply to the ship loans, not the bonds, so that’s all pretty secure.

To conclude then, I’m obviously disappointed that this year has only seen a modest recovery in trading, so I see SAGA shares as work in progress. There’s nothing that particularly concerns me, so I’m happy to continue holding, and might add to my position if the share price continues falling, as there’s nothing of concern in these numbers - it’s just all a bit flat, so nothing to get excited about either. The market cap is now looking temptingly low, I think the valuation is looking appealing.

Graham’s Section:

S&U (LON:SUS)

Share price: £20.85 (+2.7%)

Market cap: £254m

This is a family-owned and operated financial business, in two parts: a non-prime car lender, and a property bridging finance lender.

Key bullet points from today’s interim results:

- Revenue +15% to £49.4

- PBT +5% to £20.9m

- Net Receivables at the end of the period +21% to £370m (this is the size of the lending book, and is a more forward-looking indicator).

The interim dividend goes from 33p to 35p - the company is rightfully proud of its dividend record, with a stream of dividends stretching back for decades.

Divisional performance

In car lending, the collection rate improves to 94.3% of due (up from 92.4% in H1 last year), described as “well above both budget and last year”. Net receivables finished the period up by 12.5%.

When it comes to credit risk, the Chairman points to “nearly a quarter of a century’s data and a broader range in our panel of credit reference agencies” as supporting collections.

On credit risk, the company “constantly studies customer payment patterns and refines the data surrounding them. It can then adjust affordability calculations and extrapolate future cost of living trends with some accuracy. This not only reinforces future credit quality but provides greater efficiency in identifying good future customers.”

In property bridging, net receivables finished the period up by 56%. This is still a new-ish venture and it’s exciting to see how quickly S&U is growing it. But S&U will still be considered a boring financial stock by many people!

The bridging company has created a new “Bridge-to-Let Loan”, that is “designed to appeal to smaller developers and refurbishers seeking security for their project refinancing”.

The bridging pipeline “has remained consistently above budget, although seasonal factors, higher interest rates and a slightly slowing residential market has shown a recent return to budget.”

Funding

The last time I covered this stock, my only balance sheet concern was that the company had used up most of its banking facilities. Sure enough, the company today announces that it has opened a new £30m facility with its banking partners.

Balance sheet equity creeps higher to £212.5m (from £206.7m six months ago).

My view

Perhaps encouraged by the strength of its collections experience in motor lending, and by the success of its property bridging venture, the company appears to be taking a bolder stance. Gearing according to the company’s calculations increases to 73% (vs. 61% a year ago).

According to my own calculations, the company’s balance sheet leverage (debt/assets) has increased to 43% (vs. 39% a year ago).

Personally, I think these metrics are still within a reasonable range. Other lenders would take far more risk without any shame.

It’s also worth pointing out that that £370m lending book is stated after some hefty loan loss provisions. The total amounts receivable from customers, before provisions, are £374m in motor lending and £91m in property bridging, i.e. £465m in total. But then £95m of provisions are recorded, so the lending book is only stated at £370m.

If £95m of provisions seems a bit big, then you can see how an argument for investing in S&U stock could be crafted. Let’s suppose that true balance sheet equity, after a more realistic (hopefully smaller) loan loss provision, is actually £230m. In that case, the stock is “really” trading at just a 10% premium to book value. Not bad, given the long history of high ROCE and ROE!

So yes, I do believe that these shares are undervalued:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.