My 2023 watchlist for small caps

2022 was a terrible year for me, and for small caps and tech investors generally (with both AIM, and NASDAQ, down by about a third). Personally, I've given a lot of thought to all the things I did wrong in 2022, and learned the lessons hopefully. So I don't think reviewing a lousy year is a productive use of time. I'd rather look forwards, and see how we're going to make the money back again, with good ideas for 2023 and beyond.

Like many investors, I keep a watchlist of shares that I think look interesting, follow the prices, and then sometimes buy things on the list, e.g. if there’s a positive or in line trading update together with a solid outlook statement (I generally only buy after a decent trading update, to reduce the element of guesswork and profit warnings, at least initially). So when I spot an interesting share, I add it to my watchlist.

I thought it would be useful, and fun, to go through my watchlist of c.100 shares, and select what I think are the top 20 best ideas (from a Value/GARP investing perspective), and publish them - as ideas people might want to research further. Never recommendations, as it's up to you to research everything yourself.

Obviously I can’t predict the future, so I have no idea what the share prices of any of these will do. All of them are likely to go up, down, or stay about the same - but unfortunately at this stage, I don’t know which will be which!

In the past I’ve found that in a good year, I typically get a winner:loser ratio of about 60:40, in a very good year it can be as high as 80:20, and about 1 year in 3 or 4, I do badly, and have more losers than winners.

2022 was a very bad year, where my ratio of winners to losers was more like 10:90 - but that’s to be expected when the whole of AIM fell by about a third. Plus I was just in the wrong sectors, and over-concentrated, and I badly misread the macro picture. So there we go. Let's just draw a line under it, with my apologies to anyone who was influenced by my misplaced bullishness on some shares.

However, in the past, I’ve nearly always done really well the year after a bad year. So I’m hoping 2023 will be more like that!

I only own 1 share on the list, which is flagged, so am not talking my own book. But I’m considering purchases at some stage of all the rest.

It’s all on a spreadsheet, which you can view or download here [EDIT - sorry I got the sharing settings wrong, should be fixed now] - which contains explanations for why I like each share, my assessment of balance sheets (so we can avoid dilution/insolvencies, and ride out the inevitable short term disappointments that are likely to happen in a recession).

I’ve also added formulae to track this list of shares, and see how it performs in real time, using googlefinance prices that update automatically (scroll to the right, to columns J-L).

So in 12 months time, you can either praise me for picking some good shares, or laugh at my expense at another poor performance.

The list is now locked, so I won’t be editing it (other than for any factual errors that occur).

Good luck to me!

As with all our stuff, you must do your own research, and not rely on me, as my ideas will often go wrong. That’s the nature of investing. Although by selecting companies with sound balance sheets, I’ve deliberately picked shares that can ride out the inevitable profit warnings that occur in a recession. Also I don’t think any of them will need to do fundraisings, even if trading does deteriorate. So I'm not necessarily saying any of these shares will go up in price in 2023. They're more long-term investment ideas, that should do well with a multi-year timeframe. And in many cases pay decent divis along the way too.

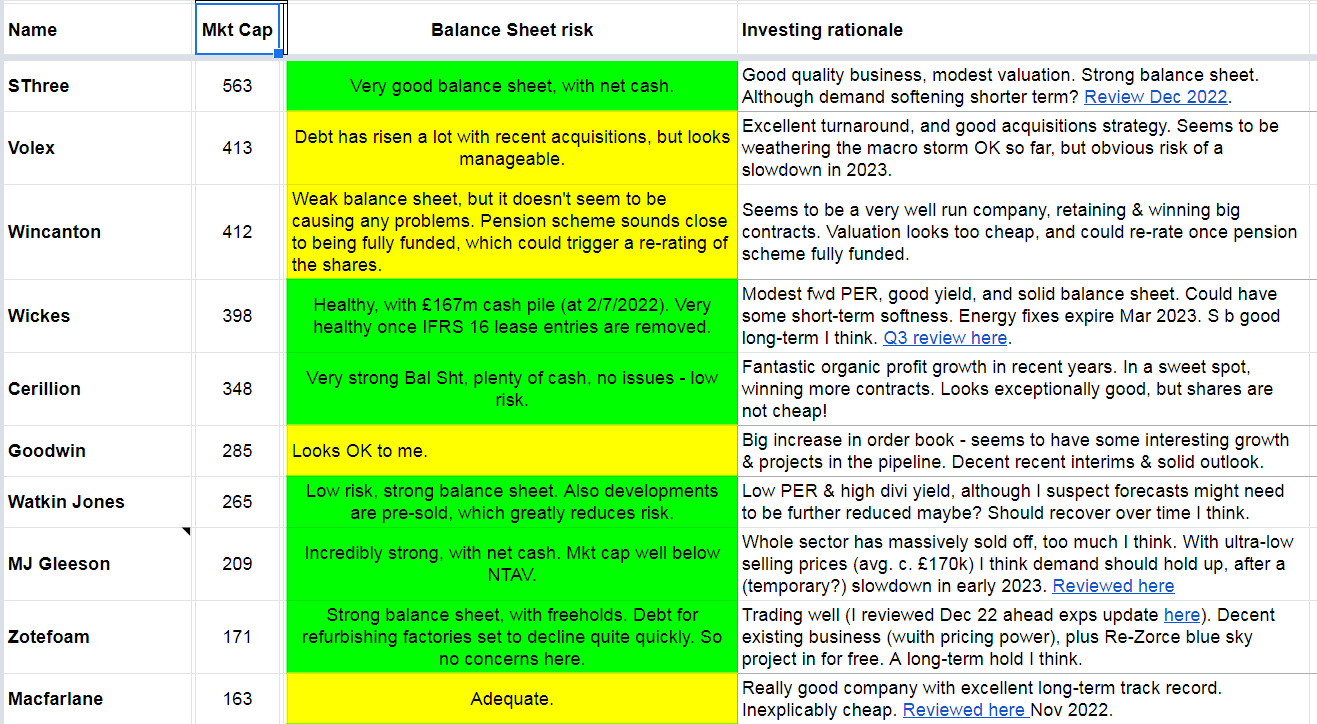

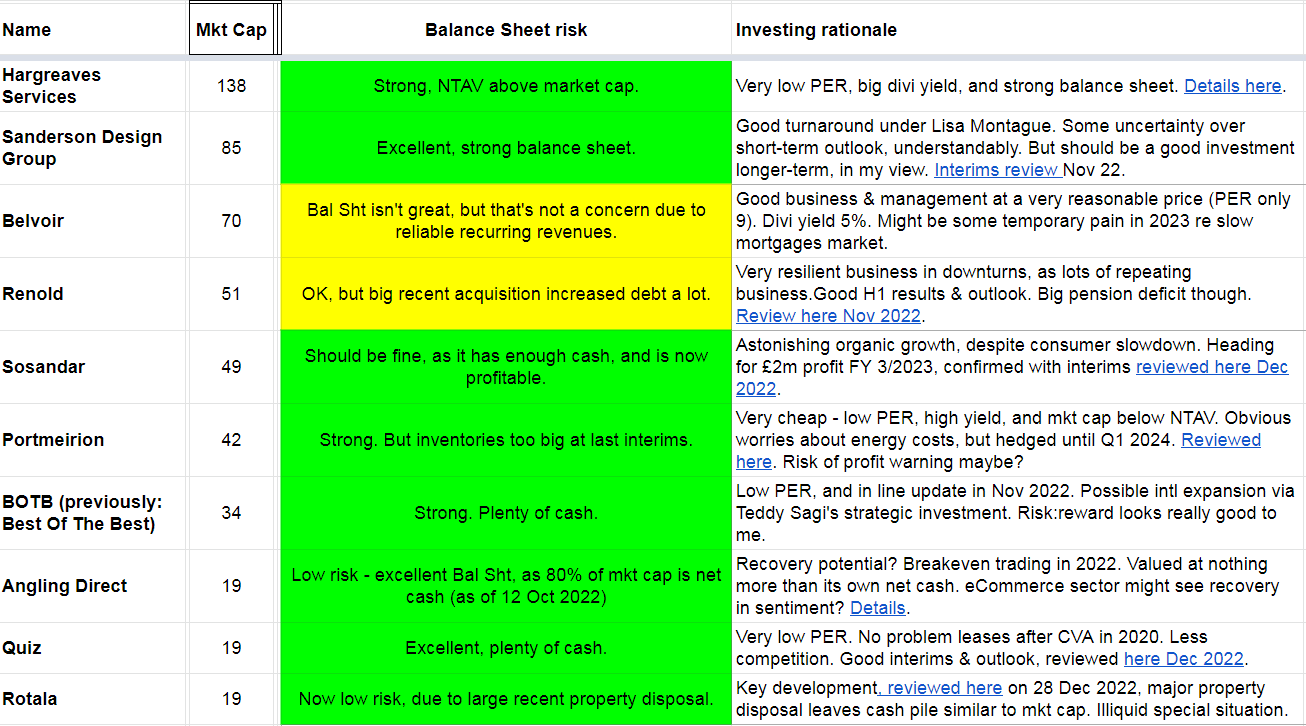

Here’s a screenshot of the spreadsheet - to give a flavour -

Here's an abbreviated form of the spreadsheet, making it narrower, for viewing here without opening the spreadsheet -

Let's see what happens. I encourage readers to post your top 5, top 10, or top 20 (whatever you fancy) shares ideas for 2023 too, and the reasons why you like them.

Good luck to all for 2023 and beyond!

Regards, Paul.

EDIT: I'm also working on another 20 speculative ideas (so riskier, and not value/GARP) for 2023. That should be published later this week.

EDIT 5 July 2023 - Half year update is here - short version: they've beaten the small caps market (AIM) by 17%.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.