Good morning from Paul & Graham!

I'll leave it there for today, but plenty more items to cover, so I'll be looking at those in tomorrow's report.

CEO interview - recorded yesterday afternoon, I had a very interesting Q&A with Sam Bazini, CEO of Warpaint London (LON:W7L) - loads of interesting points, and I think he comes across really well, as a straightforward entrepreneur. After a good recent run, I think W7L shares look fairly priced around 175p, but the company seems to have good long-term expansion plans. Above all, I like owner-managed, entrepreneurial companies with sound finances, that pay divis, and have common sense business models. So W7L ticks a lot of my boxes as a long-term investment, hence why it's on my watchlist. As always, DYOR.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda -

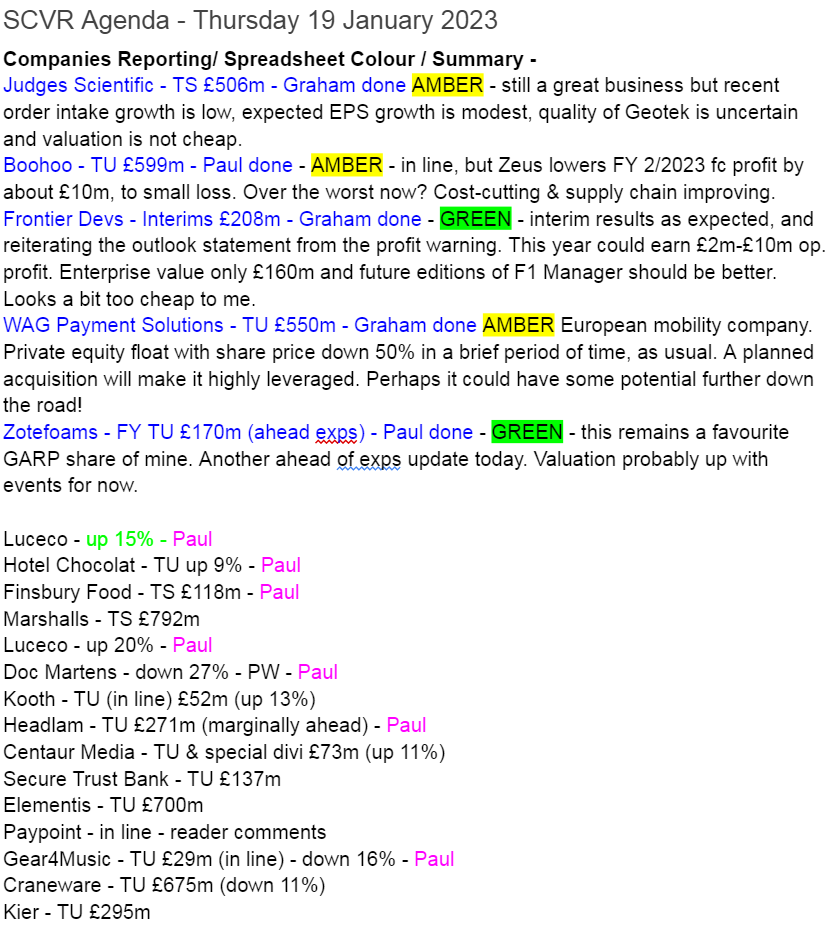

We'll put our one sentence summaries on this spreadsheet below (as we started yesterday), which makes it more efficient for Graham & I to update the article, and hopefully also gives you a very quick reference point for the overview -

I'm starting to flag, so don't think we'll get those done today, but if I get a surge of energy this evening, might do some ready for tomorrow again. Lots of interesting stuff to cover, not enough hours in the day!

Paul's Section:

Here are 11 short sections from yesterday's news, which I prepared last night -

Liontrust Asset Management (LON:LIO) - TS £789m - Update to 31 Dec 2022. Assets under management rose 3% to £32.6bn over the quarter. Net outflows of £0.6bn. Paul’s view - this seems a good time to be looking at investing in fund management shares, many of which Graham has written about in previous reports. LIO looks quite good, on a lowish fwd PER of 12.4, with a lovely 5.9% dividend yield, it looks worth a closer look. Thumbs up.

ENGAGE XR Holdings (LON:EXR) - TU £13m - see SCVR for 12 Dec 2022, this share is a bargepole job - because it looks set to run out of cash imminently. Today is says there’s E2.2m cash left (end Dec 2022), and monthly cash burn expected to be E0.4m in H1 2023. Therefore, it’s set to run out of cash in May/June 2023. For me, this is uninvestable until it’s been refinanced. Too risky before that.

Currys (LON:CURY) - TU (up 11% y’day) - Peak trading update (10 weeks to 7 Jan 2023) pleased the market. It says UK is more profitable than forecast, but International less profitable. Reiterates guidance given on 15 Dec 2022 (which was a profit warning), of £100-125m adj PBT for FY 4/2023. I reported on its profit warning here, and decided it looks too high risk, due to dependence on massive trade creditors - the risk being that credit insurers might reduce or withdraw cover. It might all turn out to be fine, but potential investors need to understand this share is quite risky, and the big divis are on shaky foundations, so could be stopped if trading deteriorates. For now though, things seem to have stabilised, with previous reduced guidance now firmed up.

Crimson Tide (LON:TIDE) - TU £17m (smaller than expected loss) - quite an interesting update. FY 12/2022 revenues up >30% vs 2021. Running at a loss, but it has a sound balance sheet, with enough cash to finance this push for growth, I reckon. Record recurring revenues of £5.8m at year end. This looks potentially interesting, if it’s able to scale up a lot more. Attempting expansion into the USA, through a partner. Worth a closer look, I’ve had my eye on this company for a while, as it seems to have potential. £17m mkt cap looks ahead of events for the moment though.

STM (LON:STM) - TS £17m (down 5%) - guidance it gives for FY 12/2022 is: revenue £24.1m, and PBT of £1.7m+. Net cash of £14m stands out, for a company with a market cap of £17m! Unusual balance sheet with £24.1m asset and liability, which seems to relate to an insurance claim - need careful scrutiny. Have any readers looked into this share, it looks a potentially interesting special situation. I did research it a few years ago, when there was a flurry of interest, but I recall there being some odd aspects to the share, and investor interest fizzled out again. I might have met management at the time, and remember thinking it seemed complicated, something to do with a regulatory grey area on pensions called QROPS? Things might have moved on since then. A review is underway, to attempt to unlock shareholder value. One for special situations investors only, I’d say. The cash pile makes it potentially interesting though.

Galliford Try Holdings (LON:GFRD) - TU £192m - Construction group gives H1 update (to Dec 2022). Trading in line with expectations. Says it has managed supply chain, clients and macro effectively. Two recent acquisitions done. Cash pile looks really impressive, but check out the balance sheet - current assets of £465m (included £219m cash at end June 2022) is more than fully offset by current liabilities of £508m. So the cash has arisen from timing benefits on working capital, and is not surplus cash, the way I view things. NTAV was only £35m at June 2022, to further reinforce this point that the cash pile is a bit of a mirage - it’s come about because customers are generous, early payers. But as the company says, having no interest-bearing debt, and no pension liabilities, is a distinct advantage. Plus it can now earn interest on the cash pile, I imagine. The cash pile was £195m at end Dec 2022. I’d like to know the average daily cash balance, not just average month end cash (as disclosed today at £154m).

Outlook - £3.5bn order book gives good visibility. Robust pipeline.

Share buybacks underway, and forecast dividend yield is 5.5%.

My opinion - not for me, as it’s a very low margin contractor on big projects, which as we know can be high risk if something goes wrong. But this is a good update, so if you are prepared to invest in this sector, this is probably a fairly good choice, so I’ll give it a grudging thumbs up!

TI Fluid Systems (LON:TIFS) - TU £606m (down 14%) - looks to have made a new, all-time low today of 117p, since it floated in Oct 2017. I’ve never looked at the company properly, but Graham reviewed it here on 3 Nov 2022.

FY 12/2022 update guides in Euros: revenue E3.26bn, adj EBIT c.E180m. Adj free cashflow E80m, and net debt:adj EBITDA of 1.9x - that all sounds reasonable.

Note there’s a substantial finance charge, so EBIT (operating profit) is not telling the full picture.

The last balance sheet at June 2022 only had NTAV of E100m. There’s over E1.1bn in gross debt, partly offset by E499m cash. So debt covenants are very important. Overall, I’m not comfortable with this balance sheet, which introduces risk, particularly if trading continues to deteriorate. There also seems to be a pension deficit. Although the interims came with a clean going concern statement, so maybe I’m worrying too much about risk?

Outlook - market conditions to remain challenging, especially China. Material impairment charge expected for fixed assets & intangibles (non-cash though).

Broker consensus forecasts for both 2022 and 2023 have been in almost continuous decline for the last 18 months. Maybe it might be best to wait for forecasts to start rising, rather than gambling on a turnaround before it has happened?

My opinion - quite a large, and complicated business, with over 100 factories worldwide.

This could be an interesting turnaround, as car production returns to normal in future, possibly. I can see both bull & bear views as having validity, so will say I’m neutral. Amber for the spreadsheet.

accesso Technology (LON:ACSO) - new business momentum, it says - this ticketing/queuing software group has had a decent run - 4-bagging from the pandemic lows, including a strong spurt since the Oct 2022 lows, like many smaller caps. Yesterday’s update says it’s signed 18 new clients, and gives some examples, but doesn’t give any indication of the financial benefit, or size of these deals. We’re told that “2022 was a strong year for accesso…”, but no figures. So it’s more a PR release than a trading update.

My opinion - this update didn’t move the share price (well, a 1% fall), and the fwd PER of 38 times looks too aggressive to me. Why pay so much for a company with a patchy track record, that’s never paid any divis? The last reported balance sheet was very good, with a substantial cash pile, so it could pay divis if it wanted.

The shares are obviously a bet on a strong recovery in the leisure sector. To justify its £341m market cap, I think it needs to be producing numbers well ahead of current expectations. So we’ll see what happens. As things stand currently, I’m neutral on Accesso.

Ibstock (LON:IBST) - TU £650m - one of the listed brick makers. FY 12/2022 update - it says volumes declined in Q4 (as expected) vs LY, but a focus on price, margin, and costs, resulted in a “solid EBITDA margin performance”. Guidance for FY 12/2022 is now: revenues £510m (up 25% vs LY), adj EBITDA “modestly ahead” of expectations. Net debt of £46m (after growth capex spend of >£35m, and £30m share buyback).

Outlook - expecting “more challenging” conditions in 2023. But sounds confident in the medium term. Note that broker consensus forecasts for 2023 have been plunging in recent months. Pension buy-in agreement agreed in Q4 - another one, after similar deals with TTG and Robinson.

My opinion - housebuilders are saying production is retrenching, so that’s bound to impact brick producers. So investors need to think about how you see the macro picture panning out. The 2023 forecasts are plunging, see below, which looks very similar to forecast earnings for the housebuilders too, unsurprisingly.

Gateley Holdings (LON:GTLY) - Interims 237m - one of the listed legal services shares, some of which have gone wrong. This one’s performed reasonably well since listing in 2015, with a positive trend on revenues & profits, and a good track record on divis (with a hiatus in 2020 re the pandemic), and quite a reasonable total shareholder return, adding the share price rise to the generous divis.

Interim results to 10/2022 were out yesterday. On the quickest of skims, the figures look OK to me, eg revenue up 22% to £76m in H1, and underlying adjusted PBT up 13% to £9.6m.

Outlook - says more challenging environment is beginning to emerge. Divis indicated at about 10p for the full year, so yield is 5.3%, assuming H2 performs in line.

Balance sheet looks OK, with about £40m NTAV, which includes the high receivables that is usual for this sector, but can be a worry as there are often write-offs needed, so correct provisioning is key.

My opinion - I tend not to invest in this sector, due to the conflict of interest between the fee earners, and outside shareholders. But the numbers for GTLY do look quite attractive.

Smartspace Software (LON:SMRT) - TU £13m (in line) - shares bounced 7% to 44.5p, on a trading update yesterday confirming that FY 1/2023 trading “continues to be in line with market expectations”. What’s odd is that it also announces a change of auditor, from RSM to Cooper Parry, “following the conclusion of a tender process”. It’s not at all normal to change auditors a fortnight before the year end. Normally the auditor would have already done some preliminary work, and be ready to come in for the final audit visit in just a few weeks time.

I’ve looked through the last 6 months’ announcements, and there doesn’t seem to be any indication that the auditors were to be changed. Indeed, on 5 July 2022 the outgoing auditor RSM, was confirmed by a 99.38% shareholder vote, to be re-appointed as the company’s auditor. So clearly there must have been a more recent falling out between SMRT and its auditor RSM. What caused that? Yesterday’s update says this -

RSM UK LLP has ceased to be the Company's auditor and has confirmed to the Company that there are no matters connected with its ceasing to hold office that need to be brought to the attention of the members or creditors of the Company for the purposes of section 519 of the Companies Act 2006.

It’s rare for an outgoing auditor to write such a letter, but it can happen. So that rules out the worst possible scenario, but it still unnerves me that the auditor is changing at this time - there must be something wrong for this to have happened, in my view.

I’m surprised the share price didn’t take a dive on this news actually. What do other people think?

Looking at the last interims, the balance sheet is looking a bit thin, and it’s still loss-making. Although there does seem to be a nice trend developing in recurring revenue growth. So it could be one to watch maybe?

On to today's news, obviously I had to start with this one! -

Boohoo (LON:BOO)

47p (pre market) - mkt cap £601m

Trading Statement - 4 months to 31 Dec 2022.

This seems a reassuring update, given the question marks over the whole eCommerce sector, which has crashed in the last 18 months, globally. Remember that the prior year comparatives are strong for online retailers, which is a headwind this year (as omicron boosted their sales LY). This is the opposite of physical retailers, who suffered during omicron in late 2021/early 2022, so they now have a tailwind of easy comparatives 2021 to beat in 2022. That’s an important distinction to bear in mind.

It’s difficult to compare to last year, as BOO has changed the phasing of its trading updates, and didn’t issue a 4 month update this time last year, but instead a 3 month update to 30 November (which showed +10% revenues).

Key points for 4 months to 31 Dec 2022 -

Revenue down -11% to £638m (but still +35% on pre-pandemic) - it says this is “in line with previous guidance” - which I’ve confirmed to a note from Zeus in Sept 2022.

All regions down a similar amount vs LY (last year). UK remains the main market, at 63% of total revenues.

Gross margin 49.7% - is a little lower than previous forecast of 50.9% - but I’m expecting this to improve as supply chains & freights costs normalise. There's a mix of retail & wholesale, so we need more detail to see the underlying trend.

Inventories down a striking 27% as supply chains loosen up, this is positive when many companies are struggling with excessive inventories.

Loads of liquidity headroom, over £300m of gross cash, but bear in mind this is more than offset by a mysterious loan (which people are assuming is provided by HSBC, but I cannot find any proof of that - if you have information on that, please leave a comment). It’s a strange set up, to draw down such a large loan, pay hefty interest on it, whilst the cash sits in the bank earning less interest presumably. We need more info on this - the costs, and terms (any covenants?) of the large borrowings.

Warehouse automation ongoing, should improve efficiency and boost bottom line. I remember a figure of £25m profit opportunity being previously mentioned.

Profit guidance - for FY 2/2023 - in line with market expectations, which is a relief for shareholders I imagine (I’m not currently holding personally).

Guidance is for 3.5% EBITDA margin, which translates into a £71.6m adj EBITDA (per Zeus, many thanks for the update note). Sounds fine, but bear in mind a heavy depreciation charge takes this to a small loss before tax of £(8.5)m. The last note I have from Zeus, dated 28 Sept 2022, shows a adj PBT of positive £1.1m, so actually forecasts have been reduced today, despite the company saying it’s traded in line.

Clearly bumping along just below breakeven, is not a good performance, given the group’s previously superb track record of decent & growing profitability, which went horribly wrong in the last financial year, as the online fast fashion boom seemed to burst. That brought with it the horror show of investors of a collapse in earnings, combined with a collapse in the rating and investor confidence -

Outlook - it’s not all doom & gloom though, as I’ve always said, there are plenty of levers eCommerce businesses can pull (e.g. huge marketing spend, which can be cut any time, to conserve cash). Plus in BOO’s case I think it was spending freely on rapid expansion (eg warehouses), but the whole tone of the commentary today has now changed to being about cost control, which I like. That’s what’s needed to rebuild margins.

Plus there are now potential favourable tailwinds from supply chains and freight (timing and cost) normalising, which should allow an improvement in gross margins. Each 1% of margin rebuild adds £17.5m to the bottom line remember.

My opinion - this looks OK to me, as I was worried there might be more bad news, which there isn’t (other than a modest edging down of FY 2/2023 forecasts).

In overview, the group is now trading around breakeven, with sensible reasons to see potential for margin improvements, as supply chains normalise.

Remember it’s also been spending a lot on pushing the growth of the newly acquired Former Arcadia and Debenhams brands. It’s a pity we’re not given a split of the losses by brand. Also, as we've discovered with ASOS (LON:ASC) and THG (LON:THG) - when companies grow hugely, and very fast, all sorts of inefficiencies creep in, and it's a slow and painful process to remedy problems that were previously obscured by rapid growth and easy profits at BOO (as opposed to Asos & THG, which never made any meaningful profits).

How to value this share? The market cap is substantial at £601m, given that profits have completely evaporated, and now need to be rebuilt. Plus the looming presence of Chinese competitor Shein, which has taken some market share.

I’d like more clarity on the large loan that’s been drawn down - terms, and who is providing it?

Overall though, this update reassures me, and I think the downtrend in share price might have ended. Note that Asos had a spectacular (in % terms) rebound recently, and BOO could benefit from a potential short squeeze.

At the time of writing (08:05) it’s still in auction, so we’ll soon find out how the market reacts to this update. I think the worst is probably over for the share price, and there’s a chance of a nice rebound at some point. Longer term? I’m not sure how to value it at the moment, which is always the case for companies trading around breakeven.

Negative trend in broker forecasts - but settling around breakeven?

.

Stockopedia is unimpressed, with a low StockRank of 32.

Horrible chart over the last 3 years, along with sector peers -

Zotefoams (LON:ZTF)

365p (up 3% at 09:00) - mkt cap £175m

This is one of my favourite GARP shares for 2023 and beyond, covered in detail last year - here’s our archive of articles for background (or just click on “Discussion” tab of any company’s StockReport to call up discussion of that share).

My last review of ZTF was recently, here on 15 Dec 2022, on a positive, ahead of expectations trading update.

Here’s the latest news today -

19 January 2023 - Zotefoams, a world leader in cellular materials technology, today provides a trading update for the Group's financial year ended 31 December 2022 (unaudited).

Strong performance and record profits

Key points -

Ahead of market expectations (again!) due to a strong finish to the year.

FY 12/2022 revenue £127.4m, up 26% on 2021

(I’m pretty sure the revenue growth is all organic too, as there was no movement in the only £2.3m goodwill on the balance sheet - see note 12 to the 2021 Annual Report. A tiny acquisition in Nov 2022 looks to have been for know-how, not revenue/profit).

Impressive upgrade in profit expectations -

Profit before tax for the year is now expected to be not less than £12.0m (2021: £7.0m), which is ahead of current market expectations and represents a year-on-year increase of over 70%. This record profit figure is net of the segment loss in the MEL Business Unit increasing to £1.9m (2021: £0.7m), which reflects the continued investment in the development of ReZorce packaging technology.

Development of the mono-material ReZorce® packaging is progressing well and is currently a significant focus of the team.

Net debt - no figure provided, but it’s coming down nicely as a multiple of EBITDA, of 1.16x which looks fine. As I’ve mentioned before, the net debt isn’t a problem. It borrowed to finance modernisation of fixed assets, now largely done. Mgt have previously indicated that net debt will fall rapidly from internal cashflows. In any case, it owns the factory freeholds, so the bank has bulletproof security, hence why ZTF is able to borrow cheaply. So debt is a non-issue to me.

Diary date - 21 March 2023.

Broker updates - annoyingly there’s nothing. The company needs to arrange some broker coverage that’s accessible for private investors, I vaguely recall nagging them about this when I spoke to the CEO in late Oct 2022 - audio here, written summary here.

Working the figures out myself, if we assume 20% corp tax (same as in the H1 numbers), then the new guidance of £12.0m PBT becomes £9.6m PAT, divided by 48.6m shares = 19.8p EPS for FY 12/2022. That’s well above the 16.2p consensus forecast shown on the StockReport.

At 365p per share, I get a PER of 18.4x - that’s not cheap, maybe priced about right for now?

Also, to be more prudent, I’m factoring in the big rise in corporation tax, to 25%, so doing that would adjust EPS down to 18.5p EPS, or a PER of 19.7x

My opinion - unchanged, I remain positive on the prospects for this share, longer-term. I think the existing business is doing well, and has demonstrated a strong ability to pass on higher inflation to its customers.

Then there’s the potential excitement of the Re-Zorce blue sky project, in for free.

So I think this share seems a nice each-way bet, although personally I wouldn’t be interested in chasing the price up much higher in the short term, despite the good performance - but that’s up to each individual investor to decide.

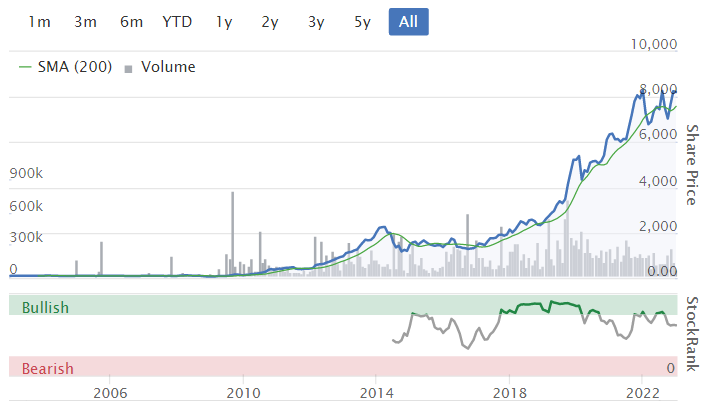

Note how the StockRank has been surging, and is now high -

Graham’s Section:

Judges Scientific (LON:JDG)

Share price: £79.50 (pre-market)

Market cap: £506m

We covered the interim results from this scientific instruments group here.

Today we have a full-year trading update for 2022. It is modestly ahead of expectations.

Key points:

Organic order intake +0.5% year-on-year

At the time of the interim results, this was reported as plus 4%. So there must have been a quite substantial softening in H2 (when measured against 2021’s performance).

Judges says:

Following a solid H1, Organic intake softened in the second half, but picked up strongly in December with the relaxation of China's Covid-19 restrictions.

Also, despite the weak growth in order intake, orders were still running higher than revenues.

This means that the order book increased from 19.8 weeks to 21.1 weeks.

(All of these figures are measured organically, i.e. a fair comparison between 2021 and 2022 after taking into account the acquisitions that took place.)

Speaking of revenues…

Organic revenues +8% year-on-year

Geotek: as anticipated, this large (up to £80m) acquisition hit its earnings targets in 2022, with the result that the sellers will receive the maximum earn-out (this is £35m in cash and shares).

Conclusion:

As a result of the solid Organic performance together with the first-year contribution from Geotek , the Board anticipates that Adjusted earnings per share for 2022 will be modestly ahead of current market expectations.

Estimates: Shore Capital have today increased their adjusted EPS estimates.

FY 2022 EPS increases 5% to 348p, and FY 2023 EPS increases 1% to 355p.

The FY 2023 estimate is held back by expected tax rises and the modest dilution from the Geotek earn-out.

My view

The order intake performance in H2 is clearly not great, but if you trust management (which I tend to do), then the reopening of China means that order intake will be better in 2023.

It has been a challenging year or so and Judges has lost some of its growth momentum, but the underlying fundamentals of the business haven’t changed too much.

One of the great imponderables for me is the long-term quality of Geotek as a business.

Judges have previously said that the addition of this business will reduce the return on invested capital of the group as a whole. We also know that its revenues can be lumpy, and that it relies on a small number of service contracts - how secure are they?

I do remain a fan of Judges as a long-term hold, and I remain optimistic that they will be able to carry out larger acquisitions than they did before, in order to “move the needle”. But for anyone hoping to time a better-than-average entry point, I’m not convinced that this is it:

Frontier Developments (LON:FDEV)

Share price: 521p (+11%)

Market cap: £205m

We covered an awful profit warning from Frontier Developments earlier this month - see here. FY May 2023 estimates for revenue fell from £135m to £100m, and for operating profit fell from £20m to £2m. The market cap swooned from £400m down towards the £200m mark.

Today we get the interim results for the period to November 2022. Key points:

Revenue £57m (previous year: £49m)

Operating profit £7m (previous year: loss £1m)

Net cash £43m (previous year: £34m), after payment of £9m to buy another games studio.

When considering the significant improvement in H1 performance compared to the prior year, remember that F1 Manager 2022 was launched in August 2022, i.e. during H1, and became the studio’s flagship title at that point.

The company also continues to monetise the existing titles Jurrasic World Evolution 2 and Planet Zoo.

Accounting profits were boosted not only by the launch of F1 Manager but also by the reduced amortisation of prior development expenses - this is an important accounting opinion, but it’s not a cash flow.

Trading update and outlook

The precise reason for the profit warning this month was that sales over the key Christmas period (i.e. after the H1 period ended in November) fell below expectations, not just for F1 Manager but for a host of other Frontier titles as well.

I don’t think there’s been any significant change since that last update, but let’s see what wording the company has come up with to describe its current prospects:

The outturn over the five remaining months of this financial year is dependent on a number of variables, including the timing and contribution from the scheduled Foundry releases and the macro-economic environment. The Board believes it is still possible to surpass last year's record revenue performance of £114 million, particularly if one of the upcoming Foundry titles is a conspicuous success. However, given the number of variables and the more challenging economic outlook, the Board have set a minimum expectation of delivering revenue of not less than £100 million in FY23.

This is similar to what they said before. But I note that the FDEV share price is up 10% today, so maybe investors are encouraged by the company’s insistence that revenues could still somehow beat last year’s number, if everything went favourably for them?

As for profitability:

The Board's expectation for revenue for FY23 of £100 million to £114 million, would deliver an IFRS operating profit in the range £2 million to £10 million.

And for FY 2024, the company is looking to achieve revenue growth of 5%, with the help of a new Warhammer game and the next annual edition of F1 Manager.

CEO comment - the CEO talks about improving the F1 game (“more accessible and engaging to a wider audience”), and this is a point that I think investors do need to bear in mind. This year’s release was only the very first in a series, and it’s possible that the sequel could be significantly better. Sequels are sometimes better than the originals!

Furthermore, it should be cheaper for Frontier to develop new editions of this game, as they only need to build on what they’ve already done. For example:

Significant outsource costs were incurred during the development of F1® Manager 2022, mainly during FY22, to deliver the large number of assets required for the twenty-two circuits which featured during the 2022 F1® season. The Group will continue to benefit from this initial investment, as the majority of those assets will be utilised in future F1® Manager titles.

So future editions of the game will in theory be cheaper to develop, and they will be better games that might appeal to more customers. What’s not to like!

My view

I’m torn between taking a neutral stance on this, or taking a more positive stance.

I think that taking a long-term stance on this, at the current market cap, I have to be positive: after all, the enterprise value is now just £160m. You only have to go back to January 2021 to find that this share was valued at £1.3 billion.

And what has changed since then? The first edition of F1 Manager didn’t go as well as hoped, but there will be another one.

The company themselves think that operating profit could be within a £2m - £10m range in FY 2023 - after a disappointing Christmas performance.

In better years, I can see this company earning £10m+, as it did in prior years on a lower revenue base than it currently enjoys.

So in my personal opinion, these shares now look like they could be in value territory.

WAG Payment Solutions (LON:WPS)

Share price: 80p (unchanged)

Market cap: £551m

This share has never been discussed previously on Stockopedia. It was floated by private equity not too long ago - October 2021 - at an offer price of 150p. Sellers were originally looking for 175p.

Here we are less than two years later and the shares are down by about 50%. So according to my IPO rule, we can now start studying it! (My IPO rule states that an IPO stock should not be studied for the first 2-3 years, unless the share price falls by 50%!)

WAG did make it into the FTSE-250 index at first, but it is now in the FTSE Small-Cap Index on the Main Market.

The company is registered in Prague and operates across Europe, providing a range of mobility products for commercial customers - fuel cards, toll boxes, fleet management services, etc.

Let’s see what today’s 2022 trading update has to say:

Total net revenue of at least €189m, up 24% year-on-year.

Organic net revenue, excluding acquisitions, of at least €181m, up 18% year-on-year and in line with guidance.

Acquisition - the company has agreed to buy Polish group Inelo for €306 million.

Inelo also provides fleet management solutions and does so in Poland, Slovenia, Croatia and Serbia. This deal would double the number of trucks connected to WAG’s platform.

I’m surprised to find that WPS is planning to fund this large deal without diluting shareholders, instead using its existing cash resources and bank borrowings. Leverage is going to exceed the top end of its normal targets as a result.

The outlook statement helps us to understand what the company is working towards:

In the year, we expanded our customer base, customer solutions and geographic presence with the new strategic partnership with JITpay, the acquisition of WebEye and the proposed acquisition of Inelo.

Together with the progress we made in developing our own digital capabilities, takes us one step closer to achieving our vision of creating a fully integrated digital end-to-end platform for our customers. Despite the challenging macroeconomic conditions, it is clear that our platform has the potential to transform the CRT industry for the better, and so we enter 2023 with confidence."

My view

I’ll have to stay neutral on this company for now but clearly there is going to be a degree of financial risk in the short-term as it completes the planned acquisition. Perhaps it could be worth studying in more detail in future? I’ll keep an open mind.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.