Good morning from Paul & Graham!

Today's report is now finished.

Agenda/summaries

A huge list again today, so we're only going to be able to cherry pick a few items (Graham's unwell, so might not be able to do his sections, but says he really wants to cover them at some point, as marked below). Therefore, no reader requests today please, unless you've spotted something exceptionally good, in which case do shout!

I'll keep going until about 15:00 today, as there's so much left to look at. Update at 15:19 - all done for today!

Quick comments (no sections below) -

Accsys Technologies (LON:AXS) - TU £182m - too complicated & lousy track record. But upbeat signs in today’s update - strong revenue growth, and “We remain on track for sales volumes in H2 to increase by 50% compared to H1 and, as a result, we continue to target our previously stated ambition of nearly doubling underlying EBITDA for the full year.''

So it might be worth readers taking a fresh look, possibly?

Empresaria (LON:EMR) - £29m - up 10% to 65p - FY 12/2022 results in line with exps. Net debt £7.9m, signif better than exps. Growth eased in Q4. “Some caution” for 2023, but also seeing “strong demand” in many markets, due to skills shortages. Medium term plan to double operating profit is reiterated. My view - a strange group of international staffing businesses, but it performs OK, and could be cheap maybe?

Foxtons (LON:FOXT) - £110m - down 4% to 36.6p - FY 12/2022 ahead of exps. 2023 more challenging. Net cash £12m. 65% revenues are “non-cyclical” - lettings and financial services (I would have thought fin servs is at least partly cyclical?). New CEO’s operational review says investment in people, etc, will be mostly self-funded from cost savings. Expecting a softer H1 2023 for sales, but lettings should be resilient. My view - probably priced about right for now, on 11.8x PER, but I suspect 2023 forecasts might need to come down, given macro conditions.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Eurocell (LON:ECEL)

145p (down 4%) - mkt cap £163m

Year end trading update

Main point - underlying PBT (cont.ops) in line with expectations (no footnote)

Revenue up 12% to £384m, driven by price (not volume)

Market now returning to pre-pandemic norms, after very strong demand.

Continuing to offset input cost inflation, although with a time lag in H2 (so margin pressure).

Key raw materials now stabilising, or even falling in price.

Insurance claim re cyber incident partially resolved at >£1m

Disposal - gets a £1m loss off the underlying figures into discontinued operations - smart move that means they manage to hit forecasts for continuing ops!

Outlook - industry expected to contract by 9% in 2023 (repair/maintenance, and new build), then recover in 2024. Confident they will out-perform market.

Restructured in Q4 2022, anticipating a slower 2023, stripped out £5m of costs.

Paused branch openings until outlook clearer.

Low debt, strong balance sheet (I’m pleased to confirm this is true!)

My opinion - a very nice company, but obviously 2023 is likely to see earnings dip. I’m not sure the forecasts have yet adequately allowed for this. I want to add this to my personal portfolio, for an economic recovery, but for now am holding fire with buildings supplies sector generally. This one, and Wickes (LON:WIX) are my two favourite sector picks, for purchase at a later date, hopefully cheaper!

Argentex (LON:AGFX)

TU £150m - Paul - AMBER - up 1% to 133p -

A confusing update, as it’s changing year-end. Singers note re-works the numbers helpfully, and puts through a big EPS upgrade, which seems to be reversing a previous downgrade, so I’m not sure what to make of this! Singers reckons 8.0p adj EPS for FY 12/2022, rising to 9.0p in 2023. PER looks reasonable, and if you think it will beat forecasts, then shares might be good value?

The forex dealers all seem to be doing well at the moment - will it last? Today’s update sounds thoroughly positive throughout. The business is expanding, taking on more overheads, including international expansion. The sector looks interesting, but I don’t know how to assess the prospects.

Rotala (LON:ROL)

Tender Offer £24m - Paul - GREEN - up 17% to 48p

Proposed tender offer at 55p for 18.18m shares (£10m). 34% premium price. 35.7% of total shares in issue will be bought back. Directors hold 31.8% of the company, and will tender their shares. Strangely, it’s borrowing £10m from HSBC existing facility, effectively as a bridging loan, to be repaid from the major property disposal underway. Why not just wait until the sale completes? My view - gives a nice opportunity to partially exit, at a premium price, if shareholders wish. Good that it confirms the value flagged here in the SCVR on 28 Dec 2022, at 34.5p per share, that the company would have ample cash for divis/buybacks. The tender offer gives a 59% profit on a third of the shares, not a bad trade!

Inspecs (LON:SPEC)

TU £84m - up 31% to 81p -

FY 12/2022 trading in line with lowered expectations (after bombshell profit warning in Oct 2022 smashed the share price down to c.45p).

Revenue flat vs 2021, at $246m. Revs up nearly 10% on constant currency though.

Slowdown in demand from Europe hit Q4. Other markets OK.

Cost cuts implemented.

Order book flat at $42m - doesn’t seem much, only 2 months revenues.

2022 hurt by Euro weakness, cost inflation & high freight costs.

Net bank debt up slightly to $34.1m. Bank has agreed covenant waivers to Sept 2023, indicating some financial distress, so possible dilution risk if trading get worse?

No divis for now.

Outlook - looking for more cost savings. Building a new factory in H2 2023 - is this wise?

New CEO from Dec 2022.

My opinion - none, as there’s not enough information to value this share. It’s still profitable though, with EPS of 6 US cents forecast for FY 12/2022. Could be a good turnaround in 2023 maybe? Personally, I prefer turnarounds where you don’t have to worry about bank debt, so it’s not for me, but good luck to holders.

Best Of The Best (LON:BOTB) (I hold)

430p (up 5% at 09:09) - mkt cap £36m

This is starting to look interesting again, after the pandemic boom has dissipated.

What’s interesting is that costs have been managed down, so profitability in H1 is only about 10% down on the much stronger revenues in H1 LY - revenues are down 29% on H1 LY. This is one of the advantages of an online-only services business - the overheads are completely flexible, especially marketing, which can be dialled up or down at will, with generally no forward spending commitments.

Moreover, investor sentiment generally has radically changed, from wanting growth at any price, to wanting profitability, and an unwillingness to back new funding rounds. Even the phrase “funding rounds” has always jarred with me, as it implies a complacent belief that constantly generating losses & cash burn is routine and acceptable.

BOTB has never been in that position, it’s always been a prudently managed, cash generative little business.

Key numbers for H1 (6 months to 31 Oct 2022) -

Revenues £13.7m (down 29%)

Profit before tax (PBT) £2.7m (down 11%)

Profit after tax (PAT) £2.44m (LY H1: £2.57m) - down 5% - this year flattered by a lower tax charge (see note 3, with a £185k benefit from “overprovision in prior period”). Hence we should probably normalise tax, which would reduce H1 EPS to about 23p by my calculations (based on 25% future rate of corporation tax)

EPS 27.65p (diluted) - UP 2% - note there are hardly any share options (good - mgt are rich enough already!), as undiluted (27.95p) EPS is almost the same as diluted.

Note that EPS has actually risen 2% vs H1 LY, see note 4, because the share count has dropped from 9.5m (weighted average) to 8.8m, a 6.8% reduction in share count - showing the benefit of the tender offer (a form of share buyback) last summer - I reported on the tender offer here in June 2022.

Balance sheet - NTAV has fallen to £3.7m from £8.1m 6 months earlier, due to excess cash (which had hit £10.8m) being used to fund the tender offer mentioned above. It’s a capital-light business, with negligible fixed assets, no inventories, and minimal receivables (probably just cash-in-transit through card merchant processors, I imagine). Therefore it could happily run on NAV of nil. Anything above that is a bonus, and a safety buffer in case of poor future trading. So everything is fine here.

Cashflow statement - always worth a look (many investors ignore this key financial statement). It clearly shows how the surplus cash has been returned to shareholders, with a £6.3m share repurchase, and £0.5m in divis paid. That is the essence of this business - it’s a cash generation machine, which rewards shareholders with a variety of divis, special divis, and buybacks - a long-standing and excellent track record (albeit volatile during the pandemic).

Outlook comments - which I find reassuring -

Following the normal attrition profile of the very large cohort of customers acquired during the pandemic, player numbers have now stabilised and the business is well placed for a return to steady growth…

Trading since the period end has continued in line with our expectations. BOTB is underpinned by solid financials, a large and loyal customer base, and a proven business model. We are excited by the business development opportunities resulting from the Globe Invest relationship and look forward to the future with confidence."

Globe Invest (GIL) - this is Tedi Sagi’s investment vehicle, which bought just under 30% of BOTB, and is planning on partnering to expand BOTB overseas. It all went rather quiet, so I was wondering if that growth idea had run aground?

GIL has a number of affiliated entities which have an extensive international presence covering content, digital marketing and software development sectors in particular, as well as a proven track record of growing global B2C and B2B businesses.

Today’s update says a deal has still not been finalised, but the mood music sounds positive - e.g. “current period of information sharing and close collaboration”, “great opportunity…”

Therefore we have to wait and see, but I could imagine a successful partnership deal being a lovely catalyst for a re-rating of this share. And even if this partnership falls through, the valuation is still cheap for the existing business.

There’s also the potential for a takeover bid from Tedi Sagi, if he likes the potential.

App - is now 25% of revenues. I’ve not tried this, so will give it a whirl.

Marketing costs - this is what has clobbered so many online businesses, and hurt BOTB badly in 2021 and 2022 - soaring cost of player acquisition through online marketing. Good news here, which could have read-across for all online businesses maybe? -

Customer acquisition during the Period focused on the best-performing digital channels, complemented by traditional TV media and the PR coverage generated by our winner surprises. We continue to see the benefits of our ongoing SEO marketing, with improving organic results allowing us to reduce spend on paid search to drive traffic to the website.

More recently, CPMs on Meta channels have started to return towards pre-Covid levels, allowing for more efficient player acquisition, particularly for the Midweek Lifestyle Competition where the wide-ranging prize offering is attracting a broader pool of players.

Looking ahead, a new TV commercial is launching in February 2023, a bespoke tracking and optimisation platform developed by GIL is being road-tested and we continue to explore new channels to market - TikTok in particular is a focus.

(there are too many abbreviations in today’s update, something that many companies are guilty of - they forget that investors may not know all the industry jargon. Memo to all companies - either don’t use abbreviations, or if you do, provide a prominent explanation please!)

It's interesting how Tik Tok seems to be breaking the stranglehold Facebook/Instagram had on online ads. That could benefit lots of eCommerce businesses maybe, with lower online marketing costs?

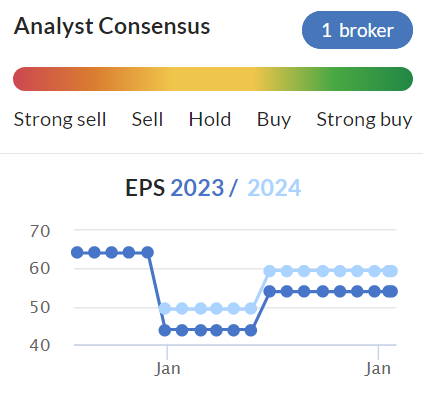

Broker update - thanks to Finncap for updating its spreadsheet - EPS is unchanged at 53.9p for FY 4/2023. It’s already done about 28p in H1, so that looks fine, the risk of a profit warning seems low to me. Although we don’t know if, and how much, cost of living pressures might impact sales of the ultimate discretionary spending?

These interims do show that even on reduced revenues, margins and profit are fine - because the cost of marketing is coming down. So I’m not worried about the consumer downturn impacting profit here.

At 53.9p adj EPS, the PER is 8.0x - that’s a bargain in my view.

My opinion - this has taken a while for me to review in detail, but I’ve been looking forward to a proper rummage through BOTB’s update. The reason is that I thought this share could be set up nicely for a decent recovery. Investor sentiment was shattered by the boom & bust pandemic performance, not helped by management banking multiple millions at £24 per share secondary placing with institutions. But that’s the past, it’s the future that should interest us.

What we currently have, is a value share, producing good profits, on a low PER of only 8.0x

The international expansion through GIL partnership (30% shareholder) is in for free, so doesn’t really matter if it falls through, there’s just upside, the way I see it.

As you can probably tell, I’m seeing the glass half full here, whilst acknowledging for others, the history might put you off.

If things work out well with GIL, this could be a nice ground floor opportunity to get a second multibagger out of BOTB shares, which worked great the first time around (if you sold during the boom). Hence I’m increasingly bullish on this share, and included it in my top 20 watchlist ideas for 2023. So far, I’m comfortable that was probably a good decision, with less guesswork & hope needed after today, as it’s confirmed that trading is OK.

Can be tricky to buy & sell though, as it’s tightly held. And as with everything, there are no guarantees the upside case will definitely happen. Something unknown could always go wrong, as with all shares.

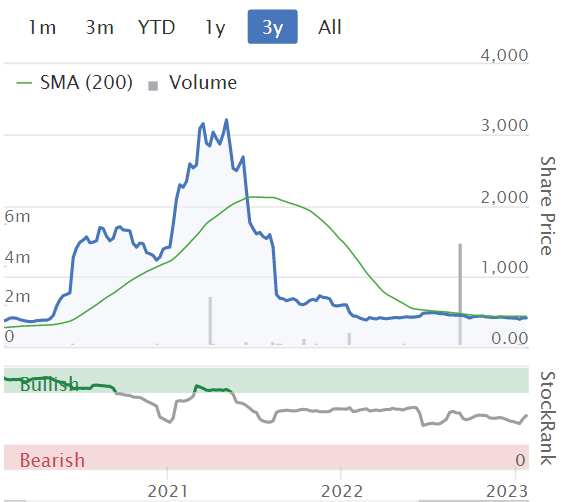

We foolishly thought that the pandemic boom was structural growth. When it became clear it wasn't, this is what happened -

.

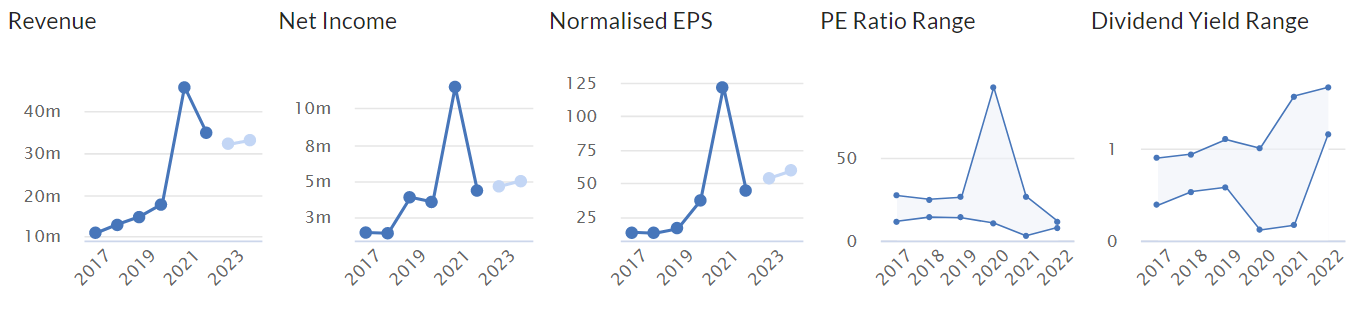

Note that Finncap raised forecasts significantly quite a while ago, but the market didn't seem to care -

.

Note that the longer term growth trend is now becoming clear, as the pandemic boom stands out as a blip -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.