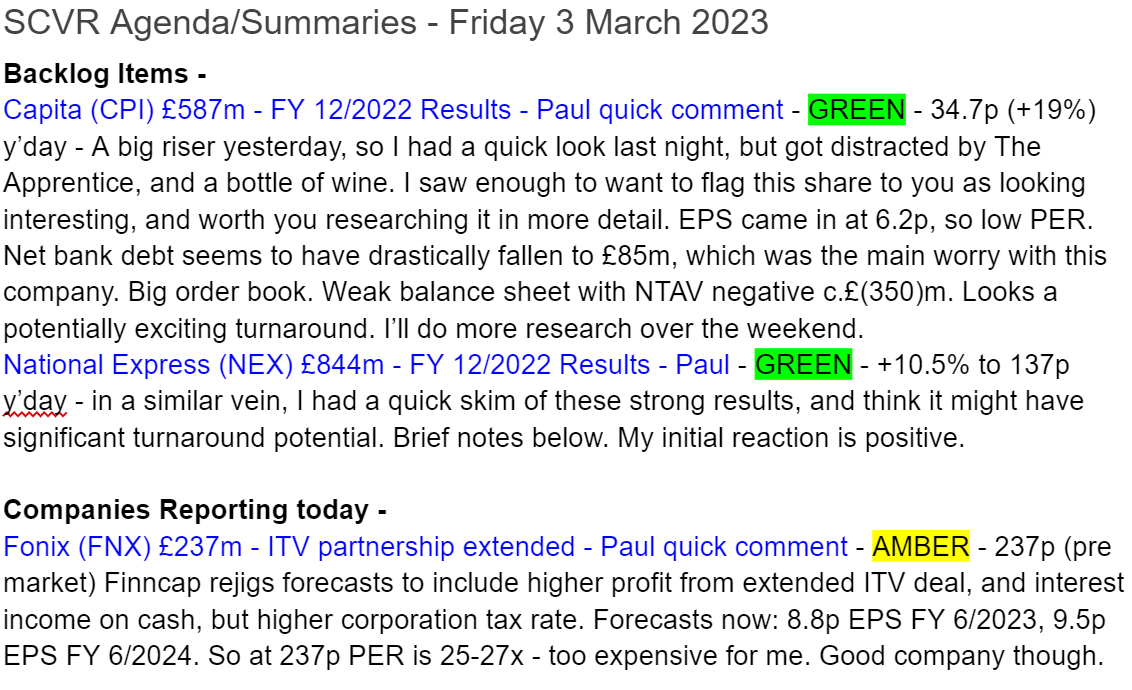

Good morning! It's just Paul here today, with plenty on the agenda from catch-up items from earlier this week.

Mystery shares in this weekend's (5 March) podcast are -

ME International (LON:MEGP) - see Wednesday's report. I'm really impressed with performance, and the future looks bright, with higher margins from raising prices, and the fast-growing laundry division is catching up with the core business, so it's no longer a one-trick pony. Shares have risen a lot of late, so it may need to consolidate, but valuation still looks good value, and I like the longer term outlook.

National Express (LON:NEX) - briefly covered in Friday's report. I think this looks a good recovery share, but need to do more work on it.

Capita (LON:CPI) - also briefly covered in Friday's report. Strong recovery in earnings, and previous concerns about excessive debt have now been fixed. Could be interesting, but again, I need to do more work on it, so more than ever, please make sure you DYOR.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

.

Paul’s Section:

National Express (LON:NEX)

139p (rose strongly yesterday)

Market cap £856m

I should emphasise that this is the first time I’ve looked at this international bus & rail operator. That’s because it’s been too big for the SCVRs here, but it’s near all time lows currently, and I’ve increased my upper limit to c.£1bn mkt cap.

I went through the FY 12/2022 results statement last night, but this was only a quick initial review, on a large and complex group, so please bear that in mind when reading this section - I’m not claiming to properly understand the group yet.

Key points (not comprehensive) -

UK operations returned to profit.

Dividend reinstated, at a fairly good 5.0p - indicating to me that financial health and debt are probably not a problem.

Underlying EPS 15.0p (seems ahead of 13.4p forecast), up from barely breakeven in 2021.

Covenant net debt £986m (2.8x EBITDA, so still quite high, but reduced from 3.6x)

Non-cash goodwill impairment charge of £261m - doesn’t matter to me, as I write-off all goodwill anyway.

Fuel 100% hedged for 2023, and 56% for 2024. Help or hindrance, now fuel costs are lower?

Q1 2022 was impacted by Omicron virus, but since then trading has recovered strongly.

Has negotiated price rises, to recover cost increases.

Outlook - 2023 expectations unchanged. Momentum continuing.

** This bit really made me sit up & take note. Cumulative (not clear what the starting point is though) free cashflow of £1.25bn expected by 2027. That’s considerably more than the market cap, so could mean the equity is too cheap? **

Covid support on costs & revenues was still big in 2022, at £132m (2021: £227m), so I’m not sure how trading will stand up in future without Govt support? But customers returning should presumably at least offset this? Needs more work.

Pensions - not big, £7.4m pa deficit recovery payments.

Debt facilities are a mixture of bonds, RCF, and leases.

Balance sheet overall looks weak, with negative NTAV of £(200)m - not a disaster by any means though, and large cash generative businesses can usually operate fine with balance sheets weaker than I’m accustomed to in the small caps world.

W.Midlands bus drivers have just gone on strike, not sure how material that is to the group?

If you look at the chart below, it’s clear that there could be recovery potential, as we hopefully normalise to a post-covid world. Note that the share count has risen from 513m to 614m over this period, but that still leaves plenty of upside in the share price, if valuation returns to pre-covid levels. Or will some investors be put off investing in transport shares at all, worrying about the risk from any future pandemics?

My opinion - I’ve only just started researching NEX, so my opinion is currently only on flimsy foundations. Notwithstanding that, I’ve seen enough to make me lean towards an initially positive view for this share, as a recovery trade (rather than something I’d want to hold forever). I’ll do more work on it in the future. What do readers think? I see Boon and Edmund Shing have both mentioned it in our discussion archive here.

Low StockRank, so that's a warning for us to be careful, or avoid it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.