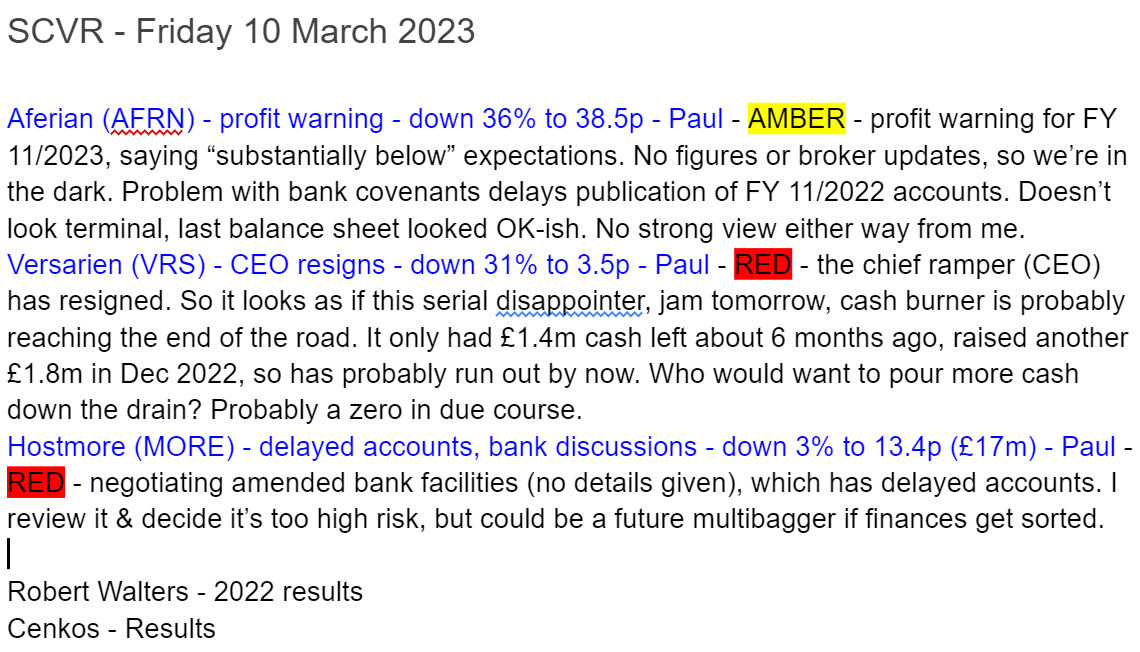

Good morning from Paul.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Aferian (LON:AFRN)

38.5p (down 36%)

Market cap £33m

Trading Update, FY22 Results Delay & Board Update (profit warning)

Aferian plc (LSE AIM: AFRN), the B2B video streaming solutions company, today provides an update on current trading and its impact on the outlook for the financial year ending 30 November 2023.

24i business is trading in line with expectations.

Amino business has seen reduced demand -

…device sales in the first half have been materially lower than anticipated.

Recovery is not expected until later in the year, as a result it warns on profit -

… management now expect Amino's outturn for the full year ending 30 November 2023 to be substantially lower than originally anticipated.

Cost savings of $5m (annualised) have already been implemented (cost efficiencies, and R&D teams)

Outlook -

… the Board now expects Group revenue and adjusted EBITDA for the year ending 30 November 2023 to be substantially below its original expectations. Whilst device revenues continue to be negatively impacted by the current market environment, the Board has confidence in the growth drivers of the video streaming market as well as Aferian's ability to address that market. Notwithstanding the difficult trading conditions of the Amino business in the first half of the year, the Company is still expected to generate a positive material adjusted EBITDA for the full year.

Note that broker forecasts have been falling considerably even before today’s profit warning, so not a happy situation -

Delay to FY 11/2022 results - no change to expectations provided on 8 Dec 2022, which said -

For the year ended 30 November 2022 the Group expects to report adjusted operating profit1 within the $7.8m-$8.8m guidance range.

But there’s a problem with bank covenants which is delaying the accounts sign off (which sounds going concern related) -

The Company is in compliance with its banking covenants and is in discussions with its banks to ensure future covenant compliance. This will delay the announcement of the full year audited results for the year ended 30 November 2022. A further announcement will be made as and when practicable.

Clearly that increases risk that a discounted placing might be required. It might turn out to be fine, but I always get nervous when bank covenants are mentioned.

It had net cash of $4m when last reported. On 8 Dec 2022. I would have expected it to update today on the current cash/debt position, but that information is missing.

NED appointment - May Royde of Kestrel Partners is set to become a NED. Kestrel is the largest shareholder, with 26%. The shareholdings are quite concentrated, so I wonder if the top holders might decide to take it private? Or he might just be joining the Board to kick ass?

Broker updates - nothing available.

Balance Sheet - I’ve checked the last one, at 31 May 2022, and it’s almost all intangible assets. Remove those, and NTAV is slightly negative at £(1.0)m. There’s almost nothing in fixed assets, so the other main items are just working capital, which is balanced, with current assets and current liabilities both around £30m. So neither strong nor weak overall, I’d say. It probably needs the bank facility to cover day-to-day swings in working capital, depending on the timing of customer payments.

Therefore it seems to me that the bank facility should be manageable, and it doesn’t look a dangerously high geared situation.

My opinion - I’ve always found Aferian difficult to analyse, as it’s not clear to me what drives the business, who it’s competing against, and if it has any competitive advantage. Historically it makes profits every year, but variable amounts. Set-top boxes might be old hat these days perhaps?

It used to pay large divis, and it has also made acquisitions, which have clearly not been very good, and performance has been in decline for several years now.

Hence I don’t know whether the company’s prospects are good, or not.

So my view is neutral. What do readers think? If you have any insights, then please do add a comment below.

The share price has fallen all the way back down to where it was c.10 years ago -

Hostmore (LON:MORE)

13.4p (down 3%)

Market cap £17m

Trading Update & Delayed Accounts

Preamble - This is the TGI Fridays casual dining/bar chain, which has been a complete disaster since it demerged from Electra Private Equity. This was one of my heaviest losses in 2022, and it’s now a share I’m wary of, given poor trading, lacklustre/overpriced menus, and worrisome bank debt.

Restaurants/bars are one of the worst sectors at the moment as we already know, being squeezed between reduced demand (and high operational gearing), and multiple inflationary costs - especially wages, energy, and food/drink ingredients. There’s also continuing over-capacity in the sector, with many independent operators likely to go bust.

The potential upside is worth considering though, and could include - possible reductions in energy prices, food inflation reducing, consumer demand returning at some point. Hence geared upside possibly, as well as geared downside. Those that survive these brutal conditions will have less competition and hence more market share. It will be fascinating to see how things pan out. And as always, recessions are when future stars are born through innovation and supplanting the stale old formats. Is TGIs a stale old format? Lots of people seem to think so, it’s frequently mentioned here in the reader comments.

Anyway, on to today’s update from MORE -

FY 12/2022 accounts were due to be published on 16 March.

Delayed due to negotiations with bank over its borrowing facilities -

The Group is currently in discussions with its lending banks to amend its existing facilities.

This process is progressing well and the Company now expects it to conclude in the first half of April. A further announcement confirming the new date of the Preliminary Results will be made in due course whilst an update on the Group's amended banking facilities will also be provided as part of the Preliminary Results announcement.

We already knew that high bank debt was a problem at MORE, so that’s why the share price has hardly budged today.

The risk is obviously that the bank force MORE into doing a dilutive equity raise, which from a position of weakness could be ruinous to existing holders. That’s the downside risk. Or it could work out fine, if the bank co-operates and agrees revised facilities. We just don’t know how this is going to pan out, and it’s a major uncertainty which could propel the shares into a big move down, or up, depending on what happens.

Current trading - we’re reassured that there has been no further deterioration -

The above matter is unrelated to recent trading, with the Company generating VAT adjusted revenues (note 1) for the first nine weeks of the 2023 fiscal year that are similar to 2022's comparable revenues. Related EBITDA and cash flows are in line with current market expectations for the full year.

As you can see below, the broker forecasts have been plummeting, and are only now around breakeven. I thought even that looked too ambitious when I last scrutinised a broker note, hence I remain of the view that another profit warning is possible. That could then trigger a covenant breach, and an emergency discounted placing, or worse.

My opinion - this share is high risk, potential high reward. If the economy begins recovering, and consumers spend more freely again, then the broker forecasts could start recovering again, and if it gets back to say 10p+ EPS, then the share price could be 5-10 bagger from the current level.

Anyone holding this share should do so with their eyes open - there’s a big risk of a heavy loss, even 100% loss in the worst case scenario, if the banks pull out and investors refuse to back an equity fundraise.

However, if it survives intact, with bank support, no dilution, and trading begins to improve, then there could be a geared recovery, giving investors a multibagger potentially.

What’s my view? I think it’s too risky right now. I’d rather pay more, once it’s sorted out the finances, than run the risk of a wipeout now. Due to tthe high risk, I've got no choice than to mark it as red.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.